|

市場調查報告書

商品編碼

1689895

富馬酸-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Fumaric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

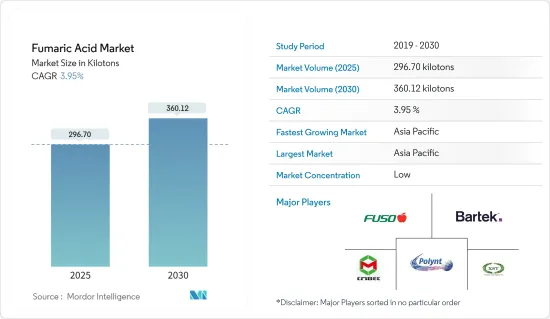

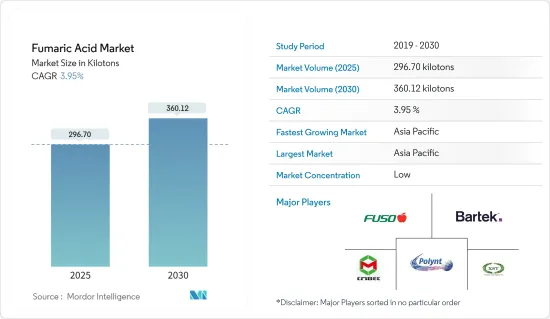

富馬酸市場規模預計在 2025 年為 296.70 千噸,預計到 2030 年將達到 360.12 千噸,預測期內(2025-2030 年)的複合年成長率為 3.95%。

2020 年,COVID-19 疫情爆發導致全國封鎖、製造活動和供應鏈中斷以及全球生產停頓,對市場產生了負面影響。然而,情況在 2021 年開始復甦,市場在預測期內恢復成長軌跡。

主要亮點

- 食品和飲料行業應用的不斷增加是市場研究的主要驅動力。

- 與富馬酸相關的健康危害是研究市場的主要限制因素之一。

- 新的潛在應用領域的出現可能會為所研究的市場帶來機會。

- 亞太地區在市場中佔據主導地位,預計在預測期內將繼續佔據主導地位。

富馬酸市場趨勢

食品和飲料佔據主導地位

- 富馬酸是一種固體有機食品酸,廣泛用作食品和飲料工業的添加劑。它被認為是一種無毒食品添加劑,可用作食品和食品飲料中的調味劑、pH調節劑、抗菌劑或酸味劑。

- 富馬酸廣泛用於烘焙、飲料和甜點,如小麥和玉米餅、冷藏餅乾麵團、酸麵團和黑麥麵包、果汁、葡萄酒、果凍和果醬、明膠甜點、藻酸鹽甜點和派餅餡料。

- 根據聯合國糧食及農業組織 (FAO) 的數據,預計 2022/23 年度全球穀物貿易量為 4.696 億噸,較 7 月的預測增加 200 萬噸,但仍比 2021/22 年度低 1.9%。

- 根據糧農組織預測,2022/23 年度(7 月/6 月)世界小麥貿易量為 1.913 億噸,與 7 月持平,比 2021/22 年度(7 月/6 月)水準下降 1.8%。

- 糧農組織預測,2022/23年度世界稻米產量為5.126億噸(精米),比2021年的最高峰低2.4%。

- 據印度農業和農民福利部稱,印度糧食產量預計達到創紀錄的3.1451億噸,比2020-21年度產量高出377萬噸。

- 預計2021-22年度印度油籽產量將達到創紀錄的3850萬噸,比2020-21年度的3595萬噸高出255萬噸。

- 由於上述原因,預計市場在預測期內將出現積極成長。

亞太地區佔市場主導地位

- 由於印度、中國和日本等國家的需求,亞太地區可能會主導全球富馬酸市場。

- 根據聯合國糧食及農業組織(FAO)預測,2022年亞洲穀物產量將達到14.71億噸,比五年平均高出2.2%。

- 在中國,加工水果、豬肉、乳製品以及一些特殊穀物和豆類都是有潛力推動該國食品加工產業成長的食品。因此,食品和飲料行業正在提供投資機會,並有望進一步產生對此類工廠使用的新設備的需求。

- 印度食品加工產業主要以出口為主。然而,由於都市化和消費者偏好,國內市場也在成長。印度加工食品出口額約為37.701億美元,主要包括加工水果、蔬菜和肉類(包括魚貝類),酒精飲料也佔了相當大的一部分。

- 根據糧農組織預測,2022年該地區穀物總產量將達到13.69億噸(稻米當量),略高於過去五年的平均水準。預計北韓、尼泊爾、緬甸,尤其是斯里蘭卡的產量將低於平均值。

- 印度農業部預計,今年稻米產量為1.3029億噸。小麥產量可能增加至1.0684億噸,比過去五年平均產量1.0388億噸高出296兆噸。

- 日本化學工業是繼運輸機械之後該國第二大製造業。運輸機械包括日本最引人注目的產業——汽車,嚴重依賴化學工業供應的原料。三菱化學公司、三井化學公司、住友化學公司、東麗株式會社和工業株式會社均位列全球化學品銷售額前 30 名。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

富馬酸產業概況

富馬酸產業市場高度分散,主要企業佔約30%的市佔率。市場上的知名公司包括 Bartek Ingredients Inc.、XST Biological、昌茂生化工程有限公司、Fuso Chemical、Polynt 等(排名不分先後)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大食品和飲料產業的應用

- 其他促進因素

- 限制因素

- 富馬酸的健康危害

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 食品級

- 工業級

- 應用

- 食品和飲料加工

- 松香紙施膠

- 不飽和聚酯樹脂

- 醇酸樹脂

- 個人護理和化妝品

- 其他用途

- 最終用戶產業

- 食品和飲料

- 化妝品

- 製藥

- 化學

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Anmol Chemicals

- Bartek Ingredients Inc.

- Changmao Biochem

- ESIM Chemicals

- Fuso Chemical Co. Ltd

- Merck KGaA

- Polynt

- Thirumalai Chemicals Ltd

- UPC Group

- Yongsan Chemicals Inc.

- XST Biological Co. Ltd

第7章 市場機會與未來趨勢

- 新應用領域的出現

The Fumaric Acid Market size is estimated at 296.70 kilotons in 2025, and is expected to reach 360.12 kilotons by 2030, at a CAGR of 3.95% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- The growing application in the food and beverage industry is a major factor driving the market studied.

- Health hazard related to fumaric acid is one of the major restraining factors for the market studied.

- The emergence of new potential application areas will likely act as an opportunity for the market studied.

- Asia-Pacific dominated the market and is expected to continue its dominance during the forecast period.

Fumaric Acid Market Trends

Food and Beverage to Dominate the Demand

- Fumaric acid is solid organic food acid extensively used as an additive in the food and beverage industry. It is considered a non-toxic food additive, which can be used as a flavoring agent, a pH control agent, an antimicrobial agent, or a pickling agent in food products and beverages.

- Fumaric acid is widely used in bakeries, beverages, and desserts, like wheat, corn tortillas, refrigerated biscuit doughs, sourdough and rye bread, fruit juice, wine, jellies and jams, gelatin desserts, alginate-based desserts, pie fillings, etc.

- According to the Food and Agriculture Organization of the United Nations (FAO), world trade in cereals in 2022/23 is forecast at 469.6 million tonnes, up by 2 million tonnes since the July forecast but still 1.9 percent below the 2021/22 level.

- According to FAO, at 191.3 million tonnes, the forecast for world wheat trade in 2022/23 (July/June) remains nearly unchanged since July and still points to a 1.8 percent decline from 2021/22 (July/June) level.

- FAO predicted the world rice production in 2022/23 to be 512.6 million tonnes (milled basis), 2.4 percent below the 2021 all-time peak.

- According to the Ministry of Agriculture & Farmers Welfare, the production of food grains in India is estimated at a record 314.51 million tonnes, which is higher by 3.77 million tonnes than the production of foodgrain during 2020-21.

- Total Oilseeds production in India during 2021-22 is estimated at a record 38.50 million tonnes which is higher by 2.55 million tonnes than the production of 35.95 million tonnes during 2020-21.

- Due to the above reasons, the market is expected to have positive growth in the forecasted period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region may dominate the global fumaric acid, owing to demand from countries like India, China, and Japan.

- According to the Food and Agriculture Organization of the United Nations (FAO), Forecast at 1,471 million tonnes, the aggregate 2022 cereal output in Asia is 2.2 percent above the five-year average.

- In China, processed fruits, pork, dairy, and some specialty grains and legumes are the food products that may drive the growth of the food processing industry in the country. Thus, the food and beverage industry is offering opportunities for investment, which is further expected to create demand for new equipment used in such plants.

- The food processing sector in India has been primarily export-oriented. However, the local market is also growing, owing to urbanization and consumer preferences. India exported processed food valued at around USD 3770.1 million which mainly consists of processed fruits, vegetables, and meats, including seafood, along with a sizeable chunk of alcoholic beverages.

- According to FAO, the far east Asia subregional aggregate cereal output is forecast at 1,369 million tonnes (rice in paddy equivalent) in 2022, slightly above the previous five-year average. Below-average outputs are expected in the Democratic People's Republic of Korea, Nepal, Myanmar and especially in Sri Lanka,

- According to the agriculture ministry of India, rice production is expected to be 130.29 million tonnes. Wheat production could increase to 106.84 million tonnes, 2.96 million tonnes higher than the past five years' average of 103.88 million tonnes.

- The Japanese chemical industry is the country's 2nd largest manufacturing industry behind transportation machinery. Transportation machinery includes Japan's most notable industry, automotive, which is highly dependent on raw materials provided by the chemical industry. Mitsubishi Chemical Corp., Mitsui Chemicals Inc., Sumitomo Chemical Co. Ltd, Toray Industries Inc., and Shin-Etsu Chemical Co. rank among the world's top 30 chemical companies measured in chemical sales.

- Thus, the aforementioned factors are projected to significantly impact the market in the coming years.

Fumaric Acid Industry Overview

The fumaric acid industry market is highly fragmented, with the top five players accounting for around ~30% of the market. Some prominent players in the market include (not in any particular order) Bartek Ingredients Inc., XST Biological Co. Ltd., Changmao Biochemical Engineering Company Limited, Fuso Chemical Co. Ltd, and Polynt

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in the Food and Beverage Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazard Related to Fumaric Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Food Grade

- 5.1.2 Technical Grade

- 5.2 Application

- 5.2.1 Food & Beverage Processing

- 5.2.2 Rosin Paper Sizing

- 5.2.3 Unsaturated Polyster Resin

- 5.2.4 Alkyd Resin

- 5.2.5 Personal Care & Cosmetics

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Cosmetics

- 5.3.3 Pharmaceutical

- 5.3.4 Chemical

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anmol Chemicals

- 6.4.2 Bartek Ingredients Inc.

- 6.4.3 Changmao Biochem

- 6.4.4 ESIM Chemicals

- 6.4.5 Fuso Chemical Co. Ltd

- 6.4.6 Merck KGaA

- 6.4.7 Polynt

- 6.4.8 Thirumalai Chemicals Ltd

- 6.4.9 UPC Group

- 6.4.10 Yongsan Chemicals Inc.

- 6.4.11 XST Biological Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of New Potential Application Areas