|

市場調查報告書

商品編碼

1689787

粗鋼:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Crude Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

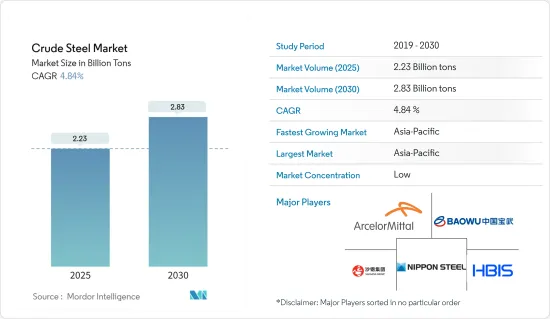

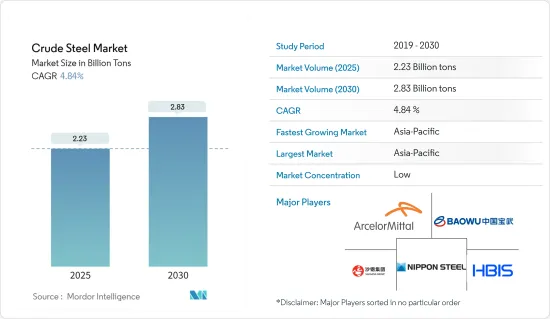

預計2025年粗鋼市場規模為22.3億噸,預計2030年將達28.3億噸,預測期內(2025-2030年)複合年成長率為4.84%。

2020 年,新冠疫情對市場產生了負面影響。受疫情影響,2020 年全球所有汽車銷售量均出現下降。然而,2021年市場復甦,導致各種汽車零件製造的粗鋼消費量增加。 2021年,由於建築、工具和機械、能源和運輸等各行業的需求增加,對石油鋼的需求也增加了。

關鍵亮點

- 從中期來看,預計市場成長將受到建築業需求成長和電動車快速成長導致的汽車產量復甦的推動。

- 另一方面,由於鋼鐵生產和替代品的可用性而導致的自然資源枯竭預計將阻礙市場成長。

- 循環經濟的日益發展趨勢可能為受訪市場帶來機遇,鋼鐵可以透過回收、再利用、再製造和再循環做出重大貢獻。

- 預計亞太地區將主導市場,其中最大的消費國是中國和印度等國家。

粗鋼市場趨勢

建築和建築業的需求增加

- 鋼及其合金是全球建築業最常使用的金屬之一。鋼材也用作屋頂和外牆的覆層材料。屋頂、檁條、內牆、天花板、覆層和外部隔熱板等產品均由鋼製成。

- 根據聯合國的數據,全球約有 50% 的人口居住在都市區,預計到 2030 年將達到 60%。經濟和人口成長的速度必須與商業、住宅和機構建設的需求相符。

- 中國的建築業是全世界最大的。根據中國國家統計局的數據,建築業商務活動指數(BASI)從2023年11月的55.9上升至12月的56.9。 BASI得分高於50表示行業成長,2023年10月的BASI得分為53.5。

- 同樣,在德國,2023 年住宅建築銷售額達到 579.5 億歐元(624 億美元)。然而,與 2022 年的 610 億歐元(656.9 億美元)相比,註冊收益較低。

- 根據聯邦統計局(德國聯邦當局)的數據,德國住宅和非住宅建築的建築許可證數量達到110.7個住宅和非住宅許可證26,000個。

- 此外,根據歐盟統計局(歐盟委員會總司)的數據,到2025年,義大利的建築收入預計將達到約576.8億美元。

- 預計到 2025 年,印度建築業規模將成長至 1.4 兆美元。到 2030 年,預計將有 6 億人居住在城市中心,因此需要額外建造 2,500 萬套中高階住宅。根據國家投資計畫(NIP),印度的基礎設施投資預算為1.4兆美元,其中24%分配給可再生能源、道路、高速公路和城市基礎設施,12%分配給鐵路。

- 預計印度未來七年將在住宅方面投資約1.3兆美元,期間可建造6,000萬套住宅。到2024年,經濟適用住宅供應量預計將增加約70%。根據 Awas Yojana(格萊珉)計劃,政府計劃為受益人建造 2,950 萬套住宅,到 2024 年 12 月將建造 2.95 億套住房。

- 因此,這些行業趨勢預計將同時推動建築業對鋼鐵的需求。

亞太地區佔市場主導地位

- 亞太地區粗鋼產業成長良好,其中中國和印度等國家佔主要消費佔有率。

- 中國是世界上最大的粗鋼生產國。不過,中國國家統計局的數據顯示,預計2023年12月中國粗鋼產量將達到6,744萬噸,低於2023年11月的7,610萬噸。鋼鐵產量下降是由於中國改變政策減少鋼鐵產量以解決污染問題。

- 中國汽車產業的擴張預計將有利於粗鋼需求。中國汽車製造業規模位居世界第一。根據OICA預測,2023年該國汽車產量將達到3,016萬輛,較2022年的2,702萬輛成長約11.6%。

- 此外,中國航空公司計劃在未來20年內購買約7,690架新飛機,價值約1.2兆美元,預計將進一步增加對粗鋼的需求。

- 根據印度汽車工業協會的報告,2022 年 4 月至 2023 年 3 月,印度汽車產量為 25,931,867 輛,較 2021 年 4 月至 2022 年 3 月的 23,040,660 輛有所成長。此外,「Aatma Nirbhar Bharat」和「印度製造」計畫等政府改革預計將促進汽車產業的發展。

- 根據國際航空運輸協會 (IATA) 的報告,預計到預測期末印度將成為世界第三大航空市場。預計未來20年中國將需要2,100架飛機,銷售額將超過2,900億美元。受這些因素影響,預計未來航太工業對粗鋼的需求將會增加。

- 此外,粗鋼與建築業密切相關,因為它是基礎設施、住宅和商業建築建設的重要基礎材料,其需求受到都市化、經濟成長和建築實踐技術進步等因素的影響。

- 鋼鐵對於將太陽能轉換為電能至關重要。鋼鐵是太陽能熱系統、泵浦、容器和傳熱裝置的基礎。此外,鐵桿是潮汐發電系統中潮汐發電機的主要元件。

- 韓國第一個電力基本計畫的目標是到2038年70%的電力來自可再生能源。

- 因此,所有上述因素都可能對未來幾年所研究市場的需求產生重大影響。

粗鋼業概況

研究涉及的市場較為分散,市場參與企業之間為爭奪更大佔有率而展開的競爭較為激烈。市場主要企業(不分先後順序)包括中國寶武鋼鐵Group Limited、安賽樂米塔爾、新日鐵、河鋼集團、沙鋼集團。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築和建築業的需求增加

- 汽車生產復甦

- 其他

- 限制因素

- 自然資源的枯竭和替代品的可用性

- 其他

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 作品

- 全靜鋼

- 半靜鋼

- 製造過程

- 鹼性氧氣轉爐(BOF)

- 電弧爐(EAF)

- 最終用戶產業

- 建築與施工

- 運輸

- 工具和機械

- 能源

- 消費品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- ArcelorMittal

- China Ansteel Group Corporation Limited

- China BaoWu Steel Group Corporation Limited

- China Steel Corporation(CSC)

- Fangda Special Steel Technology Co. Ltd

- HBIS Group

- Hyundai Steel

- JFE Steel Corporation

- JSW

- Nippon Steel Corporation

- NLMK(Novelipetsk Steel)

- Nucor Corporation

- POSCO

- Rizhao Steel Holding Group Co. Ltd

- Steel Authority of India Limited(SAIL)

- ShaGang Group Inc.

- Tata Steel Limited

- United States Steel Corporation

- Techint Group

- Hunan Valin Iron And Steel Group Co. Ltd

第7章 市場機會與未來趨勢

- 循環經濟的成長趨勢

The Crude Steel Market size is estimated at 2.23 billion tons in 2025, and is expected to reach 2.83 billion tons by 2030, at a CAGR of 4.84% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. Owing to the pandemic, the global sales of all vehicles in 2020 declined. Still, the market recovered in 2021, thereby enhancing crude steel consumption in manufacturing different automotive parts. In 2021, the demand for oil steel increased due to increased demand in various industries such as construction, tools and machinery, energy, transportation, and others.

Key Highlights

- Over the medium term, increasing demand from the building and construction industry and recovering automotive production due to rapid electric vehicle growth are likely to drive the market's growth.

- On the flip side, the depletion of natural resources due to the production of steel and the availability of substitutes are expected to hinder the market's growth.

- The growing trend of a circular economy, where steel is touted to make a significant contribution through its recovery, reuse, remanufacturing, and recycling, is likely to act as an opportunity for the market studied.

- Asia-Pacific is expected to dominate the market, with the most significant consumption from countries such as China and India.

Crude Steel Market Trends

Increasing Demand from the Building and Construction Industry

- Steel and its alloys are among the most common metals used worldwide in the construction industry. Steel is also used on roofs and as cladding for exterior walls. Products such as roofing, purlins, internal walls, ceilings, cladding, and insulating panels for exterior walls are made of steel.

- According to the United Nations (UN), around 50% of the global population resides in urban cities, which is projected to touch 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for commercial, residential, and institutional construction activities.

- China's construction industry is the largest in the world. According to the National Bureau of Statistics of China, the construction industry's business activity index (BASI) rose from 55.9 in November 2023 to 56.9 in December 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- Similarly, in Germany, revenue in housing construction reached EUR 57.95 billion (USD 62.40 billion) in 2023. However, the revenue registered was low when compared to EUR 61 billion (USD 65.69 billion) in 2022.

- According to the Federal Statistical Office (a federal authority of Germany), the number of building permits for residential and non-residential buildings in Germany has reached 110.7 for residential and 26 thousand for non-residential buildings, respectively.

- Furthermore, as per Eurostat (a directorate-general of the European Commission), it is anticipated that the construction revenue in Italy will reach around USD 57.68 billion by the year 2025.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- India is expected to witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it may witness the construction of 60 million new homes. The availability rate of affordable housing is expected to rise by around 70% in 2024. Under the PM Awas Yojana (Gramin), the government aims to build 29.5 million houses for beneficiaries, with 2.95 crore houses built by December 2024.

- Therefore, such industry trends are expected to simultaneously drive the demand for steel in the building and construction industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific has experienced favorable growth in the crude steel industry, with countries like China and India holding significant consumption shares.

- China is the largest producer of crude steel globally. However, according to the National Bureau of Statistics of China, the crude steel production in the country reached 67.44 million metric tons in December 2023 and registered low production when compared to 76.1 million metric tons in November 2023. This decline in steel production was due to policy changes in China that reduced steel output to tackle problems related to pollution levels.

- The expansion of the automotive segment in China is anticipated to benefit the demand for crude steel. The Chinese automotive manufacturing industry is the largest in the world. According to OICA, in 2023, automotive production in the country reached 30.16 million units, which increased by about 11.6%, compared to 27.02 million vehicles produced in 2022.

- Moreover, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, further expected to raise the market demand for crude steel.

- As per the reports by the Society of Indian Automobile Manufacturers, India produced 25,931,867 vehicles from April 2022 to March 2023 and registered growth when compared with 23,040,066 units from April 2021 to March 2022. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are expected to boost the automotive industry.

- According to the IATA (International Air Transport Association) report, India is poised to become the third-largest global aviation market by the end of the forecast period. The country is projected to have a demand for 2,100 aircraft over the next two decades, accounting for over USD 290 billion in sales. Due to these factors, the demand for crude steel from the aerospace industry is expected to rise in the future.

- Furthermore, crude steel is closely tied to the construction industry as a fundamental material essential for building infrastructure and residential and commercial structures, with its demand influenced by factors such as urbanization, economic growth, and technological advancements in construction practices.

- Steel is crucial in transforming solar energy into electrical power. It serves as the foundation for solar thermal systems, pumps, containers, and heat transfer devices. Additionally, a steel column is the primary element of a tidal generator in tidal power systems.

- South Korea aims to produce 70% of its electricity using renewable sources by 2038, a significant increase from the current figure of less than 40% in 2023, as outlined in the nation's 11th Basic Electricity Plan.

- Therefore, all the factors mentioned above are likely to significantly impact the demand in the market studied in the years to come.

Crude Steel Industry Overview

The market studied is fragmented, with moderately high competition among the market players to increase their shares. Some of the key companies in the market (not in any particular order) include China BaoWu Steel Group Corporation Limited, ArcelorMittal, Nippon Steel Corporation, HBIS Group, and Shagang Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Building and Construction Industry

- 4.1.2 Recovering Automotive Production

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Depleting Natural Resources and Availability of Substitutes

- 4.2.2 Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Composition

- 5.1.1 Killed Steel

- 5.1.2 Semi-killed Steel

- 5.2 Manufacturing Process

- 5.2.1 Basic Oxygen Furnace (BOF)

- 5.2.2 Electric Arc Furnace (EAF)

- 5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Transportation

- 5.3.3 Tools and Machinery

- 5.3.4 Energy

- 5.3.5 Consumer Goods

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 China Ansteel Group Corporation Limited

- 6.4.3 China BaoWu Steel Group Corporation Limited

- 6.4.4 China Steel Corporation (CSC)

- 6.4.5 Fangda Special Steel Technology Co. Ltd

- 6.4.6 HBIS Group

- 6.4.7 Hyundai Steel

- 6.4.8 JFE Steel Corporation

- 6.4.9 JSW

- 6.4.10 Nippon Steel Corporation

- 6.4.11 NLMK (Novelipetsk Steel)

- 6.4.12 Nucor Corporation

- 6.4.13 POSCO

- 6.4.14 Rizhao Steel Holding Group Co. Ltd

- 6.4.15 Steel Authority of India Limited (SAIL)

- 6.4.16 ShaGang Group Inc.

- 6.4.17 Tata Steel Limited

- 6.4.18 United States Steel Corporation

- 6.4.19 Techint Group

- 6.4.20 Hunan Valin Iron And Steel Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends of Circular Economy