|

市場調查報告書

商品編碼

1687895

美國貨運經紀-市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)United States Freight Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

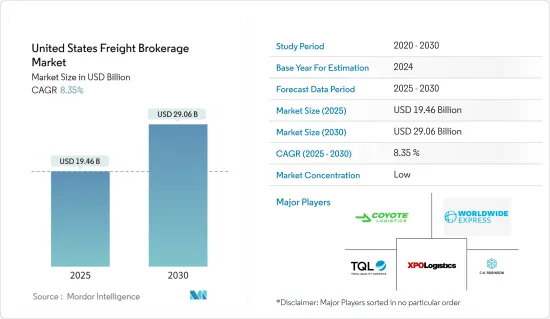

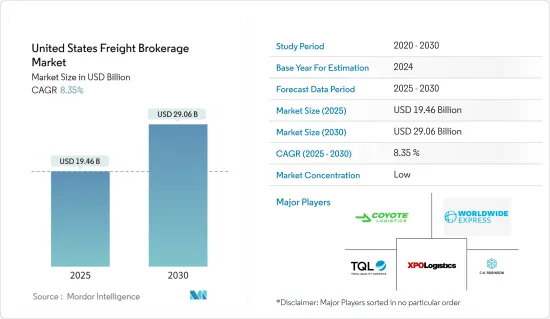

預計 2025 年美國貨運經紀市場規模為 194.6 億美元,到 2030 年將達到 290.6 億美元,預測期間(2025-2030 年)的複合年成長率為 8.35%。

關鍵亮點

- 業內人士表示,美國貨運經紀業正在提高對整體貨運市場的滲透率。美國市場參與企業處理的入境數量逐年穩定增加。預計《美國-墨西哥-加拿大協議》(USMCA)將簡化跨境運輸並統一北美供應鏈。

- 美國市場持續存在卡車司機短缺的問題,這對嚴重依賴卡車運輸公司的經紀業務等產生了負面影響。這種情況迫使貨運經紀人向托運人提供更高的價格,從而導致價格上漲和市場競爭加劇。

- 美國的零擔貨運(LTL)市場面臨激烈的競爭。零擔貨運經紀業務正在參與北美零擔貨運創新,以推動以下收益成長:

美國貨運經紀市場的趨勢

近年來,FTL 服務在該國發展勢頭強勁。

- 近年來,受美國、加拿大和墨西哥之間內陸貨運需求和跨境貿易的推動,美國的整車運輸(FTL)服務顯著成長。整車貨運經紀業務仍處於成長階段,對進入國內市場的新托運人來說具有很大的吸引力。然而,老牌托運人尋求與經紀人和運輸公司簽訂長期契約,以在國際貨運代理行業中佔據主導地位。

- FTL 經紀人為托運人提供運輸服務並為承運人監控貨物運輸。許多貨運經紀公司正在加強其數位市場,並採用自動定價、應用程式介面 (API) 連接、資料科學和內部技術等技術。美國卡車貨運經紀市場的主要企業包括 CH Robinson、XPO Logistics、Total Quality Logistics、Echo Global Logistics 和 Coyote Logistics。

- 2023年1月,施耐德國家公司宣布將投資聖地牙哥自動駕駛技術公司TuSimple。該公司的客戶包括 UPS、美國郵政服務和 McLane Co.。該公司還與 Nvidia 和亞馬遜等科技巨頭建立了合作夥伴關係。 2022年11月,Google與JB Hunt宣佈建立多年戰略合作夥伴關係,以加速JB Hunt的數位轉型並在供應鏈平台技術方面展開合作。透過利用 Google Cloud,JB Hunt 將擴展其 JB Hunt 360° 平台,該平台以數位方式將貨物與可用容量連接起來。透過利用Google的資料雲,JB Hunt 360 可以使用人工智慧和機器學習工具來預測結果並幫助使用者做出明智的決策。

製造業和汽車產業將推動市場未來發展

- 蓬勃發展的美國汽車產業需要具有最高可用性和可靠性的汽車物流解決方案,包括港到港、準時制 (JIT) 和準時順序 (JIS) 交付。該市場的成長主要受到新興國家汽車產量增加以及政府對汽車產業實施的嚴格監管標準等因素的推動。例如,美國汽車產業在 2023 年銷售強勁,銷量約 312 萬輛。此外,美國市場轎車和輕型卡車總銷量達1,550萬輛。

- 電動車的普及、消費者對產品品質和安全意識的不斷提高以及汽車產業連網型設備普及帶來的技術進步的不斷提升,為市場參與企業提供了成長機會。北美自由貿易組織(NAFTA)協定針對汽車產品的原產地規則僅基於關稅變化或基於關稅變化和區域內容價值要求。該協議要求採用淨成本法計算這些產品的區域增加值含量。

- 協定生效後,汽車、輕型汽車、引擎和變速箱的區域細分要求將按淨成本法達到50%。 2022年,裁員增加導致美國工廠活動成長率達到一年半多以來的最低水平,而中國採取的零容忍措施也令製造商擔心夏季供應問題。

- 美國製造業的衰落加劇了不平等,並降低了該國的國際競爭力。振興的製造業可以為經濟增加150萬個高薪工作崗位,並振興邊緣社區。由於創新數位化,製造業可能會經歷復興。多年來,各行業、各地區發展不平衡,有的行業蓬勃發展,有的行業卻陷入衰退。

美國貨運經紀業的細分

美國貨運經紀市場細分程度適中,既有大型區域性參與者,也有全球性參與者,還有規模較小的本地參與者(市場參與者很少)。 CH Robinson 在該行業佔據主導地位,其次是 XPO Logistics 和 Hub Group/Mode Transportation。貨運經紀市場競爭激烈,前八至十的公司佔了總收入的三分之一以上。

在技術整合方面,Convoy、Uber Freight 和 uShip 等新參與企業正在爭相透過提供貨運透明度、線上裝載板和透過行動應用程式進行貨運預訂的市場來搶佔大量市場佔有率。由於技術發展和數位貨運需求,卡車運輸即服務 (TaaS) 預計將在該國大幅成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場概述

- 當前市場狀況

- 市場動態

- 驅動程式

- 全國建築熱潮

- 國內貨運經紀業務的興起

- 限制因素

- 貨運改道及其他因素

- 全國貨物進口量下降

- 機會

- 石油和天然氣產業的需求不斷成長

- 貨運經紀系統和物流的技術進步

- 驅動程式

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 美國物流業(概況、趨勢、研發、關鍵統計等)

- 主要政府法規和舉措

- 票價洞察

- 技術簡介(數位貨運經紀、物聯網等)

- 對美國海關部門的定性和定量分析

- COVID-19對市場的影響

第5章市場區隔

- 按服務

- LTL

- FTL

- 其他

- 按最終用戶

- 製造/汽車

- 石油和天然氣、採礦和採石

- 農業、漁業和林業

- 建設業

- 分銷(包括批發、零售和快速消費品)

- 其他最終用戶(通訊、製藥等)

第6章 競爭格局

- 公司簡介

- CH Robinson

- Total Quality Logistics

- XPO Logistics Inc.

- Echo Global Logistics

- Worldwide Express

- Coyote Logistics

- Landstar System Inc.

- Schneider

- SunteckTTS

- GlobalTranz

- JB Hunt Transport Inc.

- Hub Group

- BNSF Logistics LLC

- KAG Logistics Inc.

- Uber Freight*

- 其他公司

第7章 市場機會與未來趨勢

第 8 章 附錄

The United States Freight Brokerage Market size is estimated at USD 19.46 billion in 2025, and is expected to reach USD 29.06 billion by 2030, at a CAGR of 8.35% during the forecast period (2025-2030).

Key Highlights

- As per industry sources, the penetration of the US freight brokerage sector in the total freight market is increasing. The number of entries processed by US market players has grown steadily over the years. The US-Mexico-Canada Agreement (USMCA) is further expected to streamline cross-border shipments and create uniformity for supply chains in North America.

- The ongoing shortage of truck drivers in the US market has an adverse effect on businesses like brokerages, which heavily depend on carriers. This scenario forces freight brokers to quote higher prices to shippers, leading to an increase in price and competition in the market.

- The US less-than-truckload (LTL) segment is facing intense competitive rivalry. LTL freight brokers are involved in innovations in North American LTL to drive the next leg of profit improvement.

United States Freight Brokerage Market Trends

FTL Service Has Gained Momentum in the Country in Recent Years

- In recent years, the United States has experienced substantial growth in full truckload (FTL) services owing to the demand for inland freight movement and cross-border trade between the United States, Canada, and Mexico. Full truckload freight brokerage is still in a growth phase and is a major attraction for new shippers to penetrate the domestic market. However, established shippers seek long-term contracts with brokerage firms and carriers to gain a leading position in the international freight forwarding industry.

- FTL brokers facilitate the transportation service for shippers and monitor the carriers' shipments. Many freight brokerage firms are strengthening their digital marketplace and are adopting technology, such as automated pricing, application programming interface (API) connectivity, data science, and internally facing technology. Some of the key players in the US truckload freight brokerage market are C.H. Robinson, XPO Logistics, Total Quality Logistics, Echo Global Logistics, and Coyote Logistics.

- In January 2023, Schneider National Inc. of Green Bay announced that it is investing in TuSimple, a San Diego self-driving technology company. Some of the company's customers include UPS, the US Postal Service, and McLain Co. The company also has partnerships with tech giants like Nvidia and Amazon. In November 2022, Google and JB Hunt announced a multi-year strategic alliance to accelerate JB Hunt's digital transformation and collaborate on supply chain platform technology. Powered by Google Cloud, JB Hunt is expected to expand its JB Hunt 360° platform that digitally connects shipments and available capacity. By leveraging Google's Data Cloud, JB Hunt 360 may use artificial intelligence and machine learning tools to predict outcomes, empower users, and make informed decisions.

Manufacturing and Automotive Segment is Driving the Market in the Future

- The booming automotive industry in the United States demands automotive logistics solutions with maximum availability and reliability for port-to-port transportation, just-in-time (JIT) deliveries, or just-in-sequence (JIS) deliveries. The growth in this market is mainly driven by factors such as the growing automobile production in emerging economies and strict regulatory standards imposed by governments on the automotive industry. For instance, in 2023, the US auto industry witnessed robust sales, with approximately 3.12 million cars sold. Furthermore, the total sales of cars and light trucks in the US market reached a notable 15.5 million units.

- The growing adoption of electric vehicles, increasing awareness among consumers regarding product quality and safety, and the incorporation of technological advancements, with the rising adoption of connected devices in the automotive industry, offer growth opportunities to the market players. The NAFTA rules of origin for automotive products are based on a tariff change alone or a tariff change and a regional value content requirement. The agreement requires that the regional value content for these products be calculated using the net cost method.

- The regional value content requirement for autos and light vehicles and their engines and transmissions will be 50% under the net cost method when the agreement enters into force; this percentage will be increased to 62.5% over an eight-year transition period. In 2022, factory activity in the United States grew at its slowest rate in more than a year and a half, owing to an increase in layoffs, and manufacturers were concerned about supply over the summer due to China's zero-tolerance policy.

- The decline of the US manufacturing industry has increased inequality and harmed the country's global competitiveness. Manufacturing revitalization could add 1.5 million well-paying jobs to the economy and revitalize marginalized communities. Manufacturing could experience a renaissance as a result of innovation and digitization. Years of uneven growth across sectors and geographies have resulted in some industries flourishing while others faltering.

United States Freight Brokerage Industry Segmentation

The US freight brokerage market is moderately fragmented, with the presence of large regional players, global players, and small and medium-sized local players with a few players in the market. C.H. Robinson dominates the industry, followed by XPO Logistics and Hub Group/Mode Transportation. The freight brokerage market is top-heavy, with the top 8 to 10 firms accounting for more than one-third of the total gross revenues.

As far as technology integration is concerned, new entrants such as Convoy, Uber Freight, and uShip, are trying to gain significant market share by offering price transparency, online load boards, and freight marketplaces for booking freight via mobile apps, with the goal of removing human interaction in the freight booking and payment process. Trucking-as-a-Service (TaaS) is expected to grow significantly in the country with technological developments and demand for digital freight forwarding.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growing Construction Across the Country

- 4.2.1.2 The Growing Number of Freight Brokers Across the Country

- 4.2.2 Restraints

- 4.2.2.1 Rerouting of Cargo and Other Factors

- 4.2.2.2 Reducing Freight Imports Across the Country

- 4.2.3 Opportunities

- 4.2.3.1 Growing Demand From the Oil and Gas Industry

- 4.2.3.2 Technological Advancements in Freight Brokerage Systems and Logistics

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 US Logistics Industry (Overview, Trends, R&D, Key Statistics, etc.)

- 4.6 Key Government Regulations and Initiatives

- 4.7 Insights on Freight Rates

- 4.8 Technology Snapshot (Digital Freight Brokerage, IoT, etc.)

- 4.9 Qualitative and Quantitative Insights on the US Customs Clearance Sector

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION (Market Size By Value)

- 5.1 By Service

- 5.1.1 LTL

- 5.1.2 FTL

- 5.1.3 Other Services

- 5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil and Gas, Mining, and Quarrying

- 5.2.3 Agriculture, Fishing, and Forestry

- 5.2.4 Construction

- 5.2.5 Distributive Trade (Wholesale and Retail Segments, FMCG included)

- 5.2.6 Other End Users (Telecommunications, Pharmaceuticals, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 CH Robinson

- 6.2.2 Total Quality Logistics

- 6.2.3 XPO Logistics Inc.

- 6.2.4 Echo Global Logistics

- 6.2.5 Worldwide Express

- 6.2.6 Coyote Logistics

- 6.2.7 Landstar System Inc.

- 6.2.8 Schneider

- 6.2.9 SunteckTTS

- 6.2.10 GlobalTranz

- 6.2.11 J.B. Hunt Transport Inc.

- 6.2.12 Hub Group

- 6.2.13 BNSF Logistics LLC

- 6.2.14 KAG Logistics Inc.

- 6.2.15 Uber Freight*

- 6.3 Other Companies