|

市場調查報告書

商品編碼

1687936

維護、維修和營運 (MRO) - 市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Maintenance, Repair, And Operations (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

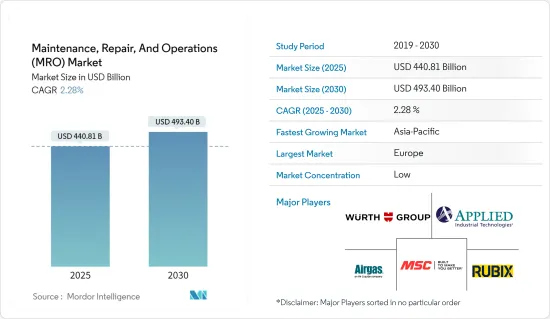

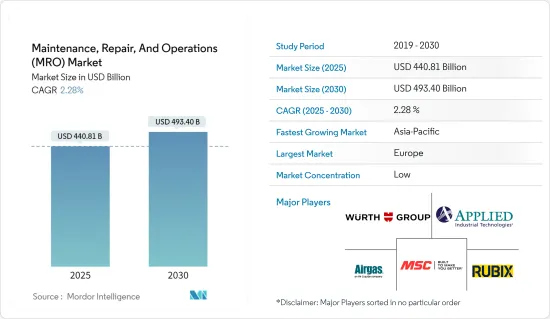

維護、維修和營運市場規模預計在 2025 年為 4,408.1 億美元,預計到 2030 年將達到 4,934 億美元,預測期內(2025-2030 年)的複合年成長率為 2.28%。

關鍵亮點

- 製造業擴大採用智慧技術以及旨在提高業務效率和降低成本的外包策略是市場成長的主要驅動力。

- 此外,對永續性的日益關注導致人們轉向維修而不是更換零件,從而刺激了對 MRO 產品的需求,從而促進了 MRO 市場的成長。新技術的出現和市場競爭加劇的需求也改變了 MRO 產業,市場供應商現在提供各種各樣的產品來滿足各種客戶的需求。

- 智慧工廠的發展和預測性維護(例如感測器和物聯網的使用)的成長預計將為 MRO 領域帶來進步。預測性維護可以在出現可見缺陷之前更換製造的零件,從而減少停機時間並節省成本。

- 然而,遵守各種法規和安全標準的日益成長的需求也給企業帶來了挑戰,導致MRO產品成本增加,並對市場成長構成挑戰。此外,供應商之間的價格競爭加劇導致利潤率下降和市場成長放緩。

- 新冠疫情擾亂了全球供應鏈,使MRO公司難以獲得維護和修理機器所需的零件和設備,導致一些公司服務延遲並增加成本。疫情導致的經濟放緩也減少了對 MRO 產品和服務的需求,進一步影響了市場成長。

MRO市場趨勢

工業MRO佔較大市場佔有率

- 維護、維修和營運(MRO)對於工業運作至關重要。有效的 MRO 實踐有助於公司管理其庫存和供應鏈,這在需要多種不同材料的製造過程中非常重要。缺少一兩個關鍵供應商可能會帶來災難性的後果,因此擁有可靠、高效的 MRO 系統至關重要。

- 工業 MRO 涵蓋各種物品和材料,包括物料輸送設備、黏合劑、磨料、泵浦、工業馬達、密封劑和膠帶、潤滑劑、實驗室用品和測試設備。特別是,隨著製造業為響應工業 4.0 法規數位化而不斷採用創新的物料輸送系統,物料輸送設備預計將經歷快速成長。

- 維護通常包括運作設備直至其發生故障,或根據運作進行主動維護。作為物料輸送的一部分,實施維護計劃並監控和分析即時運作資訊以預測零件和零件故障的機率。 GoExpedi 等公司已經開發了數位線上平台,以徹底改變能源和工業 MRO 資產的採購流程。

- 預計未來幾年工業馬達驅動的鼓風機、風扇、工業機器人、水泵和醫療設備的市場需求將會增加。最終用戶越來越願意投資節能技術,以減少碳排放、降低營運成本並提高營運效率,從而形成推動收益成長的長期趨勢。總體而言,有效的 MRO 實踐和創新技術的採用將在未來工業營運的成功中發揮關鍵作用。

亞太地區成長強勁

- 印度、日本、中國、澳洲和馬來西亞是該地區的主要國家。汽車零件、半導體晶片和資料中心等製造業的投資增加預計將推動對 MRO 供應商的需求。此外,快速的都市化和對永續建築日益成長的需求預計將推動亞太地區建築市場的成長。預計融入智慧功能以確保能源效率的綠色設施也會引起人們的濃厚興趣。

- 印度是亞太地區成長最快的MRO市場之一,得益於製造業、工業化、自動化和數位化的快速發展。製造業的擴張導致對維護的需求增加,以保持機器和流程高效運作,從而刺激了該國 MRO 市場的成長。

- 市場正在見證主要企業的合併、收購和投資,這是他們改善營運、擴大影響力以接觸客戶並滿足各種應用需求的策略的一部分。例如,2023 年 1 月,Capital A 的工程部門亞洲數位工程 (ADE) 在新山士乃開設了一個新的 MRO(維護、維修和營運)機庫設施,進一步加強了其提供最具價值、覆蓋範圍廣、效率高的一流 MRO 服務的使命。

- 印度大公司正大力投資研究市場。例如,阿達尼國防系統與技術有限公司(ADSTL)成立於2022年10月。 ADSTL是阿達尼企業的子公司,也是阿達尼集團的國防製造部門,該公司收購了印度歷史最悠久的MRO公司Air Works。

- 建設業仍然是澳洲的重要產業。例如,2022 年 4 月,Multiplex 完成了 AMP Capital 在雪梨的 50 層辦公大樓 Quay Quarter Tower 的建造。該建築由可移動的玻璃體積堆疊而成。在整個建設過程中,這座擁有45年歷史的建築從原來的45,000平方公尺擴大到89,000平方公尺,這表明澳洲建築業對MRO的需求和要求日益成長。

- 2022 年 4 月,ProcMart 在印度推出了用於大規模庫存管理的店中店解決方案。該公司實施了一種模型,透過全面、主動的 MRO 資產管理方法幫助客戶提高業務績效。該服務旨在幫助大型企業改善維護、維修和營運(MRO),同時增強其製造業務,節省成本和時間。

MRO產業概覽

MRO 市場包括 Wurth Group GmbH、Airgas Inc.(液化空氣公司)、Applied Industrial Technologies Inc. 和 MSC Industrial Direct Co. 這些參與企業在競爭激烈的市場中展開激烈競爭。市場參與企業採用的關鍵競爭策略包括收購、與產業參與企業合作以及推出新產品。

2023年3月,索能達法國宣布收購太陽能和能源效率解決方案私人分銷商安聯集團(Alliantz)的多數股權。此次收購將使該公司能夠迅速利用其分銷網路並增強技術力,以更好地服務專業的電氣和太陽能安裝商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 對供應鏈效率的需求不斷增加

- 由於對工業 4.0 的日益關注,製造設施不斷增加

- 市場限制

- COVID-19 對供應鏈的影響

第6章市場區隔

- 按 MRO 類型

- 工業MRO

- 電氣 MRO

- 設施維護、維修和大修

- 其他MRO類型

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 供應商市場佔有率

- 合併與收購

- 公司簡介

- Wurth Group GmbH

- Airgas Inc.(Air Liquide SA)

- Applied Industrial Technologies Inc.

- MSC Industrial Direct Co. Inc.

- Rubix Limited

- Motion Industries Inc.(Genuine Parts Company)

- ARCO limited

- ERIKS NV(SHV Holdings)

- WW Grainger Inc.

- Hayley Group Limited

- RS Components

- WESCO International Inc.

- Sonepar SA

第8章投資分析

第9章 市場機會與未來趨勢

The Maintenance, Repair, And Operations Market size is estimated at USD 440.81 billion in 2025, and is expected to reach USD 493.40 billion by 2030, at a CAGR of 2.28% during the forecast period (2025-2030).

Key Highlights

- The increasing adoption of smart technologies in manufacturing industries and outsourcing strategies to improve operational efficiency and reduce costs are some of the major drivers of market growth.

- Moreover, a growing focus on sustainability has led to a shift towards repairing parts rather than replacing them, contributing to the MRO market's growth by generating demand for MRO products. The emergence of new technologies and the need for enhanced competitiveness have also transformed the MRO industry, with market vendors now providing a wide range of products to cater to different customer needs.

- The development of smart factories and the growth of predictive maintenance, such as the use of sensors and iot, are expected to bring advancements in the MRO sector. Predictive maintenance allows for replacing manufacturing components before visible defects appear, thereby reducing downtime and saving costs.

- However, the increasing need for compliance with various regulations and safety standards is also a challenge for companies, leading to higher costs of MRO products and challenging market growth. Additionally, increasing competition among suppliers to compete on price leads to reduced profit margins and slow market growth.

- The COVID-19 pandemic disrupted global supply chains, making it challenging for MRO companies to get the necessary parts and equipment to maintain and repair machinery, resulting in delays in service and increased costs for some companies. The economic slowdown caused by the pandemic also reduced demand for MRO products and services, further impacting the market's growth.

MRO Market Trends

Industrial MRO to Occupy Significant Market Share

- Maintenance, repair, and operations (MRO) are essential for industrial operations. Effective MRO practices can help companies manage their inventory and supply chain, which is critical in a manufacturing process that requires several different materials. The absence of one or two critical suppliers can have disastrous consequences, making it important to have a reliable and efficient MRO system.

- Industrial MRO encompasses a wide range of items and materials, including material handling equipment, adhesives, abrasives, pumps, industrial motors, sealants and tapes, lubricants, lab supplies, and test equipment. Among these, material-handling equipment is expected to see rapid growth as the manufacturing industry continues to adopt innovative material-handling systems in response to Industry 4.0 regulations and digitization.

- Maintenance is typically approached in two ways: operating equipment until it breaks or implementing proactive maintenance based on operating hours. As part of materials handling, a maintenance schedule is implemented, with real-time operational information monitored and analyzed to forecast the probability of a part or component fails. Companies like GoExpedi have developed digital online platforms to revolutionize the procurement process for energy and industrial MRO assets.

- In the coming years, the market demand for blowers, fans, industrial robots, water pumps, and medical equipment equipped with industrial motors is expected to increase. End users are increasingly willing to invest in energy-efficient technology to lower their carbon footprint and operating expenses while enhancing operational efficiency, which creates long-term trends that enable revenue development. Overall, effective MRO practices and the adoption of innovative technologies will play a critical role in the success of industrial operations in the future.

Asia Pacific to Witness Significant Growth

- India, Japan, China, Australia, and Malaysia are the major countries considered in this region. The growing investment in the manufacturing industry, including automotive spare parts, semiconductor chips, and data centers, is expected to increase demand for MRO vendors. Additionally, the surge in urbanization and the increasing need for sustainable buildings are expected to drive growth in the Asia Pacific building construction market. Green facilities, which incorporate intelligent features to ensure energy efficiency, are also anticipated to generate high interest.

- India has one of the fastest-growing MRO markets in the APAC region due to the country's rapid development in manufacturing, industrialization, automation, and digitization. The need for maintenance to keep machinery and processes operating efficiently is rising along with the manufacturing sector's expansion, fueling the growth of the MRO market in the nation.

- The market is witnessing mergers, acquisitions, and investments by key players as part of their strategy to improve business and expand their presence to reach customers and meet their requirements for various applications. For example, in January 2023, Asia Digital Engineering (ADE), the engineering arm of Capital A, opened its new MRO (Maintenance, Repair, and Overhaul) hangar facility in Senai, Johor Bahru, further strengthening its mission of offering the best value, best in class MRO services with high efficiency across a vast coverage of locations.

- Significant players in India are investing heavily in the studied market. For instance, in October 2022, Adani Defence Systems & Technologies Ltd. (ADSTL), a subsidiary of Adani Enterprises and the defense manufacturing arm of Adani Group, acquired India's oldest MRO company, Air Works, which currently has a total presence across 27 cities for an enterprise value of around Rs 400 crore (USD 48.2 million).

- The construction industry remains one of the essential sectors in Australia. For example, in April 2022, Multiplex completed AMP Capital's 50-story office called the Quay Quarter Tower in Sydney. The building is equipped with shifting glass volumes stacked upon each other. During the entire construction process, a 45-year-old building that was initially 45,000 square meters was converted to 89,000 square meters, indicating a greater demand and requirement for MRO in Australia's overall construction sector.

- In April 2022, ProcMart launched store-in-store solutions for large-scale inventory management in India. The business introduced the model to help clients enhance performance with an overall proactive approach to MRO asset management. The service aims to enable large-scale companies to improve maintenance, repair, and operations (MRO) while beefing up manufacturing, consequently saving money and time.

MRO Industry Overview

The MRO market comprises several global and regional players, such as Wurth Group GmbH, Airgas Inc. (Air Liquide SA), Applied Industrial Technologies Inc., and MSC Industrial Direct Co. Inc. These players are competing fiercely in a highly competitive market. Vendors in the market are adopting key competitive strategies such as acquisitions, partnerships with industry participants, and new product rollouts.

In March 2023, Sonepar France announced the acquisition of a majority stake in Alliantz, a privately-owned distributor of photovoltaics and energy efficiency solutions. This acquisition will enable the company to rapidly leverage its distribution network and strengthen its technical capabilities to better serve electrical and specialized solar installers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Efficiency in Supply Chain

- 5.1.2 Increasing Focus on Industry 4.0, Leading to More Manufacturing Facilities

- 5.2 Market Restraints

- 5.2.1 Spread of COVID-19 to Affect the Supply Chain

6 MARKET SEGMENTATION

- 6.1 By MRO Type

- 6.1.1 Industrial MRO

- 6.1.2 Electrical MRO

- 6.1.3 Facility MRO

- 6.1.4 Other MRO Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Mergers and Acquisitions

- 7.3 Company Profiles

- 7.3.1 Wurth Group GmbH

- 7.3.2 Airgas Inc. (Air Liquide SA)

- 7.3.3 Applied Industrial Technologies Inc.

- 7.3.4 MSC Industrial Direct Co. Inc.

- 7.3.5 Rubix Limited

- 7.3.6 Motion Industries Inc. (Genuine Parts Company)

- 7.3.7 ARCO limited

- 7.3.8 ERIKS N.V. (SHV Holdings)

- 7.3.9 W. W. Grainger Inc.

- 7.3.10 Hayley Group Limited

- 7.3.11 RS Components

- 7.3.12 WESCO International Inc.

- 7.3.13 Sonepar SA