|

市場調查報告書

商品編碼

1689766

化學機械平坦化(CMP)漿料:市場佔有率分析、產業趨勢與成長預測(2025-2030)Chemical Mechanical Planarization (CMP) Slurry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

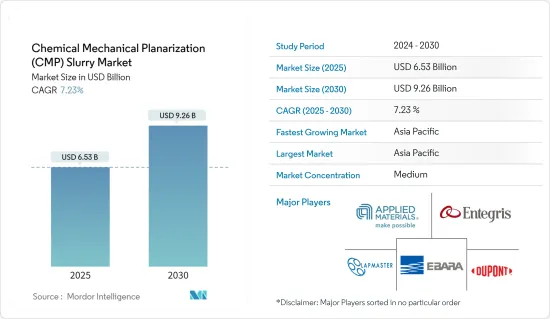

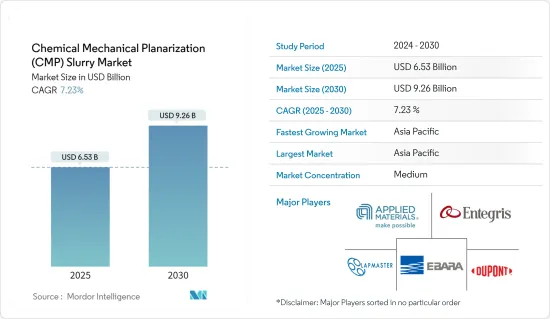

化學機械平坦化漿料市場規模預計在 2025 年為 65.3 億美元,預計到 2030 年將達到 92.6 億美元,預測期內(2025-2030 年)的複合年成長率為 7.23%。

關鍵亮點

- 由於製造技術和半導體製程的進步提高了半導體產品的性能,預計 CMP 市場在預測期內將實現穩步成長。市場成長的動力來自於製造商為實現產品創新而加大對半導體晶圓製造材料的投資。

- 化學機械拋光或平坦化(CMP)使粗糙的表面變得平整,並在半導體製造中提供許多好處。 CMP 可在一次操作中實現整個晶圓的均勻平整度。 CMP 用途廣泛,可以平坦化從金屬到氧化膜的各種材料,並且通常可以同時處理多種材料。

- CMP 解決方案透過提供均勻的平坦化和減少晶圓表面的缺陷,在實現高產量比率方面發揮關鍵作用。透過開發具有成本效益的 CMP 漿料,製造商可以最佳化其生產流程並顯著降低成本。 CMP 可應用於光學、光電、資料儲存、醫療設備等領域。 CMP應用領域的擴展將為CMP解決方案製造商創造新的市場機會,進一步推動市場成長。

- 各種 CMP 製程對精確製程控制和減少缺陷的嚴格要求影響著裝置性能、產量比率和批量製造挑戰。此外,磨料的複雜性也推動 CMP 耗材的創新。新耗材的品管正在擴大,影響製程窗口和生產線,減緩全球 CMP 設備和耗材製造的速度。

- 疫情過後,由於汽車、家用電子電器和醫療產品銷售的成長,對積體電路的需求激增。例如,根據WSTS預測,2024年全球IC市場銷售額將達到約4,870億美元。

化學機械平坦化(CMP)漿料市場趨勢

預測期內,積體電路將佔據最大的市場佔有率

- 對更高功能和更小電子設備的需求不斷成長,刺激了市場對高密度嵌入式 IC 和 VLSI 的需求,為 CMP 設備和耗材創造了成長機會。化學機械平坦化(CMP)是半導體產業中的重要製程。 CMP 製程對於積體電路和儲存盤的製造至關重要,因為它可以透過化學反應和機械力的結合有效地去除表面材料。

- 此外,隨著超大規模積體電路(VLSI)的出現,數十萬個電晶體現在可以整合到單一矽半導體微晶片上。這項工藝可實現小型化、高性能和多功能化。然而,挑戰在於將許多組件裝入有限的空間並盡量減少錯誤。這增加了徹底清除安裝表面碎屑的需要,強調了化學機械拋光在積體電路製造中的重要性。預計這將有助於市場與全球積體電路製造業同步成長。

- 美國、台灣、韓國、中國等國家是半導體晶片的主要生產國。消費和投資也對市場成長做出了重大貢獻。 CMP已成為半導體製造商生產積體電路(IC)的標準製造流程。預計物聯網、汽車和 5G 等市場對各種組件的採用率不斷提高將在預測期內推動對 CMP 設備的需求。

- 在半導體製造商、政府和其他國際組織的投資活動的支持下,市場正在取得重大發展,透過最大限度地減少對少數國家半導體供應鏈的依賴來加強全球半導體生態系統,這將推動對 CMP 市場的需求,因為拋光製程在全球積體電路製造中的應用。

- 例如,馬來西亞計劃於2024年4月建成東南亞最大的積體電路設計園區,以促進國內半導體設計、原型設計和製造。馬來西亞政府將提供多項獎勵,包括稅收優惠、辦公空間補貼和免簽證費,以吸引高科技公司和投資者入駐該工廠,支持該國的積體電路製造生態系統,並為 CMP 市場創造成長機會。

- CMP 製程還包括一個化學成分,可以有針對性地去除特定材料。與純機械拋光相比,CMP 可最大限度地減少表面缺陷,並使得光刻製程能夠應用於 IC 製造。

- 預計未來幾年全球半導體銷售額的成長將推動 CMP 市場的需求。根據SIA統計,2024年1月全球半導體銷售額達476.3億美元,較去年同期成長60多億美元。

亞太地區實現強勁成長

- 亞太地區是全球許多半導體製造工廠的所在地,其中包括台積電和三星電子等大公司。台灣是全球晶圓代工領域的領導者,在半導體價值鏈中扮演關鍵角色。在政府措施的支持下,該地區的半導體產業正經歷顯著成長,推動市場擴張。

- 亞太地區的半導體銷售額逐年成長,預計將推動CMP市場的需求。根據WSTS預測,該地區的半導體銷售額預計將在2024年和2025年大幅成長。 2023年,該地區的銷售額預計將達到2,899.9億美元,到2024年將增至3,408.7億美元,到2025年將增至3,829.6億美元。 WSTS預測,對積體電路、分立元件和其他半導體的需求增加預計將推動與前一年同期比較和2025年分別大幅成長17.5%和12.3%。預計此類發展將推動CMP市場的需求。

- 由於三星和 SK 海力士等大公司的存在以及半導體業務的巨大成長,韓國等國家成為 CMP 技術需求的主要推動力。 2024年1月,韓國政府宣布投資約4,700億美元建立全球最大半導體叢集的策略。這個雄心勃勃的計劃將在未來 23 年內展開,並將與 SK Hynix 合作在京畿道建造一個大型生產基地。隨著 SK Hynix 等公司的投資不斷增加,CMP 市場的需求預計也將上升。

- 2024 年 3 月,東進半導體開始向 SK 海力士供應用於高頻寬記憶體 (HBM) 生產的化學機械拋光 (CMP) 漿料。此漿料在晶圓製造的CMP過程中對平滑表面起著重要作用。具體來說,氧化物漿料用於平坦化絕緣層,而金屬漿料用於平坦化金屬電路。該協議將終止 Soulbrain 在韓國對 HBM 製造材料的獨家權利。預計此類市場發展將推動未來幾年的市場成長。

- 此外,由於中國地區擁有強大的半導體製造能力,預計市場將顯著成長。中國是半導體製造市場的主要企業,在該地區擁有大量工廠。根據WSTS報告,2024年1月中國半導體銷售額將達147.6億美元。這一數字較2023年1月的116.6億美元有顯著成長。在美國戰爭等地緣政治緊張局勢加劇的背景下,該地區正在進行大規模投資以促進國內生產。

化學機械平坦化(CMP)漿料產業概述

化學機械平坦化 (CMP) 漿料市場以半固體為主,主要參與者包括應用材料公司、Entegris 公司、Ebara 公司、Lapmaster Wolters GmbH 和杜邦。該市場的參與企業正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 5 月:杜邦宣布一項策略性舉措,將公司拆分為三個營業單位,並將每個實體公開上市。該計劃將把電子和水資源部門在免稅的基礎上分離,新成立的「新杜邦」將成為多元化的工業參與企業。分離後,電子和水資源部門將作為獨立營業單位運作,使每個部門更加專注和靈活。杜邦預計這三家公司都將擁有強勁的資產負債表、有吸引力的財務狀況和良好的成長前景。該公司計劃在未來 18 至 24 個月內完成這些分離工作。

- 2023 年 12 月:Entegris Inc. 在京畿道安山漢陽大學 ERICA 校區開設了韓國技術中心。該中心旨在將 Entegris 的多種能力集中到一起。該中心的策略定位是促進與涉及先進邏輯、DRAM、3D NAND半導體和其他技術的客戶進行更深入的合作。具體來說,該中心將成為薄膜沉積、化學機械平坦化(CMP)和先進濕蝕刻製程的知識中心。也將安裝先進的分析工具,以增強 Entegris 為韓國客戶提供服務的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

第5章市場動態

- 市場促進因素

- 半導體小型化需求日益成長

- Mems 和 Nems 的應用成長推動 CMP 市場成長

- 市場問題

- 製造複雜性

第6章市場區隔

- 按類型

- CMP設備

- CMP耗材

- 泥

- 墊片

- 墊片調理劑

- 其他

- 按應用

- 複合半導體

- 積體電路

- 微機電系統與奈米機電系統

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Applied Materials Inc.

- Entegris Inc.

- Ebara Corporation

- Lapmaster Wolters Gmbh

- Dupont De Nemours Inc.

- Fujimi Incorporated

- Revasum Inc.

- Resonac Holdings Corporation(Showa Denko Materials)

- Okamoto Corporation

- Fujifilm Corporation(Fujifilm Holdings Corporation)

- Tokyo Seimitsu Co. Ltd(Accretech Create Corp.)

第8章投資分析

第9章 市場機會與未來趨勢

The Chemical Mechanical Planarization Slurry Market size is estimated at USD 6.53 billion in 2025, and is expected to reach USD 9.26 billion by 2030, at a CAGR of 7.23% during the forecast period (2025-2030).

Key Highlights

- The CMP market is expected to grow steadily during the forecast period due to technological advancements in fabrication and semiconductor processes to enhance the performance of semiconductor products. Manufacturers' increasing investment in semiconductor wafer fabrication materials for product innovation drives the market's growth.

- Chemical mechanical polishing or planarization (CMP) flattens rough surfaces and offers numerous benefits in semiconductor manufacturing. It enables manufacturers to achieve uniform flatness across the entire wafer in a single operation. CMP is versatile and capable of planarizing various materials, from metals to oxide films, often handling multiple materials simultaneously.

- CMP solutions play a vital role in achieving higher yields by ensuring uniform planarization and reducing defects on the wafer surface. Developing cost-effective CMP slurries also helps manufacturers optimize their production processes, significantly saving costs. CMP is utilized in optics, photonics, data storage, and medical devices. This expansion of CMP applications creates new market opportunities for CMP solutions manufacturers, further driving the market's growth.

- The stringent requirements of precise process control and defect reduction in various CMP processes affected device performance, yield, and challenges in high-volume manufacturing. Additionally, the complexity of polished materials drives the innovation of CMP consumables. The quality control of new consumables grows, impacting the process window and production line and lowering the manufacturing of CMP equipment and consumables worldwide.

- Post-pandemic, the demand for IC has surged due to increased automotive, consumer electronics, and healthcare sales. For instance, according to WSTS, the global IC market reached around USD 487 billion in revenue in 2024.

Chemical Mechanical Planarization (CMP) Slurry Market Trends

Integrated Circuits Occupied the Largest Market Share During the Forecast Period

- The increasing demand for electronic devices and the high functionalities required in them, in line with the growth of miniaturized electronic devices, are fueling the demand for highly dense embedded ICs and VLSIs in the market, which would create a growth opportunity for CMP devices and consumables. Chemical mechanical polishing (CMP) is a pivotal process in the semiconductor industry. It effectively eliminates surface materials by combining chemical reactions with mechanical forces, making the need for the CMP process instrumental in producing integrated circuits and memory disks.

- Additionally, the emergence of very large-scale integration (VLSI) involves embedding hundreds of thousands of transistors onto a single silicon semiconductor microchip. This process leads to heightened miniaturization, enhanced performance, and improved functionality. However, the challenge lies in fitting more components into a limited space, fueling a lesser margin of error. It raises the need to ensure the total removal of debris from mounting surfaces, supporting the importance of chemical mechanical polishing in IC manufacturing. It would help the market grow in line with the development of IC manufacturing worldwide.

- Countries such as the United States, Taiwan, Korea, and China, among others, are some of the major producers of semiconductor chips. They also contribute significantly to the market's growth in terms of consumption and investments. CMP has become a standard manufacturing process semiconductor manufacturers use to fabricate integrated circuits (IC). The growing adoption of various components in markets like IoT, automotive, and 5G is expected to drive the demand for CMP equipment over the forecast period.

- The market has been registering a significant development supported by the investment activities by the semiconductor manufacturer, government, and other international agencies to strengthen the semiconductor ecosystems worldwide by minimizing the dependency of limited countries for the semiconductor supply chain, which would fuel the demand for the CMP market due to the applications of polishing process in the manufacturing of ICs worldwide.

- For instance, in April 2024, Malaysia planned to build the most extensive integrated circuit design park in Southeast Asia to promote domestic semiconductor design, prototyping, and manufacturing. The Malaysian government would offer several incentives, including tax breaks, office space subsidies, and visa exemption fees, to attract tech companies and investors to the facility, supporting the IC manufacturing ecosystem in the country and creating a growth opportunity for the CMP market.

- The chemical component in the CMP process allows for the targeted removal of specific materials. Compared to purely mechanical polishing, CMP minimizes surface defects and enables the lithography steps to be applied in IC manufacturing, which shows the demand for CMP equipment and consumables in the market.

- The growing semiconductor sales globally over the years are expected to drive the demand for the CMP market. According to SIA, in January 2024, global semiconductor sales reached USD 47.63 billion, marking an increase of over USD 6 billion from the previous year's for the same month.

Asia-Pacific to Register Major Growth

- The Asia-Pacific region holds a significant number of global semiconductor manufacturing facilities, with major players like TSMC and Samsung Electronics. Taiwan is the leading country globally for foundries and plays a crucial role in the semiconductor value chain. Supported by government initiatives, the semiconductor industry in the region is experiencing significant growth, driving market expansion.

- The growing semiconductor sales across the APAC region over the years are expected to drive the demand for the CMP market. According to WSTS, the region's semiconductor sales are expected to significantly increase in 2024 and 2025. In 2023, the region reported a revenue of USD 289.99 billion in sales, which is expected to increase to USD 340.87 billion in 2024 and USD 382.96 billion in 2025. WSTS reports that a significant increase, such as 17.5% YoY growth in 2024 and 12.3% YoY in 2025, is expected due to the growing demand for integrated circuits, discrete and other semiconductors. Such developments are expected to drive the demand for the CMP market.

- Countries like South Korea are significantly driving the demand for CMP technology due to its extensive growth in the semiconductor business with the presence of significant companies like Samsung, SK Hynix, and others. The South Korean government unveiled its strategy in January 2024 to dedicate around USD 470 billion towards establishing the world's largest semiconductor cluster. This ambitious project is set to unfold over the next 23 years and will entail the construction of a substantial production complex in Gyeonggi Province in partnership with SK Hynix. With the growing investments by companies like SK Hynix, the demand for the CMP market is expected to rise.

- In March 2024, Dongjin Semichem initiated the provision of a chemical mechanical polishing (CMP) slurry to SK Hynix for the production of high bandwidth memory (HBM). This slurry plays a crucial role in the CMP process during wafer fabrication by smoothing out the surface. Specifically, oxide slurry is utilized to flatten insulating layers, while metal slurry is employed to flatten metal circuits. This agreement marks the end of Soulbrain's monopoly on the material for HBM production in South Korea. Such developments are expected to drive the market's growth in the coming years.

- Moreover, due to its extensive semiconductor manufacturing capabilities, the market is also expected to witness significant growth in the Chinese region. China stands as a major player in the semiconductor production market, boasting the presence of numerous fabs in the area. As reported by WSTS, semiconductor sales in China hit USD 14.76 billion in January 2024. This figure marks a notable rise from January 2023, when sales in China amounted to USD 11.66 billion. With the growing geopolitical tensions, such as the US-China war, the region is investing significantly in boosting its domestic production.

Chemical Mechanical Planarization (CMP) Slurry Industry Overview

The chemical mechanical planarization market is semi-consolidated with the presence of major players like Applied Materials Inc., Entegris Inc., Ebara Corporation, Lapmaster Wolters GmbH, and Dupont De Nemours Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: DuPont unveiled a strategic initiative to divide itself into three separate entities, each to be publicly traded. The plan entails executing tax-free separations of its Electronics and Water divisions, with the newly formed 'New DuPont' emerging as a diversified industrial player. Post separation, electronics, and water will operate as independent entities, poised to leverage enhanced focus and agility within their sectors. DuPont anticipates that all three companies will boast robust balance sheets, enticing financial standings, and promising growth prospects. The company aims to finalize these separations within the next 18 to 24 months.

- December 2023:- Entegris Inc. unveiled its Korea Technology Center at the Hanyang University ERICA campus in Ansan-si, Gyeonggi-do. The center, designed as a focal point, aims to streamline Entegris' diverse capabilities under one roof. This setup is strategically positioned to foster deeper collaboration with clients involved in technologies like advanced logic, DRAM, and 3D NAND semiconductors. Specifically, the center will serve as a knowledge hub for deposition, chemical mechanical planarization (CMP), and advanced wet etch processes. It will also house sophisticated analytical tools, bolstering Entegris' ability to cater to its Korean clientele.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Miniaturization of Semiconductors

- 5.1.2 Increasing use of Mems and Nems is Fueling the Growth of the CMP Market

- 5.2 Market Challenges

- 5.2.1 Complexity Regarding Manufacturing

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 CMP Equipment

- 6.1.2 CMP Consumable

- 6.1.2.1 Slurry

- 6.1.2.2 Pad

- 6.1.2.3 Pad Conditioner

- 6.1.2.4 Other Consumable Types

- 6.2 By Application

- 6.2.1 Compound Semiconductors

- 6.2.2 Integrated Circuits

- 6.2.3 Mems and Nems

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials Inc.

- 7.1.2 Entegris Inc.

- 7.1.3 Ebara Corporation

- 7.1.4 Lapmaster Wolters Gmbh

- 7.1.5 Dupont De Nemours Inc.

- 7.1.6 Fujimi Incorporated

- 7.1.7 Revasum Inc.

- 7.1.8 Resonac Holdings Corporation (Showa Denko Materials)

- 7.1.9 Okamoto Corporation

- 7.1.10 Fujifilm Corporation (Fujifilm Holdings Corporation)

- 7.1.11 Tokyo Seimitsu Co. Ltd (Accretech Create Corp.)