|

市場調查報告書

商品編碼

1687943

智慧型手機 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smartphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

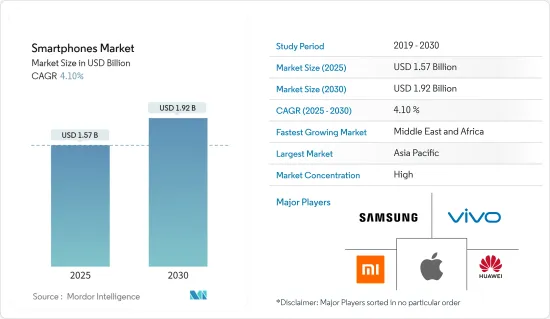

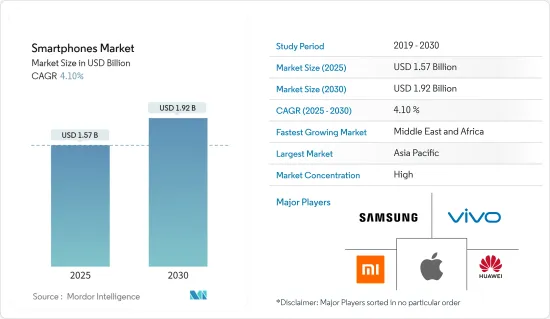

預計 2025 年智慧型手機市場規模為 15.7 億美元,到 2030 年將達到 19.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.1%。

可支配收入的增加、通訊基礎設施的發展、廉價型智慧型手機的出現以及產品發布的不斷增加等因素促進了亞洲國家智慧型手機市場的成長。

智慧型手機產業穩步發展,市場規模和機型數量不斷擴大。根據BankMyCell預測,到2024年1月,全球行動電話用戶數將達到69.3億,佔全球人口的85.74%。全球擁有智慧型手機或功能手機的人數為74.1億,佔全球人口的91.68%。

市場的主要企業正在建立策略夥伴關係,以改善他們的服務產品並保持競爭優勢。 2024 年 1 月,Ncell 宣布與三星建立令人興奮的合作關係,開放 Galaxy S24 系列智慧型手機的預訂。作為合作的一部分,Ncell 將為其用戶提供極具吸引力的配套服務和特殊設施。預訂三星 Galaxy S24 系列智慧型手機的前 500 名客戶將獲得他們首選的 Ncell LUX 號碼。

消費者對 5G 設備的興趣日益濃厚。這就是為什麼晶片製造商正在推動製造商在其新的智慧型手機產品線中加入 5G 晶片。

政府正在採取適當措施來發展和擴大該網路。例如,2023年2月,印度中央政府計畫在印度各地建立100個工程實驗室,為各領域開發5G應用程式。

此外,根據2023-24年提案預算,中央政府已撥款55.6億印度盧比(6.8048億美元)用於建立5G試驗站。 2023 會計年度,通訊部遠端資訊處理開發研究與發展中心將獲得 55 億印度盧比(6.7314 億美元)的資金,而 2022-23 會計年度則為 50 億印度盧比(6.1195 億美元)。

新冠疫情嚴重擾亂了智慧型手機市場的供需平衡。中國是大多數此類設備和零件的全球製造地,全國範圍的封鎖對智慧型手機製造業產生了不利影響,導致出貨延遲和下一代產品開發減弱。我們也看到供應商、工人和物流網路被切斷。此外,由於疫情導致消費者減少奢侈品支出並專注於必需品,消費者對智慧型手機(尤其是高階智慧型手機)的需求下降。

智慧型手機正在經歷快速成長,原因有很多,包括產品成本下降、手機設計和功能的改進、全球行動電子郵件和瀏覽服務的擴展、4G 和 5G 網路技術的出現、行動通訊業者之間競爭加劇、以及作業系統的標準化和升級。

智慧型手機在冠狀病毒大流行期間發揮了至關重要的作用,但即使在大流行消退之後,幾乎所有政府服務、醫療保健、教育、金融服務等都轉移到了線上,智慧型手機成為獲取這些服務的更便捷、更實惠的途徑。

智慧型手機市場趨勢

Android作業系統預計將大幅成長

根據 StatCounter 2023 年 12 月發布的報告,Android 仍然是全球最受歡迎的行動作業系統,市場佔有率為 70.48%,而 iOS 約為 28.8%。

此外,由於它要求開發人員了解 C++、Kotlin 和 Java 等語言,許多應用開發更喜歡使用 Android 作業系統來開發遊戲/娛樂應用程式、社交媒體應用程式、行動公共產業應用程式和生活方式應用程式。此外,Google 還提供各種開發工具,如 Android Jetpack、Firebase 和 Android SDK,以協助開發人員建立直覺的介面。

此外,該平台還允許用戶免費下載應用程式。然而,應用程式旨在提供應用程式內收費和應用程式內課程訂閱,而 Google Play Store 的收益高於 Apple Store。

能源管理和智慧家庭產品等整合物聯網 (IoT) 對高速資料連接的需求不斷成長,預計將推動 5G 智慧型手機的普及。

2023年12月,POCO推出了支援5G的新系列POCO M6,提高了智慧型手機影像處理和高階設計的標準。 POCO M6 5G 擁有 17.12 厘米(6.74 英寸)HD+螢幕大小,高 168 毫米,深 8.19 毫米,重 195 克,配備 50MP AI 雙攝系統和 5MP前置相機。 POCO M6 5G 搭載聯發科天璣 6100+八核心處理器。它配備 4GB RAM 和 128GB 儲存空間,最高可擴充至 1TB。

亞太地區預計將佔據主要市場佔有率

亞太地區是智慧型手機的主要市場之一,主要得益於其高度新興的通訊產業和龐大的基本客群。此外,該地區對行動網路的投資正在增加。印度、日本、澳洲、新加坡和韓國等國家正在加大對發展國內通訊市場的投資,也有望推動該地區市場的發展。

印度和印尼等新興經濟體對入門價格分佈智慧型手機的需求不斷增加,加上地方政府推動數位和行動經濟,智慧型手機在農村地區的普及率不斷提高,預計將推動該地區市場的發展。例如,「數位印度計劃」是印度政府的旗艦計劃,其主要目標是將印度轉變為數位化社會。

印度已推出各種計劃和激勵措施來支持電子製造業。這些措施包括鼓勵對電子價值鏈進行大規模投資、促進出口以及促進半導體生產的措施。

此外,印度政府在2023-2024年聯邦預算中降低了智慧型手機零件的關稅,以促進國內生產。就智慧型手機生產而言,這將帶來更大的國內附加價值。由於「分階段製造計畫」等多項政府舉措,印度行動電話產量已從 2014-15 會計年度的 5,800 萬部(約 1,890 億印度盧比)成長至上一會計年度(2022-23 會計年度)的 3.1 億部以上(2,750 億印度盧比)。

智慧型手機市場的主要供應商正致力於擴大其產品組合併在全部區域推出新產品。例如,2023年10月,Google正式發表Pixel 8系列,一加發表首款折疊式OnePlus Open,Vivo發表Vivo V29系列,三星發表Galaxy S23 FE。

預計未來幾年,城市人口的成長、消費者對行動裝置使用意識的增強、AR 技術的快速整合以及Over-The-Top(OTT) 平台訂閱量的不斷成長將推動市場擴張。

在中國當地,智慧型手機普及率的提高和4G的普及推動了行動網際網路使用量的激增,支持了該國在數位社會價值鏈中的發展。超過9.9億人使用行動網路服務,預計到2025年這數字將增加2億。

智慧型手機產業概況

智慧型手機市場高度整合,主要由三星、華為、蘋果和小米等參與企業主導。

2024 年 1 月:蘋果宣布將在印度班加羅爾開設新辦事處。蘋果是中央政府生產連結獎勵計畫的主要受益者。據報道,該公司 2023 年生產的 iPhone 價值將達到 1,000 億印度盧比,成為印度智慧型手機製造商中價值最高的。蘋果的供應合作夥伴富士康最近獲得核准,投資 10 億美元在班加羅爾坎佩戈達國際機場附近的多達巴拉普拉建造一座最先進的 iPhone 工廠。

2023 年 2 月:高通技術公司 (Qualcomm Technologies Inc.) 與三星電子合作,為 Galaxy S23 系列配備全球最快的驍龍處理器。高通技術公司宣布,其最新旗艦 Galaxy S23 系列將為全球 Galaxy 裝置配備高階驍龍 8 Gen 2 行動平台。全新 Snapdragon 8 Gen 2 設計加速了同類產品中最快的處理器效能,定義了互聯運算的新標準。兩家公司宣布推出 S23 系列,致力於透過其 Galaxy 旗艦設備提供最高品質的消費者體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 智慧型手機產業價值鏈分析

- 新冠疫情及其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 5G設備、服務與技術的出現

- 新興市場需求不斷成長

- 市場限制

- 需求停滯

- 市場機會

- 市場技術格局

- 智慧型手機設備生命週期分析

- 透過相關人員的生命週期

- 分析整個設備生命週期中的關鍵相關人員痛點

- 智慧型手機設備生命週期分析

- 技術藍圖分析

第6章市場區隔

- 按作業系統

- Android

- iOS

- 按地區

- 北美洲

- 歐洲

- 中國

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 海灣合作理事會國家

- 非洲

第7章競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Huawei Technologies Co. Ltd

- Apple Inc.

- Xiaomi Corporation

- 步步高電子股份有限公司(Vivo、Realme、Oppo、OnePlus)

- Lenovo Group Limited

- HTC Corporation

- HMD Global Oy

- Sony Corporation

- ZTE Corporation

- Google LLC

第 8 章供應商市場佔有率

第9章 競爭基準化分析分析

第10章投資分析

第11章:投資分析市場的未來

The Smartphones Market size is estimated at USD 1.57 billion in 2025, and is expected to reach USD 1.92 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

Factors such as increasing disposable income, the development of telecom infrastructure, the emergence of budget-centric smartphones, and an increasing number of product launches contribute to the smartphone market growth in Asian countries.

The smartphone industry has steadily developed and grown in market size and models. According to BankMyCell, by January 2024, there would be 6.93 billion mobile phone users worldwide, representing 85.74% of the world's population. The number of people who own a smart and feature phone is 7.41 billion, making up 91.68% of the world's population.

The key players in the market are involved in strategic partnerships to improve their service offerings and remain competitive. In January 2024, Ncell introduced an enticing collaboration with Samsung for the pre-order launch of the Galaxy S24 series smartphones. As part of that partnership, Ncell is offering its users attractive bundled services and special facilities exclusively. The Ncell LUX number of their choice will be available to the initial 500 customers who pre-book a Samsung Galaxy S24 series smartphone.

Consumer interest in 5G devices is growing. Thus, chipmakers are pushing manufacturers to include 5G chips in their new smartphone lineup.

The government is taking appropriate actions on network development and expansion. For instance, in February 2023, the Central Government of India planned to set up 100 laboratories in engineering institutes all over India to develop 5G applications for different sectors.

According to the budget documents for 2023-24, the Centre also provided INR 5.56 Crore (USD 680.48 Million) to set up a 5G test site. For the financial year 2023, the Centre for Development of Telematics and Research and Development of the Department of Telecommunications will receive INR 550 Crore (USD 673.14 Million), compared to INR 500 Crore (USD 611.95 Million) for the financial year 2022-23.

The COVID-19 pandemic severely disrupted the smartphone market's balance between supply and demand. Since China is the global manufacturing center for most of these devices and components, and with the nationwide lockdown, the smartphone manufacturing sector has been adversely hit by delayed shipments and weakened development of next-generation products. The country also witnessed being choked off by suppliers, workers, and logistics networks. Moreover, consumer demand for smartphones, especially in the premium segment, declined due to customers' tendency to cut down on luxury spending and focus on essentials due to the pandemic.

Smartphones are experiencing rapid growth due to various factors, such as lower product costs, improved handset design and functionality, the expansion of global mobile email and browsing services, the emergence of 4G and 5G network technologies, rising competition among mobile carriers, and the standardization and upgrading of operating systems.

Smartphones played an incredibly important role amid the widespread coronavirus pandemic, and this continued even after the pandemic was over, as almost all government services, health, education, financial services, and so on went online, with smartphones serving as a more accessible and more affordable gateway to access these services.

Smartphones Market Trends

Android Operating System is Expected to Grow Significantly

According to a StatCounter report released in December 2023, Android remained the world's most popular mobile operating system, with a market share of 70.48%, while iOS accounted for roughly 28.8%.

Furthermore, many application developers prefer Android OS to develop gaming/entertainment applications, social media applications, mobile utility applications, and lifestyle applications, as it requires the developers to know languages such as C++, Kotlin, and Java, among others. Moreover, Google also offers various development tools, such as Android Jetpack, Firebase, and AndroidSDK, to assist developers in building a user-intuitive interface.

Additionally, the platform allows users to download applications free of cost. However, the applications are designed to offer in-app purchases and in-app course subscriptions that have generated more revenue in Google Play Stores than in Apple Stores.

The increasing demand for high-speed data connectivity for integrated IoT (Internet of Things) applications, such as energy management and smart home products, is anticipated to propel the adoption of 5G smartphones.

In December 2023, POCO unveiled its new Series named POCO M6 with 5G support, which raises the bar for smartphone imaging and luxurious design. POCO M6 5G delivers a screen size of 17.12 cm (6.74 inches) HD+ display with a Mobile Height of 168 mm, Depth of 8.19 mm, and Weight of 195 g. POCO M6 5G packs with 50MP AI Dual-Camera System and 5MP Front Camera. POCO M6 5G powered by the MediaTek Dimensity 6100+ Octa Core Processor. The smartphone comes with 4GB RAM and 128GB Storage, which is expandable up to 1TB.

Asia-Pacific is Expected to Hold a Significant Market Share

Asia-Pacific is one of the significant markets for smartphones, primarily owing to the highly developing telecom sector and large customer base. Furthermore, the region is increasingly investing in the mobile network. Countries such as India, Japan, Australia, Singapore, and South Korea are increasingly investing in developing the domestic telecom market, which is also expected to drive the market in the region.

The demand for smartphones at the entry-level price points is expected to be driven by the increasing demand from the developing countries in the region, such as India and Indonesia, where smartphones are increasingly penetrating rural areas as local governments push for digital and mobile economies. For instance, the Digital India program is a flagship program of the Government of India primarily aimed at transforming the country into a digitally empowered society.

Various schemes and incentives have been implemented to support India's electronics manufacturing sector. These measures include incentives for significant investments in the electronics value chain, promotion of exports, and action to promote semiconductor production.

Further, the Government of India has reduced customs duties on parts of smartphones in the Union budget of 2023 to 2024 to boost local production; in the case of the production of smartphones, this will further increase domestic value addition. Mobile phone production in India had increased from 5.8 crore units valued at about INR 18,900 crore in 2014-15 to 31 crore units valued at over INR 2,75,000 crore in the last financial year (2022-23) because of various initiatives of the government, including the 'Phased Manufacturing program.'

The key vendors in the smartphone market are focusing on improving their product offerings and introducing new products across this region. For instance, in October 2023, Google launched the Pixel 8 Series, OnePlus launched its first foldable OnePlus Open, Vivo launched the Vivo V29 Series, and Samsung made the Galaxy S23 FE official.

The rise in the urban population, increased consumer awareness regarding mobile device usage, the surging integration of AR technology, and expanding over-the-top (OTT) platform subscriptions are expected to drive the market's expansion in the coming years.

In mainland China, rising smartphone adoption and the availability of 4G have resulted in a surge in mobile internet usage that supports the country's movement up the digital society value chain. More than 990 million people use mobile internet services, which is expected to increase by 200 million by 2025.

Smartphones Industry Overview

The smartphone market is highly consolidated, dominated by established players such as Samsung, Huawei, Apple, and Xiaomi. Most players launch new models with small technology changes such as battery power, camera configuration, and processor. Some of the recent developments are:

January 2024: Apple Inc. announced the opening of a brand-new office in Bengaluru, India. Apple is a major beneficiary of the central government's Production Linked Incentive Scheme. The company reportedly churned out iPhones worth INR 1 lakh crore in 2023, the highest for any smartphone maker in India. Apple's supply partner, Foxconn, recently got approval to invest USD 1 billion in its newest iPhone factory, which is coming up at Doddaballapura, near Bengaluru's Kempegowda International Airport.

February 2023: Qualcomm Technologies Inc. and Samsung Electronics partnered to bring the fastest Snapdragon to the Galaxy S23 series globally. Qualcomm Technologies, Inc. announced that the latest flagship Galaxy S23 series is powered by a premium Snapdragon 8 Gen 2 Mobile Platform for Galaxy worldwide. The new Snapdragon 8 Gen 2 design accelerates performance by making it the fastest processor in its class and defining a new standard for connected computers. Both companies are committed to delivering the highest quality consumer experiences on flagship Galaxy devices, so they have launched the S23 series.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Smartphones Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Launch of 5G Devices, Services, and Technologies

- 5.1.2 Increasing Demand in the Emerging Markets

- 5.2 Market Restraints

- 5.2.1 Stagnating Demand

- 5.3 Market Opportunities

- 5.4 Technology Landscape of the Market

- 5.4.1 Smartphone Device Lifecycle Analysis

- 5.4.1.1 Lifecycle Through Stakeholders

- 5.4.1.2 Key Pain-point Analysis of Stakeholders Throughout the Device Lifecycle

- 5.4.1 Smartphone Device Lifecycle Analysis

- 5.5 Technology Roadmap Analysis

6 MARKET SEGMENTATION

- 6.1 By Operating Segment

- 6.1.1 Android

- 6.1.2 iOS

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 China

- 6.2.4 Asia

- 6.2.5 Australia and New Zealand

- 6.2.6 Latin America

- 6.2.7 GCC

- 6.2.8 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Apple Inc.

- 7.1.4 Xiaomi Corporation

- 7.1.5 BBK Electronics Corporation (Vivo, Realme, Oppo, and OnePlus)

- 7.1.6 Lenovo Group Limited

- 7.1.7 HTC Corporation

- 7.1.8 HMD Global Oy

- 7.1.9 Sony Corporation

- 7.1.10 ZTE Corporation

- 7.1.11 Google LLC