|

市場調查報告書

商品編碼

1689828

生物基聚丙烯:市場佔有率分析、產業趨勢與成長預測(2025-2030)Bio-based Polypropylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

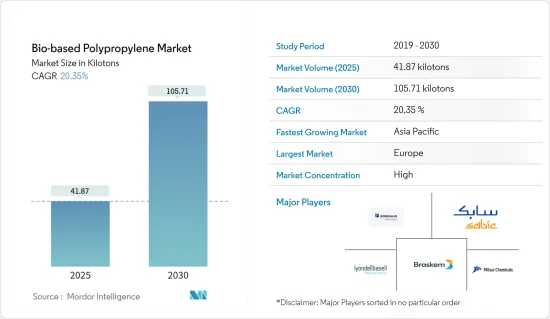

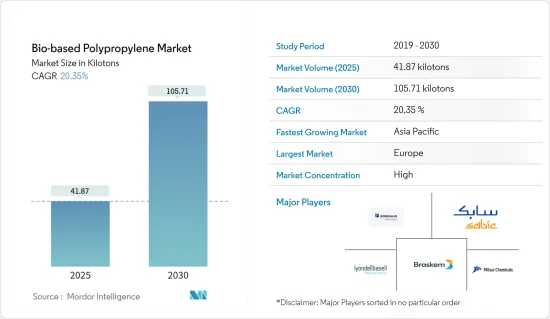

預計 2025 年生物基聚丙烯市場規模為 41.87 千噸,2030 年將達到 105.71 千噸,預測期間(2025-2030 年)的複合年成長率為 20.35%。

由於原料短缺和需求減少,COVID-19 的影響是負面的。不過,疫情過後紡織業的激增推動了生物基聚丙烯的消費。

關鍵亮點

- 推動市場發展的關鍵因素是人們對使用傳統塑膠的環境問題的日益關注,以及以可再生材料取代化石原料的動力日益增強。

- 另一方面,生物基原料的高成本阻礙了市場成長。

- 政府加強激勵力以促進生物基材料的使用,預計將為市場提供新的機會。

- 由於德國和法國的需求激增,預計歐洲將主導市場。

生物基聚丙烯的市場趨勢

射出成型應用需求不斷成長

- 生物基聚丙烯因其高熔點、優異的疲勞性能、耐熱性、耐化學性和環保性而被用於包裝、汽車、電子和醫療行業的各種射出成型應用。

- 生物基聚丙烯的需求正在穩步成長,用於包裝應用,包括有特殊要求的產品,如有機食品、奢侈品和品牌產品。

- 此外,在與技術創新、資源效率和氣候變遷相關的各種政策的推動下,世界各國政府都在推廣生質塑膠包裝。

- 最近的一項消費者調查發現,永續性是全球 60% 消費者的寶貴購買標準,而美國的排名略高於全球平均水平,為 61%。

- 此外,中國深度參與塑膠的大規模生產,並從貿易出口中獲得收入。這為各包裝公司提供了龐大的生產能力。根據ITC統計,2021年中國塑膠及模塑製品出口額約1,310.7億美元,較前一年(2020年)的約963.8億美元成長36%。

- 預計2021年全球生質塑膠產能將成長16%,達到240萬噸。 2021年生物分解性生質塑膠的總產能將達160萬噸。

- 根據米德爾哈尼斯射出成型專家 SFA Packaging 介紹,大多數食品都採用聚丙烯射出成型包裝。

- 出於對環境問題的考慮,越來越多的消費者和製造商青睞環保包裝,推動了生物基聚丙烯市場的需求。

歐洲主導市場

- 歐洲是生物基聚丙烯產業的重要基地,佔約50%的市場佔有率。歐洲在該產業的研發水準位居世界前列。

- 大多數歐洲國家對可分解塑膠(包括生物基聚丙烯)的使用有嚴格的政府規定。政府正在不斷提倡使用環保產品。

- 生物基聚丙烯主要用於包裝產業。歐洲是包裝產業的主要消費國之一,推動各個包裝領域的發展。

- 德國是歐洲最大的塑膠消費國。包裝產業中塑膠的使用量不斷增加,推動了塑膠的需求。 2021年,德國包裝產業的收益為296億歐元(345.5億美元)。這一數字較前一年的 263 億歐元(307 億美元)有所下降。

- 此外,德國政府正在推廣包裝產業使用生物基和再生材料。例如,德國聯邦參議院核准了一項新的包裝方法,以促進包裝廢棄物的回收。這對生質塑膠產業來說是一個重要的訊號,因為生物基材料和再生材料首次被認為是使包裝更加永續並減少對有限化石資源的依賴的同等可行的解決方案。

- 此外,電子商務領域的普及和不斷成長的零售市場為該地區的生物基聚丙烯市場提供了巨大的成長機會。

- 2021 年,德國 B2C 電子商務領域的銷售額約為 867 億歐元(1,010 億美元)。自新冠肺炎疫情在全球蔓延以來,網路購物呈現成長態勢。在電子商務領域,德國在2021年排名第六,落後中國、美國、英國、日本和韓國。尤其是行動商務正變得越來越重要。目前,全球有72.6億人使用智慧型手機,預計2026年這數字將達到75億人。

- 預計這些因素將在未來幾年推動歐洲生物基聚丙烯市場的發展。

生物基聚丙烯產業概況

生物基聚丙烯市場部分整合,大型企業佔相當大的佔有率。參與市場的公司(不分先後順序)包括北歐化工公司、巴西石化公司、三井化學公司、沙烏地基礎工業公司和利安德巴塞爾工業控股公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 人們對使用傳統塑膠的環境問題的擔憂日益加劇

- 越來越多用可再生原料取代化石原料

- 限制因素

- 生物基原料高成本

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 射出成型

- 紡織品

- 電影

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 其他

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Biobent Management Services Inc.

- Borealis AG

- Borouge

- Braskem

- FKuR

- INEOS

- INTER Ikea SYSTEMS BV

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- SABIC

第7章 市場機會與未來趨勢

- 增加政府獎勵措施以促進生物基材料的使用

- 其他機會

The Bio-based Polypropylene Market size is estimated at 41.87 kilotons in 2025, and is expected to reach 105.71 kilotons by 2030, at a CAGR of 20.35% during the forecast period (2025-2030).

The impact of COVID-19 was negative due to the raw materials shortage and declined demand for the product. However, an upsurge in the textile industry propelled bio-based polypropylene consumption after the pandemic.

Key Highlights

- The major factors driving the market are the rising environmental concerns regarding using conventional plastics and the increasing replacement of fossil-based feedstock with renewable materials.

- On the flip side, the high cost of bio-based materials is hindering the market's growth.

- Increasing incentives by the government promoting bio-based materials use is expected to provide new opportunities for the market.

- Europe is estimated to dominate the market studied owing to the surging demand in Germany and France.

Bio-based Polypropylene Market Trends

Growing Demand from Injection Molding Application

- Due to its high melting point, good fatigue properties, heat and chemical resistivity, and eco-friendly nature, bio-based polypropylene is used in various injection molding applications in packaging, automotive, electronics, and medical industries.

- The demand for bio-based polypropylene in packaging applications, such as wrapping organic food and premium and branded products with particular requirements, is rising steadily.

- Moreover, governments worldwide are promoting bioplastic packaging in the context of various policies for innovation, resource efficiency, and climate change.

- According to a recent consumer study, sustainability is a valuable purchase criterion for 60% of consumers globally, with the US boasting a percentage a little above the global average at 61%.

- Furthermore, China is significantly involved in producing high amounts of plastics, generating revenues from trade exports. It is, thereby, creating significant production capacities for various packaging companies. According to ITC, in 2021, China exported plastics and articles valued at about USD 131.07 billion, a 36% rise in exports from the previous year (2020), valued at around USD 96.38 billion.

- The global production capacity of bioplastics increased by 16% in 2021 to 2.4 million metric tons. Biodegradable bioplastics accounted for 1.6 million metric tons of the total capacity in 2021.

- According to the injection mold specialist SFA Packaging from Middelharnis, most foods come in injection mold packaging made of polypropylene.

- Due to environmental concerns, more consumers and manufacturers are preferring eco-friendly packaging options, boosting the demand for the bio-based polypropylene market.

Europe to Dominate the Market

- Europe is a significant hub for the bio-based polypropylene industry, with about 50% of the market share. It ranks high in R&D in this industry.

- Government regulations in most European countries regarding using bio-degradable plastics, including bio-based polypropylene, are stringent. The government is continuously pushing the usage of eco-friendly products.

- Bio-based polypropylenes are majorly used in the packaging industry. Europe is one of the leading consumers in the packaging industry and is developing various packaging segments.

- Germany is the largest plastic consumer in Europe. The increasing plastic usage in the packaging industry propelled the plastic demand. In 2021, the packaging industry in Germany generated EUR 29.6 billion (USD 34.55 billion) in revenue. It decreased compared to the previous year to EUR 26.3 billion (USD 30.70 billion).

- Moreover, the German government is promoting bio-based and recycled materials used in the packaging industry. For instance, Germany's Bundesrat, the upper house of parliament, approved a new packaging law to boost the recycling of packaging waste. It is an important signal for the bioplastics industry as, for the first time, bio-based and recycled materials are recognized as equally viable solutions to make packaging more sustainable and reduce our dependency on finite fossil resources.

- Additionally, the popularity of the e-commerce segment and the growing retail market gave a vast growth opportunity to the bio-based polypropylene market in the region through the years.

- In 2021, the B2C e-commerce sector in Germany generated around EUR 86.7 billion (USD 101 billion). Online shopping is on the rise after COVID-19 spread across the globe. In the e-commerce sector, Germany was in sixth place after China, the United States, Great Britain, Japan, and South Korea, in 2021. In particular, mobile commerce is becoming increasingly important. Currently, 7.26 billion people use smartphones, and this is estimated to reach 7.5 billion by 2026.

- The abovementioned factors are expected to drive the market for bio-based polypropylene in Europe in the coming years.

Bio-based Polypropylene Industry Overview

The bio-based polypropylene market is partially consolidated, with the major players dominating a significant portion. Some companies operating in the market (in no particular order) are Borealis AG, Braskem, Mitsui Chemicals Inc., SABIC, and LyondellBasell Industries Holdings BV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Environmental Concerns Regarding the Usage of Conventional Plastics

- 4.1.2 Increasing Replacement of Fossil-based Feedstock with Renewable Materials

- 4.2 Restraints

- 4.2.1 High Cost of Bio-based Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Injection Molding

- 5.1.2 Textiles

- 5.1.3 Films

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Biobent Management Services Inc.

- 6.4.2 Borealis AG

- 6.4.3 Borouge

- 6.4.4 Braskem

- 6.4.5 FKuR

- 6.4.6 INEOS

- 6.4.7 INTER Ikea SYSTEMS BV

- 6.4.8 LyondellBasell Industries Holdings BV

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 SABIC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Incentives by the Government Promoting the Usage of Bio-based Materials

- 7.2 Other Opportunities