|

市場調查報告書

商品編碼

1689699

過氧乙酸-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Peracetic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

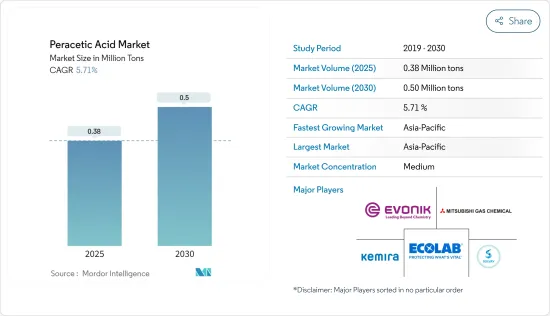

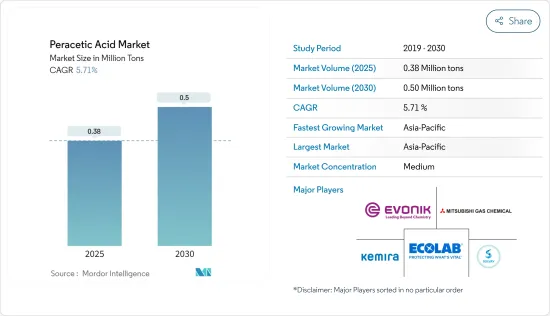

過氧乙酸市場規模預計在2025年為38萬噸,預計2030年達到50萬噸,預測期間(2025-2030年)的複合年成長率為5.71%。

COVID-19疫情對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制而關閉。供應鏈和運輸中斷進一步擾亂了市場。不過,2021年產業復甦,市場需求回歸。

關鍵亮點

- 短期內,水處理行業需求的增加以及各行業中消毒劑的使用增加是推動研究市場成長的一些因素。

- 然而,高成本和不利的健康影響預計會阻礙市場成長。

- 然而,過氧乙酸在無菌包裝中的使用日益增多預計將為市場提供機會。

- 亞太地區佔據全球市場主導地位,其中中國、印度和日本是最大的消費國。

過氧乙酸市場趨勢

市場主導的殺菌劑應用

- 過氧乙酸 (PAA) 用作消毒劑和清洗劑,例如在食品工業、水處理中以及在紙漿工業中防止生物膜形成。

- 為了保持衛生標準,使用過氧乙酸,因為它是一種廣譜除生物劑,可用於許多工業領域。過氧乙酸即使在低濃度和低溫下也能有效對抗所有類型的微生物,包括細菌、真菌、孢子和病毒。

- PAA能夠穿透細胞膜,迅速發揮其優異的抗菌作用。 PAA一旦進入細胞,就會不可逆地破壞酵素系統,導致微生物的毀滅。

- PAA 用於對食品和飲料產品進行消毒。例如,根據美國人口普查局的數據,2022年美國食品和飲料的年度零售額約為9,470億美元,較2021年成長7.65%。因此,由於食品和飲料銷售額的增加,預計過氧乙酸的需求也會增加。

- PAA 用於對設備、表面、罐、管道和寶特瓶進行消毒,保護內部材料免受生產鏈中微生物的侵蝕。它也用於紡織品和醫療設備的水處理和消毒。

- 過氧乙酸作為消毒劑的另一個重要用途是壓艙水。壓艙水用於控制船舶的縱傾、側傾、吃水、穩性或應力,每年有數十億噸壓艙水從船舶中排放。國際海事組織要求船舶只能依照一定的排放標準排放壓艙水。為了滿足該標準,可以在壓艙水使用過氧乙酸。

- 在動物保健行業,PAA 用於對錶面進行消毒,以預防牲畜疾病。使用機械噴霧器或清洗進行噴灑可以淨化系統並防止釩的生長。 PAA 主要用作食品、飲料和水處理行業的消毒劑。全球人口快速成長和都市化進程加快推動了對加工食品的需求。在已開發國家,超過70%的食品是加工食品。這些產品一般都裝在需要消毒的塑膠容器中。這導致食品和飲料行業對PAA等消毒劑的需求不斷成長。

- 此外,為了實現永續發展目標和保護環境,一些國家正在加強污水處理的規章制度。在北美,美國環保署(EPA)根據其《廢水排放指南》制定了廢水排放的國家標準。這些標準被納入國家污染物排放消除系統(NPDES)。

- 在歐盟 (EU),所有成員國都必須遵守關於都市廢水污水處理的理事會指令 91/271/EEC 中所包含的污水處理指令。不遵守這些規定的國家可能面臨法律訴訟和罰款。

- 因此,預計上述因素將在預測期內增加各行業對消毒劑的需求。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導過氧乙酸市場。由於製藥、食品飲料和化學工業的需求不斷增加,中國、印度和日本等國家對過氧乙酸的需求也增加。

- 在亞太地區,中國是GDP最大的經濟體。 2021年中國實際GDP成長8.4%,主要得益於疫情後消費支出的復甦。此外,根據國際貨幣基金組織(IMF)的預測,2022年GDP成長率為3.0%,2023年約為5.2%。

- 在食品和飲料行業,過氧乙酸被用作食品加工助劑,以增強抗菌性能,而不會給最終產品增加氣味、顏色或味道。它也用於對動物設施進行殺菌和消毒。

- 中國是最大的食品和飲料消費國之一,由於人口成長和對健康、美味包裝食品的需求增加,其食品加工行業持續擴張。該國受歡迎的食品包括烘焙產品、食品和飲料以及其他營養食品。例如,根據工業和資訊化部的資料,2023年第一季,全國飲料產量年增6%,達到4,435萬噸。

- 此外,中國輕工業聯合會的數據顯示,預計到 2022 年,年銷售額超過 280 萬美元的大型食品製造企業的收益累計超過 1.53 兆美元。與2021年相比,總收入與前一年同期比較增5.6%,顯示食品業成長強勁。

- 根據印度造紙工業協會(IPMA)統計,2021-22年印度紙和紙板出口激增約80%,達到創紀錄的1,396.3億印度盧比(約16.9217億美元)。此外,根據造紙和紙漿實驗室 (CPPRI) 的報告,印度約有 861 家造紙廠,其中 526 家正在運作,2020-21 年總裝置容量超過 2,500 萬噸。因此,預計預測期內該國對過氧乙酸的需求仍將保持在高位。

- 日本的食品加工產業生產各種各樣的食品,從傳統食品到加工食品,適合從嬰兒到老年人的每個人。由於食品和飲料消費量的增加,預計未來幾年該國的食品加工產業將會成長。該國食品和飲料行業受到包裝食品日益成長的需求的推動。

- 日本是繼美國和中國之後的世界第三大包裝食品市場。根據歐睿國際預測,到2025年,日本包裝食品市場零售額預計將達到2,045億美元,成長3.6%,即70億美元。這種成長歸因於所研究市場需求的不斷成長。

- 預計所有這些因素都將增加對過氧乙酸的需求,從而導致預測期內市場成長。

過氧乙酸產業概況

過氧乙酸市場本質上處於部分整合狀態。該市場的主要企業(不分先後順序)包括 Solvay、Evonik Industries AG、Ecolab、emira、三菱瓦斯化學公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 水處理產業的需求不斷成長

- 在各行各業中擴大用作消毒劑

- 限制因素

- 高成本和不良健康影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 殺菌劑

- 氧化劑

- 殺菌劑

- 其他

- 最終用戶產業

- 飲食

- 水處理

- 紙漿和造紙

- 醫療(包括藥品)

- 化學

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 墨西哥

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACURO ORGANICS LIMITED

- Aditya Birla Chemicals

- Airedale Chemical Company Limited

- Biosan

- Christeyns

- Diversey, Inc

- Ecolab

- Enviro Tech Chemical Services Inc.(arxada Ag)

- Evonik Industries AG

- Hydrite Chemical

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Solvay

- Stockmeier Group

第7章 市場機會與未來趨勢

- 在無菌包裝應用的使用日益增多

The Peracetic Acid Market size is estimated at 0.38 million tons in 2025, and is expected to reach 0.50 million tons by 2030, at a CAGR of 5.71% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, growing demand from the water treatment industry and increasing usage as a disinfectant across various industries are some of the factors driving the growth of the market studied.

- On the flip side, high costs and adverse effects on health are expected to hinder the growth of the market.

- However, the increase in peracetic acid use in aseptic packaging is expected to act as an opportunity for the market.

- The Asia-Pacific region dominated the market worldwide, with countries like China, India, and Japan being the biggest consumers.

Peracetic Acid Market Trends

Disinfectant Application to Dominate the Market

- Peracetic acid (PAA) is used as a disinfectant and cleanser in the food industry, in water treatment, and to prevent biofilm formation in the pulp industries.

- To maintain hygiene standards, peracetic acid is used as it is a broad-spectrum biocide and can be used in many industrial fields. It is effective against all types of microorganisms like bacteria, fungi, spores, and viruses, even at low concentrations and temperatures.

- Its capability to penetrate through the cell membrane helps it impart excellent and rapid antimicrobial effects. When PAA enters the cell, it irreversibly disrupts the enzyme system, which leads to microorganism destruction.

- PAA is used to disinfect food and beverage products. For instance, according to the US Census Bureau, in 2022, annual sales of retail food and beverage stores in the United States amounted to approximately USD 947 billion, which showed an increase of 7.65% compared with 2021. Therefore, an increase in the sales of food and beverage products is expected to create an upside demand for peracetic acid.

- PAA is applied to disinfect equipment, surfaces, tanks, pipes, and plastic bottles to protect the inside material from microorganism attacks along the production chain. It is also used to disinfect water treatment in textiles and medical devices.

- Another important use of peracetic acid as a disinfectant is in ballast water treatment. Ballast water is used to control ship trim, list, draught, stability, or stresses, and billions of tons of ballast water are discharged by ships every year. The International Maritime Organization requires ships to discharge ballast water only within specific discharge standards. To meet these standards, peracetic acid can be used in ballast water.

- In the animal health industry, PAA is used to disinfect surfaces to avoid livestock diseases. It is sprayed by mechanical sprayers or pressure washers to sanitize the system and eliminate the growth of baPAA is majorly used as a disinfectant in the food and beverage and water treatment industry. A rapidly growing population and greater urbanization globally have boosted processed food demand. More than 70% of food in developed countries is processed food. These products are generally packed in plastic containers which need disinfection. This is likely to boost disinfectants like PAA demand from the food and beverage industry.

- Further, several countries have made their wastewater treatment rules and regulations more stringent to meet the sustainable development goal and protect the environment. In North America, under the effluent guidelines, the Environmental Protection Agency (EPA) develops national standards for wastewater discharge. These standards are incorporated into the National Pollutant Discharge Elimination System (NPDES).

- In the European Union, it is mandatory for all member countries to follow the wastewater treatment directive mentioned in The Council Directive 91/271/EEC for urban wastewater treatment. If countries fail to comply with these regulations, they can receive court action and fines.

- Hence, the aforementioned factors are likely to increase disinfectant demand from various industries during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for peracetic acid during the forecast period. In countries like China, India, and Japan, the demand for peracetic acid increased due to the increasing demand from the pharmaceutical, food, beverage, and chemical industries.

- In the Asia-Pacific region, China is the largest economy in terms of GDP. China's real GDP grew by 8.4% in 2021, primarily driven by consumer spending rebound post-pandemic. Furthermore, in 2022, as per the International Monetary Fund (IMF), the country's GDP is accounted to grow by 3.0%, whereas, in 2023, the IMF has forecasted that the GDP will grow by about 5.2%.

- In the food and beverage industry, peracetic acid is used as a food processing aid for antimicrobial intervention without adding odors, colors, or flavors to the end product. It is also used to sanitize and disinfect animal facilities.

- China is one of the largest consumers of food and beverages, with the food processing industry continuing to expand in view of the growing population and rising demand for healthy and tasty packaged foods. Some of the popular food products in the country include bakery products, beverages, and other nutritious food items, among others. For instance, according to the data from the Ministry of Industry and Information Technology, the country witnessed its beverage production increase 6 percent year-on-year, reaching 44.35 million tons during Q1 2023.

- Furthermore, according to the China National Light Industry Council, major food manufacturing companies with an annual turnover of over USD 2.8 million reported revenues of over USD 1.53 trillion in 2022. Compared to 2021, the total revenue registered a year-on-year growth of 5.6 percent, indicating strong growth in the food industry.

- According to Indian Paper Manufacturers Association (IPMA), exports of paper and paperboard from India jumped to around 80% in 2021-22, touching a record value of INR 13,963 crore (~USD 1,692.17 million). In addition, as per the report of the Pulp & Paper Research Institute (CPPRI), there are about 861 paper mills in India, out of which 526 are operational, with a total installed capacity of over 25 million tons in 2020-21. Thus, the demand for peracetic acid is expected to be high in the country during the forecast period.

- The Japanese food processing industry produces a wide range of foods, from traditional to processed food, for infants and elderly people. The food processing industry in the country is estimated to grow in the coming years, owing to the higher consumption of food and beverage products. The food and beverage industry in the country is driven by the rising demand for packaged food.

- Japan is the third-largest package food market in the world after the United States and China. According to Euromonitor, it is estimated that by 2025, the retail sales in the packaged food market in Japan are expected to reach USD 204.5 billion, a growth of 3.6% or USD 7 billion. This growth is attributed to the increase in the demand for the market studied.

- All such factors are likely to increase the demand for peracetic acid, which as a result, leads to its market growth over the forecasting period.

Peracetic Acid Industry Overview

The peracetic acid market is partially consolidated in nature. The major players in this market (not in any particular order) include Solvay, Evonik Industries AG, Ecolab, Kemira, and Mitsubisho Gas Chemical Company Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand From Water Treatment Industry

- 4.1.2 Increasing Usage as A Disinfectant Across Various Industries

- 4.2 Restraints

- 4.2.1 High Cost and Adverse Effect on Health

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Disinfectant

- 5.1.2 Oxidizer

- 5.1.3 Sterilant

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Water Treatment

- 5.2.3 Pulp and Paper

- 5.2.4 Healthcare (incl. Pharmaceutical)

- 5.2.5 Chemical

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACURO ORGANICS LIMITED

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Airedale Chemical Company Limited

- 6.4.4 Biosan

- 6.4.5 Christeyns

- 6.4.6 Diversey, Inc

- 6.4.7 Ecolab

- 6.4.8 Enviro Tech Chemical Services Inc. (arxada Ag)

- 6.4.9 Evonik Industries AG

- 6.4.10 Hydrite Chemical

- 6.4.11 Kemira

- 6.4.12 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.13 Solvay

- 6.4.14 Stockmeier Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Usage In Aseptic Packaging Applications