|

市場調查報告書

商品編碼

1689942

雙相不鏽鋼:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Duplex Stainless Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

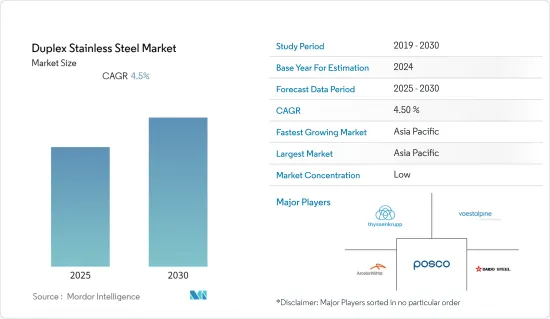

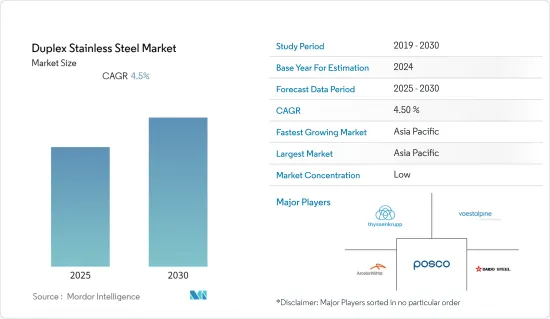

預計預測期內雙相不銹鋼市場複合年成長率將達到 4.5%。

主要亮點

- 從中期來看,耐腐蝕應用的增加和石油天然氣行業需求的成長等因素預計將推動市場成長。

- 然而,雙相不銹鋼在高溫下的使用有限預計會抑制市場的成長。

- 新油田設施對雙相不銹鋼的需求不斷成長,預計將為該行業提供成長機會。

- 預計亞太地區將主導市場,其中印度和中國等國家消費量最高。

雙相不銹鋼市場趨勢

建設產業需求增加

- 雙相不銹鋼主要用於建設產業。由於其獨特的性能,包括比碳鋼更堅固、比奧氏體不銹鋼更耐腐蝕,它被用作建築和設計材料。

- 雙相不銹鋼最常見的建築和施工應用是壯觀的人行天橋,例如新加坡的螺旋橋、聖地牙哥的海港大道大橋和卡達的新路塞爾人行天橋。

- 其他應用包括在加那利群島和紐約四大自由公園等高腐蝕性地區使用的扶手。高強度拉桿和蜘蛛配件用作玻璃帷幕牆低矮牆體結構的支撐。

- 預計未來幾年基礎設施的快速發展將推動對雙相不銹鋼的需求。

- 中國是世界上最大的建築市場之一。預計2022年中國建築業產值將達到約4.6兆美元。中國政府重點關注中小城市的基礎建設。北京市為建設計劃提供了 6.8 兆元(1 兆美元)的政府資金。

- 北京2021-2025年發展計畫總合包括102個大型企劃。中國政府已開始建造一條從西南省份四川到西藏首都拉薩的 1,629 公里(1,120 英里)長的鐵路線,該線路穿過地震多發地帶和海拔 3,000 多米的冰川。該計劃預計投資3,198億元人民幣(506億美元)。建設活動預計於 2020 年底開始,並於 2025 年完工。

- 據水利部預計,2022年水利基礎建設計劃投資將達7,036億元人民幣(980億美元),比2021年成長63.95%。 2022年,全國新開工水利計劃1.9萬餘項,其中重大計劃31項。

- 印度政府正致力於全國基礎設施建設以促進經濟成長。政府的目標是建造100座智慧城市。根據世界銀行的報告,印度未來15年必須投資8,400億美元用於城市基礎建設,才能滿足其快速成長的城市人口的需求。

- 為促進國家基礎建設,印度政府已為 2022 年撥款 100 億盧比(1,305.7 億美元)。其中包括為印度國家公路管理局 (NHAI) 撥款 134,015 億盧比(172.4 億美元),為公路運輸和公路部撥款 60,000 億盧比(77.2 億美元),為住宅和城市事務部撥款 76,549 億盧比(98.5 億美元)。

- 總體而言,預計未來幾年全球所有此類基礎設施發展都將推動市場發展。

亞太地區佔市場主導地位

- 由於快速的建設和持續的投資,亞太地區預計將主導全球市場。

- 中國的建築業規模龐大。過去兩年,基礎設施、商業和住宅領域的快速發展推動了建築業的數量和價值的成長。

- 目前,中國有多個機場建設計劃處於開發和規劃階段。這些計劃包括北京首都國際機場、成都雙流國際機場和廣州白雲國際機場。政府推出了一項大規模建設計畫,計劃在未來十年內將 2.5 億人遷移到新開發的特大城市。

- 印度的工業和商業基礎設施已成為高成長產業之一。印度政府一直在製定放寬規則等舉措,以吸引外國直接投資流入建築業,從而促進該國的整體發展。

- 2022年10月,日本國際協力機構(JICA)宣布有意更多參與印度私部門實施的計劃。未來幾年,日本發展機構希望將其對私部門計劃的全球投資增加到 150 億美元,主要關注印度的計畫。

- 印度是全球化學品銷售額第六大國家,為全球化學工業貢獻了3%。據印度品牌股權基金會(IBEF)稱,在 2022-2023 年聯邦預算中,政府向化學和石化部撥款 20.9 億印度盧比(2,743 萬美元)。預計到 2025 年,化學品需求將以每年 9% 的速度成長。這一趨勢可望提高化學工業的製造能力,並推動製造化學加工廠對雙相不銹鋼的需求。

- 由於上述因素,亞太地區市場預計在預測期內將大幅擴張。

雙相不銹鋼產業概況

全球雙相不銹鋼市場較為分散,許多公司都在競爭。主要公司包括蒂森克虜伯股份公司、奧鋼聯股份公司、安賽樂米塔爾股份公司、浦項製鐵公司及大同特殊鋼公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 提高耐腐蝕應用

- 石油和天然氣產業的需求不斷成長

- 限制因素

- 耐熱性有限

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 精益雙相不銹鋼

- 雙相不銹鋼

- 超級雙相不銹鋼

- 按最終用戶產業

- 石油和天然氣

- 建造

- 紙和紙漿

- 化學處理

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AK Steel Holding(Cleveland-Cliffs Inc.)

- ArcelorMittal SA

- Daido Steel Co. Ltd

- Jindal Stainless Ltd.

- Nippon Yakin Kogyo Co. Ltd

- Outokumpu

- POSCO

- SAIL

- Sandvik AB

- SeAH Steel Corporation

- Thyssenkrupp AG

- Voestalpine AG

第7章 市場機會與未來趨勢

- 新建油田設施對雙相不銹鋼的需求不斷成長

簡介目錄

Product Code: 69446

The Duplex Stainless Steel Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing applications for corrosion resistance and rising demand from the oil and gas industry are expected to drive the growth of the market.

- On the other hand, the limited use of duplex stainless steel at higher temperatures is expected to restrain the growth of the duplex stainless steel market.

- The rising demand for duplex stainless steel in new oilfield facilities is expected to offer growth opportunities to the industry.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption being recorded by countries like India and China.

Duplex Stainless Steel Market Trends

Rising Demand from the Construction Industry

- Duplex stainless steel finds major applications in the construction industry. It is used as a construction design material because of its unique characteristics, such as higher strength than carbon steel and higher corrosive resistance compared to austenitic stainless steel.

- The most common building and construction applications for duplexes are spectacular pedestrian bridges, like the Helix Bridge in Singapore, San Diego's Harbor Drive Bridge, and the new Lusail Pedestrian Bridges in Qatar.

- Other applications include handrails in corrosive locations, like the Canary Islands and the Four Freedoms Park in New York. High-strength tension bars and spiders are used in low-profile wall structural supports for glass curtains.

- The rapid development of infrastructure is expected to drive the demand for duplex stainless steel in the coming years.

- China is one of the largest construction markets in the world. The Chinese construction industry's output value amounted to around USD 4.6 trillion in 2022. The Chinese government mainly focuses on improving the infrastructure in small and medium-sized cities. The local body of Beijing has made CNY 6.8 trillion (USD 1 trillion) of government funds available for construction projects.

- A total of 102 mega-projects have been included in Beijing's 2021-2025 development plan. The Chinese government initiated a 1,629-kilometer line from Sichuan province in the southwest to the Tibetan capital, Lhasa, covering more than 3,000 meters through earthquake-prone terrain and glaciers. This project involves a planned investment of CNY 319.8 billion (USD 50.6 billion). Construction activities started at the end of 2020, and the line is expected to be completed by 2025.

- According to China's Ministry of Water Resources, CNY 703.6 billion (USD 98 billion) was invested in water-conservancy infrastructural projects in 2022, recording an increase of 63.95% compared to 2021. The construction of more than 19,000 water-conservancy projects began in 2022, of which 31 were considered to be major projects.

- The Government of India strongly focuses on infrastructural development across the country to boost economic growth. The government is aiming to build 100 smart cities. According to the World Bank's report, India has to invest USD 840 billion in urban infrastructure over the next 15 years in order to meet the requirements of its fast-growing urban population.

- In order to enhance the country's infrastructural sector, the Indian government allocated INR 10 lakh crore (USD 130.57 billion) in 2022. These investments included the allocated budget of INR 134,015 crore (USD 17.24 billion) for the National Highways Authority of India (NHAI), an outlay of INR 60,000 crore (USD 7.72 billion) for the Ministry of Road Transport and Highways, and INR 76,549 crore (USD 9.85 billion) for the Ministry of Housing and Urban Affairs.

- Overall, all such developments in infrastructure across the world are expected to drive the market in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market, owing to rapid construction and continuous investments across the region.

- China hosts a vast construction sector. Rapid developments in the infrastructural, commercial, and residential sectors over the past two years have boosted the construction sector in terms of volume and value.

- Currently, China accounts for numerous airport construction projects in the development and planning stages. These projects include Beijing Capital International Airport, Chengdu Shuangliu International Airport, and Guangzhou Baiyun International Airport. The government rolled out massive construction plans to shift 250 million people to the newly developed mega-cities over the next ten years.

- Industrial and commercial infrastructure in India has emerged as one of the high-growth sectors. The Indian government has been formulating initiatives like easing the rules to attract FDI inflow in the construction sector to expedite development across the nation.

- In October 2022, the Japan International Cooperation Agency (JICA) announced its intention to participate in more projects conducted by India's private sector. In the coming years, Japan's development agency hopes to increase its global investments in private-sector projects to USD 15 billion, mainly concentrating on Indian initiatives.

- India ranks sixth in the world in the sales of chemicals, and it contributes 3% to the global chemical industry. According to the Indian Brand Equity Foundation (IBEF), under the Union Budget 2022-2023, the government allocated INR 209 crore (USD 27.43 million) to the Department of Chemicals and Petrochemicals. The demand for chemicals is expected to expand by 9% per annum by 2025. This trend is expected to boost the manufacturing capabilities of the chemical industry and the demand for duplex stainless steel for manufacturing chemical processing plants.

- All the above-mentioned factors are expected to significantly boost the market in the Asia-Pacific region during the forecast period.

Duplex Stainless Steel Industry Overview

The global duplex stainless steel market is fragmented, with many players competing against one another. Some of the major companies are Thyssenkrupp AG, Voestalpine AG, ArcelorMittal SA, POSCO, and Daido Steel Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Corrosion Resistance

- 4.1.2 Growing Demand from the Oil and Gas Industries

- 4.2 Restraints

- 4.2.1 Limited Heat Resistance

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Lean Duplex Stainless Steel

- 5.1.2 Duplex Stainless Steel

- 5.1.3 Super Duplex Stainless Steel

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Construction

- 5.2.3 Paper and Pulp

- 5.2.4 Chemical Processing

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AK Steel Holding (Cleveland-Cliffs Inc.)

- 6.4.2 ArcelorMittal S.A.

- 6.4.3 Daido Steel Co. Ltd

- 6.4.4 Jindal Stainless Ltd.

- 6.4.5 Nippon Yakin Kogyo Co. Ltd

- 6.4.6 Outokumpu

- 6.4.7 POSCO

- 6.4.8 SAIL

- 6.4.9 Sandvik AB

- 6.4.10 SeAH Steel Corporation

- 6.4.11 Thyssenkrupp AG

- 6.4.12 Voestalpine AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Duplex Stainless Steel in New Oilfield Facilities

02-2729-4219

+886-2-2729-4219