|

市場調查報告書

商品編碼

1689786

沼氣-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Biogas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

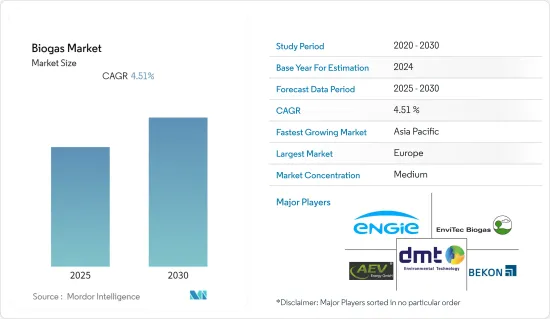

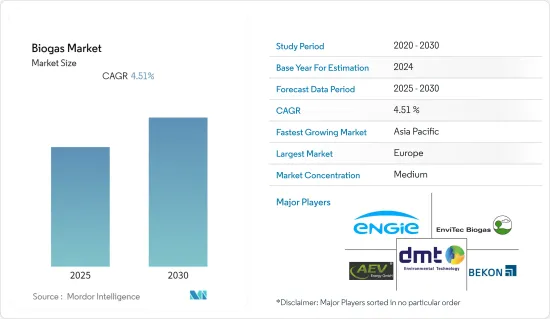

預計預測期內沼氣市場複合年成長率將達到 4.51%

關鍵亮點

- 從長遠來看,政府的支持性政策法規和應用的多樣化預計將推動市場成長。

- 另一方面,預計在預測期內,來自替代可再生能源的競爭日益激烈將阻礙沼氣的成長。

- 預計沼氣產業的技術進步和創新將在預測期內為市場提供有利的成長機會。

- 在預測期內,歐洲很可能佔據市場主導地位。這一成長歸因於投資的增加以及該地區國家(包括德國、英國和義大利)對電力和熱力發電的採用。

沼氣市場趨勢

預計發電將主導市場

- 過去十年,由於人口成長、工業化和都市化導致能源需求增加,世界發電量穩定成長。 2021年全球發電量達2,752.52兆瓦時(TWh),高於2010年的21,570.7 TWh。根據國際能源總署(IEA)的預測,未來七年全球能源需求預計將與前一年同期比較增9%。

- 沼氣是電力產業重要的發電來源,有助於實現全球清潔能源轉型的目標。沼氣發電是一項成熟的技術,已在世界各地廣泛實施。熱電聯產引擎通常用於發電並回收和利用熱量。由於電力產業對沼氣的需求不斷增加,全球沼氣裝置容量大幅成長,到2022年將達到2,137萬千瓦。

- 據世界沼氣協會(WBA)稱,沼氣可減少全球溫室氣體排放10-13%,並從世界食物廢棄物、工業生產廢棄物、農業原料和污水中提供可再生能源。溫室氣體減排和燃料最佳化預計將對沼氣發電產生正面影響。

- 此外,亞太、南美和非洲等開發中地區已經制定了多項計畫和策略,以增加沼氣在其發電結構中的作用。例如,2022 年 5 月,加納政府在阿散蒂開設了一座 400kW 混合光伏-沼氣熱解工廠。該計劃耗時48個月完成。該工廠每天可將12噸廢棄物加工成生物肥料和能源。該計劃將利用太陽能發電200千瓦,利用沼氣發電100千瓦,利用塑膠廢棄物熱解100千瓦。

- 此外,印度也正在迅速發展生質能源用於電力領域。截至 2022 年,印度生質能發電裝置容量約為 10,232 兆瓦,政府再次採取舉措推動生質能發電。例如,2022年,新可再生能源部公佈了國家生質能源計劃,該計劃將分兩個階段實施,2021年至2026年期間的支出為171.5億盧比(2.09億美元)。

- 預計這些發展將在預測期內推動全球電力需求的成長。

歐洲主導市場

- 據歐洲沼氣協會(EBA)稱,未來 27 年歐洲沼氣產量預計將達到 980 億立方公尺(bcm)。

- 近年來,歐洲沼氣廠的安裝量顯著增加。根據歐洲沼氣協會的數據,截至 2021 年,歐洲已安裝沼氣廠 18,977 座,生物甲烷廠 1,023 座,總設備容量為 167 TWh 或 25 億立方公尺(bcm)。

- 截至 2021 年,德國共有超過 9,692 座沼氣廠。除了沼氣廠外,德國還有許多燃燒木材或利用生物來源廢棄物產生熱量的工廠。沼氣廠的數量將從 2000 年的 1,050 個增加到 2021 年的 9,692 個。

- 此外,該國正在開發新的沼氣基礎設施,為不斷成長的沼氣市場提供進一步支援。例如,2022年4月,瓦錫蘭宣布將在德國建造一座大型生物液化天然氣設施。該設施預計將成為世界第二大設施,能夠液化來自可再生能源的生物甲烷和合成甲烷,生產碳中和運輸燃料 REEFUEL。該工廠預計將於明年第一季全面運作。

- 截至 2021 年,英國已安裝的沼氣容量約為 1,841MW。英國生產的沼氣(包括污水和垃圾掩埋場氣)大部分(19TWh)用於發電。此外,根據可再生能源協會的數據,大約 8 PJ 的生物甲烷有資格獲得可再生熱能激勵 (RHI)付款,預計到 2026 年新工廠運作時,生物甲烷產量將達到 110 PJ。

- 例如,2021年12月,阿斯特捷利康宣布與Future Biogas合作,協助開發一座採用碳捕獲技術的125GWh生物甲烷生產工廠。該工廠預計將於 2023 年開始建設,並將於兩年後開始商業運作。預計這些計劃將在預測期內推動沼氣市場的成長。

- 因此,基於上述幾點,歐洲很可能在預測期內佔據市場主導地位。

沼氣產業概況

沼氣市場適度整合。沼氣市場的主要企業(不分先後順序)包括 Engie SA、DMT International、IES Biogas、EnviTec Biogas AG、Weltec Biopower GmbH、Schmach Biogas GmbH 和 AEV Energy GmbH。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2028年沼氣生產裝置容量及預測(單位:GW)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 政府支持措施和政策

- 減少溫室氣體排放的舉措

- 限制因素

- 來自替代可再生能源的競爭日益激烈

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 應用

- 發電

- 生質燃料生產

- 產熱

- 飼料原料

- 牲畜糞便

- 污水

- 食物廢棄物

- 作物殘茬

- 能源作物

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 卡達

- 肯亞

- 坦尚尼亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Engie SA

- DMT International

- IES Biogas

- EnviTec Biogas AG

- Weltec Biopower GmbH

- Hitachi Zosen Inova AG

- AEV Energy GmbH

- AAT Abwasser-und Abfalltechnik GmbH

- BEKON GmbH

- Nijhuis Saur Industries

第7章 市場機會與未來趨勢

- 沼氣產業的技術進步與創新

簡介目錄

Product Code: 68238

The Biogas Market is expected to register a CAGR of 4.51% during the forecast period.

Key Highlights

- Over the long term, supportive government policies and regulations and diversifying areas of applications are expected to drive the growth of the market studied.

- On the other hand, increasing competition from alternate renewable energy sources is expected to hamper the growth of biogas during the forecast period.

- Nevertheless, the technological advancements and innovations in the biogas industry will likely create lucrative growth opportunities for the market in the forecast period.

- The Europe region is likely to dominate the market during the forecast period. This growth is attributed to the increasing investments, coupled with the adoption of power and heat generation in the countries of this region, including Germany, the United Kingdom and Italy.

Biogas Market Trends

Electricity Generation Expected to Dominate the Market

- The world in the past decade witnessed a constant increase in global electricity generation due to increasing energy demand from ever-increasing levels of population, industrialization, and urbanization. 2021 global electricity generation amounted to 2752.52 Terawatt-hours (TWh), which rose from 21570.7 TWh in 2010. According to the International Energy Agency, the global energy demand is expected to witness a year-on-year growth rate of 9% over seven years

- Biogas is a crucial source of electricity generation in the power sector, contributing to the global goals of the clean energy transition. The generation of electricity from Biogas is an established technology being widely implemented worldwide. CHP engines are often used for electricity generation, with heat recovery and use. The growing demand for biogas in the power sector has resulted in a huge growth in biogas installed capacity globally, reaching 21.37 GW in 2022.

- According to the World Biogas Association (WBA), Biogas can reduce global GHG emissions by 10-13% and provide renewable energy from the world's food waste, industrial production wastes, feedstocks from agriculture, and sewage. The reduction in GHG and optimization of fuels are expected to impact electricity generation from Biogas positively.

- Moreover, developing regions, such as Asia-Pacific, South America, and Africa, are developing several plans and strategies to increase the role of Biogas in their electricity generation mix. For instance, in May 2022, the Ghana government commissioned a new Hybrid-PV-Biogas-Pyrolysis-Plant with a capacity of 400kW at Ashanti, Ghana. The time required to complete this project was of the 48-month project. The plant can process 12 tons of waste into bio-fertilizer and energy daily. The project can generate power of 200KW from solar, 100KW from biogas, and an additional 100KW from the pyrolysis of plastic waste.

- Furthermore, India too is swiftly working on bioenergy development for the power sector. As of 2022, India had around 10,232MW of installed capacity of biomass power, and the government has again taken initiatives to promote the source. For example, in 2022, the Ministry of New and Renewable Energy notified the National Bioenergy Programme, with an outlay of INR 1715 Crores (USD 209 million) for a period 2021-2026, to be implemented in two phases.

- Thus, such developments are expected to support the growing electricity demand worldwide during the forecast period.

Europe to Dominate the Market

- According to the Europe Biogas Association (EBA), biogas production in Europe is expected to reach 98 billion cubic meters (bcm) of biomethane over next 27 years.

- In the recent years, Europe witnessed significant growth in the installation of a biogas plant. As of 2021, according to the European Biogas Association, about 18,977 biogas plants and 1,023 biomethane plants were installed, with a total installed capacity of 167TWh and 2.5 billion cubic meters (bcm).

- Germany has more than 9,692 biogas plants, as of 2021. Apart from biogas plants, Germany also has a small number of plants burning wood or generating heat from biogenic waste. From 1,050 plants in 2000, the number of biogas plants reached nearly 9,692 in 2021.

- Further, the country develops a new biogas infrastructure that can provide additional support to the growing biogas market. For instance, in April 2022, Wartsila announced the construction of a major bio-LNG facility in Germany. The facility is likely to be the second-largest facility in the world capable of liquefying biomethane and synthetic methane from renewable energy to produce REEFUEL - a carbon-neutral transportation fuel. The plant is expected to become fully operational by the first quarter of next year.

- As of 2021, the United Kingdom had around 1,841MW of biogas installed capacity. Most of the biogas (including sewage and landfill gases) produced in the United kingdom (19TWh) is used for power generation. Moreover, According to the Renewable Energy Association, around 8PJ of biomethane is qualified for payments under the renewable heat incentive (RHI), and biomethane production likely to reach 110PJ in 2026 as new plants come online.

- For instance, in December 2021, AstraZeneca announced a partnership with Future Biogas, to support the development of a 125GWh biomethane production plant fitted with carbon capture technology. The construction of the plant is expected to begin in 2023 and is expected to commence commercial operations in two years. Such projects are likely to lead to the growth of the biogas market during the forecast period.

- Hence, the afore-mentioned points, Europe is likely to dominate the market during the forecast period.

Biogas Industry Overview

The biogas market is moderately consolidated. Some of the key players in the biogas market (in no particular order) include Engie SA, DMT International, IES Biogas, EnviTec Biogas AG, Weltec Biopower GmbH, Schmach Biogas GmbH, and AEV Energy GmbH., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Biogas Production Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies And Regulations

- 4.5.1.2 Efforts To Reduce Greenhouse Gas Emissions

- 4.5.2 Restraints

- 4.5.2.1 Increasing Competition From Alternate Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Electricity Generation

- 5.1.2 Biofuel Production

- 5.1.3 Heat Generation

- 5.2 Feedstock

- 5.2.1 Livestock Manure

- 5.2.2 Sewage

- 5.2.3 Food Waste

- 5.2.4 Crop Residues

- 5.2.5 Energy Crops

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Qatar

- 5.3.5.3 Kenya

- 5.3.5.4 Tanzania

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 DMT International

- 6.3.3 IES Biogas

- 6.3.4 EnviTec Biogas AG

- 6.3.5 Weltec Biopower GmbH

- 6.3.6 Hitachi Zosen Inova AG

- 6.3.7 AEV Energy GmbH

- 6.3.8 AAT Abwasser- und Abfalltechnik GmbH

- 6.3.9 BEKON GmbH

- 6.3.10 Nijhuis Saur Industries

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements And Innovations In Biogas Industry

02-2729-4219

+886-2-2729-4219