|

市場調查報告書

商品編碼

1689932

螢石:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fluorspar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

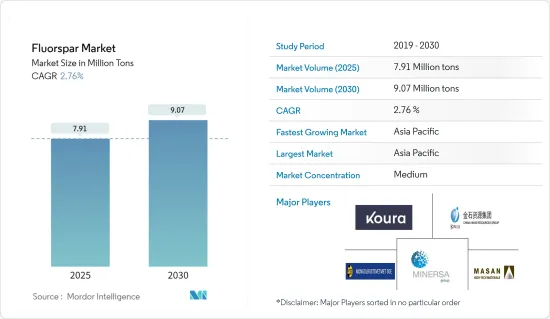

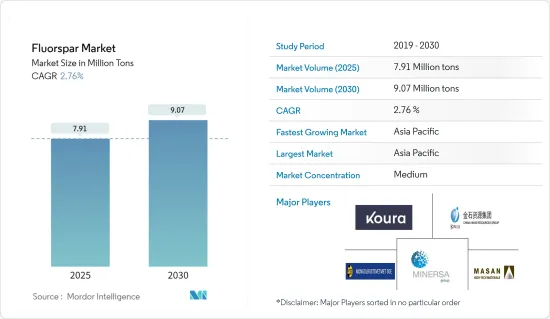

預計2025年螢石市場規模為791萬噸,2030年將達907萬噸,預測期間(2025-2030年)複合年成長率為2.76%。

主要亮點

- 推動螢石需求的主要因素是螢石提取化學品的需求不斷成長以及鋼鐵產量不斷增加。螢石的主要應用包括冶金和化學。

- 然而,有關從螢石中提取化學物質的環境法規預計會阻礙市場成長。

- 然而,螢石氟聚合物在鋰電池中的使用日益增加預計將創造新的成長機會。

- 預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。

螢石市場趨勢

冶金有望成為成長最快的應用

- 螢石在鋼鐵和其他各種金屬的生產中發揮著至關重要的作用。它起著助焊劑的作用,淨化熔融金屬中的硫、磷等雜質,增加爐渣的流動性。通常每噸金屬使用 20 至 60 磅螢石。

- 螢石含有豐富的氟化鈣,可直接用作冶金助焊劑,無需經過選礦工序。它還含有對爐渣成分至關重要的微量其他化合物。

- 在煉鋼和冶金過程中,螢石與石灰結合,以增加爐渣的流動性。特別是鋼鐵生產中螢石的消費量由原來的2公斤增加到10公斤,相當於石灰重量的5%~10%。

- 冶金工業包括金屬礦物的探勘、開採、清洗、冶煉和軋延。

- 預計螢石需求的激增將活性化全球冶金活動,從而推動預測期內螢石市場的成長。

- 在美國,蓬勃發展的採礦活動將促進國內冶金工業的發展。在美國採礦業,主要參與者包括 Newmont Mining Corp.、Peabody Energy Corp.、Arch Resources Inc. 和 Suncoke Energy Inc.。

- 根據世界鋼鐵協會的數據,預計2023年全球粗鋼產量將達18.882億噸,較2022年小幅下降0.1%。持續的衝突、能源價格的不確定性以及持續通膨導致的貨幣緊縮等發展影響了這一趨勢。然而,鋼鐵需求正在復甦,預計在預測期內將大幅成長,尤其是在亞太地區。

- 根據世界鋼鐵協會的數據,預計2023年亞洲粗鋼產量將達13.6億噸,與前一年同期比較增加0.8%。

- 鑑於這些動態,未來幾年冶金應用對螢石的需求可能會激增。

亞太地區可望主導螢石市場

- 預計預測期內亞太地區將引領螢石市場。這項需求將受到化學工業需求成長的推動,特別是中國、日本、韓國和印度等開發中國家的需求,以及鋼鐵和汽車產業應用的擴大。

- 中國是世界鋼鐵大國,佔全球鋼鐵產量的55%。世界鋼鐵協會強調,中國的鋼鐵產量保持穩定,2023 年產量將達到 10.191 億噸,與 2022 年的產量持平。其中,2023年1-10月產量達8.747億噸,比2022年同期成長1.4%。由於中國鋼鐵企業計畫透過產能置換機制每年新增產能高達1.18億噸,預計2023年中國粗鋼產能將緩慢成長。

- 韓國鋼鐵業在國家經濟格局中發揮著至關重要的作用,支撐著汽車、建築和造船等關鍵產業。韓國鋼鐵協會強調,鋼鐵業對韓國GDP的貢獻率為1.5%,對製造業的貢獻率為4.9%。韓國是全球第六大鋼鐵生產國,預計2023年粗鋼產量將達到約6,670萬噸,較2022年成長1.3%。

- 在印度,螢石主要以兩種等級進行交易:酸性螢石(酸性螢石)和亞酸性螢石,後者包括冶金級和陶瓷級,也稱為冶金螢石。與全球平均值相比,印度的螢石產量微不足道。

- 根據美國地質調查局的數據,中國是世界最大的螢石礦產國,螢石產量為570萬噸。 2023年中國螢石蘊藏量為6,700萬噸。

螢石產業概況

螢石市場部分整合。主要企業(不分先後順序)包括 Koura、China Kings Resources Group、Mongolrostsvetmet LLC、Minersa Group 和 Masan High-Tech Materials Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 螢石萃取化學品對螢石的需求不斷增加

- 鋼鐵產量增加推動需求

- 其他

- 市場限制

- 關於從螢石中提取化學物質的環境法規

- 其他

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按年級

- 酸級

- 陶瓷級

- 冶金級

- 光學級

- 寶石加工等級

- 按類型

- 安托佐內特

- 藍約翰

- 氯苯那敏

- 釔矽鎂石

- 釔螢石

- 其他

- 按應用

- 冶金

- 陶瓷製品

- 化學品

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Anhui Fitech Materials Co. Ltd

- China Kings Resources Group Co. Ltd

- Fluorsid

- Guangzhou Kunhai Trading Co. Ltd

- Koura

- Luoyang Fengrui Fluorine Industry Co. Ltd

- Masan High-Tech Materials Corporation

- Minchem Impex India Private Limited

- Minersa Group

- Mongolrostsvetmet LLC

- Sallies Industrial Minerals

- Seaforth Mineral & Ore Co.

- SR Group

第7章 市場機會與未來趨勢

- 鋰電池中含氟聚合物的使用日益增多

- 其他機會

簡介目錄

Product Code: 69369

The Fluorspar Market size is estimated at 7.91 million tons in 2025, and is expected to reach 9.07 million tons by 2030, at a CAGR of 2.76% during the forecast period (2025-2030).

Key Highlights

- The major factors driving the demand for fluorspar are the growing demand for fluorspar-extracted chemicals and increasing steel production. Key applications of fluorspar include the metallurgical and chemical sectors.

- However, environmental regulation on the extraction of chemicals from fluorspar is expected to hinder the market's growth.

- Nevertheless, the increasing use of fluorspar-made fluoropolymers in lithium batteries is expected to create new opportunities for growth.

- Asia-Pacific is expected to dominate the market and register the highest CAGR during the forecast period.

Fluorspar Market Trends

Metallurgy Expected to be the Fastest-growing Application

- Fluorspar plays a pivotal role in producing steel, iron, and various other metals. Acting as a flux, it purges impurities such as sulfur and phosphorus from molten metal and enhances the fluidity of slag. Typically, 20 to 60 pounds of fluorspar are used for every ton of metal produced.

- Fluorspar, rich in fluorite, can be employed directly as a metallurgical flux, bypassing any beneficiation process. It also contains trace amounts of other compounds essential for slag composition.

- In steelmaking and metallurgical processes, fluorspar is combined with lime to enhance slag fluidity. Notably, steel production has seen an uptick in fluorspar consumption, rising from 2 to 10 kg, which translates to 5% to 10% of lime's quantity.

- The metallurgical industry encompasses the exploration, mining, cleaning, smelting, and rolling of metal minerals.

- Given the surging demand for fluorspar, a corresponding boost in global metallurgical activities is anticipated, fueling growth in the fluorspar market during the forecast period.

- In the United States, burgeoning mining activities are set to bolster the domestic metallurgical industry. Prominent players in the US mining landscape include Newmont Mining Corp., Peabody Energy Corp., Arch Resources Inc., and Suncoke Energy Inc.

- As per the data from the World Steel Association, global crude steel production in 2023 reached 1888.2 million tons, reflecting a slight dip of 0.1% from 2022. Factors such as ongoing conflicts, energy price uncertainties, and monetary tightening due to persistent inflation influenced this trend. However, steel demand has rebounded, with projections indicating a significant uptick during the forecast period, particularly in Asia-Pacific.

- According to data from the World Steel Association, Asia's total crude steel production in 2023 reached 1.36 billion tons, marking a 0.8% increase from the previous year's production.

- Given these dynamics, a robust potential surge in fluorspar demand from metallurgical applications is anticipated in the coming years.

Asia-Pacific Expected to Dominate Fluorspar Market

- Asia-Pacific is poised to lead the fluorspar market during the forecast period. Rising demand from the chemical industry and expanding applications in steel and automotive sectors in developing nations, notably China, Japan, South Korea, and India, are set to bolster this demand.

- China, the global steel giant, accounts for 55% of the world's steel production. The World Steel Association highlights China's consistent output, with 1,019.1 million tons in 2023, matching the 2022 figure. Notably, the country's production in the first 10 months of 2023 reached 874.7 million metric tons, marking a 1.4% uptick from the same period in 2022. China's crude steel capacity witnessed modest growth in 2023, driven by plans from Chinese steelmakers to introduce up to 118 million MT/year of new capacity through a capacity swap mechanism.

- South Korea's steel sector plays a vital role in the nation's economic landscape, supporting key industries such as automotive, construction, and shipbuilding. The Korean Iron & Steel Association highlights the steel industry's contribution of 1.5% to the nation's GDP and 4.9% to its manufacturing sector. As the world's sixth-largest steel producer, South Korea achieved a production of approximately 66.7 million tons of crude steel in 2023, marking a 1.3% increase from 2022.

- In India, fluorspar is primarily traded in two grades: acid grade (acidspar) and sub-acid grade, the latter encompassing metallurgical and ceramic grades, also termed as metspar. India's fluorspar production is minimal on a global scale.

- As per the data from the US Geological Survey, China leads as the world's top miner of fluorspar, boasting an output of 5.7 million metric tons. China's fluorspar reserves stood at 67 million metric tons in 2023.

Fluorspar Industry Overview

The fluorspar market is partially consolidated in nature. The major players (not in any particular order) include Koura, China Kings Resources Group Co. Ltd, Mongolrostsvetmet LLC, Minersa Group, and Masan High-Tech Materials Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Fluorspar from Fluorspar Extracted Chemicals

- 4.1.2 Increasing Steel Production Driving the Demand

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Environmental Regulation on Extraction of Chemicals from Fluorspar

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Grade

- 5.1.1 Acid Grade

- 5.1.2 Ceramic Grade

- 5.1.3 Metallurgical Grade

- 5.1.4 Optical Grade

- 5.1.5 Lapidary Grade

- 5.2 By Variety

- 5.2.1 Antozonite

- 5.2.2 Blue John

- 5.2.3 Chlorophane

- 5.2.4 Yttrocerite

- 5.2.5 Yttrofluorite

- 5.2.6 Other Varieties

- 5.3 By Application

- 5.3.1 Metallurgical

- 5.3.2 Ceramics

- 5.3.3 Chemicals

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anhui Fitech Materials Co. Ltd

- 6.4.2 China Kings Resources Group Co. Ltd

- 6.4.3 Fluorsid

- 6.4.4 Guangzhou Kunhai Trading Co. Ltd

- 6.4.5 Koura

- 6.4.6 Luoyang Fengrui Fluorine Industry Co. Ltd

- 6.4.7 Masan High-Tech Materials Corporation

- 6.4.8 Minchem Impex India Private Limited

- 6.4.9 Minersa Group

- 6.4.10 Mongolrostsvetmet LLC

- 6.4.11 Sallies Industrial Minerals

- 6.4.12 Seaforth Mineral & Ore Co.

- 6.4.13 SR Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Fluospar-made Fluoropolymers in Lithium Batteries

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219