|

市場調查報告書

商品編碼

1689941

生物活性材料:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Bioactive Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

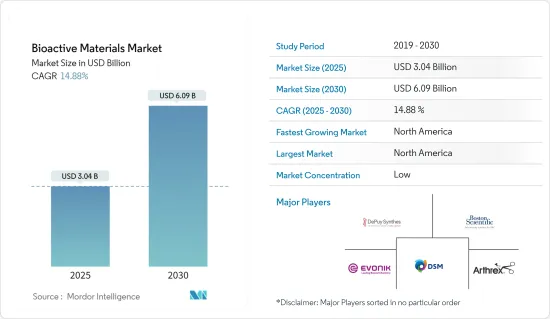

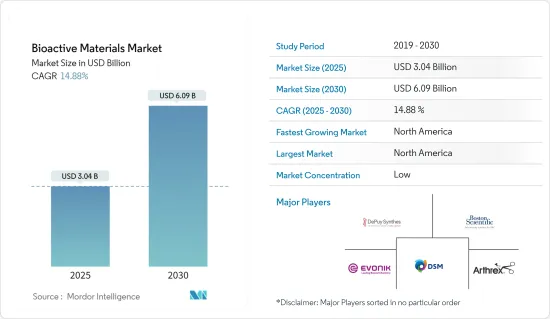

生物活性材料市場規模預計在 2025 年為 30.4 億美元,預計到 2030 年將達到 60.9 億美元,預測期內(2025-2030 年)的複合年成長率為 14.88%。

由於這種材料廣泛應用於醫療保健行業,COVID-19 對市場產生了積極影響,對醫療保健設備的需求大幅增加。

從長遠來看,預計市場將受到牙科治療和根管治療需求成長的推動。

主要亮點

- 高成本、法規和潛在毒性是市場成長的主要障礙。

- 預計整形外科不斷成長的需求和新發展將為市場創造機會。

- 預計在預測期內北美將佔據市場主導地位。

生物活性材料市場趨勢

整形外科的需求不斷增加

- 生物活性材料刺激身體的生物反應,例如與組織結合。生物活性材料可應用於奈米醫學、生物感測器、機械聯鎖、骨組織癒合、牙科等領域。

- 在整形外科中,羥磷石灰是最常用的生物活性陶瓷材料。生物活性材料在植入表面形成生理活性層,從而將材料與天然組織連接起來。透過改變生物活性材料的組成,可以改變界面結合層的結合率和厚度。

- 儘管生物活性玻璃在體內具有很高的生物活性,但與金屬植入相比,生物活性玻璃在整形外科手術中的作用有限。生物活性玻璃是一種有望應用於外科骨科領域的新型材料。

- 根據歐盟統計局的數據,到2021年,歐盟五分之一的人口(20.8%)將超過65歲。 2021年至2100年間,歐盟80歲以上人口比例預計將增加一倍以上,從6.0%增加至14.6%。

- 根據印度國家統計局(NSO)《2021年印度老年人口研究》顯示,印度老年人口(60歲以上)預計在2031年達到1.94億,比2021年的1.38億增加41%。

- 預計所有這些因素將在預測期內推動整形外科領域對生物活性材料的需求。

北美佔據市場主導地位

- 由於美國持續投資於高度發展的醫療保健和醫療技術領域,預計北美將主導全球市場。

- 美國醫療保健產業是該地區最先進的產業之一。根據醫療保險和醫療補助服務中心的數據,預計2021年至2028年期間全國醫療保健支出的平均成長率將超過5.5%,到2028年將達到約6.192兆美元。

- 生物活性材料應用於根管治療、骨缺損治療、牙齒再生、硬組織修復、幹細胞移植等領域,生物活性玻璃和微晶玻璃是骨組織工程應用的主要生物活性材料。

- 根據世界銀行的數據,美國65歲以上人口約佔總人口的16.6%。 65 歲以上的老年人需要更頻繁地就診以治療蛀牙和牙齦問題,並且關節炎的風險也更高。

- 根據美國整形外科學會 (AAOS) 的統計,肌肉骨骼疾病和關節(膝關節和髖關節)置換術是美國人最常見的手術。這些應用中生物活性材料的使用越來越多。

- 2022年,加拿大醫療保健總支出價值2,457.2億美元,預計今年底將達到2,645億美元。在醫療保健產業中,醫療設備產業是一個高度多樣化、出口導向的產業,生產設備和消耗品。該行業由產品創新推動。該行業能夠利用加拿大大學、研究機構和醫院進行的世界級的創新研究,其中一些研究成果被分拆為加拿大醫療設備公司。

- 進行手術需要先進的醫療設備和零件,包括生物活性材料。預計這項措施以及這些材料在製藥領域的應用將在未來幾年推動北美生物活性材料市場的發展。

生物活性材料產業概況

全球生物活性材料產業較為分散,主要企業佔大部分市場佔有率。主要企業包括(排名不分先後):波士頓科學公司、Depuy Synthes、贏創工業公司、DSM 和 Arthrex。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 牙科治療和根管治療的需求不斷增加

- 在醫療產業的應用日益廣泛

- 限制因素

- 高成本、法規嚴格、潛在毒性

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依材料類型

- 生物活性玻璃

- 生物活性陶瓷

- 生物活性複合材料

- 其他

- 按應用

- 整形外科

- 牙科

- 奈米醫學和生物技術

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Arthrex Inc.

- Bioactive Bone Substitutes OyJ

- Biomatlante

- BTG(Boston Scientific)

- Cam Bioceramics

- Ceraver

- Collagen Matrix Inc.

- DePuy Synthes(Johnson and Johnson)

- DSM

- Evonik Industries

- Medtronic Inc.

- Noraker

- OSARTIS GmbH

- Pulpdent Corporation

- Septodont Holding

- Stryker Corporation

- Zimmer Holdings Inc.

第7章 市場機會與未來趨勢

- 整形外科需求的不斷成長與新開發

The Bioactive Materials Market size is estimated at USD 3.04 billion in 2025, and is expected to reach USD 6.09 billion by 2030, at a CAGR of 14.88% during the forecast period (2025-2030).

As the material is widely used in the healthcare industry, COVID-19 had a positive impact on the market, as the demand for healthcare equipment grew significantly.

Over the long term, the growing demand for dental care and root canal treatment will drive the market.

Key Highlights

- On the flip side, high costs, regulations, and probable toxicity hinder market growth significantly.

- The rising demand for orthopedics and new developments are expected to create opportunities for the market studied.

- North America is expected to dominate the market during the forecast period.

Bioactive Materials Market Trends

Growing Demand from Orthopedics

- Bioactive materials stimulate a biological response from the body, such as bonding to the tissue. Bioactive materials find their application in nanomedicine and biosensors, mechanical interlocks, bone tissue healings, and dental, amongst others.

- In orthopedic surgery, hydroxyapatite is the most commonly utilized bioactive ceramic material. Bioactive materials create a physiologically active layer on the implant's surface, resulting in a link between the native tissues and the substance. Changing the composition of the bioactive material allows a wide variety of bonding rates and interfacial bonding layer thickness.

- Bioactive glasses, despite their higher bioactivity within the body, serve a minor role in orthopedic surgery compared to metallic implants. Bioactive glass is a new material that has the potential to be employed in surgical orthopedics.

- According to Eurostat, in 2021, a fifth of the EU population (20.8%) was 65 or older. Between 2021 and 2100, the proportion of people aged 80 and up in the EU's population is expected to more than double, from 6.0% to 14.6%.

- According to the National Statistical Office's (NSO) Old in India 2021 study, India's elderly population (aged 60 and more) is expected to reach 194 million in 2031, up by 41% from 138 million in 2021.

- All such factors are expected to drive the demand for bioactive materials in the orthopedics sector during the forecast period.

North America Region to Dominate the Market

- North America is expected to dominate the global market due to the highly developed healthcare sector in the United States and the continuous investments to advance the medical technology sector.

- The healthcare sector in the United States is one of the most advanced in the region. According to the Centers for Medicare and Medicaid Services, during 2021-2028, national healthcare spending is projected to grow at an average of more than 5.5% and reach approximately USD 6.192 trillion by 2028.

- Bioactive materials are used in root canal and bone defect treatment, tooth regeneration, hard tissue repairs, and stem cell transplantation. Bioactive glasses and glass ceramics are major bioactive materials used in bone tissue engineering.

- According to World Bank data, the population above 65 years of age in the United States stood at around 16.6% of the total population. They require more medical attention for tooth decay and gum problems and pose a higher risk of arthritis.

- According to the American Academy of Orthopedic Surgeons (AAOS), musculo skeletal diseases and replacement of joints (knee and hip) are the most common surgeries among the American population. These applications increasingly use bioactive materials.

- In 2022, total health expenditure in Canada was valued at USD 245.72 billion and is expected to reach USD 264.5 billion by end of this year. In the healthcare industry, the medical device sector is a highly diversified and export-oriented industry that manufactures equipment and supplies. The sector is driven by product innovations. The industry can draw on world-class innovative research conducted in Canadian universities, research institutes, and hospitals, some of which are spun off into Canadian medical device companies.

- Performing surgeries requires advanced medical devices and components, including bioactive materials.This, along with the use of these materials in pharmaceutical, is expected to drive the market for bioactive materials through the years to come in North America.

Bioactive Materials Industry Overview

The global bioactive materials industry is fragmented, with the top players accounting for a major share of the market. Some major companies are Boston Scientific, Depuy Synthes, Evonik Industries, DSM, and Arthrex, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Dental Care and Root Canal Treatment

- 4.1.2 Increasing Applications in Medical Industry

- 4.2 Restraints

- 4.2.1 High Cost, Regulations, and Probable Toxicity

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Material Type

- 5.1.1 Bioactive Glass

- 5.1.2 Bioactive Ceramics

- 5.1.3 Bioactive Composites

- 5.1.4 Other Material Types

- 5.2 Application

- 5.2.1 Orthopedics

- 5.2.2 Dental Care

- 5.2.3 Nanomedicines and Biotechnology

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arthrex Inc.

- 6.4.2 Bioactive Bone Substitutes OyJ

- 6.4.3 Biomatlante

- 6.4.4 BTG (Boston Scientific)

- 6.4.5 Cam Bioceramics

- 6.4.6 Ceraver

- 6.4.7 Collagen Matrix Inc.

- 6.4.8 DePuy Synthes (Johnson and Johnson)

- 6.4.9 DSM

- 6.4.10 Evonik Industries

- 6.4.11 Medtronic Inc.

- 6.4.12 Noraker

- 6.4.13 OSARTIS GmbH

- 6.4.14 Pulpdent Corporation

- 6.4.15 Septodont Holding

- 6.4.16 Stryker Corporation

- 6.4.17 Zimmer Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand from Orthopedics and New Developments