|

市場調查報告書

商品編碼

1689914

清洗化合物:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Purging Compound - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

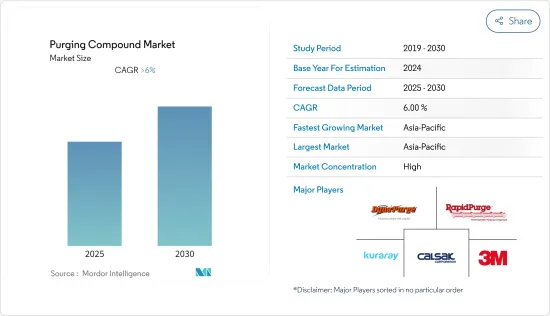

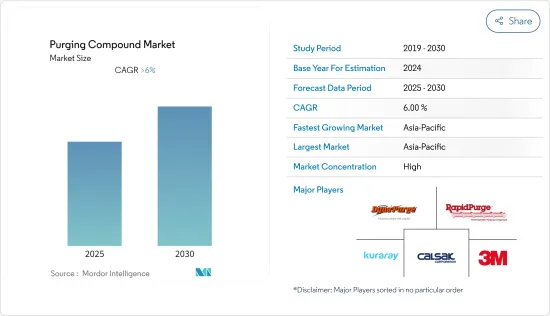

預計預測期內清洗化合物市場複合年成長率將超過 6%。

COVID-19 疫情嚴重影響了汽車和航太產業,減少了對清潔劑的需求。疫情擾亂了供應鏈,減緩了汽車和飛機的需求,關閉了許多生產設施,並減緩了化合物的清除速度。然而,隨著 2021 年全球經濟復甦和製造業回暖,企業尋求恢復生產能力,對化學品清除的需求也隨之增加。

主要亮點

- 未來,作為工業機械清洗化學品,對清潔劑的需求可能會增加。

- 預計清洗劑價格的波動將阻礙市場的成長。

- 預測期內,熱塑性塑膠加工中清洗化合物的使用預計會增加。

- 預計亞太地區將主導市場,其中中國和印度等國家佔最大的消費量。

清潔劑市場趨勢

全球市場對熱塑性塑膠加工產業清潔劑的需求不斷增加

- 市售的清潔劑是專門為清洗熱塑性成型機和擠出機而製造的產品。它通常含有基礎樹脂和添加的其他物質,用於清洗擠出機的螺桿、機筒和晶粒。

- 在競爭日益激烈的環境中,清潔劑的使用在熱塑性塑膠加工中已變得至關重要。高效生產和節省成本是塑膠加工商的關鍵標準。

- 在電動車 (EV)組裝中,通常使用注塑射出成型等熱塑性加工技術來製造各種零件,包括電池外殼、內飾和外部零件。

- 熱塑性塑膠重量輕、強度高、使用壽命長,是組裝電動車的理想材料。熱塑性塑膠易於加工,可模製成複雜的設計,從而減少生產時間和成本。根據國際能源總署(IEA)的數據,2021年純電動車銷量將達450萬輛,比2020年成長135%。

- 預計預測期內熱塑性塑膠市場將顯著成長。需求正在增加汽車產業下游加工和應用的產能。

- 由於上述因素,預計預測期內熱塑性塑膠產業的清洗化合物的應用將佔據主導地位。

亞太地區佔市場主導地位

- 由於中國和印度等新興市場的需求不斷增加,預計亞太地區將主導全球市場。該地區是聚合物和熱塑性塑膠的製造地。該地區是聚合物和熱塑性塑膠的製造地,推動了對清洗化合物的需求不斷成長。

- 最大的清潔劑生產地是亞太地區。清洗化合物生產的主要企業包括 Calsak Corporation、RapidPurge、3M、Kuraray 和 Dyna-Purge。

- 亞太地區的快速工業化正在促進食品飲料、建築、汽車、石化和化學等行業的擴張。這些行業正在逐步採用複合材料來減少停機時間並提高製造效率。

- 中國、日本和印度是該領域最大的參與者,因為他們的塑膠加工行業使用並需要大量的清潔劑。

- 許多汽車塑膠零件都是在清潔劑的幫助下製造的。根據國際汽車工業聯合會統計,2021年中國汽車產量與前一年同期比較增3%,超過2,600萬輛,成為全球最大汽車生產國。

- 根據印度品牌股權基金會的數據,2021 年印度塑膠和油氈產品出口額達到 98 億美元。這比去年的出口額成長了30%。

- 由於上述原因,預計在研究期間亞太地區的清洗化合物市場將會成長。

清潔劑產業概況

全球清潔劑市場已部分整合,只有少數幾家大公司佔據主導地位。主要企業包括 Calsak Corporation、RapidPurge、3M Company、Kuraray 和 Dyna-Purge。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 全球市場對熱塑性塑膠產業清潔劑的需求不斷增加

- 化學工業對有效去除腐蝕抑制解決方案的需求日益增加

- 其他促進因素

- 限制因素

- 消除複合材料價格波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

- 原料分析

第5章 市場區隔

- 類型

- 機械清洗

- 化學清洗

- 流體清洗

- 過程

- 射出成型

- 擠壓

- 吹塑成型

- 其他流程

- 應用

- 車

- 建築學

- 工業機械

- 聚合物

- 熱塑性樹脂加工

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Dow Chemical Company

- Kuraray Co. Ltd

- 3M Company

- BASF SE

- RapidPurge

- Daicel Corporation

- VELOX GmbH(IMCD Group)

- Calsak Corporation

- ChemTrend LP

- Dyna-Purge

- Formosa Plastics Corporation

- Ultra System SA

- Purge Right

- Clariant AG

第7章 市場機會與未來趨勢

- 工業機械清洗劑需求不斷增加

- 其他機會

The Purging Compound Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 pandemic reduced demand for purging compounds in the automobile and aerospace industries, which were severely impacted. The pandemic disrupted supply networks, lowered demand for automobiles and aircraft, and shut down many production facilities, slowing compound purging. However, in 2021, the global economy rebounded and manufacturing began, increasing the need for purging chemicals as businesses attempted to rebuild their production capacity.

Key Highlights

- In the future, the market may be able to take advantage of the growing demand for purging compounds as cleaning chemicals in industrial machines.

- Volatile prices of purging compounds are expected to hinder the growth of the market studied.

- During the forecast period, there is likely to be a rise in the use of purging compounds in thermoplastic processing.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption coming from countries such as China and India.

Purging Compound Market Trends

Increasing Demand of Purging Compound from Thermoplastic Processing Industry in Global Market

- A commercial purging compound is a product specifically manufactured to clean thermoplastic molding machines and extruders. It usually has a base resin and other substances added to it that are meant to clean the screw, barrel, and extruder die.

- The utilization of purging compounds has become a necessary piece of thermoplastics processing in the growing competitive environment. Efficient production and a decrease in cost are significant standards for plastics processors.

- In the assembly of electric vehicles (EVs), thermoplastic processing techniques like injection molding are often used to make a wide range of parts and components, such as battery housing, interior trim, and exterior body pieces.

- Thermoplastics are ideal for use in the assembly of EVs because of their low weight, high strength, and long service life. They're easy to process and can be shaped into intricate designs, both of which cut down on production time and cost. Sales of battery electric vehicles reached 4.5 million units in 2021, up 135% from 2020, according to the International Energy Agency.

- The thermoplastics market is expected to register substantial growth during the forecast period. The demand is increasing capacity in downstream processing and applications in the automotive industry.

- The application of purging compounds from the thermoplastic industry is expected to dominate during the forecast period due to the aforementioned factors.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market, owing to the increasing demand from developing nations, including China and India. The region is a manufacturing hub for polymers and thermoplastics. This factor is a propelling factor for the increasing demand for purging compounds in the region.

- The largest producers of purging compounds are based in the Asia-Pacific region. Some of the leading companies in the production of purging compounds are Calsak Corporation, RapidPurge, 3M, Kuraray Co. Ltd., and Dyna-Purge, among others.

- The rapid industrialization in the Asia-Pacific region is contributing to the expansion of several industries, including the food and beverage, construction, automotive, petrochemical, and chemical industries. These industries are gradually implementing composites to reduce downtime and increase manufacturing efficiency.

- China, Japan, and India are the biggest players in this area because the plastics processing industry uses and needs a lot of purging compounds.

- Many automobile plastic components are manufactured with the help of purging chemicals. According to the International Organization of Motor Vehicle Manufacturers, China produced over 26 million automobiles in 2021, an increase of 3% from the previous year, making it the world's largest automotive producer.

- According to the India Brand Equity Foundation, India's exports of plastic and linoleum products reached USD 9.8 billion in 2021. This is a 30% increase over the previous year's exports.

- Due to the above reasons, the market for purging compounds is expected to grow in the Asia-Pacific region during the study period.

Purging Compound Industry Overview

The global purging compound market is partially consolidated, with only a few major players dominating the market. Some of the major companies are Calsak Corporation, RapidPurge, 3M Company, Kuraray Co. Ltd., and Dyna-Purge, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of Purging Compound from Thermoplastic Industry in Global Market

- 4.1.2 Growing Demand as Effective Removal Solutions to Control Corrosion in Chemical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatile Prices of Purging Compounds

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Mechanical Purge

- 5.1.2 Chemical Purge

- 5.1.3 Liquid Purge

- 5.2 Process

- 5.2.1 Injection Molding

- 5.2.2 Extrusion

- 5.2.3 Blow Molding

- 5.2.4 Other Processes

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Industrial machinery

- 5.3.4 Polymers

- 5.3.5 Thermoplastic Processing

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dow Chemical Company

- 6.4.2 Kuraray Co. Ltd

- 6.4.3 3M Company

- 6.4.4 BASF SE

- 6.4.5 RapidPurge

- 6.4.6 Daicel Corporation

- 6.4.7 VELOX GmbH (IMCD Group)

- 6.4.8 Calsak Corporation

- 6.4.9 ChemTrend LP

- 6.4.10 Dyna-Purge

- 6.4.11 Formosa Plastics Corporation

- 6.4.12 Ultra System SA

- 6.4.13 Purge Right

- 6.4.14 Clariant AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand of Cleaning Chemicals in Industrial Machines

- 7.2 Other Opportunities