|

市場調查報告書

商品編碼

1689776

氣動設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Pneumatic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

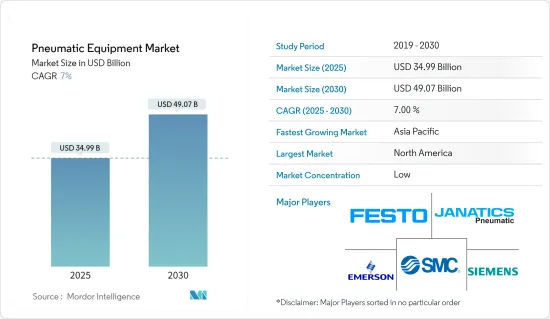

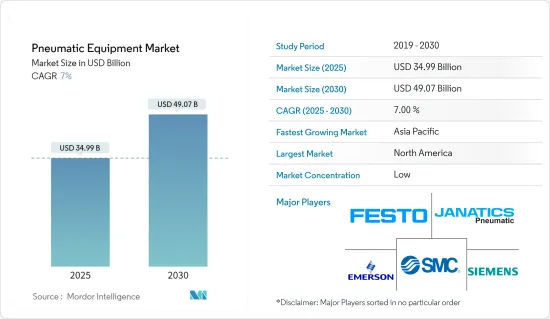

氣動設備市場規模預計在 2025 年為 349.9 億美元,預計到 2030 年將達到 490.7 億美元,預測期內(2025-2030 年)的複合年成長率為 7%。

氣動設備的主要優點之一是安全性。壓縮空氣無毒、不易燃且易於獲取,因此比電力或液壓等其他動力來源更安全。這使得氣動設備適合在有火災或爆炸風險的危險環境中使用。此外,氣動系統可能在濕度和灰塵較高的區域運行,而電氣設備在這些區域會帶來嚴重的安全隱患。

關鍵亮點

- 氣動設備的另一個優點是其可靠性和耐用性。氣動設備以其堅固性和承受惡劣操作條件的能力而聞名。它們不易受到過載、衝擊和振動的損壞,適合製造、建設業和採礦等要求嚴格的應用。氣動設備還需要最少的維護,從而減少停機時間並降低營業成本。

- 物聯網的日益普及可以歸因於多種因素,包括快速數位化、技術進步、政府措施、旨在加速數位轉型和工業 4.0 的政策和投資。目前的一個主要目標是石油公司更依賴自動化來保持流程平穩運作。

- 我們正在努力實現油田數位化,並對儀器儀表進行投資,以提高生產力並在預算內交付計劃。這些舉措對於及時收集生產資料(尤其是海上鑽機的生產數據)非常有益,進一步促進了市場研究。

- 近年來,全球各國政府都在大力推動科技業的發展。例如,阿根廷政府正在透過支持新興企業和科技公司的法律來吸引投資者。因此,越來越多的公司開始擁抱人工智慧、機器學習和機器人技術。

- 阻礙氣動設備市場成長的主要挑戰是設備使用壽命期間維護成本的波動。不銹鋼、鐵礦石、鋁、青銅等金屬合金等原料價格的波動,造成氣動設備採購成本的波動。這就造成了供需缺口。

- 新冠疫情迫使製造業重新評估傳統生產流程,主要推動整個生產線的數位轉型和智慧製造實踐。新冠疫情和全球封鎖規定嚴重影響了工業活動。封鎖的影響包括勞動力短缺、供應鏈中斷、製造過程中所用原料的短缺、可能導致最終產品產量增加並超出預算的價格波動、運輸問題等。

氣動設備市場趨勢

工業終端用戶佔據大部分市場佔有率

- 氣動系統在自動化製造中至關重要,為機械臂、夾持器和致動器提供動力。這些系統可以精確、快速地沿著組裝移動零件。特別是氣動致動器,它透過為機器人應用提供力量和控制來提高製造業務的生產率。

- 由於技術進步、基礎設施發展和技術純熟勞工等因素,全球製造業的成長預計將刺激氣動設備市場的發展。例如,中國製造業正在經歷顯著的成長,根據國家統計局的報告,2023 年工業產出預計將成長 4.6%。

- 隨著各行業自動化程度的提高,工廠對氣動設備的採用預計將迅速增加。國際機器人聯合會(IFR)預測,到2024年,全球運作的工業機器人數量將超過51.8萬台。

- 工業機器人市場的強勁成長是氣動設備產業的主要驅動力。光是 2020 年,全球工業機器人出貨量就超過 384,000 台,其中澳洲/亞洲位居榜首,預計出貨量為 266,000 台。到 2024 年,該地區預計將進一步成長,安裝量將達到 37 萬台。

- 氣動輸送機和真空系統等氣動設備對於在製造設施內運輸材料至關重要。氣動輸送機可處理散裝物料,而真空系統則非常適合提升精緻或形狀不規則的物體而不會損壞它們。

- 空氣壓縮機是氣動系統的支柱,產生為氣動設備和機械提供動力所需的壓縮空氣。此外,氣動乾燥器透過去除壓縮空氣中的水分和污染物,在維持這些系統的可靠性和性能方面發揮著至關重要的作用。氣動元件也用於製造設施內的安全系統,例如氣動安全閥和緊急關閉系統。

亞太地區實現強勁成長

- 中國在全球製造業的主導地位正在推動對氣動設備的需求。中國製造業擴大採用工業 4.0 解決方案來增強其營運並推動市場的上升趨勢。

- 近年來,中國醫學生命科學(HLS)產業經歷了顯著成長,其特點是投資強勁、技術創新迅速和業務擴張。在政府政策的支持和雄厚的資本資源下,中國正努力成為全球醫藥創新的領導者。

- 受城市人口成長和食品消費模式轉變等因素的推動,日本的食品和飲料加工及包裝產業可望實現成長。值得注意的是,《世界有機指南》強調,日本包裝有機食品消費量預計將從 2018 年的 4.014 億美元增加到 2025 年的 4.271 億美元。

- 此外,預計到 2025 年,健康食品、飲料和包裝食品的零售將達到 573 億美元。這些趨勢將鼓勵日本對食品加工和包裝工廠的投資,從而推動該領域對氣動設備的需求。

- 受都市化、人口結構變化和零售業蓬勃發展等因素的推動,印度的食品和飲料加工及包裝產業正經歷顯著成長。需求的激增刺激了食品和飲料公司增加產量。該公司正在推出新產品並使其產品多樣化,以利用不斷成長的中產階級消費群體。

氣動設備產業概況

氣動設備市場高度細分,Festo SE、艾默生電氣公司等參與企業採用合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 3 月 - Chicago Pneumatic 宣布計劃推出適用於重型商用車的新型 eBlueTork 系列電池扭力扳手。 eBlueTork 描述了可提高衝擊扳手應用中操作員和工作人員的安全性、可追溯性和生產力的高級功能。

- 2023 年 11 月-日本氣壓控制系統製造商 SMC 表示,將在 2026 年前投資 400 億日圓(2.7 億美元),在其每個地點建立 24 小時模式,旨在將產品開發時間縮短一半。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 各行業自動化的進步

- 嚴格的政府法規

- 市場問題

- 設備使用壽命期間的維護成本高昂

第6章市場區隔

- 依設備類型

- 致動器

- 閥門

- 配件

- 其他設備

- 按最終用戶產業

- 汽車

- 食品、飲料加工與包裝

- 航太與國防

- 生命科學

- 化工和石化

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Festo SE

- Emerson Electric Co.

- SMC Corporation

- Janatics

- Siemens AG

- Parker Hannifin Corp.

- Ingersoll Rand

- Koki Holdings Co. Ltd

- Chicago Pneumatic

- Eaton Corporation

- ROSS Controls

- Bimba Manufacturing Company(IMI PLC)

第8章投資分析

第9章:市場的未來

The Pneumatic Equipment Market size is estimated at USD 34.99 billion in 2025, and is expected to reach USD 49.07 billion by 2030, at a CAGR of 7% during the forecast period (2025-2030).

One of the primary advantages of pneumatic equipment is safety. Compressed air is non-toxic, non-flammable, and readily available, making it a safer alternative to other power sources like electricity or hydraulics. This makes pneumatic equipment suitable for use in hazardous environments where the risk of fire or explosion is a concern. Additionally, pneumatic systems may operate in areas with high levels of moisture or dust, where electrical equipment would pose a significant safety hazard.

Key Highlights

- Another advantage of pneumatic equipment is its reliability and durability. Pneumatic components are known for their robustness and ability to withstand harsh operating conditions. They are less susceptible to damage from overloading, shock, or vibration, making them suitable for heavy-duty applications in industries like manufacturing, construction, and mining. Pneumatic equipment also requires minimal maintenance, resulting in reduced downtime and lower operating costs.

- The increasing adoption of IoT may be attributed to factors like rapid digitalization, technological advancements, government initiatives, policies, and investments aimed at promoting digital transformation and Industry 4.0. Increasing oil companies' reliance on automation to conduct processes without delay is the main aim nowadays.

- Initiatives to digitize oil fields are implemented, leading to investment in instrumentation to increase productivity and complete projects within defined budgets. Such initiatives are incredibly beneficial to gathering production data on time, especially for offshore rigs, which further drive the market studied.

- Various governments globally have been boosting the technological sector over the past few years. For instance, the Argentine government attracts investors with legislation supporting startups and technology firms. Therefore, there has been a rise in firms utilizing AI, machine learning, and robotics.

- The major challenge impeding the pneumatic equipment market growth is the volatility in maintenance costs over the equipment's lifespan. Fluctuations in prices of raw materials such as stainless steel, iron ore, aluminum, bronze, and other metal alloys have caused volatility in the arrangement cost of pneumatic equipment. This has led to a demand-supply gap.

- The COVID-19 pandemic forced manufacturing industries to re-evaluate their traditional production processes, primarily driving digital transformation and smart manufacturing practices across production lines. The COVID-19 pandemic and lockdown restrictions worldwide severely affected industrial activities. The effects of the lockdown include labor shortages, disruptions in the supply chain, lack of availability of raw materials utilized in the manufacturing process, fluctuating prices that could force the production of the final product to increase and go beyond budget, shipping problems, etc.

Pneumatic Equipment Market Trends

Industrial End-user Segment to Hold Major Market Share

- Pneumatic systems are pivotal in automated manufacturing, powering robotic arms, grippers, and actuators. These systems ensure precise and swift movement of components along assembly lines. Pneumatic actuators, in particular, enhance productivity in manufacturing operations by providing force and control for robotic applications.

- The global rise in the manufacturing sector, driven by factors like technological advancements, infrastructure development, and skilled labor, is expected to fuel the pneumatic equipment market. China, for instance, witnessed a notable boost in its manufacturing sector, with a 4.6% increase in industrial production in 2023, as reported by the National Bureau of Statistics.

- As automation gains traction across industries, the adoption of pneumatic equipment in factory settings is poised to surge. Projections from the International Federation of Robotics (IFR) indicate that the global number of operational industrial robots will surpass 518,000 by 2024.

- The robust growth of the industrial robot market is a significant driver for the pneumatic equipment sector. In 2020 alone, over 384,000 units of industrial robots were shipped worldwide, with Australia/Asia leading the pack at an estimated 266,000 installations. By 2024, this region is expected to rise further to 370,000 installations.

- Pneumatic equipment, such as air-powered conveyors and vacuum systems, is vital in material transfer within manufacturing facilities. Pneumatic conveyors handle bulk materials, while vacuum systems are ideal for lifting delicate or irregularly shaped objects without causing damage.

- Air compressors are the backbone of pneumatic systems, generating the compressed air needed to power pneumatic equipment and machinery. Additionally, pneumatic dryers play a crucial role in maintaining the reliability and performance of these systems by removing moisture and contaminants from the compressed air. Pneumatic equipment finds applications in safety systems within manufacturing facilities, including pneumatic safety valves and emergency stop systems.

Asia-Pacific to Register Major Growth

- China's dominance in the global manufacturing landscape is propelling the demand for pneumatic equipment. As Chinese manufacturing firms increasingly adopt Industry 4.0 solutions, they are bolstering their operations, driving the market's upward trajectory.

- China's healthcare and life sciences (HLS) sector has witnessed remarkable growth in recent years, which has been marked by robust investments, rapid innovation, and expanding businesses. Backed by supportive government policies and ample capital resources, China is striving to emerge as a leading force in global pharmaceutical innovation.

- The Japanese food and beverage processing and packaging industry is poised for growth, driven by factors like a rising urban population and evolving food consumption patterns. Notably, the Global Organic Trade Guide highlights that the consumption of packaged organic food in Japan is set to rise from USD 401.4 million in 2018 to an estimated USD 427.1 million by 2025.

- Additionally, the retail sales value of health and wellness beverages and packaged food is projected to hit USD 57.3 billion by 2025. These trends are fueling investments in food processing and packaging plants in Japan, which, in turn, will drive the demand for pneumatic equipment in this sector.

- The Indian food and beverage processing and packaging sector has witnessed significant growth, driven by factors like urbanization, shifting demographics, and a thriving retail landscape. This surge in demand has spurred food and beverage companies to ramp up production. They are leveraging the expanding middle-class consumer base, introducing new products, and diversifying their offerings.

Pneumatic Equipment Industry Overview

The pneumatic equipment market is highly fragmented, with major players like Festo SE, Emerson Electric Co., SMC Corporation, Janatics, and Siemens AG. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - Chicago Pneumatic announced plans to launch a new eBlueTork Series of battery torque wrenches for heavy commercial vehicles. eBlueTork offers advanced features to improve operator and passenger safety, traceability, and productivity in impact-wrench applications.

- November 2023 - SMC, a Japanese manufacturer of pneumatic control systems, announced to invest JPY 40 billion (USD 0.27 billion) by 2026 to establish a round-the-clock model at its sites, seeking to halve the time needed for product development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation Across Industries

- 5.1.2 Stringent Government Regulations

- 5.2 Market Challenges

- 5.2.1 High Maintenance Cost Over the Equipment's Lifespan

6 MARKET SEGMENTATION

- 6.1 By Type of Equipment

- 6.1.1 Actuators

- 6.1.2 Valves

- 6.1.3 Fittings

- 6.1.4 Other Types of Equipment

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage Processing and Packaging

- 6.2.3 Aerospace and Defense

- 6.2.4 Life Sciences

- 6.2.5 Chemical and Petrochemical

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Festo SE

- 7.1.2 Emerson Electric Co.

- 7.1.3 SMC Corporation

- 7.1.4 Janatics

- 7.1.5 Siemens AG

- 7.1.6 Parker Hannifin Corp.

- 7.1.7 Ingersoll Rand

- 7.1.8 Koki Holdings Co. Ltd

- 7.1.9 Chicago Pneumatic

- 7.1.10 Eaton Corporation

- 7.1.11 ROSS Controls

- 7.1.12 Bimba Manufacturing Company (IMI PLC)