|

市場調查報告書

商品編碼

1689811

重晶石:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Barite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

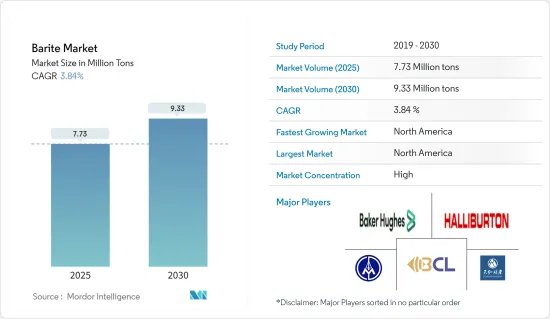

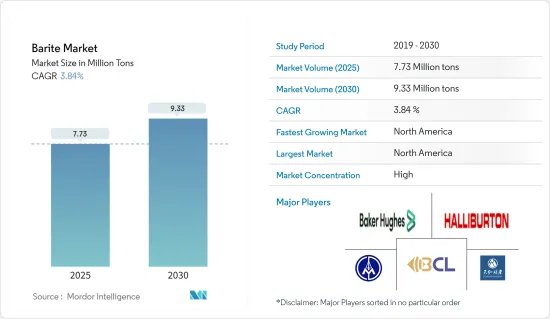

重晶石市場規模預計在2025年為773萬噸,預計2030年達到933萬噸,預測期間(2025-2030年)的複合年成長率為3.84%。

2020 年,市場受到 COVID-19 疫情的負面影響,導致主要終端用戶產業的營運突然停止。然而,由於石油和天然氣、化學品和橡膠等各個終端用戶行業的消費增加,市場在 2021-22 年顯著復甦。

主要亮點

- 從長遠來看,推動重晶石市場的主要因素將是石油和天然氣鑽探活動的需求成長以及全球塑膠產業的使用量增加。

- 然而,天青石和鐵礦石等相近替代品的可用性正在抑制重晶石市場的成長。

- 塗料和醫療產業對重晶石的採用激增可能為市場提供新的成長機會。

- 由於重晶石發揮著至關重要的作用的石油和天然氣行業的成長,北美預計將成為重晶石最大的市場。

重晶石市場趨勢

石油和天然氣產業需求旺盛

- 重晶石作為鑽井泥漿的加重劑,在石油和天然氣鑽井作業中需求量大。防止鑽井過程中石油和天然氣的爆炸性洩漏。重晶石具有獨特的物理化學性質,例如比重大、化學和物理惰性、溶解度低、磁中性等。

- 世界上的大部分需求來自石油工業。鑑於重晶石在運輸和工業終端使用領域的重要性,全球對重晶石的需求可能會持續下去,直到石油產品成為首選的一次能源來源。

- 重晶石具有無腐蝕性、惰性和高比重的特性,可用作鑽井作業中的加重劑,以清除鑽頭上的岩屑、將岩屑帶到地面、減少鑽柱中的摩擦、控制壓力、防止吹漏並提供潤滑。

- 石油工業的未來成長前景表明,石油探勘將隨著重晶石消費量而持續成長。隨著時間的推移,碳氫化合物的發現變得越來越少,這意味著生產每單位石油必須進行更多的鑽探。

- 根據國際能源總署(IEA)的報告,歐洲天然氣價格高企、發電用油量激增以及油轉氣轉換增加,推動了2022年至2023年石油需求的成長率。

- 根據能源部預測,2023年中國原油加工量將達到平均每日1,480萬桶,創歷史新高。中國近期新增的煉油產能超過其他國家,以滿足運輸燃料的需求並生產石化原料。

- 根據國際能源總署(IEA)的數據,預計2023年至2030年間,印度將佔全球石油需求成長的三分之一以上。

- 因此,全球石油和天然氣產業對重晶石的需求不斷成長可能會在未來幾年推動市場成長。

北美可望主導市場

- 重晶石,或稱硫酸鋇,在化學工業中用作石油和天然氣探勘鑽井液的加重劑、觸媒撐體、製造各種化合物的鋇源、油漆、塗料、塑膠和橡膠中的填料以及高密度輻射屏蔽材料,展示了其在不同應用中的多功能性。

- 根據BASF2023報告,在美國,由於庫存調整和工業成長疲軟,化學品需求在與前一年同期比較之後,預計2024年將小幅成長(1.1%)。

- 根據美國人口普查局的數據,2023 年美國石油產品出口將達到創紀錄的 610 萬桶/日,比 2022 年增加 2.5%。

- 據能源研究所稱,2023年12月初級能源產量年增3.2%,其中原油領漲,增幅達8.1%。

- 雖然重晶石不是電子工業的主要材料,但它被用作電子元件中使用的某些聚合物和樹脂的填料,有助於改善其性能。由於密度高,它也可用於電子和醫療設備中的輻射屏蔽。

- 因此,預計各行業對重晶石的需求不斷增加將在預測期內顯著推動北美市場的成長。

重晶石行業概況

重晶石市場呈現盤整性質。市場的主要參與者(不分先後順序)包括安得拉邦礦產開發有限公司、貴州天宏礦業、哈里伯頓能源服務公司、Baribright 和貝克休斯公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 石油和天然氣產業需求激增

- 擴大塑膠產業的應用

- 限制因素

- 是否有相近替代品

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價概覽

- 貿易概況

第5章 市場區隔

- 類型

- 床

- 靜脈礦床和填充

- 殘留礦床

- 最終用戶產業

- 石油和天然氣

- 化學

- 填料

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Andhra Pradesh Mineral Development Corporation Ltd

- Baker Hughes Inc.

- Baribright Co. Ltd

- Cimbar Performance Minerals

- Guizhou Saboman Import and Export Co. Ltd

- Guizhou Tianhong Mining Co.

- Halliburton Energy Services Inc.

- International Earth Products LLC

- New Riverside Ochre

- Newpark Resources Inc.

- Pulapathuri

- PVS Global Trade Private Limited

- Sachtleben Minerals GmbH & Co. KG

- Schlumberger Limited

- The Kish Company Inc.

- Zhongrun Barium Industry Co. Ltd

第7章 市場機會與未來趨勢

- 重晶石在塗料和醫療產業的應用逐漸增多

The Barite Market size is estimated at 7.73 million tons in 2025, and is expected to reach 9.33 million tons by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic in 2020 due to the sudden shutdown of operations in major end-user industries. However, the market recovered significantly during 2021-22 due to rising consumption from various end-user industries such as oil and gas, chemicals, and rubber.

Key Highlights

- Over the long term, the major factors driving the barite market are likely to be the growing demand from oil and gas drilling activities and the increasing usage in the plastics industry worldwide.

- However, the availability of close substitutes, such as celestite and iron ore, is restraining the growth of the barite market.

- The surge in the adoption of barite from the paint and medical industries will likely provide new growth opportunities for the market.

- North America is projected to be the largest market for barite due to the growing oil and gas industry, where barite plays a very crucial role.

Barite Market Trends

High Demand from the Oil and Gas Industry

- Barite has massive demand in oil and gas drilling operations as a weighing agent in the drilling mud. It prevents the explosive release of oil and gas during drilling. It has unique physical and chemical properties such as high specific gravity, chemical and physical inertness, low solubility, and magnetic neutrality.

- The majority of the global demand is from the petroleum industry. Given its importance in the transportation and industrial end-use sectors, the global demand for barite will likely continue until petroleum products are preferred as the chief energy source.

- The properties of barite, such as its non-corrosiveness, non-abrasiveness, insolubility in water, inertness, and high specific gravity, allow it to be used as a weighting agent in drilling operations to remove cutting from bits, transport cutting to the surface to reduce friction in the drilling string, control pressure, prevent blow-out, and provide lubrication.

- The prospectus for the future growth of the petroleum industry suggests that petroleum exploration will continue to grow, along with the consumption of barite. More drilling must be done per unit of oil as hydrocarbon discoveries become less productive with time.

- According to a report by the International Energy Agency, surging oil use for power generation and gas-to-oil switching in the wake of soaring European natural gas prices boosted the growth trajectory for oil demand over 2022 and into 2023.

- According to the Energy Institute, China's crude oil processing reached an average of 14.8 million b/d in 2023, a record high. Recently, China added more refinery capacity than any other country, partly to meet its transportation fuel requirements and produce petrochemical feedstocks.

- According to the International Energy Agency (IEA), during 2023-2030, India is expected to account for more than one-third of global oil demand growth.

- As a result, over the next few years, the market's growth is likely to be driven by the rising demand for barite from the global oil and gas industry.

North America is Expected to Dominate the Market

- Barite, or barium sulfate, is utilized in the chemical industry as a weighting agent in drilling fluids for oil and gas exploration, catalyst support, a source of barium in the production of various compounds, a filler in paints, coatings, plastics, and rubber, and for its high density in radiation shielding materials, illustrating its versatility in diverse applications.

- According to the BASF Report 2023, in the United States, demand for chemicals is projected to grow slightly in 2024 (1.1%), following a Y-o-Y decline due to inventory destocking and low industrial growth.

- According to the United States Census Bureau, oil product exports from the United States reached an all-time high of 6.1 million b/d in 2023, 2.5% higher than in 2022.

- According to the Energy Institute, in December 2023, Y-o-Y growth in primary energy production was 3.2%, with crude oil leading the way with a Y-o-Y increase of 8.1%.

- While not a primary material in the electronics industry, barite can be employed as a filler in certain polymers and resins used in electronic components, contributing to enhanced properties. Its high density also makes it useful for radiation shielding in electronic equipment and medical equipment.

- Hence, the rising demand for barite from various industries is expected to considerably boost the market's growth in North America over the forecast period.

Barite Industry Overview

The barite market is consolidated in nature. Some of the key companies in the market (not in particular order) include The Andhra Pradesh Mineral Development Corporation Ltd, Guizhou Tianhong Mining Co. Ltd, Halliburton Energy Services Inc., Baribright Co. Ltd, and Baker Hughes Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Increasing Demand from the Oil and Gas Industry

- 4.1.2 Growing Use in the Plastic Industry

- 4.2 Restraints

- 4.2.1 Availability of Close Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview

- 4.6 Trade Overview

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Bedded

- 5.1.2 Vein and Cavity Filling

- 5.1.3 Residual

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemical

- 5.2.3 Fillers

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Andhra Pradesh Mineral Development Corporation Ltd

- 6.4.2 Baker Hughes Inc.

- 6.4.3 Baribright Co. Ltd

- 6.4.4 Cimbar Performance Minerals

- 6.4.5 Guizhou Saboman Import and Export Co. Ltd

- 6.4.6 Guizhou Tianhong Mining Co.

- 6.4.7 Halliburton Energy Services Inc.

- 6.4.8 International Earth Products LLC

- 6.4.9 New Riverside Ochre

- 6.4.10 Newpark Resources Inc.

- 6.4.11 Pulapathuri

- 6.4.12 PVS Global Trade Private Limited

- 6.4.13 Sachtleben Minerals GmbH & Co. KG

- 6.4.14 Schlumberger Limited

- 6.4.15 The Kish Company Inc.

- 6.4.16 Zhongrun Barium Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Gradual Surge in Adoption of Barite from Paints & Medical Industry