|

市場調查報告書

商品編碼

1689822

碳酸伸乙酯-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Ethylene Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

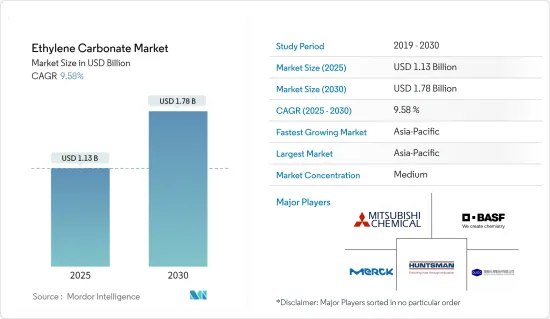

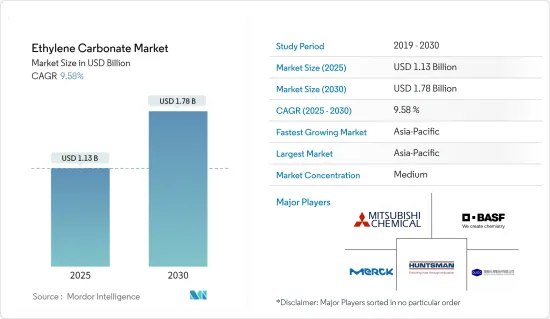

碳酸伸乙酯市場規模預計在 2025 年為 11.3 億美元,預計到 2030 年將達到 17.8 億美元,預測期內(2025-2030 年)的複合年成長率為 9.58%。

碳酸伸乙酯的生產和消費量受到了新冠疫情的影響。停產、生產限制和全球景氣衰退已經減緩了對碳酸伸乙酯和其他化學品的需求。由於需求較低,碳酸伸乙酯和其他化學品價格較便宜。疫情爆發後,電動車鋰離子電池和再生能源來源能源儲存系統對碳酸亞乙酯的需求增加。

關鍵亮點

- 碳酸乙烯酯市場近期有所成長。電動車(EV)和設備製造設備的需求不斷成長,預計將增加鋰電池和鋰的消費量,從而導致碳酸亞乙酯市場呈正成長。

- 從中期來看,影響碳酸亞乙酯市場成長的因素包括化學領域中間體的使用增加以及汽車領域對鋰電池的需求不斷成長。

- 然而,由於碳酸亞乙酯的毒性而導致的健康危害不斷增加以及其被其他替代品取代的前景預計將阻礙市場成長。

- 由於電子業高度發展且鋰離子電池產量高,亞太地區預計將主導全球市場。

碳酸伸乙酯市場趨勢

鋰電池需求不斷成長

- 碳酸伸乙酯是一種有機溶劑,用作鋰離子電池中電解質溶液的成分。電解是鋰離子電池的關鍵組成部分,因為它提供離子導電性,使鋰離子能夠在負極和正極之間移動,使電池能夠儲存和釋放能量。

- 碳酸伸乙酯除了充當溶劑外,還能穩定電解質溶液並防止在陽極形成鋰金屬。這至關重要,因為鋰金屬會導致短路和其他電池性能問題。商業和工業應用的新興產業正在推動對鋰離子電池的需求。最近的趨勢是資料中心和物料輸送產業對鋰離子電池的需求激增,尤其是在開發中國家。

- 根據國際能源總署(IEA)的預測,2021年全球純電動車銷量將達470萬輛,與前一年同期比較增加135%。

- 政府對石化燃料引擎的限制導致電動車需求激增,對鋰電池產生了重大影響。

- 電池的需求受到電子設備的興起、行動裝置需求的不斷成長、節能能源數量的增加以及已開發國家的技術突破的推動。預計這些因素將在預測期內推動碳酸乙烯酯市場的發展。

亞太地區佔市場主導地位

- 由於電子業高度發展、中國和日本的鋰離子電池產量高,以及多年來對鋰技術的持續投資,亞太地區預計將佔據市場主導地位。

- 此外,亞洲政府對內燃機的監管日益嚴格,推動了中國、日本和印度對一系列電動車的需求,從而增加了各種應用對碳酸亞乙酯的需求。

- 可以使用碳酸亞乙酯作為溶劑來生產電子塗料、黏合劑和電介質。碳酸乙烯酯可以溶解和混合其他成分,其低揮發性可以增加產品的穩定性。碳酸伸乙酯也可用於製造聚碳酸酯和其他電子聚合物。

- 日本的電子產業是世界上最大的電子產業之一。根據日本電子情報技術產業協會(JEITA)的報告,到2021年,日本將生產全球10%的電子產品。至2021年,國內電子製造業規模將超過800億美元,年增率為11%。

- 韓國的電子產業是世界上最先進的。其在消費性電子產品、半導體和其他電子元件生產領域處於世界領先地位。韓國是一些全球最大電子公司的所在地,包括三星和 LG。根據韓國貿易協會(KITA)統計,2021年韓國生產毛額與前一年同期比較成長25%,達2,007.7億美元(KITA)。

- 在製藥工業中,碳酸亞乙酯常被用作生產錠劑和膠囊等固態劑型的溶劑。碳酸亞乙酯的溶劑特性有助於活性藥物成分(API)的溶解,並可改善最終產品的混合和流動特性。

- 中國是世界第二大醫藥市場。中產階級的不斷壯大和老化、收入的增加以及都市化進程的加速正在推動醫藥市場的顯著成長。

- 根據CEIC資料,中國藥品銷售額將從2021年8月的23,740.60億元人民幣(3,506.487億美元)成長。

- 由於上述因素,預計未來幾年該地區對碳酸伸乙酯的需求將會增加。

碳酸伸乙酯產業概況

碳酸伸乙酯市場部分整合,少數大公司控制相當一部分市場。主要企業包括BASF公司、亨斯邁國際有限公司、三菱化學公司、東聯化學公司和默克公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電動汽車製造商的需求不斷成長

- 擴大化學中間體的應用

- 限制因素

- 毒性和新替代品的前景

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 鋰電池

- 潤滑劑

- 醫療產品

- 中間體和化學品

- 其他

- 最終用戶產業

- 車

- 製藥

- 石油和天然氣

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)分析**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Huntsman International LLC

- Liaoning Ganglong Chemical Co. Ltd

- Lixing Chemical

- Merck KGaA

- Mitsubishi Chemical Corporation

- OUCC

- Shandong Senjie Cleantech Co. Ltd

- Shandong Shida Shenghua Chemical Group Co. Ltd

- Taixing Taida Fine Chemical Co. Ltd

- Toagosei Co. Ltd

- Tokyo Chemical Industry Co. Ltd

- Zibo Donghai Industries Co. Ltd

第7章 市場機會與未來趨勢

- 鋰硫電池需求不斷成長

The Ethylene Carbonate Market size is estimated at USD 1.13 billion in 2025, and is expected to reach USD 1.78 billion by 2030, at a CAGR of 9.58% during the forecast period (2025-2030).

Ethylene carbonate output and consumption have been affected by COVID-19. Due to lockdowns, production limits, and global economic recession, ethylene carbonate and other chemical demands have slowed. Ethylene carbonate and other chemicals are cheaper due to lower demand. After the pandemic, the ethylene carbonate demand increased because of lithium-ion batteries for electric cars and systems that store energy from renewable sources.

Key Highlights

- The ethylene carbonate market grew recently. With the increase in demand for electric vehicles (EV) and device manufacturing units, there is an increase in lithium battery and lithium consumption, resulting in positive growth for the ethylene carbonate market.

- Over the medium term, the factors affecting the ethylene carbonate market growth include the rising number of applications for intermediates in the chemical sector and the growing need for lithium batteries in the automobile sector.

- However, on the flip side, rising health hazards due to the toxicity of ethylene carbonate and replacement prospects by other substitutes are expected to hinder the market's growth.

- Asia-Pacific is expected to dominate the global market due to its highly developed electronics sector and high production of lithium-ion batteries.

Ethylene Carbonate Market Trends

Increasing Demand for Lithium Batteries

- Ethylene carbonate is a type of organic solvent utilized as a component in the electrolyte solution of lithium-ion batteries. The electrolyte solution is a crucial component of lithium-ion batteries because it provides the ionic conductivity that enables lithium ions to travel between the anode and cathode, allowing the battery to store and release energy.

- In addition to acting as a solvent, ethylene carbonate stabilizes the electrolyte solution, avoiding the production of lithium metal on the anode. It is crucial, as lithium metal can create short circuits and other battery performance difficulties. New and exciting industries with commercial and industrial uses have increased the need for lithium-ion batteries. In recent years, demand for lithium-ion batteries from the data center and material handling industries surged, particularly in developing countries.

- According to the International Energy Agency, global sales of battery-electric vehicles reached 4.7 million in 2021, a 135% increase over the previous year.

- Government limits on fossil fuel engines have led to a rapid increase in the demand for electric vehicles, which substantially impacts lithium batteries.

- The need for batteries is driven by the increasing number of electronic devices, the growing demand for mobile devices, the increase in energy-efficient sources, and technological breakthroughs in developed nations. During the forecast period, the ethylene carbonate market is anticipated to be driven by these reasons.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market owing to its highly developed electronics sector and high production of lithium-ion batteries in China and Japan, coupled with continuous investments in the region over the years to advance lithium technology.

- Besides, the growing government regulations on combustion engines in Asia increased the need for various electric vehicles in China, Japan, and India, increasing the demand for ethylene carbonate in various applications.

- Electronic coatings, adhesives, and dielectrics can be made using ethylene carbonate as a solvent. Ethylene carbonate can dissolve and mix other components, and its low volatility can increase product stability. Ethylene carbonate can also make polycarbonates and other polymers for electronics applications.

- The Japanese electronics industry is one of the largest in the world. Japan produced 10% of the world's electronics by 2021, as the Japan Electronics and Information Technology Industries Association (JEITA) reported. In 2021, domestic electronics manufacturing exceeded USD 80 billion, a growth of 11% annually.

- South Korea's electronics industry is among the most advanced in the world. It is a global leader in producing consumer electronics, semiconductors, and other electronic components. South Korea is home to some of the world's largest electrical companies, including Samsung and LG. According to the Korea International Trade Association, South Korea produced USD 200.77 billion in 2021, up 25% from the year before (KITA).

- In the pharmaceutical industry, ethylene carbonate is frequently used as a solvent for manufacturing solid dosage forms, such as tablets and capsules. Ethylene carbonate's solvent qualities can aid in dissolving active pharmaceutical ingredients (APIs) and improving the mixing and flow properties of the finished product.

- China is the second-largest medicines market in the world. The medicines market is expanding significantly due to the country's expanding middle class and aging population, rising earnings, and expanding urbanization.

- According to CEIC Data, pharmaceutical sales in China increased to CNY 2,374,060 million (USD 350,648.7 million) in September 2021 from CNY 2,010,150 million (USD 296,899.2 million) in August 2021.

- All the abovementioned factors are expected to augment the demand for ethylene carbonate in the region over the coming years.

Ethylene Carbonate Industry Overview

The ethylene carbonate market is partially consolidated, with a few major players dominating a significant portion of the market. Some major companies include BASF SE, Huntsman International LLC, Mitsubishi Chemical Corporation, OUCC, and Merck KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Electric Vehicle Manufacturers

- 4.1.2 Increasing Applications of Chemical Intermediates

- 4.2 Restraints

- 4.2.1 Toxicity and Replacement Prospects by New Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Application

- 5.1.1 Lithium Batteries

- 5.1.2 Lubricants

- 5.1.3 Medical Products

- 5.1.4 Intermediates and Agents

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Pharmaceuticals

- 5.2.3 Oil and Gas

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Huntsman International LLC

- 6.4.3 Liaoning Ganglong Chemical Co. Ltd

- 6.4.4 Lixing Chemical

- 6.4.5 Merck KGaA

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 OUCC

- 6.4.8 Shandong Senjie Cleantech Co. Ltd

- 6.4.9 Shandong Shida Shenghua Chemical Group Co. Ltd

- 6.4.10 Taixing Taida Fine Chemical Co. Ltd

- 6.4.11 Toagosei Co. Ltd

- 6.4.12 Tokyo Chemical Industry Co. Ltd

- 6.4.13 Zibo Donghai Industries Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Lithium-sulfur Batteries