|

市場調查報告書

商品編碼

1689795

太陽能追蹤器-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

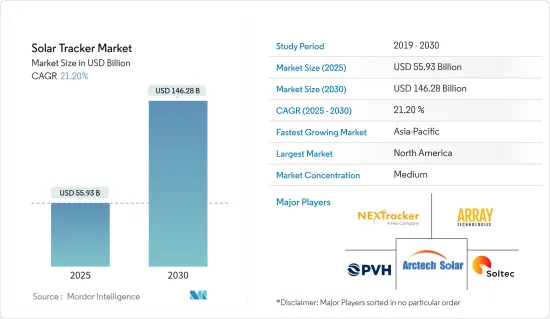

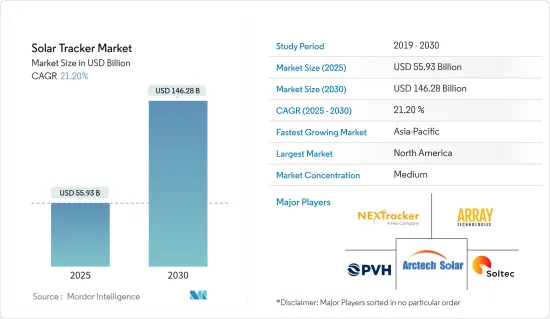

預計 2025 年太陽能追蹤器市場規模為 559.3 億美元,到 2030 年將達到 1,462.8 億美元,預測期內(2025-2030 年)的複合年成長率為 21.2%。

關鍵亮點

- 從長遠來看,預計太陽能發電裝置的增加將在預測期內產生對太陽能追蹤器的需求。

- 另一方面,安裝追蹤系統所需的高額初始投資、設計的複雜性、維護成本以及太陽能追蹤系統的容量限制預計將限制太陽能追蹤器的採用。

- 政府的支持性政策以及利用再生能源來源滿足日益成長的電力需求的努力等因素預計將在未來幾年為太陽能電池板和太陽能追蹤器創造一個利潤豐厚的市場。

- 北美佔據太陽能追蹤器市場的主導地位,其中美國成為主要客戶,到 2023 年底,超過 70% 的計劃將安裝太陽能追蹤器。

太陽能追蹤器市場趨勢

全球太陽能發電設施數量不斷增加,佔據市場主導地位

- 利用太陽追蹤技術,太陽能集熱器、反射器和太陽能發電面板都面向太陽。當太陽在天空中移動時,追蹤器確保太陽能收集器保持在接收最大太陽輻射量的位置。太陽能追蹤器的太陽追蹤能力可以使太陽能發電系統的效率提高25-35%。

- 過去十年來,由於可再生能源產業投資不斷增加,加上政府推出的優惠政策和多個國家製定的雄心勃勃的可再生能源目標,太陽能光伏 (PV)計劃的裝置容量大幅增加。根據 IRENA 2024 年再生能源容量統計數據,全球累積設置容量從 2022 年的 1,066.5 吉瓦成長 32.39% 至 2023 年的 1,412.0 吉瓦。

- 中國、美國、日本、德國、印度和澳洲等國家佔據全球光伏裝置容量容量的大部分,預計將在太陽能追蹤器市場發揮關鍵作用。

- 預計2023年中國市場新增光伏裝置容量將成長至216吉瓦,佔全球市場的55.26%以上。業界預測,這一顯著加速成長態勢將持續,2024年將增加約165吉瓦,2025年將增加170吉瓦。隨著太陽能產業的發展,預計2024年中國太陽能累積裝置容量將超過700吉瓦,到2025年底將達到近900吉瓦。

- 歐洲的太陽能產業正經歷重大發展。據SolarPower Europe稱,2023年其27個成員國將安裝約55.9吉瓦的新太陽能光電容量,較2022年的水準成長40%。歐盟累積太陽能光電裝置容量為263吉瓦,較2022年的207吉瓦成長27%。德國仍是最大的貢獻者,貢獻量達82吉瓦。

- 此外,還有幾個太陽能發電工程正在規劃或建設階段。例如,2023 年 9 月,德國能源供應商 Vatenfall 指出,在圖茨帕茨開發了一座 79 兆瓦的農業太陽能發電廠,該發電廠使用太陽能追蹤器來最佳化發電。 Vatenfall 也與電力和空調解決方案管理公司 (PASM) 簽署了一份電力購買協議,為期 10 年供應清潔電力。

- 由於上述原因,全球太陽能光電裝置正在增加,預計在預測期內將佔據市場主導地位。

北美佔據市場主導地位

- 美國是全球太陽能追蹤器的主要市場之一,大部分需求來自加州、亞利桑那州、內華達州、德州、德克薩斯州和北卡羅來納州等州。根據國際可再生能源機構(IRENA)的預測,2023年美國太陽能發電裝置容量將達到約139吉瓦,較上年成長約21%。

- 過去十年,美國太陽能市場單軸追蹤器的使用穩定成長。截至2023年底,美國將建造約22.5吉瓦的公用事業規模太陽能發電容量,其中太陽能追蹤系統將佔很大比例。

- 加拿大太陽能追蹤器市場正處於發展階段,大部分需求來自亞伯達、曼尼托巴省、安大略省和薩斯喀徹爾等省份。近年來,由於效率不斷提高且成本不斷下降,太陽能追蹤器市場發展勢頭強勁。該國有多個計劃運作。

- 亞伯達的兩個太陽能發電工程將於 2023 年 7 月開始營運:Scotford 專案(81 兆瓦)和 Saddlebtook 專案(101 兆瓦)。該計劃由 Q Cells 和 All Industrial Contractors 共同開發,將利用固定傾斜追蹤器透過雙面太陽能電池組件發電。

- 除了美國龐大的太陽能追蹤器市場外,印第安納州、維吉尼亞和內華達州等州也預計將有大量太陽能發電工程在建,這將在預測期內對太陽能追蹤器產生巨大的需求。

- 2024 年 2 月,太陽能追蹤器製造商和供應商 Soltec 獲得 Blue Ridge Power 的契約,為維吉尼亞安裝提供約 164 兆瓦的 SF7 太陽能追蹤器。 SF7 太陽能追蹤器使用更少的零件和支援更快地完成計劃。一旦建成,該電廠將減少超過 294,000 噸的排放,並能為約 17,000 戶家庭供電。

- 根據太陽能產業協會 (SEIA) 的資料,印第安納州預計在 2026 年之前安裝近 5 吉瓦的太陽能發電容量,位居全美第六位。同時,內華達州預計在同一時期安裝容量將超過 4GW,使該州的太陽能發電計畫規模排名第七。

- 因此,即將推出的太陽能追蹤系統計劃、政府支持措施以及減少對石化燃料電力依賴的努力等因素預計將推動該地區太陽能追蹤器市場的發展。

太陽能追蹤器產業概覽

太陽能追蹤器市場是半靜態的。市場的主要企業(不分先後順序)包括 NexTracker Inc.、Array Technologies Inc.、PV Hardware Solutions SLU、Arctech Solar Holding 和 Soltec Power Holdings SA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 太陽能發電設施數量不斷增加

- 限制因素

- 初期投資高

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 軸類型

- 單軸

- 雙軸

- 地區

- 北美洲

- 美國

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 南美洲

- 巴西

- 哥倫比亞

- 智利

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Soltec Power Holdings SA

- Arctech Solar Holdings Co Ltd.

- Meca Solar

- Ideematec Deutschland GmbH

- Nextracker Inc.

- Trina Solar

- Valmont Industries Inc.

- PV Hardware Solutions SLU

- Solar Flexrack

- Array Technologies Inc.

- 其他知名公司名單(包括公司名稱、總部所在地、相關產品和服務、聯絡資訊等)

- 市場排名分析

第7章 市場機會與未來趨勢

- 電力需求不斷成長

簡介目錄

Product Code: 68308

The Solar Tracker Market size is estimated at USD 55.93 billion in 2025, and is expected to reach USD 146.28 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

Key Highlights

- Over the long term, increasing solar PV installations are expected to create demand for solar trackers in the forecast period.

- On the other hand, the high initial investment required to install a tracking system, design complexity, maintenance cost, and limited capacity of solar tracking systems is expected to restrain the usage of solar trackers.

- Nevertheless, factors such as supportive government policies and efforts to meet the increasing power demand using renewable energy sources are expected to create a favorable market for solar panels and for solar trackers in the coming years.

- North America has dominated the solar trackers market, where the United States emerged as a significant customer with solar trackers installed in more than 70% of projects by the end of 2023.

Solar Tracker Market Trends

Increasing Solar PV Installations Across The Globe to Dominate the Market

- Using solar tracking technology, solar collectors, reflectors, and photovoltaic panels are oriented toward the sun. As the sun moves across the sky, a tracking device ensures that solar collectors maintain a position in which they receive the maximum amount of solar radiation as it moves across the sky. Solar tracker's ability to track the sun can improve PV system efficiency by as much as 25 to 35 percent.

- The installed capacity of solar photovoltaic (PV) projects has been growing significantly over the last decade due to increasing investments in the renewable energy industry supported by favorable government policies and ambitious renewable energy targets set by several countries. According to IRENA Renewable Energy Capacity Statistics 2024, the cumulative global installed solar PV capacity grew by 32.39%, i.e., from 1066.5 GW in 2022 to 1412.0 GW in 2023.

- Countries such as China, the United States, Japan, Germany, India, and Australia account for most of the installed PV capacity globally, which is expected to play a significant role in the solar tracker market.

- The Chinese market grew with 216 GW of newly installed PV capacity in 2023, representing more than 55.26% of the global market. Industry projections estimate that this significant acceleration is set to continue with about 165 GW expected to be added in 2024 and 170 GW in 2025. The developments in the solar energy industry is expected to witness China's cumulative solar PV capacity reach over 700 GW by 2024 and increase to close to 900 GW by the end of 2025.

- The European region has been witnessing significant developments in the solar industry. According to SolarPower Europe, In 2023, nearly 55.9 GW of new solar PV capacity was installed across the 27 Member States, representing a 40% growth rate from 2022 levels. The cumulative EU solar PV fleet amounts to 263 GW, up 27% from the 207 GW in 2022. Germany continues to be the largest contributor with 82 GW.

- Additionally, several solar projects are either in the planning or construction phase. For instance, In September 2023, Germany's energy provider Vattenfall noted the development of an Agri-Photovoltaic power plant in Tutzpatz of 79 MW using solar trackers to optimally generate electricity. Vatenfall has also inked a power purchase agreement with Power and Air Condition Solution Management (PASM) to supply clean electricity for ten years.

- Thus, owing to the above points, the increasing Solar PV installations across the globe are expected to dominate the market in the forecast period.

North America to Dominate the Market

- The United States is one of the major markets for solar trackers worldwide, with a majority of the demand coming from states like California, Arizona, Nevada, Texas, Florida, North Carolina, etc. As per the International Renewable Energy Agency (IRENA), the solar energy installed capacity in the United States of America was about 139 GW in 2023, an increase of about 21% since the previous year.

- The use of single-axis tracking in the United States's utility PV market has grown steadily over the past decade. At the end of 2023, about 22.5 GW of utility-scale solar installations were executed in the United States, where the solar tracker systems had a substantial share in the projects

- Canada's solar tracker market is in its development phase, with the majority of the demand coming from provinces like Alberta, Manitoba, Ontario, and Saskatchewan. The market for solar trackers has been gaining momentum in recent years due to their increased efficiency and declining costs. Multiple projects have been commissioned in the country.

- In July 2023, the country witnessed the commencement of two solar projects, the Scotford Project (81MW) and the Saddlebtook Project (101 MW) in Alberta. The projects, being developed by Qcells and Alltrade Industrial Contractors, would use fixed-tilt trackers to generate electricity from bifacial solar modules.

- In addition to the United States's big markets for solar trackers, states like Indiana, Virginia, and Nevada, among others, have a significantly large number of solar PV projects in the pipeline, which is expected to create significant demand for solar trackers during the forecast period.

- In February 2024, Soltec, the manufacturer and supplier of solar trackers, bagged a contract from Blue Ridge Power to supply about 164 MW of SF7 solar trackers to be located in Virginia. The SF7 solar tracker requires fewer components and supports to complete the project quickly. The power plant, upon completion, is likely to curtail over 294,000 tons of emissions, which could power about 17000 households.

- According to the data from the Solar Energy Industries Association (SEIA), around 5 GW of solar PV capacity is expected to be installed in Indiana by 2026, ranking the state's pipeline as the sixth-largest in the country. On the other hand, SEIA estimates that Nevada will install more than 4 GW over the same period, making the state the seventh-largest in terms of solar PV pipelines.

- Therefore, factors such as upcoming solar PV tracking systems projects, supportive government policies, and efforts to reduce reliance on fossil fuel-based power are expected to drive the solar tracker market in the region.

Solar Tracker Industry Overview

The solar tracker market is semi-consolidated. Some of the major players in the market (in no particular order) include NexTracker Inc., Array Technologies Inc., PV Hardware Solutions S.L.U., Arctech Solar Holding Co. Ltd, and Soltec Power Holdings SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Solar PV Installations

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Axis Type

- 5.1.1 Single Axis

- 5.1.2 Dual Axis

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Mexico

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 South Africa

- 5.2.4.4 Qatar

- 5.2.4.5 Nigeria

- 5.2.4.6 Egypt

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Colombia

- 5.2.5.3 Chile

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 Competitive Landscape

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Soltec Power Holdings SA

- 6.3.2 Arctech Solar Holdings Co Ltd.

- 6.3.3 Meca Solar

- 6.3.4 Ideematec Deutschland GmbH

- 6.3.5 Nextracker Inc.

- 6.3.6 Trina Solar

- 6.3.7 Valmont Industries Inc.

- 6.3.8 PV Hardware Solutions S.L.U.

- 6.3.9 Solar Flexrack

- 6.3.10 Array Technologies Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 Market Opportunities and Future Trends

- 7.1 Increasing Power Demand

02-2729-4219

+886-2-2729-4219