|

市場調查報告書

商品編碼

1689693

企業加密金鑰管理 (EKM):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Enterprise Key Management (EKM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

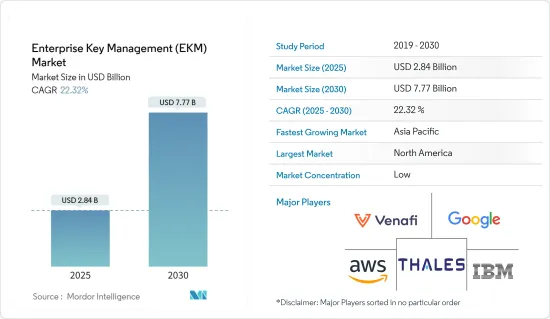

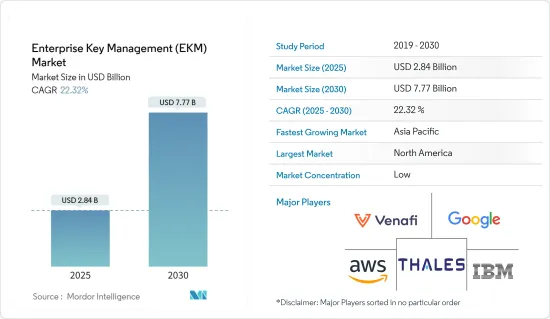

企業加密金鑰管理 (EKM) 市場規模預計在 2025 年為 28.4 億美元,預計到 2030 年將達到 77.7 億美元,預測期內(2025-2030 年)的複合年成長率為 22.32%。

主要亮點

- 企業加密金鑰管理 (EKM) 包括組織用於保護、管理和控制用於加密資料的加密金鑰的方法和技術。隨著加密在企業中變得越來越普遍,有效管理加密金鑰變得越來越重要。企業加密金鑰管理 (EKM) 系統主要解決與管理靜態資料加密金鑰相關的挑戰。這些系統可應用於銀行、金融服務和保險業、醫療保健、政府和國防、資訊科技和通訊、零售業等領域。

- 資料外洩和身分盜竊的增加導致各行業採用先進的企業安全解決方案。企業轉向數位化環境提供數位化服務,以及需要保護的敏感資料量呈指數級成長,進一步推動了市場的成長。

- 在快速數位轉型的推動下,企業需要透過擴充性來實現成本效益和效益。技術進步可以幫助實現這些目標。然而,這種數位化轉變也增加了資料外洩和網路威脅的脆弱性,從而導致巨大的財務損失。

- 目前市場缺乏熟練的專業人才,尤其是資料分析的人才。隨著資料量激增且公司難以提取有價值的見解,這種短缺尤其令人擔憂。中東地區的網路安全人員數量較少,因此很容易成為資料外洩和網路犯罪的目標。該地區的許多專家缺乏應對此類威脅的經驗,這就是為什麼全球公司都在大力投資網路安全培訓以提高員工意識。

企業加密金鑰管理 (EKM) 市場趨勢

雲端運算業務成長強勁

- 企業加密金鑰管理 (EKM) 涉及加密金鑰的安全管理,這些金鑰對於跨各種系統和應用程式加密資料至關重要。選擇雲端基礎的加密金鑰管理解決方案可帶來可擴展性、可存取性和成本效益等好處。

- 雲端基礎的加密金鑰管理系統具有高度適應性,讓企業隨著資料量波動輕鬆擴大或縮小規模。例如,Amazon Web Services (AWS) 加密金鑰管理服務 (KMS) 允許公司為其資料建立和管理加密金鑰。

- 此外,物聯網和雲端技術的廣泛應用正在導致資料生成的爆炸性成長。為了應對確保這些資料安全的挑戰,企業加密金鑰管理 (EKM) 解決方案越來越受到關注。這些解決方案使企業能夠對靜態和傳輸資料進行加密,確保只有授權使用者才能資料。

- 物聯網設備數量呈指數級成長,產生大量資料,需要強大的加密和加密金鑰管理解決方案。這些解決方案可在設備、閘道器和雲端基礎的應用程式之間傳輸數據時保護資料,從而推動市場成長。

- 聯網設備的興起導致了大量資料的產生,而這些資料通常儲存在雲端。根據愛立信的《行動報告》(2023 年 11 月),預計到 2023 年物聯網連線數將達到 157 億,到 2029 年將達到 389 億。

- 在現今的軟體產業,員工使用各種設備,公司運行不同作業系統的伺服器,網路威脅的風險很大。再加上雲端應用程式的日益普及,這推動了企業投資雲端安全解決方案。

亞太地區將經歷強勁成長

- 亞太地區企業加密金鑰管理 (EKM) 解決方案的成長主要受到快速數位轉型、雲端服務採用率不斷提高以及網路安全威脅不斷上升的推動。隨著網路威脅日益頻繁,亞太地區的企業正在優先考慮網路安全措施來保護敏感資料和通訊。

- 該地區的加密使用量顯著增加,主要集中在公共部門、零售、科技和軟體公司。物聯網在各個終端用戶垂直領域的成長趨勢,再加上亞太地區物聯網和互聯設備的成長趨勢,是推動加密擴展的關鍵因素,進一步推動企業加密金鑰管理(EKM)市場的成長。

- 從最終用戶來看,亞太地區的 IT 和通訊產業可能會顯著成長。這主要是由於技術進步、資料量不斷增加以及雲端基礎的解決方案的採用。亞太地區專注於IT、製造和工業領域的創新,為領先的管理解決方案提供者創造機會。

- 「數位印度計畫」等宣傳活動正在敦促各國政府採取強力的法規、法律體制和法律來打擊網路犯罪。此外,公有雲端處理的日益普及,使得越來越多的企業將業務系統遷移到雲端。資料安全、租戶隔離、存取控制等問題正成為這些企業日益關注的焦點。

企業加密金鑰管理 (EKM) 市場概覽

企業加密金鑰管理(EKM)市場處於半固體狀態。然而,AWS、亞馬遜網路服務公司、泰雷茲集團(Gemalto NV)、IBM 公司、Venafi 和Google公司(Alphabet)等參與者正在主導市場,這些參與者正在利用策略合作計劃來增強其服務產品、市場佔有率和盈利。

- 2023 年 11 月,英特爾公司支持的多重雲端安全公司 Fortanix Inc. 宣布推出 Key Insight,這是其資料安全管理器平台的一項新功能,可以發現、評估和補救混合多重雲端環境中的風險和合規性差距。該解決方案提供所有加密金鑰的統一洞察和控制,以保護關鍵資訊服務。

- 2023 年 4 月,WinMagic 與政府 IT解決方案供應商Carahsoft Technology Corp. 建立策略夥伴關係。根據該協議,Karasoft 將成為 WinMagic 政府主聚合器,透過與 Karasoft 經銷商合作夥伴 OMNIA Partners 和國家合作採購聯盟 (NCPA) 達成的協議,向政府機構提供其加密和身分驗證解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 最大限度地提高營運效率和安全性,同時最佳化安全性的整體擁有成本

- 精選資料遺失和合規性問題

- 由於採用物聯網和雲端技術,資料大量增加

- 市場限制

- 缺乏意識和熟練勞動力

- COVID-19 市場影響評估

第6章 市場細分

- 依部署類型

- 雲

- 本地

- 按公司規模

- 中小型企業

- 大型企業

- 按應用

- 磁碟加密

- 文件和資料夾加密

- 資料庫加密

- 通訊加密

- 雲端加密

- 按最終用戶產業

- BFSI

- 衛生保健

- 政府和國防

- 資訊科技和電訊

- 零售

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services Inc.

- Venafi

- Thales Group(Gemalto NV)

- Google Inc.(Alphabet)

- IBM Corporation

- Oracle Corporation

- Hewlett Packard Enterprise Company

- Quantum Corporation

- Winmagic Inc.

- Microsoft Corporation

- Dell Technologies Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Enterprise Key Management Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 7.77 billion by 2030, at a CAGR of 22.32% during the forecast period (2025-2030).

Key Highlights

- Enterprise key management encompasses the practices and technologies employed by organizations to secure, manage, and control cryptographic keys used for data encryption. As encryption becomes more prevalent in enterprises, the significance of effectively managing these cryptographic key materials amplifies. Enterprise key management systems primarily address the challenges associated with managing cryptographic keys for data at rest. These systems find application across various sectors, including BFSI, healthcare, government and defense, IT and telecom, and retail.

- With the rise in data breaches and the theft of private information, multiple sectors are embracing advanced corporate security solutions. The market's growth is further propelled by organizations transitioning to digital environments to offer digital services and the escalating volume of sensitive data that necessitates protection.

- Enterprises driven by rapid digital transformation seek cost-efficiency and effectiveness through scalability. Technological advancements aid in achieving these goals. However, this digital shift also heightens their vulnerability to data breaches and cyber threats, leading to substantial financial losses.

- The current market grapples with a dearth of skilled professionals, particularly in data analysis. This shortage is especially concerning as data volumes surge, leaving companies struggling to extract valuable insights. This challenge is further compounded in the Middle East, where a smaller cybersecurity workforce makes the region a prime target for data breaches and cybercrimes. Many professionals in this region lack the experience to handle such threats, prompting global companies to invest heavily in cybersecurity training to bolster employee awareness.

Enterprise Key Management (EKM) Market Trends

Cloud Segment to Witness Significant Growth

- Enterprise key management entails the secure administration of cryptographic keys, which are pivotal in data encryption across diverse systems and applications. Opting for cloud-based key management solutions offers advantages like scalability, accessibility, and cost-effectiveness.

- Cloud-based key management systems are highly adaptable, allowing organizations to scale up and down with ease in response to data volume fluctuations. For example, Amazon Web Services (AWS) Key Management Service (KMS) empowers enterprises to create and oversee encryption keys for their data.

- Furthermore, the proliferation of IoT and cloud technologies has led to a surge in data generation. As organizations grapple with the challenge of securing this data, enterprise key management solutions are gaining traction. These solutions enable organizations to encrypt data both at rest and in transit, ensuring only authorized users can access it.

- The exponential growth of IoT devices, which generate copious amounts of data, necessitates robust encryption and key management solutions. These solutions safeguard data as it moves between devices, gateways, and cloud-based applications, driving the market's growth.

- The escalating number of connected devices is fueling a data deluge, often stored in the cloud. According to the Ericsson Mobility Report (November 2023), IoT connections were projected to reach 15.7 billion by 2023 and a staggering 38.9 billion by 2029.

- In today's software industry, where employees use diverse devices and companies operate servers on various operating systems, the risk of cyber threats looms large. This, coupled with the rising adoption of cloud applications, is prompting organizations to invest in cloud security solutions.

Asia Pacific to Register Major Growth

- The growth of enterprise key management solutions in Asia-Pacific is primarily driven by rapid digital transformation, increasing adoption of cloud services, and the rise in cybersecurity threats. As the frequency of cyber threats increases, organizations in the Asia-Pacific region prioritize cybersecurity measures to protect their sensitive data and communications.

- The region is witnessing a substantial increase in encryption usage, mainly in the public sector, retail, technology, and software organizations. The rising trend of the Internet of Things among various end-user verticals, coupled with the trend of an increasing number of IoT and connected devices within the Asia-Pacific region, is a crucial factor facilitating the expansion of encryption, further helping the enterprise key management market to grow.

- By end-user verticals, the IT and telecom sector is likely to grow significantly in the Asia-Pacific region. This is mainly due to rising technological advancements, increasing data quantity, and the implementation of cloud-based solutions. Asia-Pacific's focus on innovation in IT, manufacturing, and industrial sectors creates opportunities for key management solution providers.

- Campaigns like the "Digital India Initiative" are driving the government to adopt robust regulations, legal frameworks, and laws to fight cybercrime. Additionally, the increasing popularity of public cloud computing is causing more enterprises to reallocate their business systems to the cloud. Issues concerning data security, tenant isolation, access control, etc., have gradually become a focal point for these enterprises.

Enterprise Key Management (EKM) Market Overview

The enterprise key management market is semi-consolidated. However, it is dominated by players, including AWS, Amazon Web Services, Inc., Thales Group (Gemalto NV), IBM Corporation, Venafi, and Google Inc. (Alphabet), which are leveraging strategic collaborative initiatives to enhance their offerings, market share, and profitability.

- In November 2023, Intel Corp.-backed multi-cloud security firm Fortanix Inc. launched Key Insight, a new capability in its Data Security Manager platform that allows enterprises to discover, assess, and remediate risk and compliance gaps across hybrid multi-cloud environments. The solution offers consolidated insights and control of all cryptographic keys to protect critical data services.

- In April 2023, WinMagic signed a strategic partnership with Carahsoft Technology Corp., the Government IT Solutions Provider. As per the terms of the agreement, Carahsoft will act as WinMagic's Master Government Aggregator, enabling the Public Sector to access the company's encryption and authentication solutions via contracts with OMNIA Partners and National Cooperative Purchasing Alliance (NCPA), Carahsoft's reseller partners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Optimizing Overall Ownership Cost for Security While Maximizing Operational Efficiency and Security

- 5.1.2 Loss of High Profile Data and Compliance Issues

- 5.1.3 Massive Growth of Data Due to the Adoption of IoT and Cloud Technologies

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and Skilled Workforce

- 5.3 Assessment of COVID-19 Impact on the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 Cloud

- 6.1.2 On-Premises

- 6.2 By Size of Enterprise

- 6.2.1 Small- and Medium-sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Application

- 6.3.1 Disk Encryption

- 6.3.2 File and Folder Encryption

- 6.3.3 Database Encryption

- 6.3.4 Communication Encryption

- 6.3.5 Cloud Encryption

- 6.4 By End-user Verticals

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Government and Defense

- 6.4.4 IT and Telecom

- 6.4.5 Retail

- 6.4.6 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 Venafi

- 7.1.3 Thales Group (Gemalto NV)

- 7.1.4 Google Inc. (Alphabet)

- 7.1.5 IBM Corporation

- 7.1.6 Oracle Corporation

- 7.1.7 Hewlett Packard Enterprise Company

- 7.1.8 Quantum Corporation

- 7.1.9 Winmagic Inc.

- 7.1.10 Microsoft Corporation

- 7.1.11 Dell Technologies Inc.