|

市場調查報告書

商品編碼

1689901

低摩擦塗層:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Low Friction Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

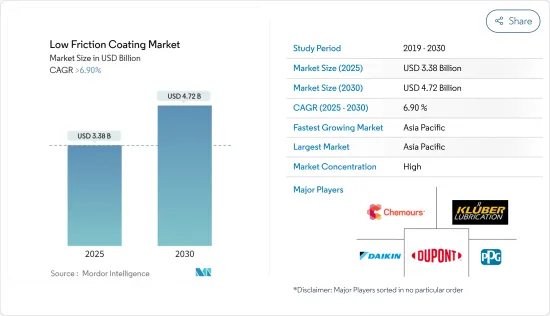

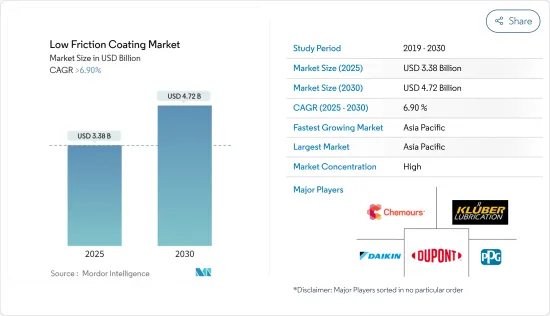

低摩擦塗層市場規模預計在 2025 年達到 33.8 億美元,預計到 2030 年將達到 47.2 億美元,預測期內(2025-2030 年)的複合年成長率將超過 6.9%。

主要亮點

- 推動市場發展的因素包括航太工業對低摩擦塗層的需求不斷增加,以及主要國家汽車工業的應用不斷擴大。

- 然而,政府關於 PTFE(聚四氟乙烯)毒性的法規預計會阻礙市場成長。

- 醫療保健行業對流體摩擦塗層的需求不斷成長,預計將在未來幾年為市場提供機會。

- 在預測期內,低摩擦塗料市場預計將實現最快的成長並在亞太地區佔據主導地位。

低摩擦塗層市場趨勢

汽車和運輸業對低摩擦塗層的需求不斷增加

- 低摩擦塗層具有極低的摩擦係數 (COF)、出色的抗咬、抗微動磨損和抗粘連性能、高耐腐蝕性和許多其他優點。

- 因此,由於需要提高燃油效率、減少排放氣體和提高性能,以及採用電氣化和自動駕駛汽車等新技術,汽車和運輸業對低摩擦塗層的需求正在增加。

- 此外,全球汽車產量的成長也進一步刺激了需求。例如,根據國際汽車製造商組織(OICA)的預測,全球汽車產量將從2022年的8,483萬輛增加到2023年的9,354萬輛,與前一年同期比較成長17%。

- 此外,根據歐洲汽車工業協會的數據,2023 年前三個季度(2023 年 1 月至 9 月)歐洲汽車總產量與 2022 年同期相比成長了近 14%。這大大促進了低摩擦塗料市場的需求。

- 預計未來幾年汽車產業將經歷顯著成長。不斷發展的數位技術、不斷變化的客戶情緒和經濟健康狀況在汽車製造的非商業性業務實踐中發揮關鍵作用。

- 例如,現代汽車集團、寶馬集團、豐田、本田、福特汽車公司和通用汽車等多家汽車製造商已宣佈在北卡羅來納州、密西根州、俄亥俄州、密蘇裡州和堪薩斯州等州投資電動車製造。預計這將促進汽車製造業的發展並增加對低摩擦塗層的需求。

- 因此,預計汽車和運輸業在預測期內對低摩擦塗層的需求最高,從而增強其在市場上的主導地位。

亞太地區發展迅速

- 預計在預測期內亞太地區將佔據市場主導地位。低摩擦塗料需求的不斷成長,加上中國和印度等國家汽車和醫療保健行業的成長,預計將推動該地區對低摩擦塗料的需求。

- 低摩擦塗層的最大生產地是亞太地區。低摩擦塗層領域的主要企業包括 VITRACOAT、大金工業、科慕公司、陶氏和 ASV Multichemie Private Limited。

- 中國是全球產銷最大的汽車市場。根據中國工業協會預測,2023年中國汽車產量將達3,016萬輛,與前一年同期比較增加11.6%。

- 此外,根據印度汽車製造商協會(SIAM)的資料,印度23會計年度的汽車產量將達到458萬輛,較22會計年度的365萬輛有大幅成長。

- 根據波音公司《2021-2040年商業展望》,到2040年中國將交付約8,700架新飛機,市場服務價值達1.8兆美元。

- 此外,公共工程部長拿督斯里亞歷山大·南塔·林奇表示,馬來西亞的建築業將在2023年實現成長,截至2023年9月,總合9,144個計劃成功實施。此外,該國對各種商業建築計劃的投資也有所增加。例如,2024年5月,Google投資約20億美元開發全國首個資料中心和Google雲端中心。新中心將建在馬來西亞中部雪蘭莪州的一個商業園區,以滿足馬來西亞學生和教育工作者對 IT 服務和人工智慧素養計劃日益成長的需求。

- 考慮到上述事實和因素,預計預測期內亞太市場對低摩擦塗層的需求將以最快的速度成長。

低摩擦塗層產業概況

全球低摩擦塗料市場正在整合。市場的主要企業包括(不分先後順序)PPG Industries Inc.、Chemours Company、杜邦、克魯勃潤滑劑和大金工業有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大在汽車產業的應用

- 航太工業對低摩擦塗層的需求不斷增加

- 限制因素

- 關於加熱聚四氟乙烯毒性的政府法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 二硫化鉬

- 二硫化鎢

- 聚四氟乙烯(PTFE)

- 其他

- 按最終用戶產業

- 汽車與運輸

- 航太與國防

- 衛生保健

- 建造

- 石油和天然氣

- 其他

- 按應用

- 軸承

- 汽車零件

- 傳動部件

- 閥門零件和致動器

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AFT Fluorotec Ltd

- ASV Multichemie Private Limited

- Carl Bechem GmBH

- DAIKIN INDUSTRIES Ltd

- DuPont

- Endura Coatings

- Curtiss-Wright Corporation

- FUCHS

- GGB

- IHI HAUZER TECHNO COATING BV

- IKV Tribology Ltd

- Impreglon UK Limited

- Indestructible Paint Limited

- Kluber Lubrication(Freudenberg SE)

- Micro Surface Corp.

- Poeton

- PPG Industries Inc.

- The Chemours Company

- VITRACOAT

第7章 市場機會與未來趨勢

- 醫療保健產業對低摩擦塗層的需求不斷成長

簡介目錄

Product Code: 69226

The Low Friction Coating Market size is estimated at USD 3.38 billion in 2025, and is expected to reach USD 4.72 billion by 2030, at a CAGR of greater than 6.9% during the forecast period (2025-2030).

Key Highlights

- Factors driving the market include the increasing demand for low-friction coatings in the aerospace industry and increasing applications in the automotive industry across major economies.

- However, government regulations on the toxicity of PTFE (polytetrafluoroethylene) are expected to hinder the market's growth.

- The growing demand for flow-friction coating in the healthcare industry is expected to act as an opportunity for the market studied in the coming years.

- During the forecast period, the low friction coating market is estimated to register the fastest growth and be the most dominant in Asia-Pacific.

Low Friction Coating Market Trends

Increasing Demand for Low Friction Coating in the Automotive and Transportation Industry

- Low-friction coatings possess extremely low coefficients of friction (COF), excellent release properties for resistance to galling, fretting, and sticking, high corrosion resistance, and many other benefits.

- Therefore, there is an increasing demand for low-friction coatings in the Automotive and Transportation Industry driven by the need for improved fuel efficiency, reduced emissions, and enhanced performance, as well as the adoption of new technologies like electrification and autonomous vehicles.

- Moreover, the rising volume of vehicle production globally is propelling the demand even further. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production globally increased from 84.83 million units in 2022 to 93.54 million units in 2023, representing a growth of 17% year-on-year.

- Furthermore, according to the European Automobile Manufacturers Association, in the first three quarters of 2023 (January 2023 to September 2023), the total production of cars in Europe increased by almost 14% compared to the same period in 2022. This substantially boosted the demand in the low-friction coating market.

- The automotive industry is expected to grow significantly over the coming years. Evolving digital technology, changes in customer sentiment, and economic health have played a vital role in non-commercial business practices of manufacturing vehicles.

- For instance, various automotive manufacturing companies such as Hyundai Motor Group, BMW Group, Toyota, Honda, Ford Motor Company, and General Motors have announced investments in electric vehicle manufacturing in North Carolina, Michigan, Ohio, Missouri, Kansas, and other states. This is likely to boost automotive manufacturing, thereby increasing the demand for low-friction coating.

- Hence, the automotive and transportation industry is projected to exhibit the highest demand for low-friction coating during the forecast period, solidifying its dominance in the market.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific is expected to dominate the market during the forecast period. The rising demand for low-friction coatings, combined with the growing automotive and healthcare industry in countries like China and India, is expected to drive the demand for low-friction coatings in this region.

- The largest producers of low-friction coating are based in Asia-Pacific. Some of the leading companies in the production of low-friction coating are VITRACOAT, Daikin Industries, The Chemours Company, Dow, and ASV Multichemie Private Limited.

- China is the world's largest automobile market in terms of production and sales. According to the China Association of Automobile Manufacturers (CAAM), vehicle production in China reached 30.16 million units in 2023, growing 11.6% compared to the previous year.

- Furthermore, according to the Society of Indian Automotive Manufacturing (SIAM) data, in the financial year 2023, India manufactured 4.58 million vehicles, marking a notable increase from the 3.65 million produced in 2022-a growth rate of about 25%.

- According to the Boeing Commercial Outlook 2021-2040, in China, around 8,700 new deliveries will be made by 2040, with a market service value of USD 1,800 billion.

- Furthermore, the construction sector of Malaysia grew in 2023, with a total of 9,144 projects successfully implemented until September 2023, according to Public Works Minister Datuk Seri Alexander Nanta Linggi. In addition, there has been an increase in the country's investments in various commercial construction projects. For instance, Google invested around USD 2 billion in developing the country's first data center and a Google Cloud hub in May 2024. The new hubs will be developed at a business park in central Malaysia's Selangor state to meet the growing demand for IT services and artificial intelligence literacy programs for Malaysian students and educators.

- Given the above-mentioned facts and factors, the demand for low-friction coatings is expected to increase at the fastest rate in the Asia-Pacific market during the forecast period.

Low Friction Coating Industry Overview

The global low-friction coating market is consolidated. Some of the major companies in the market include (not in any particular order) PPG Industries Inc., The Chemours Company, DuPont, Kluber Lubrication, and Daikin Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Automotive Industry

- 4.1.2 Growing Demand for Low-friction Coating in Aerospace Industry

- 4.2 Restraints

- 4.2.1 Government Regulation on Toxicity of Overheated PTFE

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Molybdenum Disulphide

- 5.1.2 Tungsten Disulphide

- 5.1.3 Polytetrafluoroethylene (PTFE)

- 5.1.4 Other Types

- 5.2 By End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Aerospace and Defense

- 5.2.3 Healthcare

- 5.2.4 Construction

- 5.2.5 Oil and Gas

- 5.2.6 Others End-user Industries

- 5.3 By Application

- 5.3.1 Bearings

- 5.3.2 Automotive Parts

- 5.3.3 Power Transmission Items

- 5.3.4 Valve Components and Actuators

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AFT Fluorotec Ltd

- 6.4.2 ASV Multichemie Private Limited

- 6.4.3 Carl Bechem GmBH

- 6.4.4 DAIKIN INDUSTRIES Ltd

- 6.4.5 DuPont

- 6.4.6 Endura Coatings

- 6.4.7 Curtiss-Wright Corporation

- 6.4.8 FUCHS

- 6.4.9 GGB

- 6.4.10 IHI HAUZER TECHNO COATING BV

- 6.4.11 IKV Tribology Ltd

- 6.4.12 Impreglon UK Limited

- 6.4.13 Indestructible Paint Limited

- 6.4.14 Kluber Lubrication (Freudenberg SE)

- 6.4.15 Micro Surface Corp.

- 6.4.16 Poeton

- 6.4.17 PPG Industries Inc.

- 6.4.18 The Chemours Company

- 6.4.19 VITRACOAT

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Low Friction Coating in Healthcare Industry

02-2729-4219

+886-2-2729-4219