|

市場調查報告書

商品編碼

1689810

無水氯化鋁-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Anhydrous Aluminum Chloride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

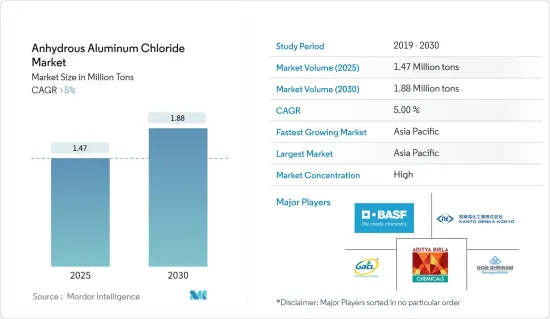

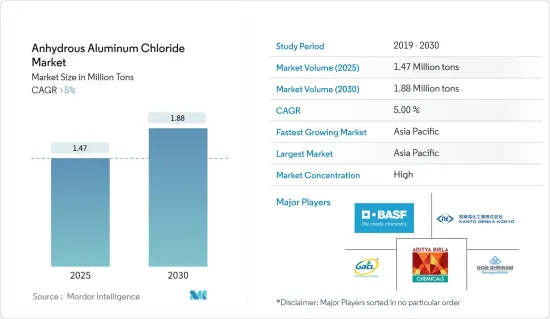

預計 2025 年無水氯化鋁市場規模為 147 萬噸,到 2030 年將達到 188 萬噸,預測期內(2025-2030 年)的複合年成長率將超過 5%。

COVID-19 疫情對無水氯化鋁市場產生了負面影響。然而,由於醫藥、農業化學品、化學品製造、顏料等領域的應用增加,市場在 2021 年已顯著復甦。

關鍵亮點

- 化學製造和顏料產業的需求不斷成長,以及製藥業的需求不斷成長,可能是無水氯化鋁市場中期成長的主要驅動力。

- 然而,無水氯化鋁的儲存困難預計將限制無水氯化鋁市場的成長。

- 香精、香料和口腔護理行業的成長可能很快就會為全球市場創造有利可圖的成長機會。

- 亞太地區是最大的市場,預計由於中國、印度和日本等國家的消費量不斷增加,在預測期內將成為成長最快的市場。

無水氯化鋁的市場趨勢

顏料領域需求增加

- 無水氯化鋁廣泛用作顏料和染料生產中的催化劑。主要用於生產CPC綠、蒽醌等衍生物。 CPC 綠色顏料是一種頻譜有機顏料,廣泛應用於紡織工業和印刷應用。蒽醌廣泛用作合成和天然纖維的染料。

- 預計染料和顏料的需求將大大受益於全球紡織業和基礎設施活動的持續發展。顏料和染料是製造各種油漆、被覆劑以及塑膠和紡織工業的其他最終用途的關鍵原料。

- 根據印度品牌資產基金會 (IBEF) 的數據,2022 財與前一年同期比較成長 41%,出口額達 444 億美元。印度是主要的棉花生產國,預計到 2030 年產量將達到 720 萬噸。

- 此外,據印度工業和國內貿易促進部稱,印度對紡織產品的投資預計將在2022年達到1,138.1億印度盧比(約13.8億美元),較前幾年有所成長。

- 根據美國全國紡織組織理事會(NCTO)的數據,2022年紡織品和服飾總出貨收益將達658億美元。

- 預計油漆和塗料行業的成長也將大力促進市場對顏料的需求成長。推動油漆和塗料行業成長的一些因素是建築業、汽車業和其他最終用戶應用的需求不斷成長。

- 由於上述因素,預計預測期內無水氯化鋁市場將快速成長。

亞太地區佔市場主導地位

- 亞太地區佔據全球市場佔有率的主導地位。由於無水氯化鋁在中國、日本和印度等國家的應用不斷擴大,該地區無水氯化鋁的利用率也增加。

- 中國目前是全球最大的染料和顏料市場,約佔全球消費量的30%。該國紡織業的成長以及對油漆和塗料的需求不斷增加是這一成長的主要驅動力。此外,預計未來幾年人口成長和消費者可支配收入增加將推動中國對染料和顏料的需求。

- 由於工業化進程加快,對無水氯化鋁的需求不斷增加,預計中國將成為該地區成長最快的國家,無水氯化鋁是各種製造業的原料和催化劑。

- 在中國和印度等國家,政府對紡織、化學製造、製藥和石化等發展中產業的支出增加預計將在預測期內刺激市場需求。

- 根據國家統計局預測,2022年石化和化學工業(不含石油和天然氣開採業)經濟運作整體穩定。 2022年,化學原料和化學製品製造業雖然產量下降,但運轉率與前一年同期比較維持在76%以上。

- 此外,據印度品牌資產基金會(IBEF)稱,印度已允許透過自動途徑在紡織業進行 100% 的外國直接投資(FDI)。預計價值 10,683 千萬盧比(14.4 億美元)的 PLI 計畫將為紡織製造商帶來巨大推動。

- 此外,在2022-23年聯邦預算中,紡織業的總撥款為1,238.2億印度盧比(16.2億美元)。其中,為紡織叢集發展計畫撥款 13.383 億印度盧比(1,750 萬美元),為國家技術紡織任務撥款 10 億印度盧比(1,307 萬美元),為印度總理莫迪大型紡織區和服裝園區計畫以及生產連結獎勵計畫撥款 1.5 億印度盧比(196 萬美元)。預計此類分配將有助於國內紡織業的發展,並在未來幾年進一步推動紡織業對無水氯化鋁的需求。

- 因此,預計這些因素將加速無水氯化鋁在各種最終用途的應用,從而推動預測期內的產業成長。

無水氯化鋁業概況

無水氯化鋁市場呈現整合態勢,各公司均佔有少量市佔率。市場的主要企業(不分先後順序)包括BASF SE、Gujarat Alkalies and Chemical Limited、Aditya Birla Chemicals、DCM Shriram 和 Kanto Denka Kogyo。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 化學製造和顏料產業的需求不斷成長

- 製藥業需求不斷成長

- 其他促進因素

- 限制因素

- 無水氯化鋁的儲存困難

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 形式

- 粉末

- 顆粒

- 結晶

- 應用

- 製藥

- 殺蟲劑

- 化學製造

- 顏料

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Aditya Birla Chemicals

- Anmol Chloro Chem

- Base Metal Group

- BASF SE

- DCM Shriram

- Gujarat Alkali & Chemicals Ltd

- Gulbrandsen Manufacturing Inc.

- Kanto Denka Kogyo Co. Ltd

- Nippon Light Metal Company Ltd

- Shandong Kunbao New Materials Group Co. Ltd

- Upra Chem Pvt. Ltd

第7章 市場機會與未來趨勢

- 香料和口腔護理行業成長

- 其他機會

The Anhydrous Aluminum Chloride Market size is estimated at 1.47 million tons in 2025, and is expected to reach 1.88 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the anhydrous aluminum chloride market. However, the market recovered significantly in 2021, owing to rising applications in pharmaceuticals, pesticides, chemical manufacturing, pigments, and others.

Key Highlights

- The growing demand from the chemical manufacturing and pigment industry and rising demand from the pharmaceutical sector are likely to be the main drivers of the anhydrous aluminum chloride market's growth over the medium term.

- However, the difficulties in storing anhydrous aluminum chloride are expected to limit the growth of the anhydrous aluminum chloride market.

- Nevertheless, growth in flavors, fragrances, and oral care industries is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific represents the largest market, and it is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Anhydrous Aluminum Chloride Market Trends

Increasing Demand from Pigments Sector

- Anhydrous aluminum chloride is widely used in manufacturing pigments and dyes as catalysts. It is primarily used to manufacture CPC green, anthraquinone, and other derivatives. CPC green pigments are broad-spectrum organic pigments widely used in the textile industry and printing applications. Anthraquinones are widely used as dyes for synthetic and natural fibers.

- The demand for dyes and pigments in the market is expected to strongly benefit from the growing textile industry and infrastructure activities across the world. Pigments and dyes are key raw materials used in manufacturing various paints, coatings, and other end-user applications in the plastic and textile industry.

- According to the Indian Brand Equity Foundation (IBEF), the Indian textile industry witnessed its exports grow by 41% year on year in FY 22, reaching USD 44.4 billion in valuation during the same period. India is a major producer of cotton, with production projected to reach 7.2 million tons by 2030.

- Additionally, according to the Department for Promotion of Industry and Internal Trade (India), the proposed investment value in textiles of India has reached INR 113.81 Billion (USD 1.38 billion) in 2022 and registered a growth compared to previous years.

- According to the National Council of Textile Organizations (NCTO), the total shipments of textiles and apparel reached USD 65.8 billion in 2022.

- The growing paints and coatings industry is also expected to strongly contribute to the growing demand for pigments in the market. A few factors driving the growth of the paints and coatings industry are rising demand from the construction segment, automotive industry, and other end-user applications.

- Owing to all the factors mentioned above, the market for anhydrous aluminum chloride is expected to grow rapidly over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asian-Pacific region dominated the global market share. With growing applications in countries such as China, Japan, and India, the utilization of anhydrous aluminum chloride is increasing in the region.

- China is currently the world's largest market for dyes and pigments, accounting for approximately 30% of global consumption. The growing textile industry and the increasing demand for paints and coatings in the country are the main drivers of this growth. Moreover, the growing population and increasing disposable income of consumers are expected to drive the demand for dyes and pigments in China in the coming years.

- China is expected to grow fastest in the region due to rapid industrialization, and the demand for anhydrous aluminum chloride to be used as a raw material and catalyst is increasing in various manufacturing industries.

- Increased government spending on industrial development, namely textile, chemical manufacturing, pharmaceuticals, and petrochemical, in countries like China and India is expected to stimulate market demand over the forecast period.

- According to the National Bureau of Statistics, in 2022, the petrochemical and chemical industries' overall economic operation (excluding oil and gas extraction) was stable. In 2022, the production declined, while the capacity utilization rate of the chemical raw material and the chemical product manufacturing industry recorded above 76%, year-on-year.

- Furthermore, according to the India Brand Equity Foundation (IBEF), the country has allowed 100% foreign direct investment (FDI) in the textile sector under the automatic route. The INR 10,683 crore (USD 1.44 billion) PLI scheme is expected to be a major booster for textile manufacturers.

- Moreover, under the Union Budget 2022-23, the total allocation for the textile sector was INR 12,382 crore (USD 1.62 billion). Out of this, INR 133.83 crore (USD 17.5 million) was for Textile Cluster Development Scheme, INR 100 crore (USD 13.07 million) for National Technical Textiles Mission, and INR 15 crore (USD 1.96 million) each for PM Mega Integrated Textile Region and Apparel parks scheme and the Production Linked Incentive Scheme. Such allocations will support the growth of the textile industry in the country, which will further enhance the demand for anhydrous aluminum chloride from the textile segment in the years to come.

- Therefore, these aforementioned factors are expected to accelerate the applications of anhydrous aluminum chloride in various end-use applications, thereby propelling industry growth during the forecast period.

Anhydrous Aluminum Chloride Industry Overview

The anhydrous aluminum chloride market is consolidated, with players accounting for a marginal share of the market studied. A few major companies in the market (not in any particular order) include BASF SE, Gujarat Alkalies and Chemical Limited, Aditya Birla Chemicals, DCM Shriram, and Kanto Denka Kogyo Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Chemical Manufacturing and Pigment Industry

- 4.1.2 Rising Demand from the Pharmaceutical Sector

- 4.1.3 Other drivers

- 4.2 Restraints

- 4.2.1 Difficult to Store Anhydrous Aluminum Chloride

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Powder

- 5.1.2 Granules

- 5.1.3 Crystals

- 5.2 Application

- 5.2.1 Pharmaceuticals

- 5.2.2 Pesticides

- 5.2.3 Chemical Manufacturing

- 5.2.4 Pigments

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Anmol Chloro Chem

- 6.4.3 Base Metal Group

- 6.4.4 BASF SE

- 6.4.5 DCM Shriram

- 6.4.6 Gujarat Alkali & Chemicals Ltd

- 6.4.7 Gulbrandsen Manufacturing Inc.

- 6.4.8 Kanto Denka Kogyo Co. Ltd

- 6.4.9 Nippon Light Metal Company Ltd

- 6.4.10 Shandong Kunbao New Materials Group Co. Ltd

- 6.4.11 Upra Chem Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Flavors and Fragrances and Oral Care Industries

- 7.2 Other Opportunities