|

市場調查報告書

商品編碼

1851898

基於模型的企業:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Model-based Enterprise - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

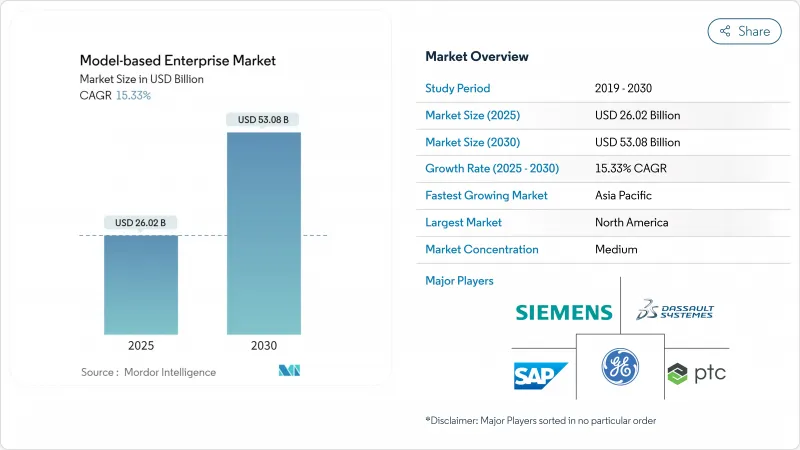

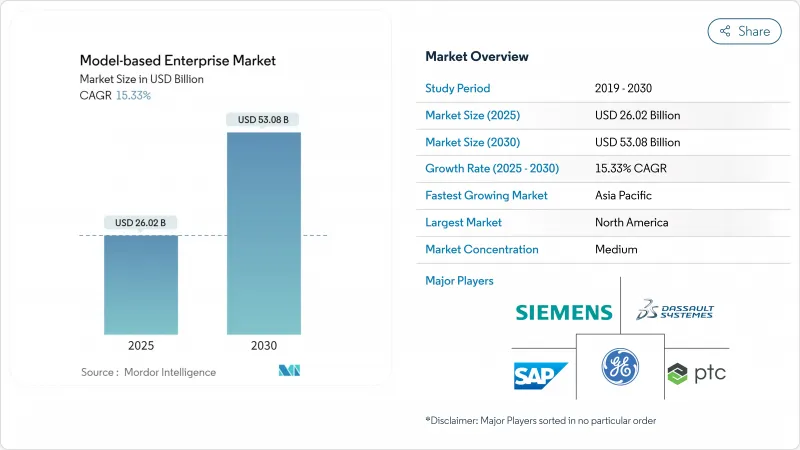

基於模型的企業市場預計到 2025 年將達到 260.2 億美元,到 2030 年將達到 530.8 億美元,複合年成長率為 15.33%。

這一發展勢頭源於工作流程從以文件為中心的模式轉變為連接設計、工程、製造和服務功能的連貫數位主線的轉變。美國國防部已強制要求將數位模型作為單一權威資料來源,這促使航太和國防相關企業迅速採用該技術。汽車製造商正在採用類似技術來加快電動車的開發速度,而雲端原生產品生命週期管理套件正在降低亞太地區中小型製造商的進入門檻。供應商正在投資人工智慧驅動的模擬、積層製造品質控制環和整合數位雙胞胎,以實現更快的投資回報,但許多用戶仍在努力應對員工技能再培訓成本和數據互通性方面的挑戰。

全球基於模型的企業市場趨勢與洞察

美國國防部數位工程指令加速在北美地區的應用

美國國防部承包商現在必須將3D模型視為設計、分析、採購和維護決策的唯一權威資訊來源。近30萬家供應商已開始更新其流程、軟體堆疊和網路安全防護措施,以確保繼續取得未來的合約。隨著共用分包商採用合規的工作流程,這一趨勢正在向商業航太蔓延。工具供應商也積極回應,提供包裝好的合規模板和自動化的基於模型的定義(MBD)檢查器,從而縮短文件編制時間並增強可追溯性。

汽車OEM廠商轉向電動車平台的全3D數位線程

純電動車專案依賴機械、電氣和熱力系統的同步設計。一家大型汽車製造商透過實施統一的3D數位線程,將平台週期從72個月縮短至36個月,同時提高了可追溯性。透過將數位雙胞胎與基於模型的系統工程相結合,團隊可以及早期模擬能量流動、碰撞行為和電池劣化,從而減少設計返工和保固風險。這些優勢正在推動該技術在歐洲、北美和中國的廣泛應用。

數據互通性挑戰阻礙了無縫整合

大約 65% 的工程計劃在將傳統 CAD 檔案轉換為功能豐富的、可用於模型驅動設計 (MBD) 的模型時會遇到延誤。僅進行幾何轉換是不夠的;必須保留數十年來累積的特徵、約束和關聯圖紙。雖然專用轉換工具正在不斷改進,但企業級遷移仍然需要資源,並且存在資料遺失的風險,這可能會阻礙數位轉型計畫的實施。

細分市場分析

到2024年,解決方案業務將佔總收入的71%,凸顯其作為大多數部署方案支柱的地位。然而,隨著企業面臨大規模部署基於模型的實踐的複雜性,服務合約的複合年成長率將達到17.8%。服務供應商正在引入人工智慧技術來實現資料遷移和檢驗的自動化,從而加快價值實現速度並提高模型準確性。市場對專注於數位線程技能的培訓和認證的需求不斷成長,表明人才缺口仍然存在。專業服務公司的出現為尋求指導但又不想承擔大型諮詢團隊高昂費用的中型製造商提供了更多選擇。

訂閱模式的興起正將收入模式從永久軟體轉向與績效指標和結果導向合約掛鉤的持續服務關係。將預測分析應用於維護和支援契約,可以在整合故障中斷生產之前發出預警。這些功能增強了客戶對可信賴合作夥伴的信任,並維持了基於模型的企業服務市場佔有率的持續成長動能。

儘管產品生命週期管理平台仍然是許多實施方案的基礎,但隨著企業尋求在設計和營運之間建立閉合迴路回饋,數位雙胞胎和模擬領域正日益受到重視。即時感測器數據被輸入到高保真模型中,以創建可自我更新的數位雙胞胎模型,從而指導指南、最佳化性能並延長資產壽命。模擬和系統工程的融合透過更早檢驗需求來減少返工。

視覺化和協作工具正在添加AR/VR疊加層,以促進身臨其境型設計評審。工程師、供應商甚至現場技術人員都可以即時查看相同模型,從而縮短決策時間。 CAD/CAM/CAE套件現在將產品製造資訊直接嵌入3D幾何模型中。這使得下游軟體(例如檢測規劃和現場計量平台)能夠使用單一資料集,從而減少轉換步驟並最大限度地減少校正誤差。

區域分析

北美地區在國防開支、成熟的航太供應鏈以及汽車製造商加速推出電動車的推動下,佔2024年全球銷量的38%。聯邦政府強制將數位化模型作為官方技術基準的政策,正促使即使是較保守的承包商也進行現代化改造。加拿大和墨西哥透過整合供應鏈參與其中,這些供應鏈必須證明其合規性,從而推動了整個北美大陸的廣泛應用。

亞太地區是成長最快的地區,2025年至2030年的複合年成長率將達到18.7%。雲端託管PLM降低了日本精密製造商、韓國電子巨頭和印度工程服務供應商的進入門檻。中國對數位化工廠的投資推動了龐大生產網路中對可擴展數位線程解決方案的需求。地方政府正在推行智慧製造補貼,以加速中小企業的參與。

在德國工業4.0計劃和法國先進航太計劃的推動下,歐洲持續強勁地採用數位孿生技術。英國位於貝爾法斯特的數位雙胞胎中心體現了英國致力於在下一代飛機研發領域保持競爭力的國家決心。永續性法規進一步鼓勵以模型為中心的設計,以追蹤碳足跡並最佳化資源利用。區域標準機構正在合作制定互通性框架,以促進跨境合作。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 美國國防部數位工程指令加速北美地區的採用

- 汽車OEM廠商轉向電動車平台的全3D數位胎面設計

- 雲端原生PLM套件的普及使亞太地區的中小企業能夠獲得這些套件

- 縮短航太MRO週轉時間帶來的投資報酬率

- 將基於模型的定義與積層製造品質工作流程結合

- 市場限制

- 傳統CAD標準與下一代MBD標準之間的資料互通性差距

- 員工再培訓的前期成本很高。

- 雲端部署中IP的網路安全隱患

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟影響分析

第5章 市場規模與成長預測

- 報價

- 解決方案

- 服務

- 按解決方案類型

- PLM軟體

- CAD/CAM/CAE

- 數位雙胞胎與仿真

- 視覺化與協作

- 按服務類型

- 整合與實施

- 諮詢與培訓

- 支援與維護

- 透過部署模式

- 本地部署

- 雲

- 公共雲端

- 私有雲端

- 混合雲端

- 按最終用戶行業分類

- 航太/國防

- 車

- 建築和基礎設施

- 電力和能源

- 零售及消費品

- 電子與高科技

- 海洋/近海

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

- 其他南美洲國家

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- Siemens AG

- Dassault Systemes SE

- PTC Inc.

- SAP SE

- Ansys, Inc.

- Autodesk Inc.

- IBM Corporation

- Oracle Corporation

- HCL Technologies Limited

- Aras Corporation

- Anark Corporation

- Hexagon AB

- Altair Engineering Inc.

- Ansys Inc.

- Rockwell Automation Inc.

- IFS AB

- Bentley Systems Inc.

- Capgemini SE

第7章 市場機會與未來展望

The model-based enterprise market is valued at USD 26.02 billion in 2025 and is forecast to reach USD 53.08 billion by 2030, reflecting a CAGR of 15.33%.

This momentum is anchored in the shift from document-centric workflows to coherent digital threads that connect design, engineering, manufacturing, and service functions. The United States Department of Defense requirement that digital models act as the single authoritative data source is spurring swift uptake among aerospace and defense contractors. Automotive manufacturers are adopting similar practices to compress electric-vehicle development timelines, while cloud-native product-lifecycle-management suites are lowering barriers for small and medium manufacturers in Asia-Pacific. Vendors are investing in AI-driven simulation, additive-manufacturing quality loops, and integrated digital twins to deliver faster ROI, yet many users still grapple with workforce reskilling costs and data-interoperability gaps.

Global Model-based Enterprise Market Trends and Insights

DoD Digital Engineering Mandates Accelerating Adoption in North America

Defense contractors must now treat 3D models as the single source of truth for design, analysis, sourcing, and sustainment decisions. Close to 300,000 suppliers have started updating processes, software stacks, and cybersecurity safeguards to stay eligible for future contracts. Uptake is spilling over to commercial aerospace as shared subcontractors align with mandate-compliant workflows. Tool vendors are responding with packaged compliance templates and automated model-based definition (MBD) checkers that cut documentation time and enhance traceability.

Automotive OEM Shift to Full-3D Digital Thread for EV Platforms

Battery-electric programs rely on concurrent design of mechanical, electrical, and thermal systems. Deploying a unified 3D digital thread has allowed leading automakers to shrink platform cycles from 72 months to 36 months while improving traceability. The integration of digital twins with model-based systems engineering lets teams simulate energy flow, crash behavior, and battery degradation early, curbing late redesigns and warranty risk. These gains drive widespread rollouts across Europe, North America, and China.

Data-Interoperability Challenges Hinder Seamless Integration

Roughly 65% of engineering projects still encounter delays when transforming historical CAD files into feature-rich, MBD-ready models. Geometry translation alone is not enough; teams must also preserve features, constraints, and linked drawings built over decades. Specialized conversion tools are improving, yet enterprise-wide migrations remain resource intensive and carry risk of data loss that can stall digital-thread initiatives.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Cloud-Native PLM Suites Enabling SMB Access in Asia-Pacific

- ROI From Aerospace MRO Turn-Around-Time Reduction

- Workforce Reskilling Creates Implementation Hurdle

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Solutions segment generated 71% of 2024 revenue, underscoring its role as the backbone of most deployments. Service engagements, however, are registering a 17.8% CAGR as enterprises confront the complexity of rolling out model-based practices at scale. Service providers are embedding AI to automate data migration and validation, shortening time-to-value and boosting confidence in model accuracy. Training and certification packages focused on digital-thread skills are rising in demand, highlighting the persistent talent gap. The influx of specialized service firms is broadening options for mid-market manufacturers seeking guidance without the expense of large consulting teams.

Rising subscription models are shifting revenue from perpetual software toward continuous service relationships tied to performance metrics and outcome-based contracts. Predictive analytics applied within maintenance and support agreements can flag integration glitches before they disrupt production. These capabilities reinforce client reliance on trusted partners, sustaining the upward trajectory of the Services share within the model-based enterprise market.

Product-lifecycle-management platforms remain the foundation of most implementations, but the Digital-Twin & Simulation segment is gaining prominence as organizations seek closed-loop feedback between design and operation. Real-time sensor data feeding high-fidelity models creates self-updating digital twins that guide maintenance, optimize performance, and extend asset life. The convergence of simulation and systems engineering reduces rework by validating requirements early, a benefit that is especially acute in regulated domains such as aerospace and medical devices.

Visualization and collaboration tools are adding AR/VR overlays to facilitate immersive design reviews. Engineers, suppliers, and even field technicians can inspect the same model in real time, shrinking the decision window. CAD/CAM/CAE suites now embed product-manufacturing information directly in 3D geometry. This allows downstream software, including inspection planning and shop-floor metrology platforms, to consume a single data set, trimming translation steps and minimizing revision errors.

The Model-Based Enterprise Market Report is Segmented by Offering (Solutions, and Services), Solution Type (PLM Software, CAD/CAM/CAE, and More), Service Type (Integration and Implementation, Consulting and Training, and More), Deployment Mode (On-Premise, and Cloud), End User Industry (Aerospace and Defense, Construction and Infrastructure, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38% of 2024 revenue, supported by defense spending, a mature aerospace supply chain, and automakers seeking to accelerate electric-vehicle launches. Federal policies that enforce digital models as the official technical baseline are nudging even conservative contractors to modernize. Canada and Mexico participate through integrated supply chains that must also prove compliance, driving widespread adoption across the continent.

Asia-Pacific is the fastest-growing region with an 18.7% CAGR over 2025-2030. Cloud-hosted PLM lowers entry barriers for Japan's precision manufacturers, South Korea's electronics champions, and India's engineering-services providers. China's investment in digital factories fuels demand for digital-thread solutions that can scale across vast production networks. Local governments promote smart-manufacturing grants, accelerating SMB participation.

Europe maintains robust adoption driven by Germany's Industrie 4.0 initiatives and France's advanced aerospace programs. A United Kingdom digital-twin center in Belfast demonstrates national commitment to remain competitive in next-generation aircraft development. Sustainability regulations further encourage model-centric design to track carbon footprints and optimize resource use. Regional standards bodies collaborate on interoperability frameworks, smoothing cross-border collaboration.

- Siemens AG

- Dassault Systemes SE

- PTC Inc.

- SAP SE

- Ansys, Inc.

- Autodesk Inc.

- IBM Corporation

- Oracle Corporation

- HCL Technologies Limited

- Aras Corporation

- Anark Corporation

- Hexagon AB

- Altair Engineering Inc.

- Ansys Inc.

- Rockwell Automation Inc.

- IFS AB

- Bentley Systems Inc.

- Capgemini SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 DoD Digital Engineering Mandates Accelerating Adoption in North America

- 4.2.2 Automotive OEM Shift to Full-3D Digital Thread for EV Platforms

- 4.2.3 Surge in Cloud-Native PLM Suites Enabling SMB Access in Asia-Pacific

- 4.2.4 ROI From Aerospace MRO Turn-Around Time Reduction

- 4.2.5 Integrating Model-Based Definition with Additive-Manufacturing Quality Workflows

- 4.3 Market Restraints

- 4.3.1 Data-Interoperability Gaps Between Legacy CAD and Next-Gen MBD Standards

- 4.3.2 High Up-Front Workforce Reskilling Costs

- 4.3.3 Cyber-security Concerns Over IP in Cloud Deployments

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Macroeconomic Impact Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Solution Type

- 5.2.1 PLM Software

- 5.2.2 CAD/CAM/CAE

- 5.2.3 Digital-Twin and Simulation

- 5.2.4 Visualization and Collaboration

- 5.3 By Service Type

- 5.3.1 Integration and Implementation

- 5.3.2 Consulting and Training

- 5.3.3 Support and Maintenance

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.2.1 Public Cloud

- 5.4.2.2 Private Cloud

- 5.4.2.3 Hybrid Cloud

- 5.5 By End User Industry

- 5.5.1 Aerospace and Defense

- 5.5.2 Automotive

- 5.5.3 Construction and Infrastructure

- 5.5.4 Power and Energy

- 5.5.5 Retail and CPG

- 5.5.6 Electronics and Hi-Tech

- 5.5.7 Marine and Offshore

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Siemens AG

- 6.3.2 Dassault Systemes SE

- 6.3.3 PTC Inc.

- 6.3.4 SAP SE

- 6.3.5 Ansys, Inc.

- 6.3.6 Autodesk Inc.

- 6.3.7 IBM Corporation

- 6.3.8 Oracle Corporation

- 6.3.9 HCL Technologies Limited

- 6.3.10 Aras Corporation

- 6.3.11 Anark Corporation

- 6.3.12 Hexagon AB

- 6.3.13 Altair Engineering Inc.

- 6.3.14 Ansys Inc.

- 6.3.15 Rockwell Automation Inc.

- 6.3.16 IFS AB

- 6.3.17 Bentley Systems Inc.

- 6.3.18 Capgemini SE

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment