|

市場調查報告書

商品編碼

1687979

智慧馬達:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Smart Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

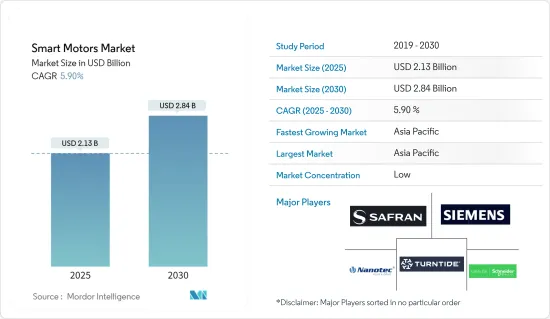

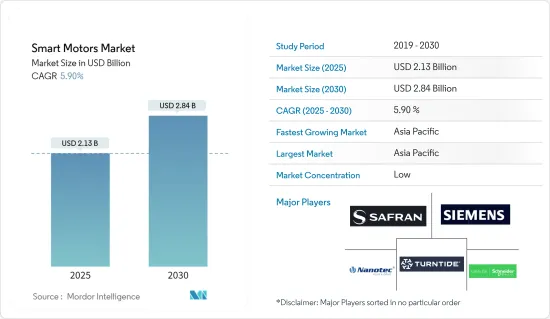

智慧馬達市場規模預計在 2025 年為 21.3 億美元,預計到 2030 年將達到 28.4 億美元,預測期內(2025-2030 年)的複合年成長率為 5.9%。

「智慧工廠」一詞是指製造工廠採用的各種完全整合的自動化解決方案。這種整合有助於簡化所有製造過程中的物料流動,促進物料在工廠車間的有效流動。

關鍵亮點

- 一些製造公司有資格實現零廢棄物生產和縮短時間。更容易監控、更少廢棄物和更快生產是自動化製造流程的主要優勢。該技術為用戶提供及時、低成本、標準化、高品質、可靠的產品。

- 最近,電子和資料分析技術的進步導致了內建智慧的智慧設備的推出。與通訊技術與網際網路的融合將實現物聯網(IoT)。根據思科預測,到 2023 年,全球手持或個人行動裝置數量將達到 87 億台,M2M 連線數量將達到 44 億個。

- 行動 M2M 連線支援廣泛的物聯網應用,到 2023 年將佔全球行動裝置和連線的 34%。隨著工業 4.0 和物聯網的核准,製造業發生了巨大的轉變,要求企業採用敏捷、更好的馬達,利用技術推動生產,透過自動化補充和增強人力,減少因流程故障導致的工業事故。

- 例如,智慧馬達的主要優勢之一是其能夠提供有關馬達性能和效率的寶貴見解。操作員可以透過即時收集和分析馬達內建感測器的資料來監控馬達的狀況。

- 這可以實現預防性維護,因為可以在潛在問題導致代價高昂的故障之前發現並解決它們。此外,收集的資料可用於最佳化馬達性能,從而節省能源並提高整體效率。

- 企業採用物聯網的最大障礙之一是複雜性以及缺乏全面了解這種複雜性的人才,導致許多組織仍然缺乏有關減少能源使用的措施、節能解決方案的安裝的資訊,以及有關可以提高能源使用性能的許多節能機會和技術的資訊。這對市場成長構成了挑戰,導致智慧馬達的採用率較低。

智慧馬達市場趨勢

工業領域預計將佔據主要市場佔有率

- 採用智慧馬達根據特定需求和目標來調整馬達速度。在工業領域,這些智慧馬達能夠處理機器內的複雜任務,並透過整合工業物聯網 (IIoT) 執行精確而多樣的功能。工業智慧馬達正在應用於各個領域,包括工業自動化、物料輸送和機器人。這些先進馬達通常被稱為「智慧」馬達,其應用正在許多工業領域穩步擴大。

- 在當今世界,技術因其眾多應用而備受關注,對機器控制的需求變得至關重要。當今的行業正在不斷投資於有效實施徹底改變業務營運的最新技術創新。智慧馬達技術融入各種工業應用將極大地促進現代技術性能的提升。

- 此外,由於先進控制功能在機器人和自動化解決方案中的重要性,工業領域對智慧馬達的需求也在增加。隨著各行各業努力提高生產效率、增加生產能力並縮短生產時間,各個領域都出現了向自動化轉變的現象。此外,勞動力短缺、人事費用上升以及對節能解決方案的需求進一步促使各行各業採用這些先進技術。

- 智慧馬達在智慧製造、馬達驅動加工設備、物料輸送、攪拌機、擠出機、泵浦和壓縮機等工業領域有著重要的應用。智慧馬達降低能耗的能力正在推動其在研究領域的應用。工業工廠中使用各種各樣的馬達,每天都要檢查馬達狀況,以確保每個現場的穩定和安全運行。監測馬達狀況需要技術技能和經驗,因此需要一種替代系統來代替經過培訓的專業人員手動監測馬達並分析其狀況。

- 隨著馬達在工業應用中的優勢日益增強,許多公司正在大力投資改進創新並推動智慧馬達技術的進步。其中一個例子是 CG Smart Motors,該公司最近宣布將於 2023 年 9 月推出智慧馬達。這項下一代技術使產業能夠監控馬達健康狀況並實施預防措施,以防止停機和故障。透過利用支援 IIoT 的通訊,該技術正在為企業提供智慧通訊,最終提高工業工廠的效率和生產力。

- 根據IFR預測,2022年全球整體工業機器人安裝數量將年增5%,超過55.3萬與前一年同期比較。這些新機器人大部分(73%)將安裝在亞洲,歐洲和美洲分別佔15%和10%。因此,預計市場將保持成長勢頭,到 2023 年預計將成長 7%。這一成長有望幫助我們達到 60 萬台的重要里程碑。它正在促進機器人行業的投資並在市場中創造良好的機會。

亞太地區預計將佔據主要市場佔有率

- *亞太地區是受訪市場中最重要的市場之一。該地區各個終端用戶產業對自動化的採用日益增多,為所研究的市場供應商提供了巨大的成長潛力。此外,該地區的能源挑戰導致低壓電氣設備的採用率增加,促使許多公司開發節能、緊湊的電器和設備,進一步推動智慧馬達的發展。

- 「印度製造」計畫等措施使印度成為世界製造地,並獲得了全球認可。 「印度製造」宣傳活動推動了印度多種工業機器人的推出。印度工業自動化領域正在經歷一場革命,將製造業的數位和實體方面結合,以實現最佳性能。我們專注於精實生產和縮短上市時間,從而加速了我們的成長。

- 由於工業 4.0 而導致的製造業的巨大轉變以及物聯網的採用,利用技術推動生產,實現更大的產能和產量,正在推動市場對智慧馬達的需求。其他驅動優勢(例如最小化維護要求和改進過程控制)也在推動採用。

- 中國對可再生能源和永續性的重視對智慧馬達市場的成長做出了重大貢獻。這些智慧馬達目前被廣泛應用於可再生能源發電和配電系統,以提高效率、控制力以及與智慧電網的整合。預計「中國製造2025」等政府措施將進一步推動智慧馬達在各產業的應用,進而帶來市場需求的激增。因此,預計中國工業部門將經歷顯著成長。

- 印度政府預計,到2023年,印度將在石油和天然氣資源探勘和開採方面吸引總計580億美元的投資。此外,雪佛龍公司、埃克森美孚和道達爾能源等知名國際能源公司也表現出在印度投資的興趣。

- 馬來西亞是東南亞第二大石油生產國和世界第五大液化天然氣(LNG)出口國。據馬來西亞國家石油公司稱,預計馬來西亞將在 2023 年向上游投資撥款 125 億美元,與前一年同期比較成長 35%。此項投資是近五年來最高的。

- 馬來西亞國家石油公司宣布,完全子公司Petronas Carigali 於 2023 年 6 月成功發現六處石油和天然氣蘊藏量。這些發展預計將推動各種自動化技術的應用,從而增加該地區石油和天然氣產業對智慧馬達的需求。

智慧馬達產業概況

智慧馬達市場高度細分,主要參與者包括賽峰電氣與電力公司、西門子股份公司、Nanotec Electronic GmbH & Co.KG、Turntide Technologies Inc. 和施耐德電氣 SE。該市場的參與企業正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023 年 7 月 - 日本電產株式會社透過其子公司日本電產電機株式會社宣布,已從該公司創始家族手中收購了美國私人控股私人公司TAR, LLC d/b/a Houma Armature Works(「Houma」)。此次收購將使日本電產馬達擴大其市場佔有率並加強其在美國的服務範圍。霍馬將能夠為 NMC 客戶提供服務。

2023 年 7 月 - Moog Animatics 宣布推出其最新的 6 級 D 型智慧馬達系列。此次升級的產品線不僅佔用空間更小,而且還確保了更低的總成本和更精簡的設計。新型智慧馬達基於其前代產品的先進可編程性,整合了馬達、多圈絕對編碼器、擴大機和控制器。它還列出了各種通訊選項,包括 USB、雙埠工業乙太網、傳統 RS-232/RS-485 和 CAN 連接。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 新冠疫情及其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 更重視減少資本支出,同時提高資產效率

- 擴展 IIoT 服務的整合,以實現預測性維護、更好的機器控制和其他服務

- 市場限制

- 採用率低

- 與替代 VFD 解決方案相關的高轉換成本

第6章市場區隔

- 按組件

- 變速驅動

- 馬達

- 按應用

- 工業的

- 商用

- 車

- 航太與國防

- 石油和天然氣

- 金屬與礦業

- 用水和污水

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

第7章競爭格局

- 公司簡介

- Safran Electrical & Power

- Siemens AG

- Nanotec Electronic GmbH & Co. KG

- Turntide Technologies Inc.

- Schneider Electric SE

- Fuji Electric Co. Ltd

- Nidec Motion Control(Nidec Corporation)

- Moog Inc.

- Dunkermotoren GmbH(Ametek Inc.)

- Shanghai Moons'Electric Co. Ltd

第8章投資分析

第9章:市場的未來

The Smart Motors Market size is estimated at USD 2.13 billion in 2025, and is expected to reach USD 2.84 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

The term' smart factory' refers to various fully integrated automation solutions adopted for manufacturing facilities. Such integration helps streamline the material flow during all the processes involved in manufacturing, allowing the movement of materials across the factory floor effectively.

Key Highlights

- Several manufacturing companies are qualified to achieve zero waste production and shorter time-to-market. Effortless monitoring, waste reduction, and production speed are significant advantages of automated manufacturing processes. This technology offers users improved standardization quality and dependable products within the time and at a much lower cost.

- Advancements in electronics and data analytics recently led to the introduction of smart devices with built-in intelligence. Their integration with communication technologies and the Internet enables the Internet of Things (IoT). According to Cisco, 8.7 billion handheld or personal mobile-ready devices and 4.4 billion M2M connections will be available by 2023.

- Mobile M2M connections enabled a broad range of IoT applications and represented 34% of global mobile devices and connections in 2023. Tremendous shifts in manufacturing due to Industry 4.0 and the approval of IoT require enterprises to adopt agile, more brilliant motors to advance production with technologies that complement and augment human labor with automation and reduce industrial accidents caused by process failure.

- For instance, one of the critical advantages of smart electric motors is their ability to provide valuable insights into motor performance and efficiency. Operators can monitor its condition by collecting and analyzing data from sensors integrated into the motor in real-time.

- This allows for proactive maintenance, as potential issues can be recognized and addressed before they lead to costly breakdowns. Additionally, the data collected can be used to optimize motor performance, leading to energy savings and improved overall efficiency.

- Many organizations still lack information about measures that reduce energy usage, installation of energy-efficient solutions, information on numerous energy-efficiency opportunities, and the technologies for enhancing the performance of the utilized energy because some of the greatest barriers to enterprise adoption of IoT are the complexity and access to talent that understands this complexity holistically. This challenges the market's growth, resulting in a low implementation rate of smart motors.

Smart Motors Market Trends

Industrial Application Segment is Expected to Hold Significant Market Share

- Smart motors are employed to regulate the motor's speed based on specific needs and purposes. In the industrial sector, these smart motors are capable of handling intricate tasks within machinery, executing precise and diverse functions through the integration of the Industrial Internet of Things (IIoT). Industrial smart motors find their application in various fields, such as industrial automation, material handling, and robotics. The utilization of these advanced motors, commonly referred to as "smart" motors, is steadily growing across numerous industrial sectors.

- The need for machine control has become highly important in today's era, where technology has gained prominence due to the numerous applications it enables. Present-day industries are continuously investing in the effective implementation of the latest innovations that have revolutionized business operations. The incorporation of smart motor technology in various industrial applications will greatly contribute to enhancing the performance of the technology utilized in the modern era.

- In addition, the industrial sector is witnessing a growing demand for smart motors due to the importance of advanced control features in robotics and automation solutions. This transition toward automation is being observed across various sectors as industries strive to enhance production efficiency, increase capacity, and reduce production time. In addition, the scarcity of labor, rising labor costs, and the need for energy-efficient solutions are further motivating industries to adopt these advanced technologies.

- Smart motors find significant applications in the industrial sector, particularly in smart manufacturing, motor-driven processing equipment, material handling, mixers, extruders, pumps, compressors, etc. The ability of smart motors to reduce energy consumption has driven their adoption in the studied sector. Industrial factories use diverse kinds of motors, and the motor conditions are confirmed daily to ensure stable and safe operations at respective sites. Since monitoring the conditions of motors requires technical proficiency and experience, there is a need for a system that could replace the manual process with highly skilled experts for monitoring motors and analyzing conditions.

- Several companies are making substantial investments to improve their innovations and promote the advancement of smart motor technology, given the increasing benefits these motors offer in industrial applications. An example of this is CG Smart Motors, which recently introduced Smart Motors in September 2023. This next-generation technology allows industries to monitor the health of their motors and implement preventive measures to prevent downtime or breakdowns. By leveraging IIoT-enabled communication, this technology facilitates smart communication for businesses, ultimately enhancing efficiency and productivity in industrial plants.

- According to IFR, 2022 witnessed a 5% increase in the number of industrial robot installations compared to the previous year, with a remarkable total of over 553,000 units deployed globally. Most of these new robots, accounting for 73%, were installed in Asia, while Europe and the Americas contributed 15% and 10%, respectively. Thus, the market is expected to maintain its growth momentum, with a projected expansion rate of 7% in 2023. This growth is anticipated to lead to a significant milestone of 600,000 units being reached. These positive developments are driving investments in the robotics industry and creating promising opportunities within the market.

Asia-Pacific is Expected to Hold Significant Market Share

- * Asia-Pacific is one of the most significant markets for the market studied. The region offers massive growth potential to the studied market vendors, owing to the growing adoption of automation across the various end-user industries in the region. The energy concern in the region is also increasing the adoption of low-voltage electrical equipment and motivating many firms to develop energy-efficient and compact electrical equipment and devices, further driving the growth of smart motors.

- Initiatives like the 'Make in India' program place India on the world map as a manufacturing hub and give global recognition to the Indian economy. The Made in India campaign has bolstered multiple new launches in industrial robots in the country. India's industrial automation sector has been revolutionized by the combination of digital and physical aspects of manufacturing to deliver optimum performance. The focus on achieving zero waste production and a shorter time to acquire the market has augmented the growth.

- The massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT to advance production, with technologies to achieve greater production capacity and output, have propelled the demand for smart motors in the market. Also, the additional drive benefits, such as minimized maintenance requirements and improved process control, boost adoption.

- China's focus on renewable energy and sustainability has greatly contributed to the growth of the smart motors market. These smart motors are now being widely employed in renewable energy generation and distribution systems to enhance efficiency, control, and integration with smart grids. The government's initiatives, such as "Make in China 2025," are expected to further promote the adoption of smart motors across various industries, leading to a surge in market demand. As a result, the industrial sector in China is anticipated to witness substantial growth.

- The Government of India has forecasted that India will attract a total investment of USD 58 billion to explore and extract oil and gas resources by 2023. Moreover, prominent international energy corporations like Chevron Corp., ExxonMobil, and TotalEnergies have shown keenness to invest in India.

- Malaysia holds the distinction of being the second-largest oil producer in Southeast Asia and the fifth-largest exporter of liquefied natural gas (LNG) across the world. According to Petronas, Malaysia is projected to allocate a significant sum of USD 12.5 billion toward upstream expenditure in 2023, representing a notable 35% increase from the previous year. This anticipated investment level is the highest seen in the past five years.

- Petronas announced that its wholly-owned subsidiary, Petronas Carigali, had successfully discovered six oil and gas reserves in June 2023. These developments are expected to drive the adoption of various automation technologies, leading to an increased demand for smart motors in the region's oil and gas sector.

Smart Motors Industry Overview

The smart motors market is highly fragmented, with the presence of major players like Safran Electrical & Power, Siemens AG, Nanotec Electronic GmbH & Co. KG, Turntide Technologies Inc., and Schneider Electric SE. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

July 2023 - Nidec Corporation announced the acquisition of TAR, LLC d/b/a Houma Armature Works, a privately owned US company ("Houma"), from its founding family through the Company's subsidiary, Nidec Motor Corporation. Through this acquisition, Nidec Motor Corporation can enhance its service offering, expanding its share within its own US installed base. Houma will be able to provide services to NMC's customers.

July 2023 - Moog Animatics has unveiled its latest offering, the Class 6 D-style SmartMotor range. This upgraded line not only boasts a smaller footprint but also promises a reduced total cost and a streamlined design. Building upon its predecessor's highly programmable nature, the new SmartMotor now integrates a motor, multiturn absolute encoder, amplifier, and controller. It also offers a diverse set of communication options, such as USB, dual-port Industrial Ethernet, and conventional RS-232/RS-485 and CAN connections.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Emphasis on Reducing Capex With Gaining Effectiveness of the Equipment

- 5.1.2 Growing Integration of IIoT Services for Enabling Services Such as Predictive Maintenance, Superior Machine Control

- 5.2 Market Restraints

- 5.2.1 Low Rate of Implementation

- 5.2.2 High Switching Cost Along with Alternate VFD Solutions

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Variable Speed Drive

- 6.1.2 Motor

- 6.2 By Application

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Automotive

- 6.2.4 Aerospace and Defense

- 6.2.5 Oil and Gas

- 6.2.6 Metal and Mining

- 6.2.7 Water and Wastewater

- 6.2.8 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Safran Electrical & Power

- 7.1.2 Siemens AG

- 7.1.3 Nanotec Electronic GmbH & Co. KG

- 7.1.4 Turntide Technologies Inc.

- 7.1.5 Schneider Electric SE

- 7.1.6 Fuji Electric Co. Ltd

- 7.1.7 Nidec Motion Control (Nidec Corporation)

- 7.1.8 Moog Inc.

- 7.1.9 Dunkermotoren GmbH (Ametek Inc.)

- 7.1.10 Shanghai Moons' Electric Co. Ltd