|

市場調查報告書

商品編碼

1689913

三聚氰胺甲醛:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Melamine Formaldehyde - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

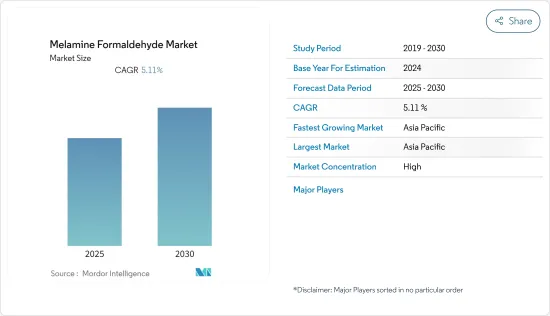

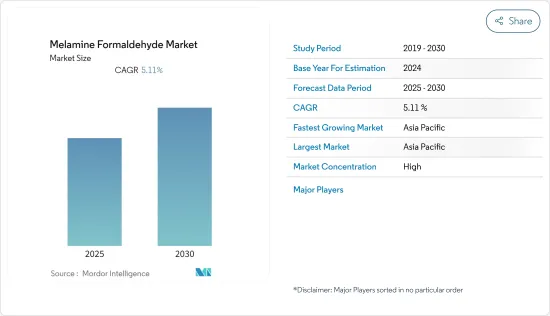

預計預測期內三聚氰胺甲醛市場複合年成長率將達到 5.11%。

由於各終端用戶產業突然停產,COVID-19 對三聚氰胺甲醛市場產生了負面影響。此外,進出口禁令擾亂了供應鏈,阻礙了整體市場的成長。不過,目前估計市場將達到疫情前的水平,並有望穩定成長。

主要亮點

- 推動市場發展的關鍵因素是福米卡層壓家具的需求不斷成長以及建設產業的高速成長。

- 預計汽車產業的衰退將阻礙市場成長。

- 硬質聚氨酯泡沫中三聚氰胺甲醛的使用量不斷增加,可能為未來幾年該市場帶來正面機會。

- 由於中國和印度家具行業的需求不斷成長,亞太地區可能會主導全球市場。

三聚氰胺甲醛市場趨勢

層壓板市場將佔據主導地位

- 三聚氰胺甲醛樹脂用於生產平板電腦檯面、廚櫃、地板、家具等使用的高壓層壓板。

- 三聚氰胺板具有多層結構,包括面紙、裝飾紙和底紙。面紙可以保護裝飾紙的花紋、圖案,使表面光亮、堅固、堅硬,具有更好的耐磨、耐腐蝕性。

- 高耐用性和易於安裝是推動強化木地板需求的主要因素。

- 從全球來看,亞太地區的住宅供不應求,無法滿足其需求。在中國,2023 年第一季房地產開發投資年減 5.8% 至 2.6 兆元(3,778 億美元)。

- 2023年3月加拿大建築業投資下降1.3%至202億美元。根據加拿大統計局的數據,2023 年 3 月住宅部門下降 2.1%,至 146 億美元。

- 隨著客製化趨勢的日益成長,家具製造商已經開始設計客製化的 RTA 家具,以增加客戶群和銷售。預計層壓家具(尤其是 RTA(即裝即組裝))的需求將持續成長。

- 牛津經濟研究院預測,建築活動規模將從 2022 年的 9.7 兆美元成長至 2037 年的 13.9 兆美元,其中,中國、美國和印度的建築市場將發揮主導作用。由於建設活動的增加,預計預測期內對三聚氰胺甲醛層壓板的需求將會增加。

- 考慮到上述因素,預計層壓板部分將在預測期內佔據市場主導地位。

中國主導亞太市場

- 中國家具業是世界上最大的家具業之一。它也是世界領先的家俱生產國、消費國和出口國之一。

- 從產量來看,中國家具產業佔全球家具產量的近40%。此外,根據《中國日報》報道,預計到 2025 年中國將新建 7,000 個購物中心。

- 由於存在許多具有多種設計和材料組合的新型住宅家具產品且不斷創新,住宅家具在零售中佔據主導地位。

- 在住宅家具中,中國對客廳和餐廳家具的需求正在穩步成長。客廳和餐廳家具佔整個家具市場的近38%,其次是餐廳家具和廚房家具。

- 所有這些因素都推動了中國對層壓板、木材膠粘劑和木材塗料的需求,為中國木材膠粘劑和木材塗料產品的發展提供了動力。

- 中國的木材膠合劑產業較為分散,由多家本土企業主導。預計未來五年行業收入的複合年成長率將超過5%。

- 根據國際貿易辦公室預測,「十四五」期間(2021-2025年),中國新基建投資總額將達到約4.2兆美元。

- 上述所有因素預計將使中國在亞太地區佔優勢。

三聚氰胺甲醛產業概況

三聚氰胺甲醛市場高度分散,領先公司的全球市場佔有率微乎其微。市場的主要企業(不分先後順序)包括BASF SE、Hexion、Arclin Inc.、Prefere Resins Holding GmbH 和 Georgia Pacific Chemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 福米卡層壓家具需求不斷成長

- 建設產業的成長

- 其他促進因素

- 限制因素

- 汽車工業的衰退

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價分析

- 技術簡介

第5章市場區隔

- 類型

- 異丁基化三聚氰胺甲醛樹脂

- 正丁基化三聚氰胺甲醛樹脂

- 其他類型

- 應用

- 層壓板

- 木材膠黏劑

- 模塑膠

- 畫

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析**/市佔分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Allnex GMBH

- Arclin, Inc.

- BASF SE

- Cornerstone Chemical

- Frati Luigi SpA

- Hexion

- Metadynea Metafrax Group

- Pacific Texchem Private Limited

- Sprea Misr

第7章 市場機會與未來趨勢

- 硬質聚氨酯泡棉。

- 其他機會

The Melamine Formaldehyde Market is expected to register a CAGR of 5.11% during the forecast period.

COVID-19 negatively impacted the melamine formaldehyde market due to the abrupt production halt in various end-user industries. Also, a ban on export and imports disrupted the supply chain, thus hampering the overall market growth. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The major factors driving the market studied are the growing demand for formica laminated furniture and high growth in the construction industry.

- The decline in the automobile industry is expected to hinder the market's growth.

- The increasing usage of melamine formaldehyde in rigid polyurethane foam will likely be an opportunity for the market studied in the coming years.

- The Asia-Pacific region is likely to dominate the global market, owing to the increasing demand from the furniture industry in China and India.

Melamine Formaldehyde Market Trends

Laminates Segment to Dominate the Market

- Melamine formaldehyde resins are applied in manufacturing high-pressure laminates used in tabletops, kitchen cabinets, flooring, furniture, etc.

- Melamine laminated sheet is in a multilayer structure, including surface paper, decoration paper, and bottom paper. The surface paper protects patterns and designs on the decorative paper, makes the surface brighter, solider, and harder, and provides better wear and corrosion resistance.

- High durability and ease of installation are major factors driving the demand for laminated flooring.

- Globally, there is a significant undersupply to meet the demand for housing in Asia-Pacific. In China, property development investment dropped 5.8% year on year to CNY 2.6 trillion (USD 377.8 billion) in the first quarter of 2023.

- Canada's investment in building construction decreased by 1.3% to USD 20.2 billion in March 2023. Statistics Canada said the residential sector declined 2.1% to USD 14.6 billion in March 2023.

- With the growing customization trend, furniture players started designing customized RTA furniture to increase their customer base and sales. The growing demand for laminated furniture, especially from the RTA (Ready to assemble furniture), is expected to drive the demand.

- Oxford Economics estimates that building activity will increase from USD 9.7 trillion in 2022 to USD 13.9 trillion in 2037, led by markets for construction in China, the United States, and India. The demand for laminates composed of melamine formaldehyde is anticipated to rise during the projected period due to the rise in construction activities.

- Based on the aspects above, the laminates segment is expected to dominate the market in the forecast period.

China to Dominate the Asia-Pacific Market

- The Chinese furniture industry is one of the biggest furniture industries in the world. It is also among the leading furniture producers, consumers, and exporters.

- The production side of the Chinese furniture industry accounts for nearly 40% of the world's furniture production. Also, according to China Daily, China is likely to witness the construction of 7,000 more shopping centers, estimated to be opened by 2025.

- Residential furniture sales dominated retail sales due to the availability and innovation of many new residential furniture products in varied designs and material combinations.

- Among residential furniture, the demand for living and dining room furniture steadily grew in China. The living room and dining room furniture dominated the market with a share of nearly 38% in the overall furniture market, followed by the dining room and kitchen furniture.

- All these factors are driving the demand for lamination, wood adhesives, and wood coatings in China, providing impetus to the country's wood adhesives and wood coatings products.

- China's wood adhesive industry is fragmented and dominated by many local players. The industry's sales are expected to witness a CAGR of over 5% during the next five years.

- According to International Trade Agency, China's overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach roughly USD 4.2 trillion.

- All the above factors are expected to make China dominant in the Asia-Pacific region.

Melamine Formaldehyde Industry Overview

The melamine formaldehyde market is highly fragmented, where the major players account for a negligible global market share. Some of the major companies in the market (in no particular order) include BASF SE, Hexion, Arclin Inc., Prefere Resins Holding GmbH, and Georgia Pacific Chemicals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Formica Laminated Furniture

- 4.1.2 Growth in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Decline in the Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Iso-butylated Melamine Formaldehyde Resin

- 5.1.2 n-butylated Melamine Formaldehyde Resin

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Laminates

- 5.2.2 Wood Adhesives

- 5.2.3 Molding Compounds

- 5.2.4 Paints and Coatings

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Allnex GMBH

- 6.4.3 Arclin, Inc.

- 6.4.4 BASF SE

- 6.4.5 Cornerstone Chemical

- 6.4.6 Frati Luigi S.p.A

- 6.4.7 Hexion

- 6.4.8 Metadynea Metafrax Group

- 6.4.9 Pacific Texchem Private Limited

- 6.4.10 Sprea Misr

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Usage of Melamine Formaldehyde in the Rigid Polyurethane Foam

- 7.2 Other Opportunities