|

市場調查報告書

商品編碼

1687990

劑量計:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

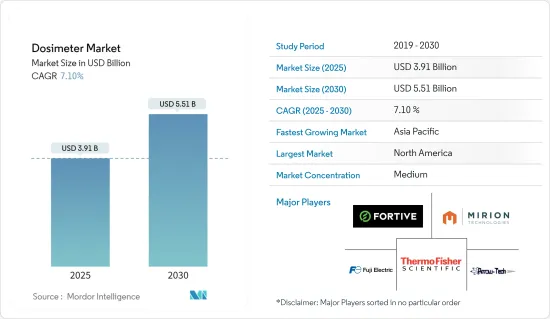

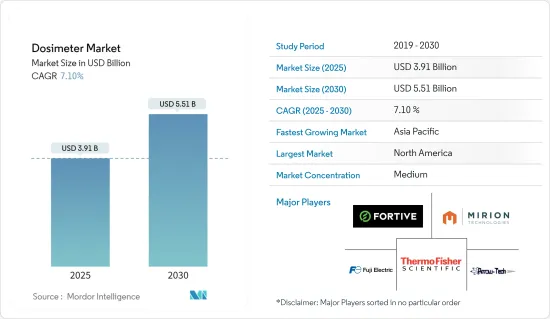

劑量計市場規模預計在 2025 年為 39.1 億美元,預計到 2030 年將達到 55.1 億美元,預測期內(2025-2030 年)的複合年成長率為 7.1%。

主要亮點

- 劑量計在各行業有著廣泛的應用,包括醫療保健和製造業。在製造業中,放射源和X光設備的使用日益需要劑量計來長期監測輻射暴露。被動劑量計,例如膠片徽章和熱釋光劑量計,通常用於製造業的常規監測。

- 旨在控制輻射和確保工人安全的政府法規正在推動工業領域對劑量計的需求。然而,設備的高成本、對電磁場的敏感性以及機械不穩定性可能會阻礙主動劑量計市場的成長。

- 心血管疾病、癌症和神經系統相關疾病的增加推動了對劑量計的需求,因為這些疾病需要準確的輻射監測。劑量計在核子醫學和治療放射性藥物領域有著廣泛的應用並展現出良好的前景。醫護人員正在採用穿戴式劑量計來分析輻射水平。

- 旨在改進劑量計技術的持續研究和開發正在推動市場的發展。小型化和其他領域的進步使得使用更小的穿戴式劑量計進行即時監測成為可能,這些劑量計正應用於從核能設施到太空開發等各個行業。

- 此外,具有無線通訊功能的劑量計可以實現無縫資料傳輸和遠端監控,而結合生物劑量測定和考慮遺傳變異等技術的個人化劑量計方法可以解釋個體對輻射敏感性的差異。

- 總體而言,由於輻射介導技術的使用增加、政府法規以及確保工人安全的需求等因素,預計各行業對劑量計的需求將會成長。然而,設備成本高和對環境因素的敏感度等因素可能會限制市場的成長。

- 2024 年 6 月,賽默飛世爾科技宣布推出 Thermo Scientific NetDose Pro 數位劑量計,這是一款穿戴式的連網輻射監測設備。這款緊湊型設備旨在追蹤和告知員工包括醫療保健在內的各行各業的輻射暴露風險,並幫助公司遵守嚴格的監管要求。

劑量計市場的趨勢

放射性物質在工業領域的廣泛使用推動了市場

- 科學和工業領域廣泛應用放射性同位素,以提高生產力並為材料和製程提供獨特的見解。放射性同位素充當示踪劑,監測流體流動和過濾、檢測洩漏以及測量製程設備上的引擎磨損和腐蝕。據核能總署(IAEA)稱,世界各地有數十萬台此類儀器在運作。據國際原子能機構稱,世界各地有數十萬台此類儀器在運作。

- 放射性同位素也用於研究各種材料的混合和流動、檢查金屬部件以及評估各個行業中焊接的完整性。工業伽馬輻射檢測利用輻射的穿透力來有效地篩選材料。它的工作原理與機場安檢中使用的X光類似,但使用密封的鈦膠囊內含有微小的放射性顆粒。

- 此外,放射性同位素也用作核子反應爐的燃料來發電,並在紙張生產中控制紙張、塑膠和金屬板的厚度。它也用於製造夜光塗料和放射性發光物體。

- 印度近幾十年來工業化迅速發展,導致輻射和有害氣體的暴露增加。許多行業和醫院都實施了劑量測定系統,以防止員工和醫療保健專業人員受到過度輻射。這些因素預計將推動印度市場的成長。

- 根據麻省理工學院發表的報導稱,截至2024年1月,美國約有70家公司致力於開發先進核子反應爐,其中約有7家公司因其核能計劃的性質而與監管機構合作。人們對標準水冷技術以外的替代核子反應爐技術的興趣日益濃厚。

亞太地區預計將實現強勁成長

- 預計亞太地區將主導全球劑量計市場,這主要是由於各個終端用戶產業對輻射的應用越來越多。由於核能發電以滿足日益成長的能源需求,以及中國、日本和印度等新興經濟體制定了嚴格的人類安全法規,預計該地區的收益將大幅成長。

- 埃克森美孚預測,2040年亞太地區的核能需求將達到22兆BTU,佔比達45兆BTU。中國核能產業協會報告稱,預計2023年中國核能發電將達到4.4兆瓦時,佔全國發電量的5%,並將進一步增加,滿足人口對清潔能源的需求。

- 據世界核能協會稱,中國預計在2030年超越美國成為世界最大的核能發電。中國核能發電廠的建設正在增加,預計這將在預測期內推動劑量計的需求。例如,中國將於2024年開始建造三座核子反應爐,並計畫在2025年至2030年間再建造23座核子反應爐。

- 中國也將核能安研究納入國家科技規劃,建立了國家核能與輻射安全監管研發中心,進行輻射環境監測和技術審查關鍵技術研究,並提升核安水平。預計這些舉措將在預測期內推動中國對劑量計的需求。

- 日本是世界上老化最快的社會之一,相當一部分人口年齡在65歲以上。根據2023年的國家統計數據,每10人中就有1人年齡超過80歲,65歲以上的人口占總人口的29.5%。根據國家社會安全與人口問題研究所的資料,到2040年,65歲以上人口預計將佔總人口的34.8%。人口老化推動了對醫療保健解決方案的需求,老年人口癌症發生率的增加將影響醫療保健產業對劑量計的需求。因此,預計未來幾年劑量計市場將在日本各地擴大。

- 根據國際能源總署和世界核能協會發布的消息,截至2024年4月,16個國家正在建造約60座核子反應爐,未來還計劃興建110核子反應爐。在建設活動方面,亞洲處於領先地位。約有30個國家正在規劃或已經啟動核子反應爐計畫。

劑量計行業概況

劑量計市場由 Fortive Corporation、Mirion Technologies Inc.、Thermo Fisher Scientific Inc.、Arrow-Tech Inc. 和 Fuji Electric 等主要公司主導。這些公司正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2024 年 4 月,Mirion Medical 的子公司 Mirion Dosimetry Services 推出了具有增強輻射暴露監測功能的無線劑量計 InstadoseVUE。先進的無線技術提供穩定的連接、更快的資料傳輸和長電池壽命。它還有一個電子顯示螢幕,因此您可以即時檢查情況。此劑量計可以隨時隨地監測輻射計量,無需傳統的徽章返回流程並簡化了合規性。

- 2023 年 5 月,IBA 在奧地利維也納舉行的歐洲放射腫瘤學和治療放射學學會 (ESTRO) 年會上展示了其在放射治療品質保證方面的最新創新。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 新冠肺炎疫情和其他宏觀經濟因素的後續影響將影響市場

第5章 市場動態

- 市場促進因素

- 醫療領域對輻射和監測設備的需求不斷增加

- 擴大放射性物質在工業領域的應用

- 市場限制

- 產品精度高、政府監管嚴格、高成本

第6章 市場細分

- 按類型

- 電子個人劑量計 (EPD)

- 熱釋光劑量計 (TLD)

- 光釋光劑量計 (OSL)

- 底片徽章劑量計

- 其他類型

- 按應用

- 活動型

- 被動型

- 按最終用戶產業

- 衛生保健

- 石油和天然氣

- 礦業

- 核能

- 工業

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Fortive Corporation

- Mirion Technologies Inc.

- Thermo Fisher Scientific Inc.

- Arrow-Tech Inc.

- Fuji Electric Co. Ltd

- ATOMTEX

- Tracerco Limited

- Automess-Automation and Measurement GmbH

- SE International Inc.

- Radiation Detection Company Inc.

第8章投資分析

第9章:市場的未來

The Dosimeter Market size is estimated at USD 3.91 billion in 2025, and is expected to reach USD 5.51 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

Key Highlights

- Dosimeters have diverse applications in various industries, including the medical and manufacturing sectors. In the manufacturing sector, using radioactive sources or X-ray machines has increased the need for dosimeters to monitor radiation exposure over an extended period. Passive dosimeters, such as film badges and thermoluminescent dosimeters, are commonly used for routine monitoring in the manufacturing industry.

- Government regulations, which aim to control emissions and ensure labor safety, boost the demand for dosimeters in the industrial sector. However, the device's high cost, sensitivity to electromagnetic fields, and mechanical instability can hinder the growth of the active dosimeter market.

- The demand for dosimeters is propelled by the increasing prevalence of cardiovascular diseases, cancer, and neurology-related conditions, necessitating precise radiation monitoring. Dosimetry equipment finds extensive applications in nuclear medicine and therapeutic radiopharmaceuticals, presenting lucrative prospects. Healthcare practitioners are embracing wearable dosimeters to analyze radiation levels, while the rising use of imaging devices mandates robust radiation exposure monitoring.

- Market growth is further fueled by continuous research and development efforts aimed at enhancing dosimeter technology. Advancements such as miniaturization enable real-time monitoring with smaller, wearable dosimeters, catering to diverse industries from nuclear facilities to space exploration.

- Additionally, dosimeters equipped with wireless communication capabilities facilitate seamless data transfer and remote monitoring, while personalized dosimetry approaches consider individual variations in radiation sensitivity, incorporating techniques like biodosimetry and accounting for genetic variability.

- Overall, the demand for dosimeters is expected to grow in various industries, driven by factors such as the increasing use of radiation-mediated technology, government regulations, and the need for worker safety. However, market growth may be limited by factors such as the high cost of the device and its sensitivity to environmental factors.

- In June 2024, Thermo Fisher Scientific announced the launch of the Thermo Scientific NetDose Pro digital dosimeter, a wearable, connected device for monitoring radiation. This compact instrument is designed to track and inform radiation exposure risk for personnel in a variety of industries, such as healthcare, and help companies adhere to stringent regulatory requirements.

Dosimeter Market Trends

The Rising Application of Radioactive Substances Across the Industrial Sector is Driving the Market

- Science and industry have numerous applications for radioisotopes that improve productivity and provide unique insights into materials and processes. Radioisotopes serve as tracers to monitor fluid flow and filtration, detect leaks, and gauge engine wear and corrosion of process equipment. According to the International Atomic Energy Agency (IAEA), several hundred thousand such gauges are operating worldwide. They are used to measure the amount of radiation absorbed in materials.

- Radioisotopes are also used to study the mixing and flow rates of various materials, inspect metal parts, and assess the integrity of welds across a range of industries. Industrial gamma radiography utilizes the penetrating power of radiation to screen materials effectively. It works similar to X-rays used in airport security checks but with a small pellet of radioactive material in a sealed titanium capsule.

- In addition, radioisotopes are used as fuel in nuclear reactors to generate power and control the thickness of paper, plastic, and metal sheets during manufacturing. They are also used to manufacture luminescent paints and objects that exhibit radio-luminance.

- India has seen rapid industrialization in recent decades, leading to increased radiation and harmful gases. Dosimetry systems are being installed to prevent excessive radiation exposure to employees and healthcare professionals in many industries and hospitals. These factors are expected to propel the growth of the market in India.

- As of January 2024, approximately 70 companies in the United States were working on advanced nuclear reactors, of which around 7 companies were working with regulators due to the nature of the nuclear project, based on an article published by MIT. The interest in alternative nuclear reactor technology, besides the standard water-cooled technology, has increased.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is expected to dominate the global dosimeter market, primarily due to the increasing adoption of radiation across various end-user industries. The region is anticipated to witness significant revenue growth, driven by the growing focus on nuclear power for electricity generation to meet the rising energy demands and stringent regulations for human safety in emerging countries such as China, Japan, and India.

- Exxon Mobil estimates that 2040 nuclear energy demand in the Asia-Pacific region will reach 22 quadrillion BTUs, accounting for 45 quadrillion BTUs. China Nuclear Energy Association reported that in 2023, China's nuclear power generation reached 440,000 gigawatt-hours, accounting for 5% of the nation's electricity output, and it is expected to increase further to meet the population's clean energy demand.

- According to the World Nuclear Association, China is on track to become the world's leading producer of nuclear energy by 2030, surpassing the United States. The increasing construction of nuclear power plants in China is expected to boost dosimeter demand over the forecast period. For instance, in 2024, China started the construction of 3 nuclear reactors, and the country has planned the additional construction of 23 nuclear reactors from 2025 to 2030.

- China also included R&D in nuclear safety in their national planning for scientific and technological programs, established a National Research and Development Center for Nuclear and Radiation Safety Regulation, and conducted research on key technologies of radiation environment monitoring and technical review to enhance safety. These initiatives are expected to drive dosimeter demand in China during the forecast period.

- Japan has one of the world's largest aging populations, with a significant portion being over 65 years old; this population is expected to rise substantially by 2060. According to the 2023 national statistics, 1 out of 10 people were aged 80 or above, while 29.5% of the population was 65 or above. Those aged above 65 are expected to account for 34.8% of the population by 2040, based on data provided by the National Institute of Population and Social Security Research. The aging population is likely to drive demand for healthcare solutions, and the rise in cancer incidence in the geriatric population will affect the demand for dosimeters from the healthcare sector. Hence, the dosimeter market is expected to expand across Japan in the coming years.

- As of April 2024, based on the information published by the IEA and World Nuclear Association, there were about 60 nuclear reactors under construction in 16 countries, along with 110 nuclear reactors planned for the future. Asia is leading the race in terms of construction activities. About 30 countries are planning or starting a nuclear reactor program.

Dosimeter Industry Overview

The dosimeter market is semi-consolidated, with the presence of major players such as Fortive Corporation, Mirion Technologies Inc., Thermo Fisher Scientific Inc., Arrow-Tech Inc., and Fuji Electric Co. Ltd. These players are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2024: Mirion Dosimetry Services, a Mirion Medical company, unveiled the InstadoseVUE wireless dosimeter, offering enhanced radiation exposure monitoring. Advanced wireless technology allows it to ensure stable connectivity, faster data transmission, and prolonged battery life. The device features an electronic display for real-time insights and status updates. The dosimeter simplifies compliance with its anytime, anywhere dose monitoring, eliminating the need for traditional badge return processing.

- May 2023: IBA presented the latest innovations from its radiation therapy Quality Assurance offering at the European Society for Therapeutic Radiology and Oncology (ESTRO) Annual Meeting held in Vienna, Austria.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 After-effects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Radiation and Monitoring Devices Across the Medical Sector

- 5.1.2 Rising Application of Radioactive Substances Across the Industrial Sector

- 5.2 Market Restraint

- 5.2.1 Product Accuracy, Stringent Government Regulations, and High Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electronic Personal Dosimeter (EPD)

- 6.1.2 Thermo Luminescent Dosimeter (TLD)

- 6.1.3 Optically Stimulated Luminescence Dosimeters (OSL)

- 6.1.4 Film Badge Dosimeter

- 6.1.5 Other Types

- 6.2 By Application

- 6.2.1 Active

- 6.2.2 Passive

- 6.3 By End-user Industry

- 6.3.1 Healthcare

- 6.3.2 Oil and Gas

- 6.3.3 Mining

- 6.3.4 Nuclear Plants

- 6.3.5 Industrial

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fortive Corporation

- 7.1.2 Mirion Technologies Inc.

- 7.1.3 Thermo Fisher Scientific Inc.

- 7.1.4 Arrow-Tech Inc.

- 7.1.5 Fuji Electric Co. Ltd

- 7.1.6 ATOMTEX

- 7.1.7 Tracerco Limited

- 7.1.8 Automess - Automation and Measurement GmbH

- 7.1.9 SE International Inc.

- 7.1.10 Radiation Detection Company Inc.