|

市場調查報告書

商品編碼

1689704

智慧插頭:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Plug - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

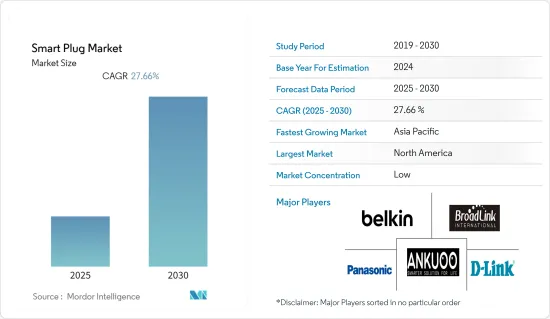

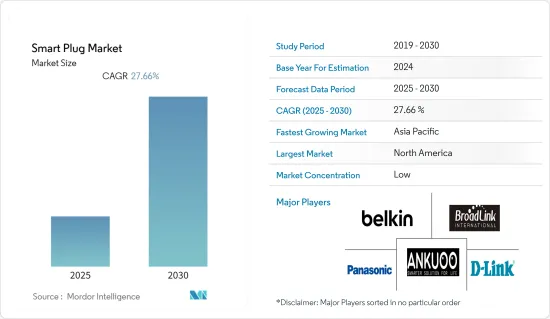

預測期內,智慧插頭市場預計將以 27.66% 的複合年成長率成長。

市場擴張很大程度上歸功於物聯網(IoT)、智慧語音辨識等現代科技的快速應用。市場的主要驅動力是全球智慧家庭的廣泛應用和物聯網框架的發展。

主要亮點

- 美國、中國、印度等已開發國家及開發中國家對物聯網(IoT)的接受度不斷提升,協助智慧家居產業的建置。實現設備通訊的技術潛力正在促進市場需求。儘管供應鏈存在不一致,但疫情及其影響凸顯了大幅改善網路連線和自動化招募的必要性。許多顧客在封鎖期間購買了智慧家電。

- 智慧家庭設備可以實現對家庭各個元素的遠端監控和控制,是一個蓬勃發展的領域,擁有主要製造商和大眾採用者。在過去的兩年中,隨著自動化提高了智慧家庭用戶的舒適度,許多技術發展增加了對智慧家電的需求。此外,節約能源對於保護環境和降低監控成本也很重要。智慧加熱和冷卻系統透過監控需求並進行有效管理使消費者能夠節省能源。

- 智慧家電(尤其是冰箱、洗碗機、智慧電視、語音助理和微波爐)需求的顯著成長推動了對基於 Wi-Fi 產品的需求,而網際網路連接技術的進步則推動了智慧家庭設備市場的發展。

- 智慧插頭變得越來越普遍,但也引發了安全疑慮。如果智慧插頭受到威脅,使用者的安全和隱私就會受到損害。如果智慧插頭用於商業或工業建築的需量反應,那麼如果受到攻擊並被攻擊者控制,其影響可能是嚴重的。智慧插頭的安全問題已引起學術界和工業界的關注。

智慧插頭市場趨勢

物聯網框架的進步有望推動市場成長

- 愛立信預計,未來兩年內,預計近60%的行動電話動物聯網(IoT)連接將是寬頻連接,其中4G將佔據大多數。隨著 5G 新無線電 (NR) 在現有和新頻段實施,該部分的吞吐量資料速率將顯著提高。此外,大規模物聯網 (Massive IoT)、NB-IoT 和 Cat-M 技術可服務於涉及大量低複雜度、低成本設備的廣域使用案例,這些設備具有較長的電池壽命和低到中等的吞吐量,目前正在全球部署。

- 這些優勢將使窄頻物聯網得到廣泛的應用,從智慧電錶到智慧城市、智慧建築基礎設施控制和智慧農業。換句話說,哪裡需要連接,哪裡就能連結。智慧電錶是最突出的使用案例之一,智慧插頭在這些應用中發揮關鍵作用。電錶、水錶和氣表的聯網是窄頻技術的物聯網領域。消費者不需要大量資料即可啟用其電錶的物聯網功能。此外,NB-IoT 的強大覆蓋範圍使其成為傳輸通常安裝在地下的智慧電錶訊號的理想選擇。

- 市場上許多公司正在投資產品開發,設計具有此類能源監控功能的智慧插頭。 2022年11月,Smarteefi投資為其智慧開關產品線引進了一款新產品:16A WiFi智慧插頭。該型號是世界上第一個具有內建手錶系統的型號,該時鐘系統獨立於網際網路手錶週期。這為用戶提供了獨特的功能,例如可靠的時間表、保證的倒數計時器以及更準確的日常和即時能源監控。

- 此外,2022年10月,中國MOKO Smart推出了用於智慧家庭和能源計量產業能源管理應用的智慧插頭,使客戶和能源解決方案供應商受益。 MK117NB智慧插頭可以遠端系統管理負載開關,監控能源使用情況並降低電力消耗。其測量精度達0.5%,配備功率和能量計。

- 使用智慧型手機應用程式,您可以每小時、每天、每月甚至回顧性地監控總用電量。 MK117NB 智慧插頭在許多國家都有銷售,並且與多種插頭類型相容。它使具有物聯網功能的常見電器設備能夠更深入地了解他們的能源使用情況,並將即時電力消耗量轉化為準確的計費資訊。

北美引領智慧插頭市場

- 北美是建築自動化領域智慧技術的早期採用者,因為它具有使用方便、能源管理等多種應用領域,為該地區的市場供應商創造了機會。市場發展受到美國和加拿大等新興經濟體的推動。此外,包括貝爾金國際公司(Belkin International Inc.)在內的許多國際智慧家庭產品製造商都在美國開展業務。

- 該地區能源和電力領域的許多行業正在投資收購提供智慧插頭產品的智慧家庭解決方案提供商,這表明北美市場的成長潛力。例如,2022年12月,NRG Energy Inc.的美國生產部門透過規劃和投資28億美元收購Vivint Smart Home Inc.,從大型電力企業發展成為零售消費者,後者提供包括智慧插頭在內的多種智慧電子產品。

- 該地區的市場供應商正在與物聯網平台提供商合作,加速推出智慧插頭產品;具有內建高級功能和相容性的更新智慧插頭可以安全地用於各種應用,從而推動市場成長。例如在加拿大,加速消費品牌數位轉型的物聯網(IoT)平台供應商Ayla Networks宣布,其物聯網韌體將被整合到Canadian Tire的NOMA iQ智慧家居產品線中,該系列產品包括智慧照明、智慧插頭和智慧空氣清淨器,用戶可以透過一體化應用程式進行連接。

- 在這個市場中,各公司正在合作擴大其智慧家居產品陣容,其中包括智慧插頭。透過這些合作,現有的傳統電子公司正在利用最新的基於 Wi-Fi 的技術推出新的智慧家庭產品線,從而刺激市場成長。此外,公司正在開發各種線上和線下分銷管道,以銷售其產品並增加其在市場上的佔有率。例如,2022 年 10 月,Roku 與智慧家庭產品公司 Wyze 合作增加了新的智慧家庭設備系列。該產品系列包括可視門鈴、保全攝影機、智慧照明和智慧插頭,將透過美國沃爾瑪獨家銷售。

- 此外,2023 年 1 月,總部位於美國Alterco Robotics 的公司 Shelly 在拉斯維加斯舉行的 2023 年消費性電子展上推出了多款智慧家庭自動化設備,其中包括 Shelly Plus Plug 的擴展版。該公司的這些智慧插頭可供商業使用,並使用藍牙連接和可配置的多色 LED指示器。因此,市場供應商努力在設計、功能、特性和連接性方面開發現代智慧插頭以滿足客戶需求,從而推動市場採用並為北美供應商創造機會。

智慧插頭產業概況

智慧插頭市場高度分散,由幾家主要企業組成。目前,只有少數幾家大公司在市場市場佔有率上佔據主導地位。許多公司對研發計劃進行大量投資,以開發創新、高品質的產品。報告中介紹的一些行業知名企業包括 Belkin International, Inc.、BroadLink Technology 和Panasonic Corporation。

TP-Link Technologies今年2月發布了亞馬遜EP25P4 Kassasmart Wi-Fi插件,可與Siri和Apple HomeKit整合。此外,透過技術創新,公司優先為WLAN市場的客戶、供應商和合作夥伴開發家庭和企業網路解決方案和服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 評估新冠肺炎疫情對市場的影響

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 智慧家庭採用率顯著成長

- 物聯網框架的進步

- 市場限制

- 關於智慧插頭和物聯網的安全問題

第6章 市場細分

- 科技

- Bluetooth

- Wi-Fi

- 應用

- 產業

- 商業

- 家

- 地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Belkin International Inc.

- Broadlink International

- Panasonic Holdings Corporation

- D-Link Corporation

- Ankuoo Electronics Inc.

- EDIMAX Technology Co. Ltd

- Vesync Co. Ltd(Etekcity Corporation)

- Xiaomi Inc.

- Sariana LLC(Satechi)

- Wipro Limited

- Revogi Innovation Co. Ltd

- Lenovo Group Limited

- Leviton Manufacturing Co. Inc.

- TP-Link Technologies Co. Ltd

- Shenzhen Tenda Technology Co. Ltd

第8章投資分析

第9章:市場的未來

The Smart Plug Market is expected to register a CAGR of 27.66% during the forecast period.

Market expansion was significantly impacted by the rapid adoption of contemporary technologies, including the Internet of Things (IoT), smart voice recognition, and others. The major driving factors of the market are the significant adoption of smart homes globally and the development of the IoT framework.

Key Highlights

- A rising Internet of Things (IoT) acceptance rate in developed and developing countries such as the United States, China, India, and so on has helped build the smart home industry. The potential of technologies to enable device communication has contributed to market demand. Even though there were supply chain inconsistencies, the pandemic and its effects highlighted significant improvements in internet connectivity and the need for adoption automation. Many customers made smart home appliance purchases during the lockdown.

- Smart home gadgets enable remote monitoring and control of home elements and are a booming sector with big manufacturers and mass adopters. Over the past two years, many technological developments have raised the demand for smart home appliances as automation enhances user comfort in smart homes. Further, conserving energy to protect the environment and reduce monitoring costs is critical. Smart heating and cooling systems enable consumers to conserve energy by monitoring and efficiently managing demand.

- A significant advancement in demand for smart home appliances, especially refrigerators, dishwashers, smart TVs, voice assistants, and microwave ovens, has pushed the demand for Wi-Fi-based products and technology advancements that enable Internet connectivity to power the market for smart home gadgets.

- Smart plugs are becoming increasingly common, raising security issues. Compromised smart plugs would compromise users' security and privacy. The effects of smart plugs being penetrated and under attackers' control could be severe if they are employed in commercial or industrial buildings for demand response. Smart plug security issues have garnered attention from academic and industrial groups.

Smart Plug Market Trends

Advances in IoT Framework is Expected to Drive the Market Growth

- According to Ericsson, almost 60% of cellular Internet of Things (IoT) connections are anticipated to be broadband connections by the next two years, with 4G connecting the vast majority. Throughput data rates for this segment will significantly rise as 5G New Radio (NR) is implemented in existing and new spectrums. Further, Massive IoT, NB-IoT, and Cat-M technologies, which offer wide-area use cases involving numerous low-complexity, low-cost devices with extended battery lives and low-to-medium throughput, are still being implemented globally.

- These benefits make it possible to employ Narrowband IoT in many different applications, from smart metering to smart cities and intelligent building infrastructure control to smart farming. In other words, anywhere objects need to be connected. Smart metering is one of the most prominent use cases, and smart plugs play a significant role in these applications. Electricity, water, and gas meter networking is an IoT field for narrowband technology. Consumers do not require much data to enable IoT functionality on a meter. Also, NB-IoT's robust coverage is ideal for transmitting signals from smart meters frequently installed in basements.

- Many companies in the market are investing in their product development to design smart plugs with these energy-monitoring features. In November 2022, Smarteefi invested capital in introducing a new product, the 16A WiFismart plug, to its line of smart switches. This model contains the world's first built-in clock system, allowing it to be independent of the internet clock cycle. It would give users unique features such as an assured schedule, a guaranteed countdown timer, and more accurate daily/real-time energy monitoring.

- Further, in October 2022, China-based MOKO Smart launched a smart plug for energy management applications in the smart home and energy metering industries to benefit customers and energy-solution providers. The "MK117NB Smart Plug" can remotely manage load switches, monitor energy use, and reduce power consumption. It has a measurement accuracy of 0.5% and includes a power and energy meter.

- With a smartphone app, users can monitor total energy consumption hourly, daily, monthly, and historically. The MK117NB Smart Plug can be used in many countries and supports many plug types. It makes it possible for common electrical devices to be IoT-enabled, giving users a greater understanding of their energy usage and the ability to translate real-time electricity consumption into precise billing information.

North America Leads in the Smart Plug Market

- The North American region has been an early adopter of smart technologies in building automation due to its various applications, including convenience in use and energy management, creating an opportunity for market vendors in the region. The market's growth is supported by two major developed economies in the region, including the United States and Canada. In addition, the United States is home to many international producers of smart home products, including Belkin International Inc.

- Many industries in the energy and power sector in the region are investing capital in acquiring smart home solution providers with smart plug product offerings, which shows the potential for the market's growth in North America. For instance, in December 2022, NRG Energy Inc.'s US production unit grew from a major power business to retail consumers by planning and investing USD 2.8 billion in Vivint Smart Home Inc., which provides a broad range of smart electronic products, including smart plugs.

- Market vendors in the region have been collaborating with IoT platform providers to accelerate the speed of their smart plug product launch, fueling the market's growth because, with inbuilt advanced features and compatibilities, these updated smart plugs can be utilized in various applications securely. For instance, in Canada, Ayla Networks, a company that provides Internet of Things (IoT) platforms that accelerate digital transformation for consumer brands, announced that its IoT firmware would power the line of smart home products from Canadian Tire called NOMA iQ comprising smart lighting, smart plugs, and smart air purifiers that users can connect to via an all-in-one app.

- Companies in the market are partnering to expand their smart home product offerings, including smart plugs. Established traditional electronic companies use the latest wi-fi-based technology through these partnerships and introduce new smart home product lines, fueling the market's growth. Additionally, the companies are developing various distribution channels for product sales, such as online and offline, to increase their market presence. For instance, in October 2022, Roku added a new line of smart home devices in collaboration with Wyze, a company in smart home products. The product line includes video doorbells, security cameras, smart lighting, and smart plugs and would be available exclusively through Walmart in the United States.

- In addition, in January 2023, Shelly, an Allterco Robotics US company, started several smart home automation gadgets at the 2023 Consumer Electronics Show in Las Vegas, including the extension of Shelly Plus Plugs. These smart plugs from the company would be commercialized and use Bluetooth connectivity and configurable multicolor LED indicators. This development of the latest smart plugs in terms of design, function, feature, and connectivity by the market vendor to match the customers' demand is fueling the market adoptions and creating an opportunity for the vendors in the North American region.

Smart Plug Industry Overview

The Smart Plug Market is highly fragmented and consists of several major players. Few of these major players currently dominate the market in terms of market share. Many organizations massively invest in research and developmental projects to develop innovative, high-quality products. Notable names in the industry profiled in the report are Belkin International, Inc., BroadLink Technology Co., Ltd., Panasonic Corporation, etc.

TP-Link Technologies Co. Ltd launched its EP25P4 Kassasmart Wi-Fi plug-in Amazon, which can be integrated with Siri and Apple HomeKit, in February this year. In addition, the company prioritizes developing home and business networking solutions and services for customers, providers, and partners in WLAN markets through its technological innovation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of The Impact of COVID-19 on the Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Substantial Growth in the Adoption of Smart Homes

- 5.1.2 Advances in IoT Framework

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to Smart Plugs and IoT

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Bluetooth

- 6.1.2 Wi-Fi

- 6.2 Application

- 6.2.1 Industrial Use

- 6.2.2 Commercial Use

- 6.2.3 Household Use

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Belkin International Inc.

- 7.1.2 Broadlink International

- 7.1.3 Panasonic Holdings Corporation

- 7.1.4 D-Link Corporation

- 7.1.5 Ankuoo Electronics Inc.

- 7.1.6 EDIMAX Technology Co. Ltd

- 7.1.7 Vesync Co. Ltd (Etekcity Corporation)

- 7.1.8 Xiaomi Inc.

- 7.1.9 Sariana LLC (Satechi)

- 7.1.10 Wipro Limited

- 7.1.11 Revogi Innovation Co. Ltd

- 7.1.12 Lenovo Group Limited

- 7.1.13 Leviton Manufacturing Co. Inc.

- 7.1.14 TP-Link Technologies Co. Ltd

- 7.1.15 Shenzhen Tenda Technology Co. Ltd