|

市場調查報告書

商品編碼

1689880

聚氯三氟乙烯:市場佔有率分析、產業趨勢與成長預測(2025-2030)Polychlorotrifluoroethylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

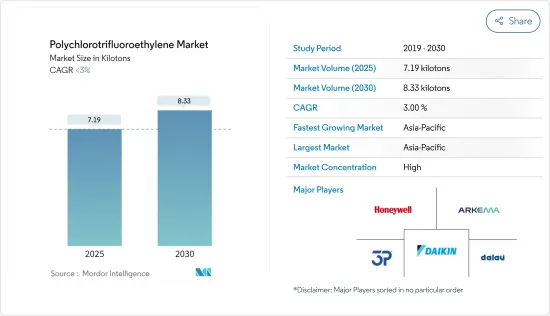

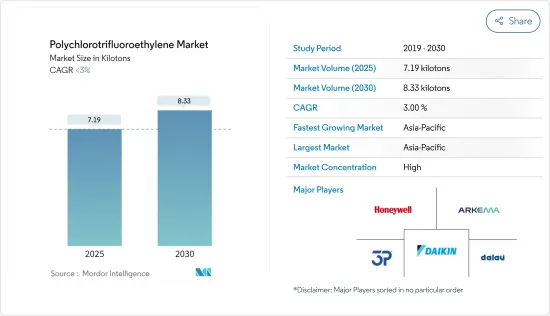

聚氯三氟乙烯市場規模預計在 2025 年為 7.19 千噸,預計在 2030 年達到 8.33 千噸,預測期間(2025-2030 年)的複合年成長率低於 3%。

2020年新冠疫情期間,生產受到衝擊,部分時段需求受到影響,以及供不應求導致原料價格波動,影響了整體聚氯三氟乙烯市場的成長。然而,製藥業消費的增加正在推動市場成長。

主要亮點

- 市場成長的主要因素是電氣和電子產業的廣泛應用,利用了聚氯三氟乙烯的特性,以及在製藥業的不斷擴大的使用。

- 另一方面,預計預測期內 PEEK、聚醯亞胺和 FEP 等替代品的存在將限制市場成長。

- 航太工業的不斷擴大的應用可能會在未來幾年提供新的成長機會。

- 由於各種終端用戶產業的存在以及中國、印度和東南亞國協的成長,亞太地區預計將成為最大的聚氯三氟乙烯市場。

聚氯三氟乙烯市場趨勢

電氣和電子領域正在成為快速發展的行業

- 聚氯三氟乙烯因其適當的電氣特性而被廣泛應用於半導體。聚氯三氟乙烯具有優異的機械性能,特別是硬度和耐化學性,可以在最極端的溫度條件下使用。

- 聚氯三氟乙烯不易燃、耐化學腐蝕、光學透明度高且吸濕性接近零。冷卻後,它變得透明、有彈性且輕盈。由 PCTFE 製成的薄膜可用作水蒸氣屏障,以保護磷光體致發光燈中的螢光粉塗層。

- 電子產業不斷發展。可攜式電腦、行動電話、遊戲系統和其他個人電子設備的生產預計將繼續刺激對電子元件的需求。

- 根據美國國際貿易委員會的數據,2022年全球半導體銷售額約為5,740億美元。中國是全球領先的半導體製造國,2022年佔全球半導體銷售額的32%以上。

而且

- 根據半導體產業協會介紹,歐盟委員會於2023年4月通過了《歐盟晶片法案》,計劃調動470億美元的公共和私人投資,到2030年使歐洲大陸在全球晶片產量中的佔有率翻倍。此外,日本政府於2023年2月核准在年度預算中額外撥款28億美元,用於津貼私人對晶片製造設備、原料、電源晶片和微控制器的投資。 2022年美國將成為全球最大的消費國,市場佔有率為48%,其次是韓國,市佔率19%。

- 根據世界半導體貿易統計資料,2023 年半導體產業總收入約為 572.5 億美元,而 2022 年為 538.5 億美元。

- 在預測期內,聚氯三氟乙烯市場可能會受到上述所有因素的推動。

亞太地區主導聚氯三氟乙烯市場

- 預計預測期內聚氯三氟乙烯市場將由亞太地區主導,原因是各行各業(主要在中國、日本和印度)的需求量很大。

- 中國生產大量PCTFE。有幾家中國公司在國內外生產和銷售這些產品。上海三愛富新材料有限公司和浙江舒華是中國兩家知名的PCTFE生產公司。

- 中國是全球第二大醫藥市場,也是全球成長最快的醫藥市場。根據中國國家統計局的報告,2022年中國醫藥產業銷售額將超過3.36兆元(5,280億美元),而2021年為3.3兆元(5,100億美元)。

- 中國政府推出政策支持並鼓勵國內醫療設備創新,預計將促進市場成長。作為僅次於美國的世界第二大醫療保健市場,該市場變得越來越艱難,尤其是自新冠疫情爆發以來。預計到2030年中國將佔全球醫療設備產業收益佔有率的25%。

- 此外,印度也從美國、中國和歐洲等多個國家進口PCTFE。國內製藥和電子產業對 PCTFE 的需求不斷成長,推動了全部區域的經濟成長。隨著政府開始加強向人民提供醫療設施的活動,該國的醫療保健產業可能會擴大業務。

- 電子業也是亞太地區聚氯三氟乙烯的主要消費產業。根據日本電子情報技術產業協會發布的資料,預計2023年日本電子設備總產值約為106,992.67億日圓(約758.357億美元),2022年約為109,772.29億日圓(約832.28億美元)。

- 因此,預計預測期內各行業不斷成長的需求和政府支持將推動該地區的市場研究。

聚氯三氟乙烯產業概況

聚氯三氟乙烯市場本質上是整合的。所研究的市場參與者(無特定順序)包括大金工業有限公司、霍尼韋爾國際公司、阿科瑪、3P Performance Plastics Products、Dalau Ltd. 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電氣電子產業推動市場

- 製藥業應用的成長

- 其他促進因素

- 限制因素

- 替代產品的可用性

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按應用

- 薄膜和片材

- 電線電纜

- 塗層

- 其他應用(閥門、墊圈、化學加工設備、化學品運輸等)

- 按最終用戶產業

- 製藥

- 航太

- 電氣和電子

- 其他終端用戶產業(化工、汽車等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3P Performance Plastics Products

- AFT Fluorotec Ltd

- Arkema

- Daikin Industries Ltd

- Dalau Ltd

- Dechengwang

- FCS

- Honeywell International Inc.

- MCP Engineering

第7章 市場機會與未來趨勢

- 航太業的成長機會

- 其他機會

The Polychlorotrifluoroethylene Market size is estimated at 7.19 kilotons in 2025, and is expected to reach 8.33 kilotons by 2030, at a CAGR of less than 3% during the forecast period (2025-2030).

During the COVID-19 outbreak in 2020, the prices of raw materials witnessed volatility due to affected production, affected demand for a particular period, and a supply shortage, which impacted the overall growth of the polychlorotrifluoroethylene market. However, rising consumption in the pharmaceutical industry has propelled market growth.

Key Highlights

- The primary factor driving the market studied is its broad range of applications in the electrical and electronics industries, owing to its properties and growing applications in the pharmaceutical industry.

- On the other hand, the presence of substitutes like PEEK, polyimide, and FEP is expected to restrict market growth during the forecast timeline.

- Growing applications in the aerospace industry are likely to offer new growth opportunities in the coming years.

- Asia-Pacific is expected to be the largest polychlorotrifluoroethylene market owing to the presence of various end-user industries and growth in China, India, and ASEAN countries.

Polychlorotrifluoroethylene Market Trends

Electrical and Electronics Segment to be the Fastest-growing Industry

- Polychlorotrifluoroethylene is extensively used in semiconductors because of its suitable electrical properties. It has excellent mechanical properties, especially hardness and chemical resistance, and can also operate in the most extreme temperature conditions.

- Polychlorotrifluoroethylene is non-flammable and has chemical resistance, high optical transparency, and near-zero moisture absorption. It becomes transparent, elastic, and lighter when cooled. Films made of PCTFE are used as a water-vapor barrier to protect phosphor coatings in electroluminescent lamps.

- The electronics industry is continuously progressing. The production of portable computing devices, cellular phones, gaming systems, and other personal electronic devices is expected to continue to fuel the demand for electronic components.

- According to the United States International Trade Commission, global semiconductor sales in 2022 were around USD 574 billion. China is the world's major semiconductor manufacturer, and it accounted for more than 32% of global semiconductor sales in 2022.

- Furthermore, the European Commission passed the "EU Chips Act" in April 2023, a plan to double the continent's share in global chip production by 2030 through mobilizing USD 47 billion in public and private investment, according to the Semiconductor Industry Association.

Additionally, in February 2023, the Japanese government approved a USD 2.8 billion supplement to the annual budget to subsidize private investments in chipmaking equipment, raw materials, power chips, and microcontrollers.

The United States accounted for a total market share of 48% in 2022, making it the largest consumer worldwide, followed by Korea with a market share of 19%. - According to the World Semiconductor Trade Statistics data, the total revenue from the semiconductor industry in 2023 was around USD 57.25 billion compared to USD 53.85 billion in 2022.

- During the forecast period, the polychlorotrifluoroethylene market is likely to be driven by all of the above factors.

Asia-Pacific to Dominate Polychlorotrifluoroethylene Market

- Asia-Pacific is expected to dominate the polychlorotrifluoroethylene market during the forecast period due to the high demand from various industries, mainly in China, Japan, and India.

- China manufactures PCTFE in large volumes. Several Chinese companies manufacture it and sell it domestically and internationally. Shanghai 3F New Material Co. Ltd and Zhejiang Juhua Co. Ltd are two well-known Chinese companies that manufacture PCTFE.

- China is the world's second-largest pharmaceutical market and the fastest-emerging market in the sector. As per the report of the National Bureau of Statistics of China, the pharmaceutical industry in China generated revenues of more than CNY 3.36 trillion (USD 0.528 trillion) in 2022 compared to CNY 3.3 trillion (USD 0.51 trillion) in 2021.

- The Chinese government has implemented policies to support and encourage domestic innovation in medical devices, which is expected to boost market growth. As the world's second-largest healthcare market, after the United States, the country's market has become more strict, especially since the COVID-19 pandemic. China is expected to have 25% of the global medical device industry's revenue share by 2030.

- Furthermore, India imports PCTFE from various countries, including the United States, China, and Europe. Increasing demand for PCTFE from the pharmaceutical and electronics industries within the country has propelled overall regional growth. The healthcare industry in the country is likely to upscale its operations as the government has initiated enhancement activities to provide healthcare facilities to its population.

- The electronic industry is another major consumer of polychlorotrifluoroethylene in Asia-Pacific. Japan is one of the largest producers of consumer electronics in recent times. According to the data released by the Japan Electronics and Information Technology Industries Association, the total production of electronics in the country was around JPY 10,699,267 million (USD 75,835.7 million) in 2023 and JPY 10,977,229 million (USD 83,228 million) in 2022.

- Thus, rising demand from various industries, coupled with government support, is expected to drive the market studied in the region during the forecast period.

Polychlorotrifluoroethylene Industry Overview

The polychlorotrifluoroethylene market is consolidated in nature. Some of the players in the market studied (not in any particular order) include Daikin Industries Ltd, Honeywell International Inc., Arkema, 3P Performance Plastics Products, and Dalau Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Electrical and Electronics Segment to Boost the Market

- 4.1.2 Growing Applications in Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Films and Sheets

- 5.1.2 Wires and Cables

- 5.1.3 Coatings

- 5.1.4 Other Applications (Valves, Gaskets, Chemical Processing Equipment, Chemical Transport etc.)

- 5.2 By End-user Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Aerospace

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries (Chemical Industry, Automotive, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 Egypt

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3P Performance Plastics Products

- 6.4.2 AFT Fluorotec Ltd

- 6.4.3 Arkema

- 6.4.4 Daikin Industries Ltd

- 6.4.5 Dalau Ltd

- 6.4.6 Dechengwang

- 6.4.7 FCS

- 6.4.8 Honeywell International Inc.

- 6.4.9 MCP Engineering

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Opportunity in the Aerospace Industry

- 7.2 Other Opportunities