|

市場調查報告書

商品編碼

1689729

自動貼標機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automatic Labeling Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

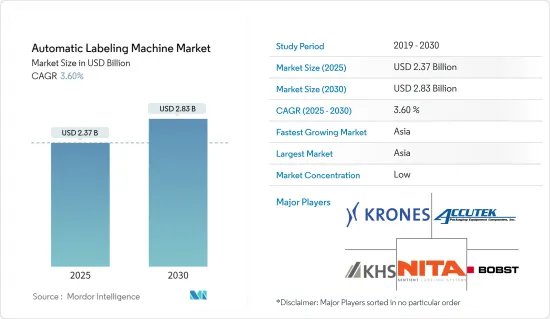

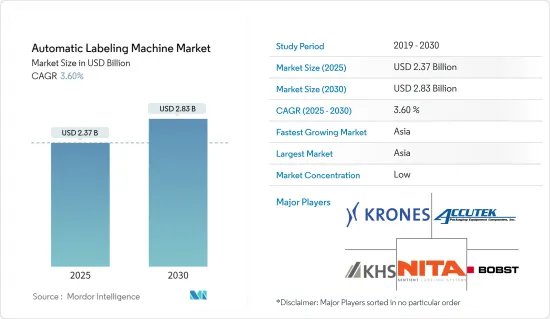

自動貼標機市場規模預計在 2025 年為 23.7 億美元,預計到 2030 年將達到 28.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.6%。

主要亮點

- 技術進步和數位轉型大大增加了標籤的重要性。供應鏈複雜性的提高、監管要求的提高以及消費者對產品資訊的需求正在推動這一成長。最終用戶產品有多種包裝和材料選擇,從塑膠容器到生物分解性材料,每種都需要獨特的標籤解決方案。從全球來看,隨著製造商尋求提高效率、減少錯誤和適應日益增加的產品變化,對速度更快的自動化貼標機的需求正在成長。這一趨勢在食品飲料、製藥和電子商務行業中尤為明顯,準確、快速的標籤對於庫存控制、可追溯性和客戶滿意度至關重要。

- 標籤技術的進步也促進了智慧標籤的發展,智慧標籤結合了2D碼和無線射頻識別標籤等功能,以增強產品追蹤並向消費者提供更多資訊。此外,電子商務加速了對高效標籤系統的需求,以管理大量的運輸和退貨。環境議題也影響標籤實踐,人們更重視永續材料和環保油墨。隨著全球市場聯繫日益緊密,多語言和特定地區的標籤要求為產業帶來了新的複雜性,推動了靈活、適應性強的標籤解決方案的創新。

- 食品和飲料行業對快速、準確的標籤解決方案的需求日益成長,推動了貼標機市場的成長。這項需求是由各行各業推動的,他們不斷提高生產流程的自動化和效率。貼標機可確保產品識別、可追溯性和符合法規要求。為了滿足日益成長的需求,製造商正致力於透過採用新的技術進步來增強其產品功能。這些進步包括改進的印刷技術、與生產線系統的整合、增強的資料管理和客製化的軟體功能。

- 市場也呈現出一種趨勢,即機器的用途更加廣泛,可以適應各種類型和尺寸的標籤,以滿足食品和飲料製造商的多樣化需求。隨著產業的不斷發展,貼標機製造商有望投資研發以創造更多創新解決方案。這可能包括用於即時監控和維護的物聯網連接,以及用於最佳化標籤流程和減少錯誤的人工智慧驅動系統。

- 自動貼標機在零售產品中的使用越來越廣泛,推動了貼標機市場的發展。這一趨勢與零售業密切相關,預計將持續下去。在新興經濟體中,包裝食品和飲料的普及率很高,為各種包裝材料提供了成長機會。追蹤和防偽標籤可以有效地監控貨物並確保產品的完整性。用於打擊詐騙和盜竊的安全標籤的需求可能會增加對該設備的需求。在美國,將無線射頻辨識(RFID)技術融入感壓標籤在各行各業中正變得越來越重要。然而,製造商面臨著跟上最新貼標機技術的挑戰,而且與半自動或手動替代品相比,全自動機器的初始成本更高。

- 貼標機的高成本限制了市場的擴展。如此高成本可能會阻止潛在買家(例如中小型企業)投資先進的標籤設備。購買和安裝貼標機的初始資本支出可能很大,通常需要佔用公司預算的很大一部分。此外,持續的維護、維修和潛在的升級也會進一步增加整體擁有成本。這些經濟負擔可能會導致一些公司選擇手動標記流程或不太複雜的設備,從而導致效率和準確性降低。因此,儘管自動標籤解決方案具有長期利益,但一些公司仍需要幫助證明投資的合理性,而且市場的潛在成長將受到這些經濟進入障礙的限制。

自動貼標機市場趨勢

飲料領域佔很大市場佔有率

- 飲料業對自動化的需求不斷成長將推動自動貼標機市場的發展。隨著消費者越來越注重產品細節,標籤對於提供產品資訊和促進銷售至關重要。為了滿足日益成長的飲料需求,製造商正在轉向自動標籤系統。自動貼標機與手動貼標流程相比有幾個優點:這些機器可以提高效率、降低人事費用並提高標籤放置的準確性。此外,我們能夠適應各種容器形狀和尺寸,滿足飲料行業多樣化的包裝需求。此外,自動貼標機可以高速運行,使製造商能夠滿足不斷成長的生產需求。

- 飲料業對一致的品牌和法規遵循的需求進一步推動了自動貼標機的採用。這些系統可以實現精確的標籤定位,確保整個產品線的外觀統一。它還可以透過準確顯示營養成分、成分和有效期等所需資訊來幫助製造商遵守標籤法規。隨著飲料行業的擴大和多樣化,對靈活高效的標籤解決方案的需求預計會增加。這一趨勢可能會刺激自動貼標機技術的進一步創新,包括與生產線更好地整合以及更強的客製化能力,以滿足特定行業需求。

- 飲料製造商面臨多重挑戰,包括勞動力短缺、需求增加以及供應鏈持續中斷。食品包裝自動化對於這些組織來說至關重要,因為它可以提高製造生產力而無需額外的勞動力。由於未來幾年需求預計會增加,而且勞動力短缺的情況將持續下去,包裝自動化可能會變得更加重要。因此,製造商正在轉向技術解決方案。工業 4.0 技術的進步將在未來十年改變食品製造業。

- 由於食品和飲料行業的需求不斷成長,製造商不斷投資於貼標機的創新。不斷發展的飲料產業對高速自動貼標機的需求日益增加。這項需求是由業界對高效、準確的標籤解決方案的需求所推動的,以滿足消費者的期望和監管標準。此圖顯示了 2023 年德國蔬果飲料銷售量按包裝類型分佈。一次性 PET 是最受歡迎的包裝,佔總銷售量的 49%,其次是紙盒包裝,佔 34%。這些資料凸顯了這些包裝材料的龐大市場佔有率,並強調了多功能標籤解決方案的重要性。

- 由於飲料包裝材料種類繁多,包括PET、玻璃和紙盒,飲料包裝行業需要高階的自動貼標機。這些機器必須能夠適應各種容器形狀、尺寸和物料輸送,同時保持高速和高精度。快速適應不同包裝類型的能力對於製造商在動態飲料行業中保持競爭力至關重要。此外,對永續性和環保包裝選擇的關注度不斷提高,推動了標籤技術的創新。製造商正在開發能夠有效應用可回收標籤和使用環保包裝材料的機器,以符合消費者偏好和永續包裝解決方案的監管要求。

亞洲:可望實現高成長

- 亞洲是世界上人口最多的地區,消費者對包裝的認知正在顯著提高。這一趨勢推動了食品業對包裝解決方案和高速、高品質標籤系統的巨大需求。中國、台灣和越南利用這個不斷成長的市場,已成為該地區自動貼標機的主要出口國。受多種關鍵因素推動,亞太地區對印刷標籤的需求正在快速成長。新興市場的經濟成長正在增加可支配收入和消費者的消費能力。同時,消費者的健康意識也日益轉向標示清晰的包裝食品和飲料。這些因素共同促進了該地區食品和飲料行業的擴張。

- 隨著都市化進程的加速和零售網路在亞太地區的擴張,高效、準確的標籤解決方案變得越來越重要。自動貼標機滿足嚴格的貼標要求,確保產品可追溯性並保持高速生產。在語言要求多樣化和監管標準嚴格的市場中,這項技術非常有價值。電子商務的成長和對產品差異化的日益重視也推動了先進標籤解決方案的採用。為了滿足亞太市場的多樣化需求,製造商正在投資能夠適應多種包裝類型和尺寸的多功能貼標機。隨著該地區的不斷發展,自動貼標機市場預計將成長,製造過程的自動化將進一步推動這一趨勢。

- 中國對貼標機的需求主要由兩個關鍵因素驅動:各行業對提高生產力的需求日益成長以及技術的持續進步。食品飲料、製藥、化工等行業尤其重要。此外,中國的監管要求在塑造市場方面發揮重要作用。中國監管機構要求,包括糖果、葡萄酒、堅果、罐頭食品和起司在內的進出口食品在過境前必須接受標籤和產品品質檢查。然而,這些特定的標籤要求並不適用於國產食品。

- 此外,印度標籤機械產業近年來也經歷了顯著成長。這種成長歸因於多種因素,包括工業化程度的提高、包裝商品的需求增加以及標籤技術的進步。食品和飲料、製藥和消費品產業是這項擴張的主要驅動力,因為它們需要高效、準確的標籤解決方案來滿足監管要求和消費者的期望。此外,政府推動國內製造業的舉措進一步推動了印度標籤機械市場的成長。

- 推動日本包裝市場的產業主要包括食品、酒精飲料、非酒精飲料、化妝品和盥洗用品。這些行業反映了消費者偏好和市場動態,極大地影響了日本的包裝趨勢和需求。 2022 年,亞太國家將消費約 2,880 億公升包裝飲料,預計到 2025 年將上升至 3,360 億公升。這一成長軌跡證實了該地區包裝商品市場的不斷擴大。

- 2022年全球包裝飲料消費量將達到約1.4兆公升,凸顯國際飲料包裝產業規模龐大。這些統計數據,包括區域細分和到 2025 年的預測,顯示亞太地區為自動標籤市場帶來了龐大的商機。飲料消費量的預期成長將推動對高效、準確標籤解決方案的需求,使該地區成為自動標籤技術提供者和包裝設備製造商的有吸引力的市場。

自動貼標機市場概況

自動貼標機市場較為分散,Nita Labeling Systems、Bobst Group SA、KHS GmbH 和 Krones AG 等多家全球和區域參與者在競爭激烈的市場領域爭奪關注。該市場的特徵是產品差異化程度低、產品擴散度高、競爭激烈。

- 2024 年 7 月,Nita Inc. 收購了位於明尼蘇達州的專門生產旋轉標籤的製造商 Shorewood Engineering LLC。 Shorewood 因向美國主要消費品公司供應頂級標籤而聞名。 Shorewood 的旋轉貼標機無縫增強了 Nitta 現有的線上貼標機。值得注意的是,傳統的行業領導者主要位於歐洲,而 Shorewood 是唯一一家位於北美的旋轉貼標機製造商。

- 2024 年 7 月 Domino Printing Sciences 推出尖端的自動印刷和標籤檢驗技術。這項創新旨在最大限度地減少代價高昂的標籤錯誤。新推出的產品擁有先進的編碼自動化軟體,無需手動輸入。此外,它還具有整合的機器視覺系統,以確保精確的程式碼準確性。

- 2023 年 11 月西班牙標籤專家 Germark 透過購買新的 DIGITAL MASTER 340 加強了與 BOBST 的合作。這是 Germark 在短短三年內購買的第四台 BOBST 機器。一體式模組化標籤印刷機將增強德國的數位印刷能力,實現完全成品標籤的線上生產,滿足高階客戶的需求,尤其是美容和化妝品行業的高階客戶。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 進出口分析

第5章 市場動態

- 市場促進因素

- 食品和飲料包裝自動化需求不斷成長

- 自動貼標機的普及

- 市場限制

- 貼標機高成本

第6章 市場細分

- 依技術分類

- 壓敏/自黏貼標機

- 收縮套標機

- 不乾膠貼標機

- 套標機

- 其他技術

- 按最終用戶

- 食物

- 飲料

- 藥品

- 個人護理

- 化學品

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 印度

- 中國

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 墨西哥

- 巴西

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- SACMI IMOLA SC

- Accutek Packaging Equipment Companies Inc.

- Krones AG

- SIDEL GROUP(Tetra Laval Group)

- HERMA GmbH

- Nita Labeling Systems

- World Pack Automation Systems

- Domino Printing Sciences PLC

- Bobst Group SA

- KHS GmbH

- ProMach Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Automatic Labeling Machine Market size is estimated at USD 2.37 billion in 2025, and is expected to reach USD 2.83 billion by 2030, at a CAGR of 3.6% during the forecast period (2025-2030).

Key Highlights

- The importance of labeling has grown significantly due to technological advancements and digital transformation. The increasing complexity of supply chains, regulatory requirements, and consumer demand for product information drives this growth. End-user products are available in various packaging and material options, ranging from plastic containers to biodegradable materials, each requiring specific labeling solutions. The demand for faster and automated labeling equipment has increased globally as manufacturers seek to improve efficiency, reduce errors, and meet the rising volume of product variations. This trend is particularly evident in the food and beverage, pharmaceuticals, and e-commerce industries, where accurate and rapid labeling is crucial for inventory management, traceability, and customer satisfaction.

- The evolution of labeling technology has also led to the development of smart labels, incorporating features like QR codes and RFID tags, which enhance product tracking and provide consumers with detailed information. Additionally, e-commerce has further accelerated the need for efficient labeling systems to manage the high volume of shipments and returns. Environmental concerns have also influenced labeling practices, with a growing emphasis on sustainable materials and eco-friendly inks. As global markets become more interconnected, multilingual and region-specific labeling requirements have added another layer of complexity to the industry, which is driving innovation in flexible and adaptable labeling solutions.

- The increasing need for high-speed and accurate labeling solutions in the food and beverage industry is driving the growth of the labeling machine market. This demand is fueled by the industry's push for automation and efficiency in production processes. Labeling machines ensure product identification, traceability, and compliance with regulatory requirements. Manufacturers are focusing on enhancing their product features by incorporating new technological advancements to meet this growing demand. These advancements include improved printing technologies, integration with production line systems, and enhanced data management and customization of software capabilities.

- The market is also seeing a trend toward more versatile machines that can handle various label types and sizes, catering to the diverse needs of food and beverage producers. As the industry continues to evolve, labeling machine manufacturers are expected to invest in research and development to create more innovative solutions. These may include IoT connectivity for real-time monitoring and maintenance and AI-driven systems for optimizing labeling processes and reducing errors.

- The increasing use of automatic labeling machines in retail products drives the labeling machine market. This trend is closely tied to the retail industry and is expected to continue. Developed economies show high penetration of packaged food and beverages, offering growth opportunities for various packaging materials. Labels with tracking and anti-counterfeiting features enable effective shipment monitoring and ensure product integrity. The demand for security labeling to combat fraud and theft will likely increase equipment demand. In the United States, radio-frequency identification (RFID) integration in pressure-sensitive labels has gained importance across various industries. However, manufacturers face challenges in keeping up with the latest labeling machine technologies, and fully automatic machines come with higher initial costs compared to semi-automatic or manual alternatives.

- The significant expenses associated with labeling machines pose a limitation on market expansion. These high costs can deter potential buyers, such as tiny and medium-sized enterprises, from investing in advanced labeling equipment. The initial capital outlay for purchasing and installing labeling machines can be substantial, often requiring a considerable portion of a company's budget. Additionally, ongoing maintenance, repairs, and potential upgrades further contribute to the total cost of ownership. This financial burden may lead some businesses to opt for manual labeling processes or less sophisticated equipment, potentially compromising efficiency and accuracy. Consequently, the market's growth potential is restricted by these financial barriers to entry, as some businesses need help to justify the investment despite the long-term benefits of automated labeling solutions.

Automatic Labeling Machine Market Trends

The Beverages Segment to Hold a Significant Market Share

- The increasing demand for automation in the beverages industry drives the automatic labeling machine market. Labels are crucial in providing product information and boosting sales as consumers become more conscious about product details. Manufacturers are shifting to automated labeling systems to meet the growing beverage demand. Automatic labeling machines offer several advantages over manual labeling processes. These machines increase efficiency, reduce labor costs, and improve accuracy in label placement. They can handle various container shapes and sizes, accommodating the diverse packaging needs of the beverages industry. Additionally, automatic labeling machines can operate at high speeds, enabling manufacturers to meet increased production demands.

- The beverages industry's need for consistent branding and regulatory compliance further fuels the adoption of automatic labeling machines. These systems can apply labels with precise positioning, ensuring a uniform appearance across product lines. They also help manufacturers comply with labeling regulations by accurately applying required information, such as nutritional facts, ingredients, and expiration dates. As the beverages industry expands and diversifies, the demand for flexible and efficient labeling solutions is expected to grow. This trend will likely drive further innovations in automatic labeling machine technology, including improved integration with production lines and enhanced customization capabilities to meet specific industry requirements.

- Beverage manufacturers face several challenges, including labor shortages, increased demand, and persistent supply chain disruptions. Food packaging automation is crucial for these organizations as it enhances manufacturing productivity without requiring additional labor. As demand is expected to rise over the next few years and workforce shortages continue, packaging automation will likely become increasingly important. Consequently, manufacturers are adopting technological solutions. Advancements in Industry 4.0 technologies are poised to transform food manufacturing in the coming decade.

- Due to increasing demand for the food and beverage industries, manufacturers are continuously investing in innovating with labeling machines. The growing beverages industry further drives the need for fast, automatic label machines. This demand is fueled by the industry's requirement for efficient and accurate labeling solutions to meet consumer expectations and regulatory standards. The graph illustrates the sales distribution of fruit and vegetable beverages in Germany in 2023 by packaging type. Disposable PET was the most popular packaging, accounting for 49% of total sales, followed by cartons at 34%. This data highlights the significant market share of these packaging materials and underscores the importance of versatile labeling solutions.

- The diverse range of beverage packaging materials, including PET, glass, and cartons, necessitates high-end automated labeling machines in the beverage packaging industry. These machines must be capable of handling various container shapes, sizes, and materials while maintaining high-speed operations and precision. The ability to quickly adapt to different packaging types is crucial for manufacturers to remain competitive in the dynamic beverages industry. Furthermore, the increasing focus on sustainability and eco-friendly packaging options drives innovation in labeling technology. Manufacturers are developing machines that can efficiently apply recyclable labels and work with environmentally friendly packaging materials, aligning with consumer preferences and regulatory requirements for sustainable packaging solutions.

Asia Expected to Register a High Growth Rate

- Asia, home to the world's largest population, is experiencing a significant increase in consumer awareness regarding packaging. This trend drives substantial demand for packaging solutions and high-speed, high-quality labeling systems in the food industry. China, Taiwan, and Vietnam have emerged as the region's primary exporters of automatic labeling machines, capitalizing on this growing market. The demand for printed labels in Asia-Pacific is expanding rapidly, fueled by several key factors. Economic growth in emerging markets has resulted in increases in disposable incomes and consumer spending power. Simultaneously, consumer health consciousness is increasingly shifting toward packaged food and beverages with clear labeling. These factors collectively contribute to expanding the region's packaged food and beverages industry.

- As urbanization continues and retail networks expand across Asia-Pacific, efficient and accurate labeling solutions are becoming more critical. Automatic labeling machines meet stringent labeling requirements, ensure product traceability, and maintain high production speeds. This technology is precious in markets with diverse language requirements and strict regulatory standards. The growth of e-commerce and the increasing emphasis on product differentiation also drive the adoption of advanced labeling solutions. Manufacturers are investing in versatile labeling machines that can handle various packaging types and sizes, catering to the diverse needs of the Asia-Pacific market. As the region continues to develop, the automatic labeling machine market is expected to grow, while increasing automation in manufacturing processes is further propelling this trend.

- The demand for labeling machines in China is primarily driven by two key factors: the increasing need for productivity enhancements across various industries and ongoing technological advancements. Industries such as food and beverage, pharmaceutical, and chemical are particularly significant. Additionally, Chinese regulatory requirements play a crucial role in shaping the market. Chinese regulators mandate label verification and product quality testing before goods cross borders for imported and exported food, including candy, wine, nuts, canned food, and cheese. However, these specific labeling requirements do not apply to domestically produced food items.

- Further, India's labeling machinery industry has experienced a substantial expansion in recent years. This growth can be attributed to several factors, including increased industrialization, rising demand for packaged goods, and advancements in labeling technology. The food and beverage, pharmaceutical, and consumer goods industries have been critical drivers of this expansion, as they require efficient and accurate labeling solutions to meet regulatory requirements and consumer expectations. Additionally, the government's initiatives to promote domestic manufacturing have further boosted the growth of the labeling machinery market in India.

- The key industries driving the Japanese packaging market include food, alcoholic beverages, non-alcoholic beverages, cosmetics, and toiletries. These industries significantly influence packaging trends and demand in Japan, reflecting consumer preferences and market dynamics. In 2022, Asia-Pacific countries consumed approximately 288 billion liters of packaged beverages, with projections indicating an increase to 336 billion liters by 2025. This growth trajectory underscores the region's expanding market for packaged goods.

- Global consumption of packaged beverages reached about 1.4 trillion liters in 2022, highlighting the vast scale of the international beverage packaging industry. These statistics, which provide regional breakdowns and forecasts for 2025, suggest that Asia-Pacific presents significant opportunities for the automatic labeling market. The anticipated growth in beverage consumption will likely drive demand for efficient and accurate labeling solutions, making the region an attractive market for automatic labeling technology providers and packaging equipment manufacturers.

Automatic Labeling Machine Market Overview

The automatic labeling machine market is fragmented, comprising several global and regional players like Nita Labeling Systems, Bobst Group SA, KHS GmbH, and Krones AG, vying for attention in a contested market space. This market is characterized by low product differentiation, growing product penetration, and high competition.

- July 2024: Nita Inc. acquired Shorewood Engineering LLC, a Minnesota-based manufacturer specializing in rotary labels. Shorewood is renowned for providing top-tier labels to leading US consumer packaged goods companies. The rotary labelers from Shorewood seamlessly enhance Nita's existing in-line labeler offerings. Notably, Shorewood stands out as the sole North American manufacturer of rotary labelers, with traditional industry leaders based predominantly in Europe.

- July 2024: Domino Printing Sciences unveiled a cutting-edge automated printing and label verification technology. This innovation aims to assist manufacturers in minimizing expensive labeling mistakes. The newly introduced product boasts sophisticated coding automation software, which removes the need for manual input. Additionally, it features an integrated machine vision system, guaranteeing precise code accuracy.

- November 2023: Spanish label specialist Germark bolstered its collaboration with BOBST by acquiring a new DIGITAL MASTER 340. This marked Germark's fourth BOBST machine in just three years. The All-in-One modular label press is set to enhance Germark's digital printing capabilities, enabling the production of fully finished labels in-line, catering specifically to its upscale clientele in the beauty and cosmetics industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation in Food and Beverage Packaging

- 5.1.2 Growing Adoption of Automatic Labeling Machine

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Labeling Machines

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Pressure-sensitive/Self-adhesive Labelers

- 6.1.2 Shrink Sleeve Labelers

- 6.1.3 Glue-based Labelers

- 6.1.4 Sleeve Labelers

- 6.1.5 Other Technologies

- 6.2 By End User

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Pharmaceutical

- 6.2.4 Personal Care

- 6.2.5 Chemicals

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SACMI IMOLA SC

- 7.1.2 Accutek Packaging Equipment Companies Inc.

- 7.1.3 Krones AG

- 7.1.4 SIDEL GROUP (Tetra Laval Group)

- 7.1.5 HERMA GmbH

- 7.1.6 Nita Labeling Systems

- 7.1.7 World Pack Automation Systems

- 7.1.8 Domino Printing Sciences PLC

- 7.1.9 Bobst Group SA

- 7.1.10 KHS GmbH

- 7.1.11 ProMach Inc.