|

市場調查報告書

商品編碼

1687916

語音生物辨識:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Voice Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

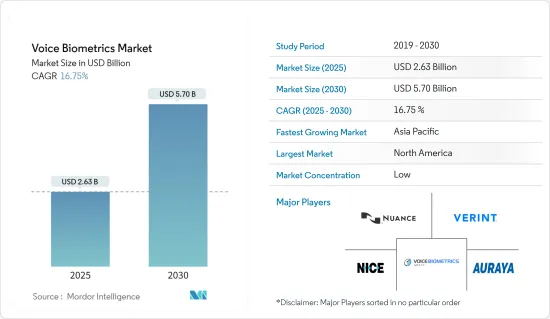

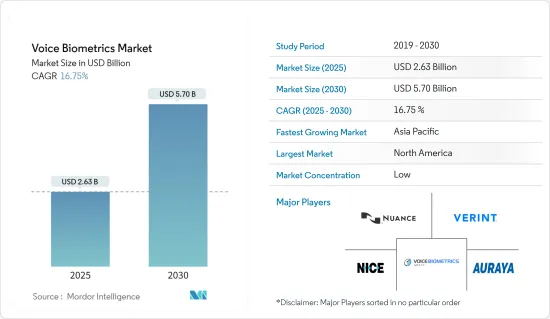

語音生物辨識市場規模預計在 2025 年為 26.3 億美元,預計到 2030 年將達到 57 億美元,預測期內(2025-2030 年)的複合年成長率為 16.75%。

隨著專業詐騙大規模使用被盜資料的現象迅速成長,基於知識的身份驗證越來越不足以區分合法用戶和詐騙。這就是生物辨識技術越來越受歡迎的原因。語音生物辨識是一種多功能技術,可用於多個領域,包括客服中心身份驗證、免持介面、銀行帳戶保護和行動應用開發。

主要亮點

- 政府和私人服務擴大使用數位平台,金融公司競相使銀行業務變得更簡單、更容易訪問,這些都推動著對同樣強大、安全、故障率極低的身份驗證技術的需求。市場已經從傳統的密碼認證流程轉向無密碼認證技術。語音辨識由於其能夠識別具有不同特徵的所有個體的獨特能力,已成為最強大的身份驗證技術之一。

- 銀行業、汽車業和醫療保健業是重點產業。醫療保健是三者中採用語音辨識最多的領域,採用語音辨識技術協助創建電子健康記錄。同時,越來越多的銀行正在整合語音認證以增強安全性,尤其是對於透過電話進行的交易。

- 語音銀行正在席捲金融業,金融科技公司競相提供更先進、更強大、更安全的解決方案。預計未來幾年語音銀行將朝幾個方向發展。據智慧軟體工程稱,1,800 萬美國消費者已經嘗試了語音支付,許多銀行和金融機構也正在向其客戶提供該服務。語音銀行的成長預計將推動市場成長。由於行動和網路銀行應用程式中語音辨識的廣泛應用,預計銀行業在預測期內將實現顯著成長。

- 生物辨識語音系統的效率取決於語音辨識和語音辨識的成功,這會影響解決方案的整體表現。研究人員和公司已經採用了許多方法來從訊號中識別語音特徵,包括 LPCC、MFCC 和 LPC。生物辨識語音系統之所以受到廣泛認可,是因為該解決方案具有高效、準確、辨識速度快、產品功能強大、成本低廉、使用者友善的特性。

- COVID-19 疫情凸顯了語音生物辨識作為非接觸式身分驗證方法的必要性,對研究市場的需求方動態產生了正面影響。根據 2021 年生物辨識調查,64% 的受訪者正在提高支援遠端入職和行動應用程式的技術優先級,從而直接產生對語音生物識別技術的需求。

語音生物辨識市場趨勢

銀行、金融服務和保險成為語音生物辨識應用的關鍵領域

- 銀行需要掌握最佳的身份驗證方法來打擊網路詐騙。傳統上,銀行使用基於知識的身份驗證方法,例如 PIN 和動態密碼。對非接觸式和無縫技術的需求已經滲透到銀行安全領域,尤其是考慮到 COVID-19 疫情的影響。銀行業務中的語音生物辨識技術是一種很有前景的網路銀行解決方案,它超越了需要人員親自到場的視網膜和指紋掃描器。

- 此外,隨著攻擊者/駭客變得越來越老練,潛在目標和入口點的數量不斷擴大,金融業的網路攻擊正在顯著增加。此外,隨著新銀行和金融科技的普及和增加,用戶數量也大幅增加。儘管銀行官員多次警告,人們仍然陷入詐騙的陷阱。例如,印度儲備銀行 (RBI) 報告稱,21 會計年度印度全國發生了約 7,400 起銀行詐騙案件。印度儲備銀行表示,2020 年印度發生了 8,700 起銀行詐騙案件,涉案金額高達 1.85 兆印度盧比。此外,根據印度電腦緊急應變小組 (CERT-In) 報告的資訊,印度在 2019 年報告了無數起與數位銀行相關的網路安全事件,2020 年報告了 2,90,445 起。

- 此外,根據 VMware 的數據,2020 年上半年針對金融機構的網路攻擊與前一年同期比較增了 238%。自疫情開始以來,近 75% 的銀行和保險集團的網路犯罪激增。

- 業務語音生物辨識技術對於擴大便利銀行服務和改善客戶體驗至關重要。例如,銀行提供退休金和保險等社會安全產品,這些產品需要提供生活證明才能付款。語音生物辨識技術有助於個人身份驗證。生物辨識技術還可以識別人的聲音的某些特徵,從而使識別更加可靠和防篡改。

- 語音生物辨識技術也可以幫助加強 KYC 流程。例如,在南亞這樣的多語言國家,即使在偏遠地區,人們的教育程度也各有不同。語音生物辨識技術可以幫助這些人納入金融安全網,因為它是獨立於語言的解決方案。

- 此外,生理生物辨識技術需要在客戶所在地配備掃描儀,而語音生物辨識技術只需要現有的電話線和行動基礎設施。該軟體駐留在銀行。為了創建身份驗證樣本,可能會要求使用者說出隨機產生的短語。如果不匹配,則拒絕存取。此方法對於試圖利用錄音的駭客非常有效。

預計北美將佔最大佔有率

- 隨著行動和雲端技術的快速普及以及運算能力的空前技術進步,語音辨識技術正被廣泛應用於各種各樣的應用中。在美國,醫療保健產業有望在語音辨識技術的發展中發揮關鍵作用,因為該技術可用於記錄與健康相關的資料。語音辨識技術有可能取代目前仍在使用的許多傳統方法。

- 根據美國醫療保險和醫療補助服務中心的數據,預計2019年至2028年全國醫療保健支出將以每年平均5.4%的速度成長,2028年將達到6.2兆美元。這也包括在IT和計算服務方面的支出,以更好地儲存和保護患者資料。此外,醫療系統正在尋求語音轉錄來識別診斷過程中發現的可報銷情況,同時確保不會錯過重要的健康指標。

- 由於詐騙案件不斷增多,該地區盈利的銀行業擴大採用生物辨識技術。該地區已經實施了大量安全且多樣化的安全解決方案。在北美,G+D Mobile Security 與三星 SDS 合作,宣布推出符合 FIDO 標準的 Convegno 行動身分驗證。該解決方案利用生物識別,包括指紋、臉部、虹膜和語音識別,提供多因素身份驗證安全解決方案。

- 包括加拿大皇家銀行、蒙特利爾銀行和羅傑斯通訊在內的幾家加拿大機構已開始使用語音生物辨識技術透過電話識別消費者。加拿大道明銀行集團表示,客戶可以提供聲紋登入帳戶,並跳過客服中心的安全問題。為此,TD 使用 VoicePrint。 TD VoicePrint 是一種語音辨識系統,客戶可以在電話與銀行的現場客戶服務人員交談時使用他們的聲紋來驗證和確認他們的身份。

- 加拿大越來越多的商店正在轉向自助結帳,以便更好地服務顧客。根據達爾豪斯大學的雜貨店體驗全國調查報告,超過一半的加拿大人(54%)更喜歡自助結帳,66%的人至少有時使用自助結帳。儘管顧客可以根據自己的方便使用自助結帳,但這並不總是高效的。因此,許多加拿大商家正在探索店內語音生物識別解決方案。然而,由於設備和小工具的前期成本高,許多加拿大零售商似乎不願意升級到最新技術。

語音生物辨識行業概況

語音生物辨識市場競爭依然激烈,已有多家新興企業進入生物辨識生態系統。最近市場出現了一些併購活動。隨著大量資金湧入該領域的新興企業,我們可以期待未來幾年將看到多款新產品的推出。最近的趨勢如下:

- 2021 年 9 月-Skit(前身為 Vernacular.ai)在 B 輪資金籌措中獲得 2,300 萬美元。此輪融資由 WestBridge Capital主導,其他參與者包括 Exfinity Ventures、Kalaari Capital、Sense AI 領投的 Letsventure企業聯合組織,以及 Prophetic Ventures 的 Aaryaman Vir Shah 領投的 Angelist企業聯合組織。

- 2021 年 8 月-Lumen Vox 推出了新一代自動語音辨識(ASR) 引擎。新的自動語音辨識引擎基於人工智慧 (AI) 和深度機器學習 (ML),在提供最準確的語音客戶體驗方面勝過競爭對手。

- 2021 年 7 月-泰雷茲推出了新的語音生物辨識解決方案,它是泰雷茲數位身分服務平台的一部分,用於入職和身分驗證。新的解決方案可以輕鬆地與現有的客服中心註冊流程整合。

- 2021 年 6 月-Acurav 宣布其語音生物辨識技術 VoiSentry 可部署到身障者和言語障礙殘障人士。 VoiSentry 根據您聲音的一般特徵而不是特定的字詞來計算語音生物識別。這使得用戶可以確認他們的 IVR 選擇並使用他們的聲音來驗證身份和驗證檢查。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 技術簡介

- 評估新冠肺炎對市場的影響

第5章 市場動態

- 市場促進因素

- 安全威脅日益複雜

- 政府大規模部署技術以保障公民安全

- 市場挑戰

- 關於第三方(雲端)資料儲存的安全性問題

第6章 市場細分

- 類型

- 主動生物識別

- 被動生物識別

- 部署模型

- 本地

- 雲

- 公司規模

- 中小型企業

- 大型企業

- 按行業

- 銀行、金融服務和保險

- 零售與電子商務

- 資訊科技/通訊

- 政府和國防

- 其他行業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 澳洲

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲國家

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Nuance Communications Inc.

- Verint Systems Inc.

- Voice Biometrics Group

- NICE Ltd

- Auraya Inc.

- Phonexia SRO

- BioCatch Ltd

- Pindrop Security Inc.

- Aculab Inc.

- Uniphore Software Systems Pvt. Ltd

- LexisNexis Risk Solutions Inc.

- One Vault SA

- Lumen Vox LLC(Voice Trust GmBH)

- VoicePIN.com Sp. z oo

- SESTEK

第8章投資分析

第9章:市場的未來

The Voice Biometrics Market size is estimated at USD 2.63 billion in 2025, and is expected to reach USD 5.70 billion by 2030, at a CAGR of 16.75% during the forecast period (2025-2030).

The proliferation in the large-scale use of stolen data by professional fraudsters renders knowledge-based authentication increasingly inadequate for distinguishing legitimate users from fraudsters. This has led to the proliferation of biometric technologies. Voice biometrics is a versatile technology that uses several areas, including call center authentication, hands-free interface, bank account protection, and mobile application development.

Key Highlights

- With the increasing use of digital platforms for government and private services deployment and the race of financial firms to make banking simple and more accessible, there is a growing need for a similar, strong, and secured authentication technology with negligible chances of failure. The market is already transitioning from traditional password authentication processes to password-less authentication techniques. Owing to its unique feature of identifying every individual with different traits, voice recognition is gaining traction as one of the powerful authentication techniques.

- The banking, automotive, and healthcare sectors are significant. Healthcare was the largest of the three in deploying voice recognition to assist with creating electronic medical records. Meanwhile, a growing number of banks are integrating voice authentication for an extra layer of security, especially for transactions that take place over the phone.

- Voice banking is conquering the financial industry, and FinTechs are competing to offer more advanced, robust, and secure solutions. The development of voice banking is predicted to move in several directions in the next few years. According to Intelligent Software Engineering, 18 million US consumers have already tried paying by voice, and many banks and financial institutions offer this service to their clients. The growth of voice banking is anticipated to provide growth to the market. The banking sector is expected to register a significant growth rate over the forecast period, owing to the higher adoption of voice recognition in mobile and web banking applications.

- The proficiency of a biometric voice system is dependent on successful speech identification and voice recognition and affects the solution's overall performance. Researchers and corporations employ many approaches to identify voice features from a signal, including LPCC, MFCC, and LPC. The higher acceptability of the biometric voice system is credited to the solutions' efficiency, accuracy, identification speed, increased product capabilities, low cost, and user-friendly nature.

- The COVID-19 pandemic has highlighted the need for voice biometrics as a contactless method of authentication and has positively influenced the demand-side dynamics of the studied market. According to the Biometric Survey 2021, 64% of the respondents have increased prioritization for technology that supports remote onboarding and mobile apps, creating a direct demand for voice biometrics.

Voice Biometrics Market Trends

Banking, Financial Services, and Insurance have Emerged as the Leading Fields for Voice Biometric Applications

- Banks must continuously stay on top of the best-suited methods for authentication to combat online fraud. Traditionally, banks have used knowledge-based authentication methods such as PINs and one-time passwords. The demand for contactless and seamless technologies has permeated even banking security, especially in light of the COVID-19 pandemic's impact. Voice biometrics in banking is a promising online banking solution that goes beyond the retina and fingerprint scanners that require people's physical presence.

- Further, as attackers/hackers have become more sophisticated and the number of potential targets or entry points has expanded, cyber attacks in the financial industry have increased significantly. The sheer number of users has also drastically increased along with the proliferation and addition of new banking and financial technologies. Despite numerous warnings from bankers, people fall prey to scams. For instance, in fiscal 2021, the Reserve Bank of India (RBI) reported around 7,400 bank fraud cases across India. In 2020, RBI said 8,700 bank fraud cases in India with an INR 1.85 trillion. Further, as per the information reported by Indian Computer Emergency Response Team (CERT-In), an unlimited number of 2,46,514 and 2,90,445 cyber security incidents about digital banking were reported in 2019 and 2020 in India, respectively.

- Also, according to VMware, the first half of 2020 witnessed a 238% increase in cyberattacks targeting financial institutions compared to the previous year. Nearly 75% of banks and insurance groups have seen a spike in cybercrime since the pandemic's start.

- Voice biometrics in banking is crucial to extending comfortable banking services and improving customer experience. For instance, banks offer social security products like pensions and insurance requiring proof-of-life authentication when the payments are disbursed. Voice biometrics facilitate the discrete authentication of people. Also, biometric technology can identify several features of human voices to make identification reliable and tamper-proof.

- Voice biometrics also aid in enhancing the KYC processes. For instance, multilingual countries like South Asia have people of varying education levels across far-flung areas. Voice biometrics can help include such people into a financial security net as the solutions are language-independent.

- Further, physiological biometrics necessitates scanners at the customer's location, whereas voice biometrics require nothing more than existing phone lines and mobile infrastructure. The software is present on the bank's end. To create a sample to authenticate, the user may be asked to say a randomly generated phrase. If a match is not found, access will be denied. This method is effective against hackers who attempt to use voice recordings.

North America is Expected to Hold the Largest Share

- Voice recognition technology is used in various applications due to the rapid growth in the acceptance of mobile and cloud technologies and unmatched technological advancements in computing power. The healthcare industry is expected to play a significant role in developing voice recognition technology in the United States, owing to its use in producing health-related data records. Voice recognition technology has the potential to replace some of the more traditional approaches that are still in use.

- According to the Center for Medicare and Medicaid Services, United States, National health spending is projected to grow at an average annual rate of 5.4% from 2019 to 2028 to reach USD 6.2 trillion by 2028. This also includes the expenditure for IT and computing services for better storage and protection of patient data. Furthermore, health systems are searching for voice-enabled transcriptions to identify reimbursable conditions discovered during the diagnostic while ensuring that crucial health indicators are not missed.

- The lucrative banking sector in the region has seen a rise in the adoption of biometric technologies as the number of fraud cases has increased. In the area, many secure and diverse security solutions are being introduced. In North America, G+D Mobile Security has introduced its FIDO-compliant Convegno Mobile Authentication in conjunction with Samsung SDS. The solution leverages biometrics such as fingerprint, face, iris, and voice credentials to provide security solutions with multi-factor authentication.

- Several Canadian organizations, including Royal Bank of Canada, Bank of Montreal, and Rogers Communications, have begun using speech biometrics to identify consumers over the phone. According to the TD Bank Group of Canada, customers can sign into their accounts or skip call center security questions by providing a voiceprint. For this, TD uses VoicePrint. TD VoicePrint is a voice recognition system that allows customers to use their voiceprint to verify their identity and identify themselves when speaking with one of the bank's Live Customer Service employees over the phone.

- More stores in Canada are moving to self-checkout lanes to serve customers better. More than half of Canadians (54%) favor self-checkout lanes, and 66% use them at least some of the time, according to Dalhousie University's Grocery Experience National Survey Report. Customers can use self-checkout lines at their own leisure, but they are not necessarily as efficient. As a result, many Canadian merchants are looking for voice biometrics solutions in their stores. However, due to the initial high cost of equipment and gadgets, many retailers in Canada will be unwilling to upgrade to the latest technologies.

Voice Biometrics Industry Overview

The voice biometrics market remains highly competitive, with several emerging players getting into the biometric ecosystem. The market has witnessed a few mergers and acquisitions in the recent past. With the inflow of massive amounts of funds into the startups operating in this space, the launch of several new products is expected in the years ahead. Some of the recent developments are as follows:-

- September 2021 - Skit, formerly known as Vernacular.ai, secured USD 23 million as part of its Series B funding, led by WestBridge Capital with participation from Exfinity Ventures and Kalaari Capital, Letsventure syndicate led by Sense AI, and Angelist syndicate led by Aaryaman Vir Shah from Prophetic Ventures.

- August 2021 - Lumen Vox launched the next-generation automatic speech recognition (ASR) engine with transcription. The new automatic speech recognition engine, built on artificial intelligence (AI) and deep machine learning (ML), outpaces its competition in delivering the most accurate speech-enabled customer experiences.

- July 2021 - Thales announced a new voice biometric solution, part of Thales' Digital Identity Service Platform for onboarding and authentication. The new solution integrates effortlessly with existing call center enrolment processes.

- June 2021 - Aculab announced that its voice biometrics technology, VoiSentry, can be deployed to those with physical and speech impairments. VoiSentry calculates voice biometrics based on general characteristics of the sound of the voice rather than specific words. Hence, it enables the user to positively affirm IVR choices and complete identification and verification checks using their voice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technology Snapshot

- 4.4 An Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Sophistication of Security Threat

- 5.1.2 Large-scale Adoption of Technology by Governments to Secure Citizens

- 5.2 Market Challenges

- 5.2.1 Security Concerns Pertaining to Third-party (Cloud) Data Storage

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Active Biometrics

- 6.1.2 Passive Biometrics

- 6.2 Deployment Model

- 6.2.1 On-premises

- 6.2.2 Cloud

- 6.3 Enterprise Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 Vertical

- 6.4.1 Banking, Financial Services, and Insurance

- 6.4.2 Retail and E-commerce

- 6.4.3 Telecommunications and IT

- 6.4.4 Government and Defense

- 6.4.5 Other Industry Verticals

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Australia

- 6.5.3.3 India

- 6.5.3.4 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle-East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nuance Communications Inc.

- 7.1.2 Verint Systems Inc.

- 7.1.3 Voice Biometrics Group

- 7.1.4 NICE Ltd

- 7.1.5 Auraya Inc.

- 7.1.6 Phonexia SRO

- 7.1.7 BioCatch Ltd

- 7.1.8 Pindrop Security Inc.

- 7.1.9 Aculab Inc.

- 7.1.10 Uniphore Software Systems Pvt. Ltd

- 7.1.11 LexisNexis Risk Solutions Inc.

- 7.1.12 One Vault SA

- 7.1.13 Lumen Vox LLC (Voice Trust GmBH)

- 7.1.14 VoicePIN.com Sp. z o.o.

- 7.1.15 SESTEK