|

市場調查報告書

商品編碼

1689930

變性腈綸纖維:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Modacrylic Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

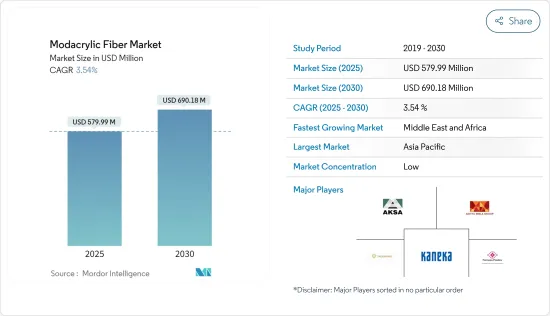

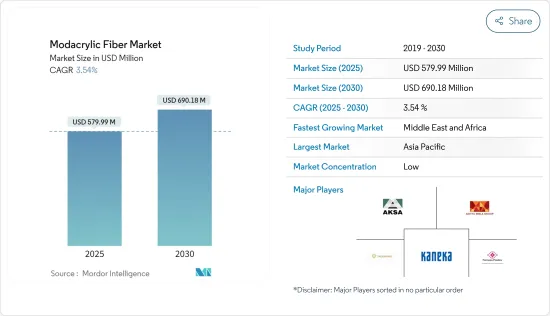

預計 2025 年改質腈綸纖維市場規模為 5.7999 億美元,到 2030 年將達到 6.9018 億美元,預測期內(2025-2030 年)的複合年成長率為 3.54%。

在新冠疫情期間,原料供應減少,影響了腈綸纖維的生產。不過,疫情過後紡織業的景氣度提振了腈綸紡織業的需求。

主要亮點

- 推動市場發展的主要因素之一是防護衣中使用的改質腈綸纖維的需求不斷增加。

- 然而,EPA(美國環保署)關於改性腈綸纖維中殘留單體使用的規定預計會阻礙市場成長。

- 作為發用纖維的改性腈綸纖維的需求不斷成長,可能為未來幾年的市場帶來機會。

- 預計亞太地區將佔據市場主導地位,其中中國和印度等國家的消費量最高。

改質腈綸纖維的市場趨勢

防護服飾改質腈綸纖維需求不斷成長

- 變性腈綸纖維是一種人造纖維,其成纖物質是由重量百分比低於85%、高於35%的丙烯腈單元組成的長鏈合成聚合物。

- 改質腈綸纖維具有阻燃性,同時兼具其他纖維的耐用性和舒適的手感等特性,因此廣泛應用於消防服等高性能防護衣。

- 人造毛皮產業的技術進步正在鼓勵時裝設計師、零售商和服裝製造商將生產從動物毛皮轉向人造毛皮等合成替代品。

- 職業安全與健康管理局製定了法規,為工作現場暴露於火焰和電弧閃光危險的員工提供阻燃服飾和服飾。

- 美國、中國和其他國家石油和天然氣工業的成長可能會增加對防護衣的需求。在石油業、海上和陸上石油鑽井現場、精製或碳氫化合物分銷場所,操作員必須穿著防火服。

- 美國是世界上最大的石油和天然氣生產國。我們75%的原油供應和90%的天然氣供應都是國內生產的。 2021年,其原油日產量將達到約1,100萬桶。預計到 2023 年這一數字將達到每天 1,240 萬桶,超過 2019 年創下的紀錄。

- 因此,由於上述因素,預測期內,改性腈綸纖維在防護衣中的應用很可能佔據市場主導地位。

亞太地區可望主導市場

- 預計預測期內亞太地區將主導改性腈綸纖維市場。隨著中國和印度等開發中國家人口的成長以及對毛髮纖維的需求不斷增加,預計將推動該地區對改性腈綸纖維的需求。

- 改性腈綸纖維用於生產玩偶頭髮、假髮和接髮。改性腈綸纖維假髮在全球髮纖維業務中佔有很大的佔有率,是繼天然頭髮之後第二受歡迎的假髮材料。根據美國國際貿易委員會統計,中國、印尼和印度是全球假髮的主要出口國。總產量中約有30%在中國國內銷售,其餘出口,主要銷往美國、歐洲和非洲國家。

- 此外,紡織業的強勁成長,加上生活方式的改變和消費者購買力的增強,正在推動對改性腈綸纖維的需求。根據中國國家統計局的數據,2022 年 1 月至 5 月中國服飾業零售額為 5,093 億元人民幣(758.3 億美元)。

- 中國是各種紡織用途織物的主要生產國,也是世界最大的襯墊傢俱出口國。它還佔世界紡織品和服飾產量的一半以上,佔全球服裝出口的30%以上。

- 由於上述因素,亞太地區改性腈綸纖維市場預計在研究期間將大幅成長。

腈綸纖維產業概況

全球市場分散,只有少數幾家大公司佔據主導地位。主要企業包括 Aditya Birla Management Corporation Pvt。有限公司、鐘化工業株式會社、台塑工業株式會社、Aksa Akrilik Kimya Sanayi AS 和 Taekwang Industrial(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 防護服飾改質腈綸纖維需求不斷成長

- 其他促進因素

- 限制因素

- 美國環保署關於改質腈綸纖維中殘留單體使用的規定

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 防護衣

- 毛髮纖維

- 工業

- 腈綸絨

- 室內裝潢/家居

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率**/排名分析

- 主要企業策略

- 公司簡介

- Kaneka Corporation

- Aditya Birla Management Corporation Pvt. Ltd

- Formosa Plastics Corporation

- Aksa Akrilik Kimya Sanayi AS

- Dralon

- Grupo Kaltex SA de CV

- Pasupati Acrylon Ltd

- Japan Industrial Co. Ltd

- Fushun Rayva Fiber Co. Ltd

- China Petrochemical Corporation

- FCFA

- Jiangsu Jinmao International E-Commerce Co. Ltd

第7章 市場機會與未來趨勢

- 改質腈綸纖維作為發用纖維的需求不斷成長

- 其他機會

The Modacrylic Fiber Market size is estimated at USD 579.99 million in 2025, and is expected to reach USD 690.18 million by 2030, at a CAGR of 3.54% during the forecast period (2025-2030).

Declined raw material supply during COVID-19 had impacted the production of modacrylic fiber. However, the surging textile industry after the pandemic propelled the demand for the modacrylic fiber industry.

Key Highlights

- One of the main factors driving the market is the growing demand for modacrylic fiber for use in protective apparel.

- However, an EPA regulation on the use of residual monomers in modacrylic fiber is expected to hinder the growth of the market studied.

- Growing demand for modacrylic fiber as hair fiber is likely to act as an opportunity for the market studied in the coming years.

- The Asia-Pacific region is expected to dominate the market with the largest consumption from countries, such as China and India.

Modacrylic Fiber Market Trends

Growing Demand for Modacrylic Fiber for Use in Protective Apparel

- Modacrylic fiber is a manufactured fiber in which the fiber-forming substance is any long-chain synthetic polymer composed of less than 85% but at least 35% by weight of acrylonitrile units.

- Modacrylic fiber is widely used in high-performance protective clothing, such as firefighting turnout gear, because the material possesses flame resistance combined with other desirable textile properties, such as durability and a good hand feel.

- Technological advancements in the artificial fur industry have encouraged fashion designers, retailers, and apparel manufacturers to shift from animal fur to synthetic fur, such as faux fur, for manufacturing their products.

- The Occupational Safety and Health Administration has developed regulations to provide flame-retardant apparel or clothing to employees who are exposed to the hazards of flames or electric arcs in the work premises.

- The growing oil and gas industry in the United States, China, and other countries is likely to boost the demand for protective apparel. In the oil sector, operators are required to wear fire protection uniforms in oil extraction stations, both offshore and on land, in oil refining plants, or in the hydrocarbon distribution.

- The United States is the world's top producer of oil and natural gas. It produces 75% of its crude oil supply and 90% of its natural gas supply domestically. By 2021, it is producing about 11 million barrels of crude oil per day. It is expected to reach 12.4 million barrels per day by 2023, which would surpass the record high set in 2019.

- Hence, owing to the above-mentioned factors, the application of modacrylic fiber in protective apparel is likely to dominate the market during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for modacrylic fibers during the forecast period. The rising demand for hair fiber, along with the growing population in developing countries, like China and India, is expected to drive the demand for modacrylic fiber in this region.

- Modacrylic fibers are utilized in the production of doll hair, wigs, and extensions. Modacrylic fiber wigs make up a significant share of the worldwide hair fiber business and are the second most popular wig material after natural hair. According to the US International trade commission, China, Indonesia, and India are significant exporters of hair wigs across the globe. From the total production, about 30% of the wigs are sold in China while the rest are exported, particularly to the United States, European and African countries.

- Furthermore, the strong growth in the textile industry coupled with the changing lifestyle and rising consumer purchasing power has propelled the demand for modacrylic fibers. According to the National Bureau of Statistics (NBS) of China, from January to May 2022, retail sales in the China apparel sector were valued at RMB 509.30 billion (USD 75.83 billion).

- China is the top producer of fabrics that are utilized in various segments of fabric applications, along with being the leading exporter of upholstered furniture in the world. The country accounted for more than half of the global textile and clothing production, as well as more than 30% of worldwide apparel exports.

- Owing to the above-mentioned factors, the market for modacrylic fibers in the Asia-Pacific region is projected to grow significantly during the study period.

Modacrylic Fiber Industry Overview

The global market is partially fragmented in nature with only a few major players dominating the market. Some of the major companies are Aditya Birla Management Corporation Pvt. Ltd, Kaneka Corporation, Formosa Plastics Corporation, Aksa Akrilik Kimya Sanayi AS, and Taekwang Industrial Co. Ltd., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Modacrylic Fiber for Use in Protective Apparel

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 EPA Regulations on Use of Residual Monomers in Modacrylic Fiber

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Protective Apparel

- 5.1.2 Hair Fiber

- 5.1.3 Industrial Fabric

- 5.1.4 Modacrylic Pile

- 5.1.5 Upholstery and Household

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Kaneka Corporation

- 6.4.2 Aditya Birla Management Corporation Pvt. Ltd

- 6.4.3 Formosa Plastics Corporation

- 6.4.4 Aksa Akrilik Kimya Sanayi AS

- 6.4.5 Dralon

- 6.4.6 Grupo Kaltex SA de CV

- 6.4.7 Pasupati Acrylon Ltd

- 6.4.8 Japan Industrial Co. Ltd

- 6.4.9 Fushun Rayva Fiber Co. Ltd

- 6.4.10 China Petrochemical Corporation

- 6.4.11 FCFA

- 6.4.12 Jiangsu Jinmao International E-Commerce Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Modacrylic Fiber as Hair Fiber

- 7.2 Other Opportunities