|

市場調查報告書

商品編碼

1687988

硬質塑膠包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

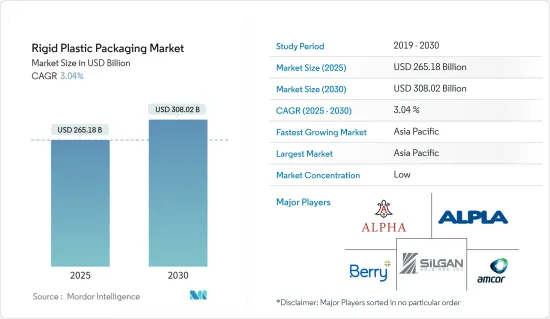

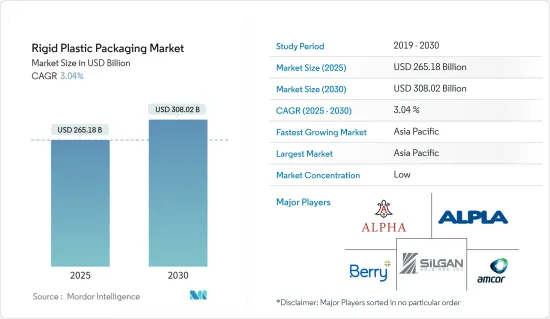

2025 年硬質塑膠包裝市場規模估計為 2,651.8 億美元,預計到 2030 年將達到 3,080.2 億美元,預測期內(2025-2030 年)的複合年成長率為 3.04%。

硬質塑膠包裝是全球包裝產業新時代的核心,其多功能性正迅速成為許多包裝產品產業的基礎。塑膠是世界上最突出的包裝材料之一。其重量輕、成本低的特性使其立即受到所有最終用戶的歡迎。

關鍵亮點

- 永續性正在成為硬質塑膠包裝產業的首要任務。最終用戶和監管機構要求更永續的解決方案,包括再生材料、減少塑膠消費量和環保選擇。

- 硬包裝的可回收性明顯高於軟包裝。主要原因是硬質包裝通常是單一聚合物的整體結構,這使得它比軟包裝中通常使用的整體多層結構更容易回收。

- 隨著環保意識的增強,製造商越來越意識到環保產品的重要性。因此,人們對傳統合成產品的清潔替代品的偏好預計將推動對Oxo生物分解性塑膠的需求。

- 硬質塑膠因其可回收和永續的特性,目前是世界上最值得信賴的包裝材料之一。在過去的幾十年裡,它影響了當前的生產趨勢,提供了卓越的品質、耐用性和永續性。食品和飲料、化妝品、製藥、工業和汽車等終端用戶領域對硬質塑膠包裝解決方案的需求正在成長。

- 由於人們對環境問題的擔憂日益加劇,預計市場將面臨監管標準的動態變化所帶來的重大挑戰。世界各國政府正在回應公眾對塑膠包裝廢棄物尤其是塑膠包裝廢棄物的擔憂,並實施法規以盡量減少環境廢棄物並改善廢棄物管理流程。

- 與塑膠使用相關的環境問題日益嚴重是塑膠包裝替代品市場成長的主要原因。與硬質包裝解決方案相比,軟質塑膠包裝具有更廣泛的應用,因此成為包裝製造商高度青睞的替代方案。此外,軟包裝所需的材料較少,產品與包裝的比例比硬包裝高得多。

硬質塑膠包裝市場趨勢

聚對苯二甲酸乙二酯(PET)顯著成長

- PET 塑膠瓶已成為笨重且易碎的玻璃瓶的廣泛替代品,因為它們為礦泉水和其他飲料提供了可重複使用的包裝,並且使運輸過程更加經濟。 PET 的高透明度和天然的二氧化碳阻隔性能使其用途廣泛,易於吹製成瓶並形成其他形狀。可以透過著色劑、紫外線防護劑、氧氣阻隔劑/清除劑和其他添加劑來改善 PET 的性能,從而使品牌能夠開發出適合其特定需求的瓶子。

- 在硬質包裝產業,PET 可用於生產微波食品托盤和軟性飲料、水、果汁、運動飲料、啤酒、漱口水、番茄醬、沙拉醬和食品罐的塑膠瓶。居家醫療、飲料和個人護理等各個終端用戶行業對寶特瓶的需求正在成長。成長的動力來自於消費者的偏好以及寶特瓶的特性,例如重量輕、可回收性高。

- 一些跨國公司越來越意識到將 PET 回收製成飲料容器等食品級產品的迫切性。這推動了 PET 需求的成長。例如,可口可樂計劃在2030年在其包裝中使用50%的再生PET。聯合利華、歐萊雅和寶潔等大公司已宣布大幅增加包裝中消費後再生(PCR)樹脂的使用量,使其加倍,其中PET是首選樹脂類型。例如,聯合利華承諾在2025年實現100%的塑膠包裝可重複使用或回收。

- 市場供應商正致力於提高 PET 一次性包裝的可回收性,以符合法規要求並創建閉合迴路回收週期。對回收材料的日益重視預計將為 PET 一次性包裝提供成長前景。

- 例如,2023 年 10 月,可口可樂印度公司在全國多個市場為其旗艦品牌可口可樂推出了 250 毫升和 750 毫升包裝尺寸的全再生寶特瓶。該公司的策略包括在市場上促銷低價包裝以吸引更多消費者,並幫助消費者選擇小包裝以抵消高通膨的影響。

- 根據美國塑膠工業協會(PLASTICS)硬質塑膠包裝小組(RPPG)的數據,塑膠佔全球包裝產業的三分之一,其中很大一部分是硬質塑膠包裝。此外,根據經合組織的報告,預計2019年至2060年間全球塑膠使用量將成長168%,到2060年將達到12億噸,這進一步推動了市場研究。

亞太地區佔很大市場佔有率

- 中國的寶特瓶和其他硬包裝的回收率大幅提高。目前正在推行多種策略來解決循環經濟問題,包括使用替代材料、投資開發生物基塑膠以及設計包裝以形成循環循環。

- 中國在2021-2025年五年規劃中表示,將提高塑膠回收和焚燒能力,推廣「綠色」塑膠產品,並打擊包裝和農業中塑膠的濫用。新的五年計畫還要求鼓勵商店和宅配業者減少「不合理」的塑膠包裝,到2025年將都市區垃圾焚燒率從去年的每天58萬噸提高到大約80萬噸。預計此類發展將增加國內對可回收硬質塑膠包裝的需求。

- 人口成長、勞動人數增加以及忙碌的生活方式等關鍵因素正在推動該行業的發展。最終用戶領域的預期成長正在推動硬質塑膠包裝產業的需求。

- 為了減少塑膠對環境的影響,印度也注重塑膠產品的再利用和回收,其中飲料業的公司已經合作推動回收。

- 例如,2024 年 1 月,可口可樂印度公司和 Reliance Retail 宣布啟動一項名為「Bhool Na Jana, Plastic Bottle Lautana」的永續發展舉措,重點是透過孟買 Reliance Retail 商店的反向自動販賣機 (RVM) 和收集箱收集消費後 PET。該先導計畫旨在創建循環經濟,符合印度政府的「清潔印度」計劃,將在孟買和德里的 36 家 Reliance Retail 商店(包括 Smart Bazaar 和 Sahakari Bhandar)啟動,併計劃到 2025 年擴展到印度各地的 200 家商店。

- 日本漫長的海岸線對日本經濟成長產生了重大影響。戰略定位,有利於貿易和海上活動,使日本成為世界主要貿易國之一。

硬質塑膠包裝市場概況

硬質塑膠包裝行業的特點是分散,主要企業包括 Amcor PLC、Berry Global Inc.、Sealed Air Corporation 和 Greif Inc.,以及許多其他製造商。儘管進入門檻很高,但在工業、食品和飲料強勁需求的推動下,區域包裝公司正在意識到進入硬質包裝領域的價值。市場領導者正在利用競爭策略,專注於收購、合作、強大的研發和尖端創新。

- 2024 年 3 月 - Mauser Packaging Solutions 和 Rikutec Packaging 建立獨家夥伴關係關係,共同推動永續 IBC 解決方案的發展。兩家公司將生產和銷售專門滿足高純度需求的頂級多向包裝。此次合作將推出最先進的、可重複使用的重型 1,000 公升 IBC,並透過 Rikutec 的創新產品增強 Mauser 的產品組合。

- 2024 年 1 月 – ALPLA 收購波多黎各的 Fortiflex。兩家公司一直合作為加勒比海和中美洲市場生產包裝產品。透過收購 Fortiflex,ALPLA 旨在加強其 2023 年成立的工業部門,該部門專門從事大容量包裝解決方案,並擴大提案。 2023年,ALPLA和Fortiflex均在哥斯大黎加建立了一條新的桶生產線。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 新法規預計將增加對氧化可分解塑膠的需求

- 終端用戶產業對硬質塑膠包裝解決方案的需求不斷成長

- 市場問題

- 塑膠業嚴格立法

- 與軟質塑膠包裝的競爭

第6章市場區隔

- 依產品類型

- 瓶子和罐子

- 托盤和容器

- 瓶蓋和瓶塞

- 中型散裝容器(IBC)

- 鼓

- 調色盤

- 其他

- 按材質

- 聚乙烯(PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯(ps)和發泡聚苯乙烯(EPS)

- 聚氯乙烯(PVC)

- 其他硬質塑膠包裝材料

- 按最終用戶

- 食物

- 飲料

- 醫療保健

- 化妝品和個人護理

- 工業的

- 建築與施工

- 汽車

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 德國

- 義大利

- 英國

- 西班牙

- 波蘭

- 亞洲

- 中國

- 印度

- 日本

- 泰國

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- Amcor Group GmbH

- Alpha Packaging Inc.

- Berry Global Inc.

- Alpla Group

- Silgan Holdings Inc.

- Sealed Air Corporation

- Plastipak Holding Inc.

- Sonoco Products Company

- Resilux NV

- Graham Packaging Company Inc.

- Greif Inc.

- Mauser Packaging Solutions(Bway Holding Corporation)

- Pact Group Holdings Ltd

- Gerresheimer AG

第8章投資分析

第9章 市場機會與未來趨勢

The Rigid Plastic Packaging Market size is estimated at USD 265.18 billion in 2025, and is expected to reach USD 308.02 billion by 2030, at a CAGR of 3.04% during the forecast period (2025-2030).

Rigid plastic packaging is at the centre of a new era in the global packaging industry, and its versatile usage is becoming the foundation for many industries that package their products. Plastic is one of the most prominent packaging materials in the world. Its lightweight and low-cost nature instantly made it prominent among all end-users.

Key Highlights

- Sustainability is becoming a top priority for the rigid plastics packaging industry. End users and regulators demand more sustainable solutions, such as recycled materials, reduced plastic consumption, and eco-friendly options.

- The recyclability of rigid packaging is significantly higher than that of flexible packaging. The main reason is that rigid packaging typically has a mono-polymer monolithic structure, which is much easier to recycle than the monolithic multi-layer structures commonly used in flexible packaging.

- With rising environmental concerns, manufacturers have ever-grown awareness about the importance of environmentally friendly products. As a result, the preference for clean substitutes from conventional synthetic products is expected to drive the demand for oxo-biodegradable plastics.

- Rigid plastic is presently one of the world's most trusted packaging materials due to its recyclable and sustainable characteristics. Over the past few decades, it has continued influencing current production trends, providing superior quality, durability, and sustainability. The demand for rigid plastic packaging solutions has been experiencing growth across end-user sectors such as food, beverage, cosmetics, pharmaceuticals, industrial, automotive, etc.

- The market is expected to be significantly challenged due to dynamic changes in regulatory standards, primarily due to increasing environmental concerns. Governments worldwide are responding to public concerns regarding plastic packaging waste, especially plastic packaging waste, and implementing regulations to minimize environmental waste and improve waste management processes.

- Growing environmental concerns associated with plastic usage are a primary reason for the growth of alternatives for plastic packaging in the market. Flexible plastic packaging is highly preferred as an alternative by packaging manufacturers due to its wide applications in replacing rigid packaging solutions. Furthermore, flexible packaging requires less material, resulting in a significantly higher product-to-package ratio than its rigid counterparts.

Rigid Plastic Packaging Market Trends

Polyethylene Terephthalate (PET) to Register Significant Growth

- Plastic bottles made from PET are widely replacing heavy and fragile glass bottles since they offer reusable packaging for mineral water and other beverages, allowing a more economical transportation process. With its clarity and natural CO2 barrier properties, PET has wide applications and is easily blown into a bottle or molded into any other shape. PET properties can be improved with colorants, UV blockers, oxygen barriers/scavengers, and other additives to develop a bottle to match a brand's specific needs.

- In the rigid packaging industry, PET manufactures microwavable food trays and plastic bottles for soft drinks, water, juices, sports drinks, beer, mouthwash, ketchup, salad dressings, and food jars. There is a growing demand for PET bottles from various end-user industries, such as home care, beverages, and personal care. The growth is driven by consumer preference and its properties, such as being lightweight and having a high recycling rate.

- Several global companies increasingly recognize the urgency of recycling PET into food-grade products, such as beverage containers. This can drive the growth of the demand for PET. For instance, the Coca-Cola Company intends to use 50% recycled PET in its containers by 2030. Major companies, such as Unilever, L'Oreal, and P&G, announced a significant increase, thereby doubling the usage of post-consumer recycled (PCR) resins in their packaging, for which PET was a desirable resin type. For instance, Unilever is committed to making 100% of its plastic packaging reusable or recyclable by 2025.

- Market vendors are focusing on increasing the recyclability of PET single-use packaging to adhere to the regulations and create a closed-loop recycling cycle. The increasing emphasis on recycling these materials is expected to provide growth prospects for PET single-use packaging.

- For instance, in October 2023, Coca-Cola India introduced fully recycled PET bottles in pack sizes of 250 ml and 750 ml for its flagship Coca-Cola brand across multiple markets in the country. The company's strategy includes promoting low-priced packs in the market to attract more consumers and assist shoppers in selecting smaller packs to counteract the impact of high inflation.

- According to the Plastics Industry Association (PLASTICS)'s Rigid Plastic Packaging Group (RPPG), plastics account for one-third of the global packaging industry, and much of this plastic packaging is rigid. In addition, as stated by an OECD report, plastics use worldwide is expected to grow by 168 per cent from 2019 to 2060, reaching 1.2 billion metric tonnes by 2060, driving the market studied.

Asia-Pacific Holds Significant Market Share

- China is witnessing significant recycling rates in plastic bottles and other rigid packaging options. Multiple strategies are being advanced to address the issue of a circular economy, including substituting for alternative materials, investments toward the development of bio-based plastics, and designing packaging to make the circular loop.

- In a 2021-2025 "five-year plan," China announced it would improve its plastic recycling and incineration capacities, promote "green" plastic products, and combat the misuse of plastic in packaging and agriculture. The new five-year plan would push merchants and delivery companies to reduce "unreasonable" plastic wrapping and increase garbage incineration rates in cities to about 800,000 tons per day by 2025, up from 580,000 tons last year. Such developments are expected to increase the country's demand for recyclable rigid plastic packaging.

- Significant factors like the growing population drive the industry, increasing working individuals, and hanging lifestyles with busy schedules. Growth prospects of end-user segments are leading to a rise in the need for the rigid plastic packaging industry.

- India is also focused on reusing and recycling plastic products as part of lowering the environmental impact of plastics, and as part of this, companies operating in the beverage industry are partnering to promote recycling.

- For instance, in January 2024, Coca-Cola India and Reliance Retail announced the launch of a sustainability initiative titled 'Bhool Na Jana, Plastic Bottle Lautana,' focused on post-consumer PET collection at Reliance Retail stores in Mumbai via Reverse Vending Machines (RVMs) and collection bins. With an idea for a circular economy, this pilot project, aligned with the Government's Swachh Bharat Mission, has begun in 36 Reliance Retail stores, including Smart Bazaar and Sahakari Bhandar stores in Mumbai and Delhi, and will extend to 200 stores across India by 2025 with a target of collecting 5,00,000 PET bottles annually in the pilot phase.

- Japan's long coastline has significantly impacted the country's economic growth. The country's strategic location along essential sea routes has made it easier to trade and conduct maritime activities, which has helped Japan to become one of the top trading countries in the world.

Rigid Plastic Packaging Market Overview

The rigid plastic packaging industry is characterized by fragmentation, featuring prominent players like Amcor PLC, Berry Global Inc., Sealed Air Corporation, and Greif Inc., alongside numerous other manufacturers. Despite high entry barriers for newcomers, regional packaging firms are increasingly recognizing the value of entering the rigid packaging domain, driven by robust demand from sectors such as industrial, food, and beverages. Major players in the market are leveraging competitive strategies, focusing on acquisitions, partnerships, robust R&D, and cutting-edge technological innovations.

- March 2024 - Mauser Packaging Solutions and Rikutec Packaging have forged an exclusive partnership, aligning with the global push for sustainable IBC solutions. Together, they're set to produce and promote top-tier multiway packaging, specifically designed for high-purity needs. This collaboration will see the introduction of a state-of-the-art, reusable, and heavy-duty 1,000-litre IBC, enhancing Mauser's product lineup with Rikutec's innovative offerings.

- January 2024 - ALPLA has acquired Fortiflex, a company based in Puerto Rico. The two firms have collaborated to manufacture packaging products catering to the Caribbean and Central American markets. With the acquisition of Fortiflex, ALPLA aims to bolster its industrial division, which focuses on large-volume packaging solutions established in 2023, and broaden its offerings as a comprehensive provider for its customers. In 2023, both ALPLA and Fortiflex set up a new production line for buckets in Costa Rica.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Oxo-Degradable Plastics is Expected to Increase with New Regulations

- 5.1.2 Increasing Rigid Plastic Packaging Solution Demand Across the End-user Industry

- 5.2 Market Challenges

- 5.2.1 Stringent Laws and Regulations Pertaining to Plastic Industries

- 5.2.2 Competition from Flexible Plastic Packaging

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles and Jars

- 6.1.2 Trays and Containers

- 6.1.3 Caps and Closures

- 6.1.4 Intermediate Bulk Containers (IBCs)

- 6.1.5 Drums

- 6.1.6 Pallets

- 6.1.7 Other Product Types

- 6.2 By Material

- 6.2.1 Polyethylene (PE)

- 6.2.2 Polyethylene Terephthalate (PET)

- 6.2.3 Polypropylene (PP)

- 6.2.4 Polystyrene (ps) and Expanded Polystyrene (EPS)

- 6.2.5 Polyvinyl Chloride (PVC)

- 6.2.6 Other Rigid Plastic Packaging Materials

- 6.3 By End User

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Cosmetics and Personal Care

- 6.3.5 Industrial

- 6.3.6 Building and Construction

- 6.3.7 Automotive

- 6.3.8 Other End User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 France

- 6.4.2.2 Germany

- 6.4.2.3 Italy

- 6.4.2.4 United Kingdom

- 6.4.2.5 Spain

- 6.4.2.6 Poland

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Thailand

- 6.4.3.5 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Alpha Packaging Inc.

- 7.1.3 Berry Global Inc.

- 7.1.4 Alpla Group

- 7.1.5 Silgan Holdings Inc.

- 7.1.6 Sealed Air Corporation

- 7.1.7 Plastipak Holding Inc.

- 7.1.8 Sonoco Products Company

- 7.1.9 Resilux NV

- 7.1.10 Graham Packaging Company Inc.

- 7.1.11 Greif Inc.

- 7.1.12 Mauser Packaging Solutions (Bway Holding Corporation)

- 7.1.13 Pact Group Holdings Ltd

- 7.1.14 Gerresheimer AG