|

市場調查報告書

商品編碼

1687992

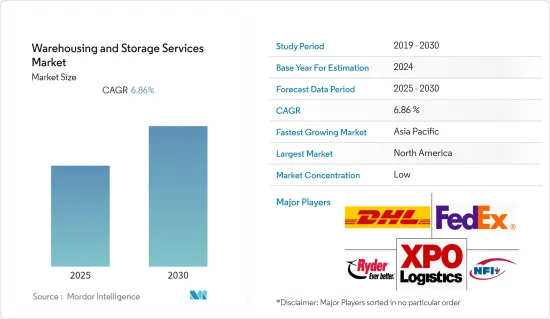

倉儲服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Warehousing and Storage Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計倉儲和儲存服務市場在預測期內的複合年成長率將達到 6.86%。

工業部門的成長、對製成品、加工和冷凍食品的需求不斷增加以及電子商務產業的擴張是推動倉儲和儲存服務需求的一些主要因素。

關鍵亮點

- 倉儲和存儲服務描述的是其他企業或組織的財產的存儲,例如零件、設備、車輛、成品和生鮮產品。全通路模式需求的不斷成長預計將推動市場的發展。儘管消費者已經接受了網上購物的趨勢,但實體門市仍然佔據著相當大的市場佔有率,並且正在擴大倉儲市場,特別是在家具等大宗商品領域。

- 隨著供應鏈重組以滿足比以往任何時候都更快的需求,倉庫也擴大整合物流,而物流服務在這過程中發揮關鍵作用。此外,隨著全球趨勢進一步擴大,全球營運的行業的很大一部分庫存經常從海外交付到倉庫,透過供應鏈運輸成品,這也推動了對倉儲服務的需求。

- 需求的成長和儲存新型產品的要求對倉儲服務供應商的複雜性產生了重大影響,他們現在開始尋找可以幫助降低複雜性並為他們提供更好地管理設施的工具的創新技術。例如,倉儲系統就是這樣一種解決方案,它提供了公司整個庫存和供應鏈履約業務的可視性,從配送中心到商店貨架。

- 此外,倉儲服務供應商還專注於最佳化食材、處理和揀選流程,以進一步縮短交貨時間,同時確保交貨品質。這些趨勢正在推動新倉庫建設和管理技術的發展。此外,為了與全球參與企業競爭,許多供應商在其倉儲業務中採用了 GPS、RFID、VoIP 設備、數位語音和影像技術等新技術。

- 然而,倉儲服務提供者面臨的主要挑戰之一是建立倉庫和引進先進技術所需的高額投資。此外,中小企業缺乏意識和全球通用標準也對市場成長構成挑戰。

- 受新冠疫情影響,許多倉庫比以往任何時候都更加運作,主要經營食品、藥品和日用品。亞馬遜、Aldi、Asda 和 Lidl 均表示需要擴大產能並僱用更多倉庫員工。雖然某些行業,特別是工業和製造業的需求減少,尤其是在初始階段,但預計未來幾年市場將逐步復甦。

冷藏冷凍倉庫市場趨勢

冷藏倉庫和倉儲產業強勁成長

- 冷藏倉庫和儲存設施處理需要在冷藏控制室儲存的產品。它也是低溫儲存和保存易腐爛產品的地方。大多數冷藏庫或冷藏倉庫的設計都具有能夠將物品保存在最佳條件下的特性。冷藏和倉儲行業的機構提供回火、冷凍和氣調儲藏等服務。

- 冷藏倉儲和儲存市場呈現正面成長趨勢,主要集中在製藥和食品飲料領域。護理品質委員會建議將胰島素、抗生素液體、注射、眼藥水和一些藥膏儲存在 20°C 至 80°C 之間,以保持其有效性。根據美國人口普查局的數據,2021 年有 1.1745 億美國使用眼藥水或洗眼液。預計到 2023 年這一數字將上升到 1.1849 億。液體藥物需求的成長,尤其是在大流行之後,預計將對市場成長產生積極影響。

- 在運輸和儲存對溫度敏感的產品時,冷藏保管是供應鏈管理 (SCM) 的重要組成部分。此外,北美自由貿易協定(北美自由貿易組織(NAFTA) )等雙邊自由貿易協定正在創造新的機會,允許美國供應商擴大生鮮食品貿易,同時最大限度地降低進口關稅。此類貿易協定有利於市場成長。

- 考慮到對冷藏的需求不斷成長,市場上的供應商不斷致力於擴大其足跡。例如,根據國際冷藏倉庫協會(IARW)的統計,Lineage 物流是北美最大的冷藏物流供應商,擁有42,526,060立方公尺的控溫空間。

預計北美將佔很大佔有率

- 有幾個因素推動著北美倉儲物流市場的發展。隨著經銷商和零售商對儲存原料和成品的物流需求不斷增加,製造商擴大將倉儲服務外包,以專注於擴大生產和業務。此外,業務效率的提高和成本的節約正在促使托運人將物流業務委託給倉儲服務供應商。

- 亞馬遜和沃爾瑪等零售和電子商務巨頭的存在極大地促進了該地區對倉儲和儲存服務的需求。據沃爾瑪稱,截至 2022 年,該公司使用 31 個純電子商務履約中心和 4,700 家位於 90%美國人口 10 英里範圍內的商店來配送線上訂單。

- 根據對美國亞馬遜賣家的調查,賣家在上游倉儲配送業務面臨的三大痛點為收費系統複雜、倉儲成本高、倉儲容量不足。為了應對這些挑戰,供應商越來越注重製定新的商務策略來吸引更多的客戶。例如,亞馬遜於 2022 年 9 月宣布了一項新服務,該服務將允許賣家使用新建的專用設施進行大量庫存儲存和自動配送。

- 由於製造業、零售業和製藥業的顯著成長,美國市場顯示出潛在的成長。根據美國商務部的數據,到 2021 年,美國倉儲業的銷售額將增加至 5,049 萬美元。隨著供應商繼續專注於擴大其設施,預計這一趨勢將會成長。

- 此外,北美是快速採用新技術的地區,因此預計新倉儲和儲存技術的採用率將保持在高位。此外,所需的基礎設施、不斷增強的意識和熟練勞動力的可用性也是支持這一趨勢的其他重要因素。

倉儲服務業概況

倉儲和儲存服務市場競爭激烈,主要是因為存在多個參與企業。由於進入門檻相對較低,預計競爭將會加劇。長期夥伴關係、合併、收購以及對倉庫軟體的大量投資是公司在日益激烈的競爭中保持生存所採用的主要成長策略。市場的主要企業包括 DHL International Gmbh、XPO Logistics Inc. 和 FedEx Corp。

- 2022 年 9 月 - 領先的合約物流供應商 GXO Logistics Inc. 與拜耳合作開設了新的倉庫設施。 GXO 將在內布拉斯加州科爾尼開設一個佔地 350,000 平方英尺的新工廠,並將透過其共用空間物流網路 GXO Direct 為拜耳作物科學部門管理倉庫支持,包括所有入站和出站業務。

- 2022 年 5 月—溫控物流中心開發商和營運商 Vertical Cold Storage 從 US Cold Storage 手中收購了位於佛羅裡達州、內布拉斯加州和北卡羅來納州的三個公共冷藏倉庫。該公司進行這些收購是為了支持其不斷擴大的蛋白質業務,其中包括家禽、肉類、家禽和魚貝類。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 全通路分銷日益普及

- 電子商務產業的成長

- 市場限制

- 投資和維護成本高

第6章市場區隔

- 按類型

- 普通倉庫和倉儲

- 冷藏倉庫

- 農產品倉儲

- 擁有者

- 個人倉庫

- 公共倉庫

- 保稅倉庫

- 按最終用戶產業

- 製造業

- 消費品

- 飲食

- 零售

- 醫療保健

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- DHL International GmbH

- XPO Logistics Inc.

- Ryder System Inc.

- NFI Industries Inc.

- AmeriCold Logistics LLC

- FedEx Corp

- Lineage Logistics Holding LLC

- NF Global Logistics Ltd

- APM Terminals BV

- DSV Panalpina AS

- Kane Is Able Inc.

- MSC-Mediterranean Shipping Agency AG

第8章投資分析

第9章:未來市場展望

The Warehousing and Storage Services Market is expected to register a CAGR of 6.86% during the forecast period.

The growth of the industrial sector, increasing demand for manufactured products, processed and frozen food products, and the expansion of the e-commerce industry are among the significant factors driving the demand for warehousing and storage services.

Key Highlights

- Warehousing and storage services provide storage for another company or organization's property, including parts, equipment, vehicles, products, and perishable goods. The increasing demand for an omnichannel model is expected to drive the market. Although customers embrace the online buying trend, offline stores still hold a significant market share, especially in the big-ticket products segment, such as furniture, which expands the warehouse and storage market.

- With supply chains being reconfigured to meet demand faster than ever, warehouses are increasingly integrating logistics, as logistics services play a crucial role in this process. Additionally, with the globalization trend further expanding its scope, a significant portion of the inventory of industries that operate globally is delivered frequently from abroad to a warehouse to transfer finished goods through the supply chain, which in turn is also driving the demand for warehouse and storage services.

- The growth in demand and requirement to store new product types have significantly impacted the complexity of the warehouse service providers, who now have started to look for innovative technologies that can help them reduce the complexity and provide them with tools to manage the facility better. For instance, Warehouse Management System is one such solution that offers visibility into a business' entire inventory and works supply chain fulfillment operations from the distribution center to the store shelf.

- Furthermore, warehousing/storage service providers are also focusing on optimizing their batching, handling, and picking processes to enhance delivery times further while ensuring the quality of delivery. Such trends facilitate the development of new warehouse construction and management techniques. Additionally, to compete with global players, many vendors are adopting emerging technologies, such as GPS, RFID, VoIP devices, digital voice, and imaging technology for warehouse operations.

- However, the higher investment required to set up warehouses and adopt advanced technologies is among the significant challenges warehouse/storage service providers face. Furthermore, a lack of awareness among SMEs and common global standards also challenges the market's growth.

- COVID-19 resulted in many warehouses running busier than ever, mainly catering to food products, pharmaceuticals, and essential household goods. Amazon, Aldi, Asda, and Lidl have all reported a need to increase their capacities and hire an additional warehouse workforce. Although in some sectors, especially in the industrial and manufacturing domain, the demand declined, especially during the initial phase, the market is expected to recover gradually in the coming years.

Warehousing and Storage Market Trends

The Refrigerated Warehousing and Storage Segment to Grow Significantly

- The refrigerated warehousing and storage facilities deal with products that require refrigerated and controlled rooms for storage. It also refers to where perishable products are stored or kept at low temperatures. Most of these cold storage rooms or refrigerated warehouses are designed with properties that can keep the items within optimum conditions. Establishments in the refrigerated warehousing and storage industry provide services, such as tempering, blast freezing, and modified atmosphere storage services.

- Refrigerated warehousing and storage are showing positive trends toward market growth, mainly in the pharma and food and beverage sectors. The Care Quality Commission recommends that insulins, antibiotic liquids, injections, eye drops, and some creams must be stored between 20C and 80C to maintain the effectiveness of the medicines. According to the U.S. Census Bureau, 117.45 million Americans used eye drops and eyewash in 2021. This figure is projected to increase to 118 .49 million in 2023. The increasing demand for liquid pharmaceutical products, especially after the pandemic, is expected to impact the market's growth positively.

- Refrigerated storage is integral to Supply Chain Management (SCM) when transporting and storing temperature-sensitive products. New opportunities are also being created by bilateral free trade agreements, such as the North America Free Trade Agreement (NAFTA), which allows vendors in the United States to increase the trading of perishable food products with minimal import duties. Such trade agreements favor the market's growth.

- Considering the growing demand for cold storage warehouses, the vendors operating in the market continuously focus on expanding their footprint. For instance, according to the International Association of Refrigerated Warehouses (IARW), Lineage Logistics was the most extensive refrigerated warehousing and logistics provider in the North American region, with 42,526.06 thousand cubic meters of temperature-controlled space.

North America is Expected to Hold a Major Share

- Several factors also drive the warehousing and storage market in the North American region. An increase in logistics needs for storing raw materials and finished goods for distributors and retailers has been growing as manufacturing companies increasingly outsource warehousing services to focus on productional and operational expansions. Additionally, enhanced operational efficiency and cost savings encourage shippers to outsource the logistics portion of their activities to warehouse service providers.

- The presence of retail and e-commerce giants, such as Amazon and Walmart contributes significantly to the region's demand for warehouse and storage services. According to Walmart, as of 2022, the company uses 31 dedicated e-commerce fulfillment centers and 4,700 stores within 10 miles of 90% of the U.S. population to fulfill online orders.

- According to a survey of U.S. Amazon sellers, the three most significant pain points for sellers in upstream warehousing and distribution operations were complicated fee structures, high prices for storage, and insufficient storage capacity. To address these challenges, vendors are increasingly focusing on developing new business strategies to attract more customers. For instance, in September 2022, Amazon announced new services to enable sellers to use new, purpose-built facilities for bulk inventory storage and automated distribution.

- With significant growth in the manufacturing, retail, and pharma units, the market shows potential growth in the United States. According to the U.S. Department of Commerce, the U.S. warehousing and storage industry's revenue increased to USD 50.49 million in 2021. With vendors continuously focusing on expanding their facilities, such trends are only expected to grow further.

- Furthermore, the adoption rate of new warehouse and storage technologies is expected to remain high in the North American region as the region is among the early adopters of new technologies. Additionally, the required infrastructure heightened awareness, and availability of a skilled workforce are other significant factors supporting such trends.

Warehousing and Storage Industry Overview

The warehousing and storage services market is competitive, mainly because of the presence of several players. The competition is expected to intensify because of the relatively low entry barriers. Long-term partnerships, mergers, acquisitions, and high investments in warehouse management software are the prime growth strategies adopted by companies to sustain the growing competition. Some major players operating in the market include DHL International Gmbh, XPO Logistics Inc., and FedEx Corp, among others.

- September 2022 - GXO Logistics Inc., a leading pure-play contract logistics provider, opened a new warehouse facility with Bayer. GXO will manage warehouse support, including all shipping and receiving activities, for Bayer's Crop Science division through its shared-space distribution network GXO Direct at the new 350,000-square-foot facility in Kearney, Nebraska.

- May 2022 - Vertical Cold Storage, a developer, and operator of temperature-controlled distribution centers acquired three public refrigerated warehouses in Florida, Nebraska, and North Carolina from US Cold Storage. The company made these acquisitions to support its expanding protein business, including poultry, meat, poultry, and seafood.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Popularity of Omnichannel Distribution

- 5.1.2 Growth in the E-commerce Industry

- 5.2 Market Restraints

- 5.2.1 High Investment and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 General Warehousing and Storage

- 6.1.2 Refrigerated Warehousing and Storage

- 6.1.3 Farm Product Warehousing and Storage

- 6.2 By Ownership

- 6.2.1 Private Warehouses

- 6.2.2 Public Warehouses

- 6.2.3 Bonded Warehouses

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Consumer Goods

- 6.3.3 Food and Beverage

- 6.3.4 Retail

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DHL International GmbH

- 7.1.2 XPO Logistics Inc.

- 7.1.3 Ryder System Inc.

- 7.1.4 NFI Industries Inc.

- 7.1.5 AmeriCold Logistics LLC

- 7.1.6 FedEx Corp

- 7.1.7 Lineage Logistics Holding LLC

- 7.1.8 NF Global Logistics Ltd

- 7.1.9 APM Terminals BV

- 7.1.10 DSV Panalpina AS

- 7.1.11 Kane Is Able Inc.

- 7.1.12 MSC - Mediterranean Shipping Agency AG