|

市場調查報告書

商品編碼

1687963

雷射清洗:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Laser Cleaning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

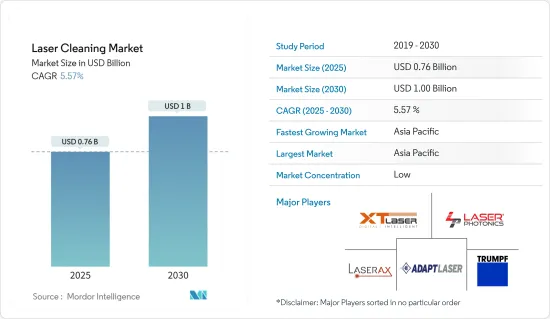

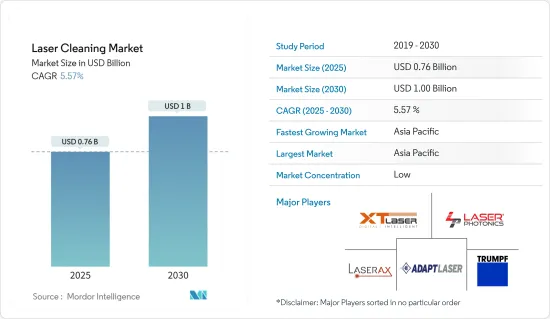

雷射清洗市場規模預計在 2025 年為 7.6 億美元,預計到 2030 年將達到 10 億美元,預測期內(2025-2030 年)的複合年成長率為 5.57%。

雷射清洗已成為各行業必不可少的階段/過程。雷射清洗主要應用於製造業,隨著生產精細化的提高,其硬體技術也經歷了多次升級。

關鍵亮點

- 自動化清洗程序通常用於為進一步的工業操作準備表面,但必須遵循工業 4.0 引入的修改。此外,還使用化學溶劑,會產生潛在危險的蒸氣和液體廢棄物,而噴砂系統會產生大量廢棄物並損壞精密表面。這些問題促使人們採用雷射技術來解決表面清洗問題。

- 汽車產業是雷射清洗市場的主要貢獻者,也是主要促進因素之一。在汽車製造過程中,汽車開發人員正在尋找在黏合之前簡單快速地處理複合材料零件的方法,以確保車架的結構完整性。

- 此外,汽車領域主要關注所有不同材料的整合和分離。因此,雷射技術是開發不同材料輕量化設計和靈活生產流程的關鍵一步。

- 高功率雷射清潔器旨在去除重金屬。根據情況,這些設備可能分為 350W、500W、1,000W 甚至 2,000W。然而,由於功率輸出的增加,這些設備價格昂貴。因此,這些裝置僅與使用重金屬的大型生產/維修設施一起使用。

雷射清洗市場趨勢

汽車產業將強勁成長

- 雷射清洗可以去除所有污染物,而不僅僅是可見的污染物。雷射清洗在汽車領域的一些主要用途包括去除腐蝕、去除塗層、選擇性去除面漆以及汽車生產或維護中的氧化物處理。

- 雷射清洗可以恢復擁有所有原始部件且外觀狀況良好的高價值汽車。腐蝕較少的好車越來越難找到,尤其是隨著車齡的成長。據 Adapt Laser Systems 稱,通用汽車、米其林和豐田等汽車製造商已與該公司在雷射技術(包括清潔技術)方面展開合作。

- 此外,預計在預測期內,電動車需求的增加和雷射清洗機的部署將推動需求的成長。雷射清洗使用每秒數千個脈衝來吸收和去除雜質。

- 例如,根據 KBB 的數據,2023 年第一季美國電池電動車的銷量略低於 258,900 輛。與 2022 年第一季的銷售額相比,年增約 44.9%。 2023 年第一季的銷量也比 2022 年第四季有所成長,成為過去兩年來該國純電動車銷量最好的一個季度。

- 使用雷射系統清潔電池組件可使生產商快速安全地工作,同時將燒蝕過程控制在 1-3 微米的材料去除範圍內。這使得保持基材層完好無損變得更容易,從而產生比未清洗區域更好的連接,並大大提高了數小時和數英里內的粘合穩定性。

亞太地區:預計大幅成長

- 我國已開始投入大量人力、物力推動雷射清洗技術的研究。隨著過去十幾年先進雷射的發展,雷射在能量輸出、波長範圍、雷射品質和能量轉換效率方面都取得了進步。雷射器已經從低效率、笨重的二氧化碳雷射器發展到輕巧、緊湊的光纖雷射器,從連續輸出雷射器發展到奈秒、皮秒、飛秒範圍的短脈衝雷射器,從可見光輸出發展到長波長紅外線和短波長紫外光輸出。

- 此外,雷射清洗技術的快速進步與雷射技術的進步密切相關。雷射清洗技術在理論和實踐上在國內都取得了積極的成果。

- 根據 IBEF 預測,到 2027 年,印度建築市場規模預計將達到 1.42 兆美元。截至 2023 年 9 月,印度建築開發(城鎮、住宅、基礎建設、建築開發計劃)和建築(基礎設施)活動領域的外國直接投資達到 320.8 億美元。

- 該國多家公司正採取策略性舉措,增強自身能力,為工業領域客戶提供更強大的解決方案。例如,2024 年 2 月,Meera Laser Solution Pvt.有限公司宣布將在普納開設一個新的技術中心。新中心旨在支持製造活動以及研發活動。該設施配備了先進的機械設備和現代化的研發實驗室,致力於促進工業雷射解決方案領域的創新和協作。它還設有專門的實驗室,以促進尖端雷射技術的持續實驗、測試和開發。

雷射清洗行業概況

雷射清洗市場由許多地區和國際參與企業細分。由於市場分散,參與企業之間的競爭非常激烈,各種新參與企業都在投資市場。濟南新天科技(XT Laser)、通快集團、Laser Photonics Corporation、Laserax Inc. 和 Adapt Laser Systems 是該市場的主要參與企業。市場參與企業正在採取夥伴關係、創新和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024年3月,Laser Photonics Corporation與北美最大的緊固件分銷商、領先的工業技術和產品分銷商和提供商Fastenal Company(FAST)簽署了分銷協議。該協議預計將擴大該公司的基本客群和分銷商網路,同時為客戶提供根據其需求量身定做的尖端工業雷射解決方案。

- 2023 年 12 月,All Printing Resources 推出了 TWEN Anilox 雷射清潔系統 (TAC)。 TWEN TAC 技術描述了一種使用雷射方法清洗網紋輥的安全、永續且經濟有效的方法,不會磨損或損壞表面。全自動觸摸乾淨科技除了輸入您的身分證外,不需要任何手動輸入。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 的副作用和其他宏觀經濟因素將如何影響市場

第5章市場動態

- 市場促進因素

- 雷射清洗與傳統方法

- 電子元件微型化日益普及

- 市場問題

- 高成本且缺乏熟練勞動力

第6章市場區隔

- 按輸出範圍

- 高的

- 中等的

- 低的

- 按最終用戶產業

- 基礎設施

- 車

- 航太航太

- 產業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Jinan Xintian Technology Co. Ltd(XT Laser)

- TRUMPF Group

- Laser Photonics Corporation

- Laserax Inc.

- Adapt Laser Systems

- Clean-Lasersysteme GmbH

- P-Laser

- IPG Photonics Corporation

- Scantech Laser Pvt. Ltd

- Anilox Roll Cleaning Systems

- HGLaser Engineering Co. Ltd

- Coherent Corp.

第8章投資分析

第9章:市場的未來

The Laser Cleaning Market size is estimated at USD 0.76 billion in 2025, and is expected to reach USD 1.00 billion by 2030, at a CAGR of 5.57% during the forecast period (2025-2030).

Laser cleaning has become a vital phase/process in various industries. Adopted mainly in manufacturing, laser cleaning has witnessed multiple upgrades to the hardware technology as sophisticated production is on the rise.

Key Highlights

- Automatic cleaning procedures, typically used to prepare surfaces for further industrial operations, must follow the modifications introduced by Industry 4.0. Furthermore, chemical solvents are used, which results in potentially dangerous vapors and liquid waste products, and abrasive blasting systems cause significant waste and damage to delicate surfaces. These issues prompted the adoption of surface cleaning solutions based on laser technology.

- The automotive industry has significantly contributed to the laser cleaning market, one of the prime driving factors. During the car manufacturing process, automotive developers look for an easy and quick way to treat composite parts before bonding to ensure the integrity of the frame's structure.

- Furthermore, the automotive domain is primarily concerned with integrating and separating all different materials. Thus, laser tech is a crucial step for developing lightweight designs from different materials and flexible production processes.

- The high-power laser cleaners are designed to clear increasingly heavy metals. In some situations, these devices are classified as 350W, 500W, 1000W, and even 2000W. However, due to the increased power, these devices are costly. As a result, these machines are used only in cases that involve a large production/repair facility that uses heavy-duty metals.

Laser Cleaning Market Trends

Automotive Sector to Witness Major Growth

- Laser cleaning removes all contaminants, not just those that are visible. The significant instances where laser cleaning is used in automotive include corrosion removal, coating removal, topcoat select removal, oxide treatment in automotive production or maintenance, etc.

- Laser cleaning can restore a high-value vehicle that has all its original parts and is in good condition on the surface. Great cars with little corrosion are tough to obtain, especially as they age. According to Adapt Laser Systems, automotive manufacturers such as GM, Michelin, and Toyota have partnered with the company for laser technologies, including cleaning.

- In addition, the increase in the demand for electric vehicles and the deployment of laser cleaning machines are expected to boost the demand during the forecast period. Thousands of pulses per second are used in laser cleaning to absorb and eliminate impurities.

- For instance, according to KBB, in the first quarter of 2023, just under 258,900 battery-electric vehicles were sold in the United States. This was a year-over-year increase of around 44.9% compared to the sales recorded in the first quarter of 2022. The first quarter of 2023 also recorded a hike in sales compared to the fourth quarter of 2022, making it the best quarter for BEV sales in the country across the past two years.

- Cleaning battery components with a laser system enables producers to work fast and safely while managing the ablation process down to 1 to 3-micron levels of material removal. This makes keeping the substrate layer intact easier, resulting in connections far superior to non-cleaned areas and significantly improved bond stability over time and miles.

Asia-Pacific Expected to Register Significant Growth

- China has begun committing a significant amount of human and material resources to advancing laser cleaning technology research. With the development of advanced lasers in the last ten years, lasers have advanced in energy output, wavelength range, laser quality, and energy conversion efficiency. Lasers have evolved from inefficient and bulky carbon dioxide lasers to lightweight and compact fiber lasers, from continuous output laser to nanosecond, picosecond, and femtosecond short-pulse laser, and from visible light output to long-wave infrared light and short-wave ultraviolet light output.

- Furthermore, the rapid advancement of laser cleaning technology is intimately connected to the advancement of laser technology. In both theory and practice, laser cleaning technology has yielded positive outcomes in the country.

- According to IBEF, the construction market is expected to reach USD 1.42 trillion by 2027. FDI in construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors stood at USD 32.08 billion in September 2023 across India.

- Several companies in the country are making strategic moves to strengthen their capabilities and offer enhanced solutions to clients in the industrial sector. For instance, in February 2024, Meera Laser Solution Pvt. Ltd announced the opening of its new technology center in Pune. The new center is designed to support manufacturing activities and research and development. The facility is equipped with advanced machinery and modern research and development labs and is positioned to promote innovation and collaboration within the industrial laser solutions sector. It features specialized laboratories facilitating continuous experimentation, testing, and the development of cutting-edge laser technologies.

Laser Cleaning Industry Overview

The laser cleaning market is fragmented due to many regional and international players. Owing to the fragmented nature of the market, the competition among the players is high; various new players are also investing in the market. Jinan Xintian Technology Co. Ltd (XT Laser), TRUMPF Group, Laser Photonics Corporation, Laserax Inc., and Adapt Laser Systems are the key players in the market. Market players are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In March 2024, Laser Photonics Corporation entered into a distribution agreement with the Fastenal Company (FAST), the largest fastener distributor in North America and a leading distributor and provider of industrial technology and products. This agreement is expected to increase its customer base and expand its distributor network while equipping the company with cutting-edge industrial laser solutions tailored according to its client's needs.

- In December 2023, All Printing Resources introduced the TWEN anilox laser cleaning system (TAC). The TWEN TAC technology is laser-based, providing a safe, sustainable, and cost-effective method for cleaning anilox rolls without causing surface wear or damage to the surfaces. It does not require any human input, except for the entry of an ID, to use its fully automated Touch and Clean technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Laser Cleaning Over Traditional Approach

- 5.1.2 Increasing Adoption of Miniaturization in Electronic Components

- 5.2 Market Challenges

- 5.2.1 High Cost and Lack of Technical Expertise

6 MARKET SEGMENTATION

- 6.1 By Power Range

- 6.1.1 High

- 6.1.2 Medium

- 6.1.3 Low

- 6.2 By End-user Industry

- 6.2.1 Infrastructure

- 6.2.2 Automotive

- 6.2.3 Aerospace and Aircraft

- 6.2.4 Industrial

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jinan Xintian Technology Co. Ltd (XT Laser)

- 7.1.2 TRUMPF Group

- 7.1.3 Laser Photonics Corporation

- 7.1.4 Laserax Inc.

- 7.1.5 Adapt Laser Systems

- 7.1.6 Clean-Lasersysteme GmbH

- 7.1.7 P-Laser

- 7.1.8 IPG Photonics Corporation

- 7.1.9 Scantech Laser Pvt. Ltd

- 7.1.10 Anilox Roll Cleaning Systems

- 7.1.11 HGLaser Engineering Co. Ltd

- 7.1.12 Coherent Corp.