|

市場調查報告書

商品編碼

1687935

電信 API -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Telecom API - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

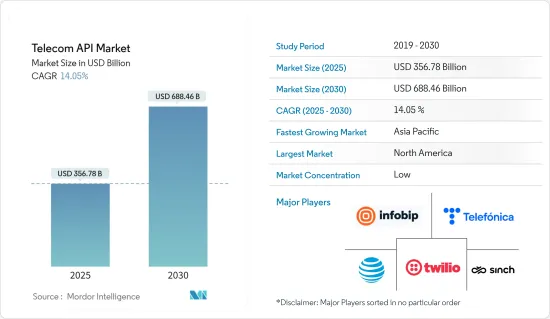

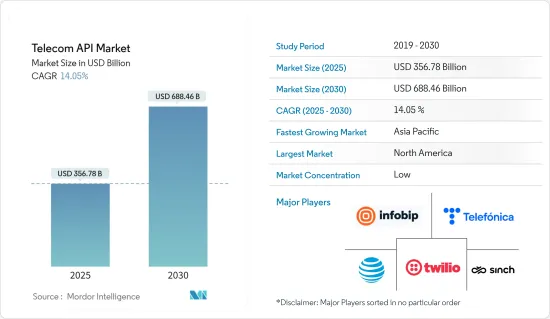

預計 2025 年電信 API 市場規模為 3,567.8 億美元,到 2030 年將達到 6,884.6 億美元,預測期內(2025-2030 年)的複合年成長率為 14.05%。

通訊API(應用程式介面)是一系列通訊協定、工具和定義,允許各種軟體應用程式與通訊網路服務進行通訊和交互,例如語音呼叫、通訊、定位服務、付款處理等。此外,智慧型手機的廣泛普及和行動應用程式的日益普及對通訊API 產生了巨大的需求,這些 API 通常用於增強應用程式功能。愛立信預計,2023年全球智慧型手機行動網路用戶數將達到約67億,到2028年將超過77億人。

關鍵亮點

- 通訊業者正在進行數位轉型以保持競爭力。 API 支援不同系統之間的整合並促進新的數位服務。通訊業者不僅利用 API 提供服務,還透過收入分成和基於訂閱的定價等 API收益模式創造額外的收益來源。

- 例如,2024年5月,Digital Nasional Berhad(DNB)和愛立信宣布了一項計劃,利用世界領先的5G網路的功能來加速馬來西亞企業的數位化。這些開創性的行業舉措為先進技術鋪平了道路,使各個行業的企業能夠實現數位化,並推動馬來西亞向數位先進國家邁進。

- 物聯網設備的激增需要設備與後端系統之間的無縫連接和通訊。電信API提供設備管理、資料交換和控制所需的介面,支援物聯網生態系統的發展。根據 IHS 預測,到 2025 年,將有超過 750 億台物聯網 (IoT) 連接設備投入使用。

- 亞太和非洲等市場通訊API 領域新興企業近期的崛起預計將為預測期內的通訊API服務供應商帶來獨特的機會。沃達豐、Google等產業巨頭、通訊服務供應商(CSP)和技術供應商夥伴關係正在與這些新興市場新興企業合作,並提供應用開發的API,從而完善通訊新興企業成長的培育生態系統,促進市場成長。例如,2023 年 11 月,Twilio 和 Nexmo 等領先公司正在將 AI 整合到其 API 中,以使自動化任務和個人化通訊更加創新和高效。

- 此外,與現有舊有系統的兼容性問題阻礙了 API 的無縫整合。由於與舊有系統的兼容性問題,API 整合面臨相當大的挑戰。這些障礙源自於舊舊有系統的架構和技術與現代 API 的要求之間的顯著差異。舊有系統通常需要更大的靈活性、標準合規性和適應性才能無縫連接新的 API。這些挑戰包括舊有系統和現代 API 標準之間的技術差異、資料格式、安全通訊協定、可擴展性等等。解決這些挑戰對於發揮現有系統中現代 API 的潛力至關重要。

- 在新冠疫情期間,通訊API供應商透過實施新產品開發、併購、地理擴張等策略,開發了解決方案來應對疫情,以實現更好的可近性。例如,去年3月,美國T-Mobile Venture投資了開發語音、視訊和通訊API的通訊API開發新興企業Signalwire,以開發API和5G技術。

- 此外,俄羅斯-烏克蘭戰爭擾亂了該地區的基礎設施和網際網路連接,導致通訊API 提供者及其客戶的服務中斷。這種地緣政治緊張局勢可能導致監管變化和製裁,影響跨國業務營運,電訊API 市場的夥伴關係和交易變得複雜。

通訊API 市場趨勢

混合動力汽車佔據了很大的市場佔有率

- 通訊API 的混合部署是指結合內部部署基礎架構和雲端服務的模型。該策略允許通訊業者在利用雲端的靈活性和可擴展性的同時保持對其關鍵系統和資料的控制。通訊業者通常選擇混合方法來受益於雲端的效率,同時仍遵守監管要求。例如,2023 年 4 月,Google Cloud 宣布推出基於 Apigee 技術建構的 Anthos Service Mesh,用於管理和保護混合環境中的 API 流量。

- 通訊產業正在經歷從實體網路到數位網路的重大轉變。電訊業擁有廣泛的消費者群體,無論家用電子電器產品或身處何地,都需要為其提供廣泛的服務。作為回應,通訊業者正在轉向雲端解決方案來提供符合消費者需求的服務。

- 對微服務日益成長的需求可以看作是企業應用開發的自然演變。在當前市場情勢下,向雲端平台遷移並向 API 經濟轉變等技術趨勢顯而易見。基於網路的應用程式可協助通訊產業的服務供應商提高行動通訊、寬頻服務和開放原始碼技術的品質和可靠性,增加市場佔有率並提高盈利。

- 通訊業者專注於改善客戶體驗,正在利用微服務架構 (MSA) 重新思考其 IT 和網路架構能力,以支援可擴展性和彈性。在世界各地政府法規的推動下,通訊業者正在透過 API 開放其通訊系統。預計這將推動整個通訊經營模式中中介軟體架構解決方案的成長。

- 行動應用支援環境 (MASE) 是一個在行動裝置和稱為行動閘道的裝置上運作的分散式系統。後者充當固定和無線網路基礎設施之間的橋樑。它是行動用戶端的代理,這些客戶端通常透過頻寬有限的不可靠無線接取網路連接。 MASE 描述了對 UMTS 適配層 (UAL) 的訪問,從而實現了應用程式和中介軟體元件對所有可能的底層網路的統一存取。額外的通用支援層描述了分散式系統所需的功能。

- 蜂巢式網路技術的進步使用戶能夠體驗更快的資料通訊和更低的延遲。此外,資料密集型服務和應用程式的使用正在迅速成長。透過行動電話網路傳輸的資料量大幅增加,主要原因是消費者對影片的需求以及企業和消費者向雲端服務的轉變。預計此因素將推動對 5G 連線的需求,5G 連線可提供更快的速度和更高容量的網路。此外,隨著未來幾年 5G 的推出,預計通訊業者將熱衷於專注於中間件架構供應商支援的邊緣運算解決方案。根據愛立信2023年11月發布的《行動報告》,預計2029年底,5G行動用戶數將超過53億人。

- 許多企業正在投資混合解決方案,因為它們提供了靈活的方法。各種通訊業者融合內部部署和雲端基礎的解決方案的優勢。例如,2024 年 2 月,擁有超過 8,900 萬用戶的日本主要行動通訊業者NTT Docomo Corporation 選擇 AWS 在日本全國各地商業部署其 5G 開放無線接取網路(RAN)。 AWS 正在支援 Docomo 在 AWS 上開發將在混合雲端環境中運行的 5G Core。

北美佔據主要市場佔有率

- 該地區正在推動顯著的市場成長,主要得益於早期和廣泛採用 API 技術。快速的技術創新以及雲端基礎的服務在通訊領域的日益普及預計將推動通訊API 市場的成長。例如,2023 年 2 月,通訊業者計劃在未來三到五年內每年平均投資 2.06 億美元用於通訊業者雲端轉型計畫所需的技術,以支援其行動網路策略。

- 該地區由美國和加拿大組成。在美國,相當多的行動網路業者已經在利用通訊API 來維護語音自動電話偵測和騷擾電話管理。其中一些相同的流程和程序可能成為 LoT 網路身份驗證和授權代理的橋樑。根據通訊的預測,到2023年美洲的行動用戶數將超過11.4億人。

- 近日,滑鐵盧大學宣布成立「5G及未來」行動網路技術合作組織,致力於建構安全的5G網路切片,加強加拿大的國家安全與國防。該組織獲得美國國防部 (DND) 國防卓越與安全創新 (IDEaS) 計畫的資助。來自滑鐵盧大學的一群電腦科學家正在主導這個多方合作夥伴聯盟。費用為150萬加元(112萬美元)。

- 此外,根據 GSMA 的數據,到 2023 年,5G 連線預計將佔加拿大所有行動連線的 34%,到 2025 年將達到 49%。

- 此外,政府旨在改善數位連接和支持通訊創新的措施正在推動市場需求。資助計畫和獎勵可以鼓勵國家通訊網路的推廣。 2023年4月,愛立信與加拿大政府合作,承諾在未來五年內投資超過4.7億加幣用於下一代技術的研發,包括人工智慧、5G Advanced、6G、Cloud RAN和核心網路。

- 隨著對經濟高效且方便用戶使用的基於瀏覽器的通訊解決方案的需求不斷成長,許多知名供應商正在尋求在該地區採用垂直特定的 WebRTC 和雲端解決方案,這有望推動市場成長。

- 加拿大設施型通訊服務供應商,即建設和營運加拿大通訊網路的公司,專注於確保對網路基礎設施和營運的投資,從而在不斷成長的網路流量和不斷變化的使用模式面前擁有極強的彈性網路,進一步推動通訊API 市場的發展。

電信 API 產業概覽

電信 API 市場競爭激烈,主要通訊業者包括 AT&T Inc.、諾基亞公司、Twilio Inc. 和愛立信。

- 2024 年 2 月,愛立信旗下的 Vonage 與美國跨國通訊業者AT&T 聯手,透過 API 將網路的功能擴展到開發人員和企業。 Vonage通訊和網路 API 使開發人員能夠輕鬆地將通訊功能嵌入應用程式、系統和工作流程中。

- 2023年9月,德國通訊業者德國電信宣布以「MagentaBusiness API」品牌實現網路應用程式介面(API)的商業化。這使得開發人員和企業客戶能夠建立透過德國電信網路在德國各地通訊的應用程式和服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭強度

- 替代品的威脅

- 主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 行動資料需求不斷成長以及數位通訊的興起

- 5G技術的出現

- 市場問題

- 越來越多的 API 漏洞引發安全性疑慮

第6章通訊業的 API使用案例

第7章市場區隔

- 按服務類型

- 通訊API

- IVR/語音商店、語音控制 API

- 付款API

- WebRTC(即時連線)API

- 位置和地圖 API

- 用戶身分管理和 SSO API

- 其他

- 依部署類型

- 混合

- 多重雲端

- 其他

- 按最終用戶

- 企業開發者

- 內部電信開發人員

- 合作夥伴開發者

- 長尾開發者

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 韓國

- 澳洲

- 紐西蘭

- 印度

- 泰國

- 新加坡

- 馬來西亞

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

第8章競爭格局

- 公司簡介

- AT& T Inc.

- Telefonica SA

- Twilio Inc.

- Infobip Ltd

- Sinch(CLX Communication)

- Verizon Communications Inc.

- Orange SA

- Deutsche Telekom AG

- Ribbon Communications

- Huawei Technologies Co. Ltd

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Google LLC(Apigee Corporation)

- Vodafone Group

- Nokia

第 9 章供應商能力矩陣

第 10 章 關鍵供應使用案例

第11章投資分析

第12章:投資分析市場的未來

The Telecom API Market size is estimated at USD 356.78 billion in 2025, and is expected to reach USD 688.46 billion by 2030, at a CAGR of 14.05% during the forecast period (2025-2030).

A telecom API (application programming interface) is a set of protocols, tools, and definitions that allow different software applications to communicate and interact with telecom network services, such as voice calling, messaging, location services, and payment processing. Further, the proliferation of smartphones and the increasing popularity of mobile apps created a significant demand for telecom APIs, often used to enhance app functionality. According to Ericsson, smartphone mobile network subscriptions worldwide reached almost 6.7 billion in 2023, and they are expected to exceed 7.7 billion by 2028.

Key Highlights

- Telecom companies are undergoing digital transformation to stay competitive. APIs enable integration between different systems and facilitate new digital services. Telecom operators are leveraging APIs not only for service delivery but also for generating additional revenue streams through API monetization models such as revenue sharing and subscription-based pricing.

- For instance, in May 2024, Digital Nasional Berhad (DNB) and Ericsson announced a program to catalyze the digitalization of enterprises in Malaysia, enabled by the capabilities of the world-leading 5G network. These pioneer industry initiatives will pave the way for advanced technologies to enable the digitalization of enterprises across different industry verticals and drive Malaysia forward as a leading digital nation.

- The proliferation of IoT devices requires seamless connectivity and communication between devices and backend systems. Telecom APIs provide the necessary interfaces for device management, data exchange, and control, supporting the growth of the IoT ecosystem. According to IHS, more than 75 billion Internet of Things (IoT) connected devices will be in use by 2025.

- The recent increase in the number of startups launched in the field of telecom API in markets such as Asia-Pacific and Africa is anticipated to open unique opportunities for telecom API service providers during the forecast year. Industry giants such as Vodafone, Google, and communications service providers (CSPs) and technology supplier groups have created partnerships with startups from these emerging markets to complete a nurturing ecosystem for the growth of telecom startups by offering their APIs for application developments, thus propelling the market's growth. For instance, in November 2023, major players like Twilio and Nexmo integrated AI into their APIs, making them more innovative and efficient for automating tasks and personalizing communications.

- Moreover, compatibility issues with existing legacy systems obstruct the seamless integration of APIs. The integration of APIs faces considerable challenges due to compatibility issues with legacy systems. These hurdles stem from the significant differences between the architecture and technology of older legacy systems and the requirements of modern APIs. Often, legacy systems need more flexibility, standards compliance, and adaptability to connect with newer APIs seamlessly. These challenges include technological disparities, data formats, security protocols, and scalability between legacy systems and modern API standards. Addressing these challenges is critical to harness the potential of modern APIs within existing systems.

- At the time of the COVID-19 pandemic, telecom API vendors developed solutions to cope with the situation for better accessibility by implementing strategies such as new product developments, mergers and acquisitions, and geographical expansion. For instance, in March of the previous year, US-based T-Mobile Venture invested in telecom API development startup Signalwire, which develops voice, video, and messaging APIs to advance API and 5G technology, among others.

- In addition, the Russia-Ukraine War disrupted infrastructure and internet connectivity in the region, leading to service interruptions for telecom API providers and their customers. Such geopolitical tensions may result in regulatory changes or sanctions affecting cross-border business operations, potentially complicating partnerships and transactions in the telecom API market.

Telecom API Market Trends

Hybrid Segment to Hold Considerable Market Shares

- Hybrid deployment in the context of telecom APIs refers to a model that combines on-premises infrastructure and cloud services. This strategy allows telecom companies to maintain control over critical systems and data while leveraging the flexibility and scalability of the cloud. Telecom companies often opt for a hybrid approach to comply with regulatory requirements while benefiting from cloud efficiencies. For instance, in April 2023, Google Cloud introduced Anthos Service Mesh, built on Apigee technology, for managing and securing API traffic in hybrid environments.

- The telecommunications sector is significantly transitioning from physical to digital networks. The telecom industry comprises a wide range of consumers who need to be offered a broad spectrum of services, irrespective of their appliances and locations. To cater to this, telecom carriers seek cloud solutions to deliver their services in response to consumer demands.

- This rise in demand for microservices can be considered a sign of the natural evolution of enterprise application development. Technology trends, such as migration to cloud platforms and shifting toward an API economy, are witnessed in the current market scenario. Web-based applications can help service providers in the telecom industry improve the quality and reliability of their mobile communications, broadband services, and open-source technologies, boost their market share, and improve their profitability.

- Focusing on improving the customer experience, telecommunications players are revising microservices architecture (MSA) in their IT and network architectural capabilities to support extensibility and elasticity. The supportive government regulations worldwide encourage telecom players to open their communication systems via APIs. This is expected to promote the growth of middleware architecture solutions across telecommunications business models.

- The Mobile Application Support Environment (MASE) is a distributed system that works on mobile devices and devices known as mobility gateways. The latter act as a bridge between fixed and wireless network infrastructures. It is an agent for mobile clients, often linked over unreliable wireless access networks with limited bandwidth. MASE gives access to the UMTS adaption layer (UAL), which allows unified access to all conceivable underlying networks for applications and middleware components. An additional general support layer provides the functionality required for distributed systems.

- The evolution of cellular network technology has authorized users to experience faster data speeds and lower latency. It has also prompted the rapidly increasing use of data-heavy services and applications. The significant rise in the volume of data carried by cellular networks has been primarily driven by consumer need for video and business and consumer moves to cloud services. This factor is expected to drive the need for a 5G connection that offers fast and high-capacity networks. Moreover, with the introduction of 5G in the coming years, telecom companies are expected to be eager to focus on edge computing solutions, which would be enabled by middleware architecture vendors. According to the Ericsson Mobility Report released in November 2023, 5G mobile subscriptions were anticipated to exceed 5.3 billion by the end of 2029.

- Various players are investing in hybrid solutions as they offer a flexible approach, allowing telecom companies to blend the benefits of on-premises and cloud-based solutions. This also enables them to meet varying compliance requirements, security concerns, and scalability needs. For instance, in February 2024, NTT DOCOMO INC., Japan's significant mobile operator with more than 89 million subscribers, selected AWS to commercially deploy its nationwide 5G Open Radio Access Network (RAN) in Japan. AWS supports DOCOMO in developing its 5G Core on AWS, which runs in a hybrid cloud environment.

North America to Hold Significant Market Share

- The region is significantly driving market growth mainly due to its early and widespread adoption of API technologies. Rapid technological innovations, along with the increasing penetration of cloud-based services across the telecom sector, are expected to drive the growth of the telecom API market. For instance, in February 2023, telecom operators planned to invest an average of USD 206 million per year for the next three to five years in the technologies required for the telco cloud transformation programs to support their mobile network strategies.

- The region comprises the United States and Canada. A significant number of mobile network operators are already leveraging telecom APIs to sustain robocall detection and unwanted call management in the United States. Some of these same processes and procedures will become bridges toward the mediation of LoT network authentication and authorization. According to the International Telecommunication Union, in 2023, the number of mobile subscriptions in the Americas region totaled over 1.14 billion.

- Recently, to create safe 5G network slicing and enhance Canada's security and defense, the University of Waterloo announced the creation of the "5G and Beyond" mobile network technology collaboration. The organization has received funding from the Department of National Defense (DND) for its Innovation for Defense Excellence and Security (IDEaS) program. A group of computer scientists from the University of Waterloo is leading the multi-partner consortium. It will cost CAD 1.5 million (USD 1.12 million).

- In addition, according to GSMA, in 2023, 5G connections accounted for 34% of all mobile connections in Canada, and they are expected to reach 49% by 2025.

- Furthermore, government initiatives aimed at improving digital connectivity and supporting innovation in telecommunications drive the demand in the market. Funding programs and incentives may encourage the deployment of telecom networks nationwide. In April 2023, Ericsson invested more than CAD 470 million for the next five years jointly with the government of Canada in the research and development (R&D) of next-generation technologies such as artificial intelligence, 5G advanced, 6G, Cloud RAN, and core network.

- With the rising demand for cost-effective and user-friendly browser-based communication solutions, many notable vendors are looking to introduce vertical-specific WebRTC and cloud solutions in the region, which is expected to boost the market's growth.

- Canada's facilities-based telecommunications service providers, the companies that build and operate Canada's telecommunications networks, are focused on ensuring investments in network infrastructure and operations, resulting in incredibly resilient networks in the face of intensified network traffic and altered usage patterns, further propelling the telecom API market.

Telecom API Industry Overview

The intensity of competitive rivalry is high in the telecom API market, owing to the presence of major telecom players such as AT&T Inc., Nokia Corporation, Twilio Inc., and Ericsson. The level of intensity of competitive rivalry is expected to increase significantly during the forecast period, owing to higher market penetration and the deployment of powerful, innovative API algorithms, especially by established market players.

- February 2024: Ericsson-owned Vonage and American multinational telecommunications operator AT&T collaborated to expand the power of the network for developers and enterprises through APIs. Vonage's communications and network APIs make it easy for developers to embed communications capabilities into applications, systems, and workflows.

- September 2023: German carrier Deutsche Telekom announced the commercial launch of network application programming interfaces (APIs) under the brand "MagentaBusiness API." With this, developers and business customers can now build apps and services that communicate using Deutsche Telekom's network in Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Mobile Data and the Rise of Digital Communication

- 5.1.2 Advent of 5G technology

- 5.2 Market Challenges

- 5.2.1 Security Concern Due to the Increasing API Vulnerabilities

6 API USE CASES IN THE TELECOM INDUSTRY

7 MARKET SEGMENTATION

- 7.1 By Type of Service

- 7.1.1 Messaging API

- 7.1.2 IVR/Voice Store and Voice Control API

- 7.1.3 Payment API

- 7.1.4 WebRTC (Real-Time Connection) API

- 7.1.5 Location and Map API

- 7.1.6 Subscriber Identity Management and SSO API

- 7.1.7 Other Types of Service

- 7.2 By Deployment Type

- 7.2.1 Hybrid

- 7.2.2 Multi-cloud

- 7.2.3 Other Deployment Types

- 7.3 By End User

- 7.3.1 Enterprise Developer

- 7.3.2 Internal Telecom Developer

- 7.3.3 Partner Developer

- 7.3.4 Long Tail Developer

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.3.1 China

- 7.4.3.2 South Korea

- 7.4.3.3 Australia

- 7.4.3.4 New Zealand

- 7.4.3.5 India

- 7.4.3.6 Thailand

- 7.4.3.7 Singapore

- 7.4.3.8 Malaysia

- 7.4.3.9 Rest of Asia-Pacific

- 7.4.4 Latin America

- 7.4.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 AT&T Inc.

- 8.1.2 Telefonica SA

- 8.1.3 Twilio Inc.

- 8.1.4 Infobip Ltd

- 8.1.5 Sinch (CLX Communication)

- 8.1.6 Verizon Communications Inc.

- 8.1.7 Orange SA

- 8.1.8 Deutsche Telekom AG

- 8.1.9 Ribbon Communications

- 8.1.10 Huawei Technologies Co. Ltd

- 8.1.11 Telefonaktiebolaget LM Ericsson

- 8.1.12 Cisco Systems Inc.

- 8.1.13 Google LLC (Apigee Corporation)

- 8.1.14 Vodafone Group

- 8.1.15 Nokia