|

市場調查報告書

商品編碼

1689929

運動複合材料:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Sports Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

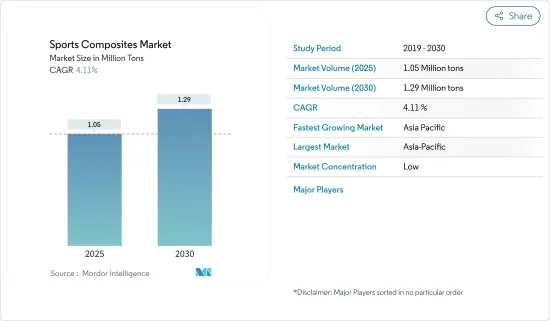

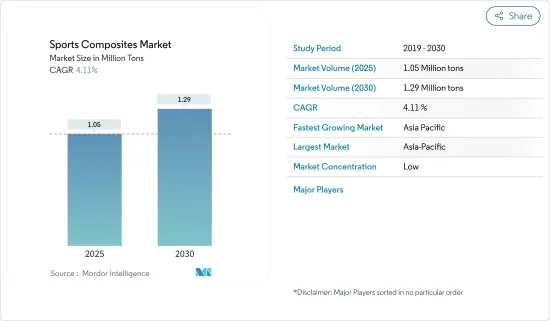

預計 2025 年運動複合材料市場規模為 105 萬噸,2030 年將達到 129 萬噸,預測期間(2025-2030 年)的複合年成長率為 4.11%。

2020 年,COVID-19 疫情對市場造成了影響,全國停工、製造活動和供應鏈中斷、全球範圍內的生產暫停。然而,情況在 2021 年開始復甦,市場在預測期內恢復成長軌跡。

主要亮點

- 對輕型、高性能運動器材的需求不斷增加以及高爾夫行業的不斷發展是預測期內推動市場發展的主要因素。

- 另一方面,碳纖維製造成本高造成的不利條件阻礙了市場的成長。

- 新能源複合材料在運動裝備領域的應用不斷擴大,可望為市場帶來新的成長機會。

- 預計預測期內亞太地區將主導全球運動複合材料市場。

運動複合材料市場趨勢

滑雪和單板滑雪的需求不斷成長

- 碳纖維在滑雪板和滑雪板製造中的應用已相當廣泛,涵蓋越野滑雪、競賽滑雪、自由騎行和滑雪登山等所有類別。

- 這種現象為滑雪板的技術特性帶來了多種優勢。但由於時尚和製造商的行銷策略,也存在誇張的情況。

- 碳纖維在滑雪板和滑雪板製造(尤其是滑雪登山)中的成功應用是由於其優良的特性:品質輕且滑雪板較寬(腳下超過 100 毫米)。

- 利用纖維增強塑膠(FRP)的內部黏合效應,開發出一種採用異向性層設計的新型滑雪板技術。該研究涉及由三種替代材料(即碳纖維、玻璃纖維和亞麻纖維增強複合材料)製成的滑雪板的技術、經濟和環境評估。

- 在這種情況下,材料選擇和纖維排列角度都會從成本、環境和技術三個分析維度顯著影響所得 FRP 的剛度。

- 從環境角度來看,天然纖維是最永續的選擇,從經濟角度來看,玻璃纖維是最好的,從技術角度來看,碳纖維是最好的。因此,對於任何製造商而言,在做出決策之前,每個分析項目的重要性都至關重要。

- 美國和加拿大是滑雪板和滑雪板製造複合材料的主要消費國,因為這些材料在氣候較溫暖的國家的使用有限。

- 預計所有這些因素將有助於確定預測期內全球對複合材料的需求。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導全球運動複合材料市場。

- 由於競爭激烈、媒體贊助和社會認可度不斷提高,體育產業正在經歷快速成長。

- 中國已成為運動服裝、配件和鞋類的一個有吸引力的市場。由於人事費用上升,跨國公司正在將業務遷往中國以外。然而,運動服和運動服的需求量很大。

- 根據國際貿易局預測,2024年,中國運動服飾市場規模將達到828億美元,年增率為11%。

- 中國將於2023年舉辦2022年亞運。根據亞奧理事會(OCA)介紹,亞運會將於2023年9月23日至10月8日在杭州舉行。亞運會通常會吸引來自全部區域的10,000多名運動員參賽。

- 此外,在印度,根據印度青年事務和體育部的數據,印度政府透過「Khelo India」計畫在2021-22年用於體育的支出將達到83.9億印度盧比(1.1億美元)。此類支出和體育規劃可能會支持學習市場的需求。

- 印度2021-22年自行車及零件資料總額為343.3億印度盧比(4.6億美元),2021-22年進口資料為187.64億印度盧比(2.51億美元)。

- 因此,近年來對高爾夫球桿、曲棍球棒、球拍、自行車等運動器材的需求不斷增加,預計將進一步推動該地區研究市場的需求。

運動複合材料產業概況

全球運動複合材料市場較為分散。主要公司包括東麗、西格里碳素、三菱化學碳纖維及複合材料、Rockwest複合材料及Excel複合材料。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 對輕量、高性能運動用品的需求不斷增加

- 高爾夫產業的成長

- 限制因素

- 碳纖維製造成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 玻璃纖維增強

- 碳纖維增強

- 其他類型

- 樹脂類型

- 環氧樹脂

- 聚氨酯

- 其他樹脂類型

- 應用

- 高爾夫球桿

- 曲棍球棒

- 球拍

- 自行車

- 滑雪和單板滑雪

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Celanese Corporation

- Dexcraft

- EPSILON Composite

- Exel Composites

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Rockman

- Rock West Composites

- SGL Carbon

- Toray Industries Inc.

- Topkey

第7章 市場機會與未來趨勢

- 新能源複合材料在體育用品的應用

The Sports Composites Market size is estimated at 1.05 million tons in 2025, and is expected to reach 1.29 million tons by 2030, at a CAGR of 4.11% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- The major factor driving the market studied is the increasing demand for lightweight and high-performance sports equipment and the growing golf industry during the forecast period.

- On the flip side, unfavorable conditions arising due to the high manufacturing cost of carbon fibers hinder the market's growth.

- The growing application of new energy composites in sports equipment will likely provide new growth opportunities for the market.

- Asia-Pacific region is expected to dominate the global sports composites market during the forecast period.

Sports Composites Market Trends

Increasing Demand for Skis and Snowboards

- The use of carbon fibers in the construction of skis and snowboards has spread considerably in all categories, including piste skiing, race, freeride, and ski mountaineering.

- This phenomenon has led to some advantages in the technical characteristics of the skis. However, there have also been some exaggerations, largely due to fashion and the marketing policies of manufacturers.

- The appropriate use of carbon fibers in the construction of skis and snowboards, especially for ski mountaineering, is owing to its excellent characteristics with a contained mass and even wider skis (over 100 mm under the foot).

- A new snowboard technology was developed using an anisotropic layer design, taking advantage of the internal coupling effects of fiber-reinforced plastics (FRP). This work deals with the technical, economic, and environmental evaluation of a snowboard made of three alternative materials, namely carbon, glass, and flax fiber-reinforced composites.

- In this case, both the material choice and the fiber placement angles significantly impact the stiffness of the resulting FRP in the three dimensions of analysis: cost, environmental, and technical.

- The natural fiber is the most sustainable option environmentally, glass fiber is the best economically, and carbon fiber is the best in terms of technical performance. Therefore, the importance attributed to each dimension of analysis is essential for any manufacturer before making the decision.

- Owing to its limited usage in warmer countries, the United States and Canada are the primary consumers of composites for manufacturing skis and snowboards.

- All such factors are expected to help determine the global demand for composites over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the global sports composites market during the forecast period.

- The sports industry has been growing significantly due to high competition, media sponsorships, and increased social awareness.

- China has been an attractive market for athletic apparel, accessories, and footwear. Multinational companies are shifting their operations outside China due to rising labor costs. However, the country has a high demand for sportswear and activewear.

- According to the International Trade Administration, the Chinese sportswear market is expected to reach USD 82.8 billion by 2024, growing at an annual rate of 11%.

- China will host the 2022 Asian Games in 2023. The games will take place in Hangzhou from September 23 to October 8, 2023, as per the Olympic Council of Asia (OCA). The Asian Games generally attract more than 10,000 athletes across the region.

- Moreover, in India, according to the Ministry of Youth Affairs and Sports, the expenditure on sports by the Indian government in FY 2021-22 accounted for INR 8.39 billion (USD 0.11 billion) through the Khelo India scheme. Such expenditures and sports schemes are likely to support the demand for the market studied.

- India's total export data of bicycles and parts in 2021-2022 was INR 34,330 million ( USD 460 million), and the total import data in 2021-2022 was INR 18,764 million (USD 251 million).

- Therefore, the demand for sports equipment, such as golf shafts, hockey sticks, rackets, and bicycles, is expected to grow in recent times, further boosting the demand for the market studied in the region.

Sports Composites Industry Overview

The global sports composites market is fragmented in nature. The major companies are Toray Industries Inc., SGL Carbon, Mitsubishi Chemical Carbon Fiber and Composites Inc., Rock West Composites, and Exel Composites, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight and High-Performance Sports Equipment

- 4.1.2 Growing Golf Industry

- 4.2 Restraints

- 4.2.1 High Manufacturing Cost of Carbon Fibers

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Glass-Fibre Reinforced

- 5.1.2 Carbon-Fibre Reinforced

- 5.1.3 Other Types

- 5.2 Resin Type

- 5.2.1 Epoxy

- 5.2.2 Polyurethane

- 5.2.3 Other Resin Types

- 5.3 Applications

- 5.3.1 Golf Shafts

- 5.3.2 Hockey Sticks

- 5.3.3 Rackets

- 5.3.4 Bicycles

- 5.3.5 Skis and Snowboards

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Dexcraft

- 6.4.3 EPSILON Composite

- 6.4.4 Exel Composites

- 6.4.5 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.6 Rockman

- 6.4.7 Rock West Composites

- 6.4.8 SGL Carbon

- 6.4.9 Toray Industries Inc.

- 6.4.10 Topkey

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Application of New Energy Composites in Sports Equipment