|

市場調查報告書

商品編碼

1687962

LED磷光體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)LED Phosphors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

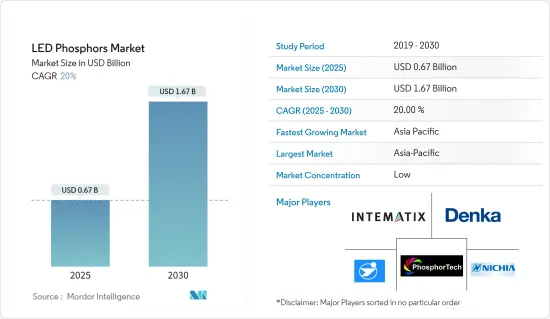

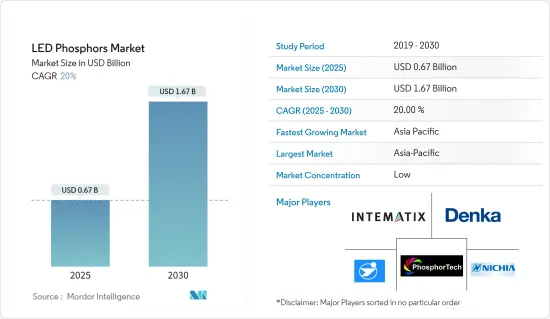

預計 2025 年 LED磷光體市場規模將達到 6.7 億美元,到 2030 年將達到 16.7 億美元,預測期內(2025-2030 年)的複合年成長率為 20%。

與傳統照明系統相比,LED 照明技術越來越受到青睞,這是推動市場成長的主要因素之一。此外,白光LED的廣泛使用進一步刺激了市場成長。

關鍵亮點

- LED磷光體是製造白光LED必備的材料。磷光體的成分顯著決定了LED的效率、光品質和穩定性。白色 LED 通常將發藍光的氮化銦晶粒與磷光體結合在一起,以捕獲藍光並將其轉換為峰值為黃色或琥珀色的寬頻譜。

- 政府強制使用 LED 的規定正在加速多個地區對所研究市場的需求。例如,在美國,能源效率法律要求典型燈泡達到每瓦 45 流明,而 60 瓦白熾燈泡每瓦產生約 15 流明,鹵素白熾燈泡每瓦產生約 20 流明,CFL 燈泡每瓦產生 65 流明,LED 每瓦產生 80-100 流明,同時消耗很少的能量。

- 遠東聯邦大學 (FEFU) 的材料科學家與國際研究團隊合作,發明了一種複合陶瓷材料 (Ce3+:YAG-Al2O3)——一種固體光轉換器 (磷光體),可用於地面和航太技術。此模塑膠LED系統比市場上的同類產品可多儲存20-30%的能量。根據俄羅斯正在實施的光電發展藍圖,到2025年,開發效率為150 lm/W以上的LED技術將可節省高達30%的電力。

- 磷光體LED智慧照明硬體組件的開發將產生與此部分相關的額外成本。儘管過去幾年硬體組件的價格有所下降,但這一因素仍然是估算智慧照明計劃最終價格的重要因素之一。在智慧照明生態系統中,硬體包括幾個關鍵元素,並可透過光源和感測器等附加組件進行增強。智慧照明解決方案的後端部分至少需要 2,000 小時的開發團隊合作,價格從 60,000 美元起。

LED磷光體市場趨勢

智慧型手機成為成長最快的應用程式

- LED磷光體是製造白光LED必備的材料。白光 LED(發光二極體)由於其可靠性、高效率和低能耗,成為傳統白熾燈和螢光的一種很有前途的替代技術。目前,市售的由藍色LED晶片和YAG:Ce3+黃色磷光體組成的白光LED廣泛應用於行動電話顯示器的背光照明。

- LED 因其發光效率高、耐用且體積小而成為行動電話供電攜帶式設備的首選技術。 LCD(液晶顯示器)面板和鍵盤背光採用約0.1W(瓦)的低功耗白色LED。可以將多個 LED 串聯在一起以提供更多光線,就像手電筒或閃光燈一樣。 1W 的高功率LED 用於 200 萬像素或更高的照相行動電話,使其在照度條件下更容易拍照。

- 隨著高階智慧型手機的需求超過中階和低階機型,市場預計將會擴大。低價定價模式中加入了諸如多鏡頭前後前置相機、無邊框顯示器和更大電池等高級功能。這可能會對市場成長產生影響。過去五年來,顯示器的進步不斷加速。 OLED 技術已成為最受歡迎的智慧型手機顯示技術,全球大多數知名行動電話供應商提供 OLED 設備。研發可能仍是智慧型手機顯示器市場製造商的首要任務。研發是智慧型手機顯示器市場參與企業最常採用的策略之一。這些努力主要集中在改進現有產品和開發新產品。

- 預計智慧型手機產量的增加將推動受調查市場的發展。根據愛立信預測,到2022年,全球智慧型手機用戶數量將超過60億,預計未來幾年將成長數億。智慧型手機用戶最多的國家是中國、印度和美國。

- 智慧型手機顯示器各種功能的開發可望推動 LED 磷光市場的發展。例如,在智慧型手機領域,預計對OLED、AMOLED、PMOLED等增強型顯示器以及放大和可捲曲的透明顯示器的需求將會增加。此外,三星還使用 OLED 顯示器為行動裝置提供可折疊顯示器。例如,三星首款折疊式設備提供了兩種螢幕:一個 7.3 吋 1532x2152(361 PPI)折疊式AMOLED 大螢幕,可向內折疊;另一個 4.5 吋 840x1960 AMOLED 小螢幕,可在行動電話關閉時使用。該公司將該顯示器命名為三星 Infinity Flex Display。

亞太地區可望成為成長最快的市場

- 亞太地區LED磷光體市場將隨著LED照明、液晶電視及顯示器、可攜式PC等家用電子電器產品的擴張而擴大。預計市場將受到政府透過提供廉價土地加大對希望在該地區發展 LED 製造的外國公司支持力度的推動。此外,已經頒布了許多立法來支持節能照明設備,這可能會推動磷光體LED 市場的成長。

- 印度是世界上成長最快的市場之一。印度人口稠密,因此對照明解決方案的需求龐大。政府推出的節能照明解決方案、基礎設施的改善以及建築業的擴張正在推動全國的需求。這些因素使得印度成為LED和磷光體產品生產的有前景的市場。

- 例如,印度政府於2022年6月宣布了15家PLI 2.0白色家電家用電子電器計畫受益者,入選公司包括Adani Copper Tubes、LG Electronics和Wipro Enterprises。九家公司將投資 46 億印度盧比,專注於 LED 照明組件。因此,印度預計將生產 LED 晶片封裝、LED 驅動器、LED 引擎、LED 燈管理系統、電容器金屬化薄膜等,這將成為推動研究區域市場發展的關鍵因素。

- 此外,中國的雙碳行動計畫旨在使中國的溫室氣體排放在2030年達到峰值,並在2060年實現碳中和。由於排放技術和低碳企業將帶來巨大的回報,這兩個目標預計將釋放價值數兆美元的投資機會。中國實現氣候變遷目標最快且成本最低的方法之一是將城市照明改用LED照明。高品質的 LED維修美化了社區,使城市環境對居住、工作和旅遊的人們更加舒適和有吸引力。

- 預計預測期內亞太地區將強勁成長。它廣泛應用於照明、指示器、液晶背光等應用,因此在該地區的需求量很大。此外,該地區各國的住宅基礎建設激增也推動了市場需求。此外,亞太地區消費者對三星等公司生產的設備的需求不斷成長,預計將在未來幾年推動 LED磷光體市場的發展。

LED磷光體產業概況

LED磷光體市場主要由北京宇極國際、Intematix株式會社、Phosphor Tech株式會社、Denka、日亞化學株式會社等主要企業細分。市場參與企業正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 11 月,SGH 公司 Cree LED 宣布推出 PhotophyllTMSelect LED,這是一種先進的園藝頻譜,可在 XLamp XP-G3 LED 和 J 系列 2835 3V G 類 LED 上使用。具有 PhotophyllSelect 的 LED 具有園藝指標的全面特性,使燈具製造商能夠輕鬆調整藍/綠/紅頻譜比以滿足特定植物的需求。

2022年4月,Denka株式會社成立了新的企業發展。我們將重組全公司的研究開發和新業務開發框架,以進一步推動旨在創造新業務和實現現有業務永續成長的活動。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 擴大智慧照明系統的使用

- LED磷光體的先進技術開發

- 市場問題

- 缺乏意識且高成本

第6章市場區隔

- 按應用

- 智慧型手機

- 液晶電視

- 筆記型電腦/平板電腦

- 車

- 照明(住宅和工業)

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Beijing Yuji International Co. Ltd.

- Intematix Corporation

- Phosphor Tech Corporation

- Denka Co. Ltd.

- Nichia Corporation

- Mitsubishi Chemical Corporation

- Philips Lumileds Lighting Company

- Luming Technology Group Co. Ltd.

- Citizen Electronics Co. Ltd

- Cree LED Inc.(SMART Global Holdings Inc.)

第8章投資分析

第9章:市場的未來

The LED Phosphors Market size is estimated at USD 0.67 billion in 2025, and is expected to reach USD 1.67 billion by 2030, at a CAGR of 20% during the forecast period (2025-2030).

The growing preference for LED lighting technologies over conventional lighting systems is one of the primary factors driving the market's growth. Additionally, the increasing popularity of white LEDs has further propelled the market growth.

Key Highlights

- LED phosphors are crucial materials in the manufacture of white LEDs. Phosphor composition largely determines an LED's efficiency, light quality, and stability. White LEDs are generally a combination of a blue light-emitting indium gallium nitride die and phosphor, which takes blue light and then converts it into a broad-spectrum peaking at yellow or amber.

- Government regulations mandating the use of LEDs are accelerating the demand in the market studied in several regions. For instance, in the United States, as the law requires energy savings to be 45 lumens per watt for the common types of light bulbs, a 60-watt incandescent light bulb can put out around 15 lumens per watt; a halogen incandescent bulb offers around 20 lumens per watt; CFL bulb provides 65 lumens per watt; LEDs put out 80 to 100 lumens per watt with a fraction of energy.

- Materials scientists at FEFU (Far Eastern Federal University), in partnership with an international research team, advanced the invention of composite ceramic materials (Ce3+:YAG-Al2O3), i.e., solid-state light converters (phosphors) that can be used in ground and aerospace technologies. LED systems based on molded materials can preserve 20-30% more energy than commercial analogs. According to the photonics development roadmap run in Russia, the development of LED technology with an efficiency of more than 150 lm/W would allow for savings of up to 30% in electricity by 2025.

- While developing phosphors LED smart lighting hardware components, there is an additional cost associated with this part of the project. Even though the price for hardware components has been dropping over the last few years, this element remains one of the essential factors in estimating the final price of the smart lighting project. In a smart lighting ecosystem, hardware contains several important elements, sometimes enhanced by additional components, such as light sources and sensors. The backend part of the smart lighting solution consumes at least 2,000 hours of development teamwork, and its price starts at USD 60,000.

LED Phosphors Market Trends

Smartphone to be the Fastest Growing Application

- LED phosphors are crucial materials in the manufacture of white LEDs. White LEDs (light-emitting diodes) are a promising technology replacing conventional incandescent and fluorescent lamps owing to their reliability, high efficiency, and low energy consumption. Currently, commercial white LEDs comprising a blue LED chip and YAG: Ce3+ yellow phosphor are widely used to backlight mobile phone LCDs.

- LED is the technology of choice in battery-powered portable devices like mobile phones due to its high luminous efficiency, durability, and small size. Low-power white LEDs of about 0.1W (watts) are used to backlight LCD (Liquid Crystal Display) panels and keyboards. Multiple LEDs, like a torch or flashlight, can be linked together to provide more light. High-power LEDs of 1 W are utilized in camera phones with high resolutions of 2M pixels or higher to facilitate photography in low-light conditions.

- The market would grow as demand for high-end smartphones outpaces mid-range and low-end. Premium features such as multi-lens front or rear cameras, bezel-less displays, and large batteries are being added to lower-cost models. It would affect market growth. Displays have advanced at an increasing rate during the previous five years. OLED technology has emerged as the most popular smartphone display technology, with the world's most prominent phone providers offering OLED devices. R&D would continue to be a priority for manufacturers in the smartphone display market. Research and development are some of the most common strategies employed by players in the smartphone display market. These initiatives are focused on both improving existing products and developing new ones.

- The rise in the production of smartphones is expected to drive the studied market. According to Ericsson, the number of smartphone subscriptions globally in 2022 surpassed six billion. It is expected to rise by several hundred million in the coming years. The countries that have the highest number of smartphone users are China, India, and the United States.

- The developments in the various features toward the development of smartphone displays are expected to drive the led phosphorus market. For example, smartphones are expected to witness growing demand for enhanced displays, such as OLED, AMOLED, and PMOLED, augmented displays, and rollable transparent displays. Additionally, Samsung uses OLED displays to offer mobile devices that come with foldable displays. For instance, Samsung's first foldable device offered two screens with a large 7.3" 1532x2152 (361 PPI) foldable AMOLED that folds inside and a smaller 4.5" 840x1960 AMOLED to be used when the phone is closed. The company branded the display as the Samsung Infinity Flex Display.

Asia-Pacific is Expected to be the Fastest Growing Market

- The Asia-Pacific LED phosphor market would expand with the expansion of consumer electronics products, including LED lights, LCD TVs and displays, and portable PCs. The market is anticipated to be driven by the government's increasing support for providing cheaper land to foreign companies intending to develop LED manufacturers in the region. Furthermore, many laws have been passed to support energy-efficient lighting equipment, which would cause the Phosphor LED Market to grow.

- India is one of the global markets with the quickest growth. India has a significant demand for lighting solutions because of its dense population. With the improvement of infrastructure and the expansion of the construction sector, government initiatives for energy-efficient lighting solutions are boosting demand nationwide. Due to these factors, India is a promising market for both the production of LEDs and phosphor products.

- For instance, the Indian government announced 15 PLI 2.0 white goods program recipients in June 2022. Adani Copper Tubes, LG Electronics, and Wipro Enterprises are a few of the chosen businesses. With a commitment of INR 4.6 billion, nine companies would concentrate on LED light components. As a result, India would produce LED Chip packing, LED Drivers, LED Engines, LED Light Management Systems, and Metallized films for capacitors, among other products, which would be a key component driving the market in the area under study.

- Furthermore, China's dual carbon policy aims to peak the nation's greenhouse gas emissions by 2030 and achieve carbon neutrality by 2060. With enormous benefits for emissions-reduction technology and low-carbon businesses, these two objectives are anticipated to provide trillions of dollars worth of investment opportunities. One of China's quickest and least expensive methods to meet its climate targets is converting city lighting to LEDs. High-quality LED retrofits beautify the area, making the urban environment more pleasant and appealing to those who live, work, and visit there.

- APAC is anticipated to increase strongly during the predicted period. Due to its widespread use in applications, including illumination, indicators, and LCD backlights, the material is in high demand in the region. Demand for the market is also being driven by a surge in the building of residential infrastructure among the region's nations. Additionally, rising consumer demand in APAC for devices made by companies like Samsung will likely drive the LED phosphor market in the coming years.

LED Phosphors Industry Overview

The LED phosphors market is fragmented with key players like Beijing Yuji International Co. Ltd, Intematix Corporation, Phosphor Tech Corporation, Denka Co. Ltd, and Nichia Corporation, among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, Cree LED, an SGH company, announced the release of PhotophyllTMSelect LEDs, an advanced horticulture spectrum available on the XLamp XP-G3 LEDs and the J Series 2835 3V G Class LEDs. LEDs made with PhotophyllSelect have been thoroughly characterized in horticulture metrics, allowing luminaire manufacturers to easily adjust blue/green/red spectral ratios to meet specific plant needs.

In April 2022, Denka Company Ltd. established a new business development. It restructured its companywide research and new business development framework to promote activities further to create new businesses and ensure the sustainable growth of its existing businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Usage of Smart Lighting Systems

- 5.1.2 Advanced Technological Developments in LED Phosphors

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and High Cost

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Smartphones

- 6.1.2 LCD TVs

- 6.1.3 Laptops/Tablets

- 6.1.4 Automotive

- 6.1.5 Lighting (Residential and Industrial)

- 6.1.6 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Beijing Yuji International Co. Ltd.

- 7.1.2 Intematix Corporation

- 7.1.3 Phosphor Tech Corporation

- 7.1.4 Denka Co. Ltd.

- 7.1.5 Nichia Corporation

- 7.1.6 Mitsubishi Chemical Corporation

- 7.1.7 Philips Lumileds Lighting Company

- 7.1.8 Luming Technology Group Co. Ltd.

- 7.1.9 Citizen Electronics Co. Ltd

- 7.1.10 Cree LED Inc. (SMART Global Holdings Inc.)