|

市場調查報告書

商品編碼

1687892

重型卡車—市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Heavy Duty Trucks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

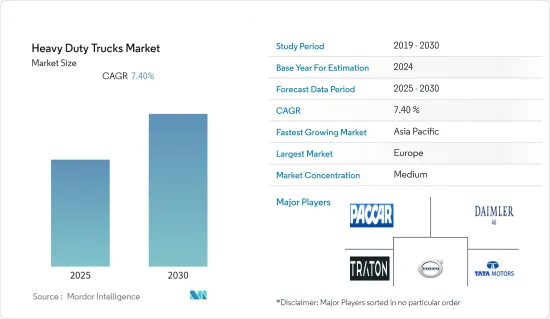

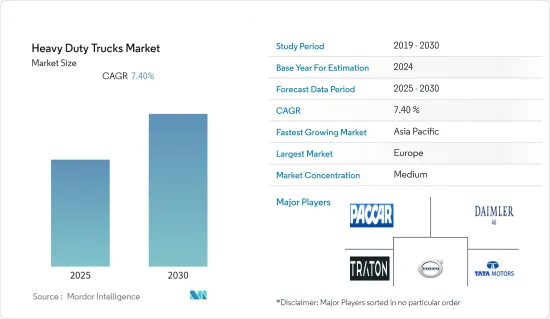

預計重型卡車市場在預測期內的複合年成長率將達到 7.4%。

目前,重型卡車市場價值為2,045.6億美元,預計未來五年將達到3,139.5億美元。

在新冠疫情期間,各大OEM的重卡市場均大幅下滑。疫情導致運輸業完全停擺,為貨運公司和製造公司將貨物從一個地方運送到另一個地方帶來了新的挑戰。疫情期間,由於全球物流和供應鏈系統嚴重中斷,重型卡車產量下降。然而,由於OEM希望透過向市場引入大量投資來重啟生產,因此預計預測期內市場將會成長。

從長遠來看,更嚴格的車輛排放氣體標準、更高的車輛安全性以及快速成長的物流、零售和電子商務領域預計將推動全球對新型先進卡車的需求。對具有更高有效載荷能力和更強懸吊系統的強力車輛的需求不斷成長,以及對省油卡車的需求不斷成長,可能會進一步刺激市場需求。例如,美國公路交通安全管理局為使用柴油、天然氣和替代燃料的重型卡車引擎的燃油經濟性制定了新的標準。

亞太地區是世界上經濟成長最快的地區。隨著印度和東南亞國協的建設活動活性化,該地區有望成為推動全球建築業發展的主要市場。由於 Freightliner、Kenworth、International、Peterbilt、Volvo 和 Mack 等主要製造商的存在,以及該地區貨運需求的激增,北美重型卡車市場可能會大幅成長。

重型卡車市場趨勢

混合動力和電動式重型卡車將對市場產生積極影響

混合動力電動車市場的高成長是由各國政府制定的嚴格排放法規所推動的。歐盟委員會(EC)也正在開發新的軟體解決方案來確定燃料消費量和二氧化碳排放。為了應對北美和歐洲的這些政策變化,市場參與企業正在推出新的混合動力電動和全電動重型卡車車型。

由於基礎設施不斷擴大和貨運需求不斷成長,北美、印度和日本是預計未來幾年電動卡車銷售將出現積極成長的一些主要地區。然而,由於經濟放緩,2019 年全球大多數國家的卡車銷量均出現下滑,而 2020 年則受新冠疫情影響,這一下滑趨勢進一步延續。

特斯拉、比亞迪、沃爾沃和梅賽德斯-奔馳等公司都將在未來幾年推出電動卡車車型,以取代柴油和汽油引擎車型。例如

- 2022 年 1 月:沃爾沃卡車推出增程式 VolvoVNR 電動卡車。沃爾沃VNR電動車的最大續航里程為240公里。該公司推出了其 8 級*電動卡車的改進版本,續航里程提高至 440 公里(275 英里),電池儲存容量提高至 565kWh。性能的提升源自於電池設計的改進和新的 6 電池包裝選項。

由於消費者偏好的變化、先進的充電基礎設施、快速充電站的可用性以及電動汽車相對於傳統內燃機卡車的輔助優勢,預計貨運對電動卡車的需求將會成長,並且市場在預測期內可能會呈指數級成長。

亞太地區將對整體市場產生重大影響

研究期間亞太地區重型卡車產業的擴張是由於產品銷售的增加,知名參與企業在該地區佔有重要地位。低工資勞動力的易得性和低成本的豐富原料可以促進建築業和汽車業的發展,從而導致產品在亞太地區的大規模滲透。預計預測期內泰國、中國、印度、馬來西亞和印尼等國家將為該地區市場的收益做出重大貢獻。

預計在預測期內,政府將持續加強對電動車的監管,該地區的OEM製造商和供應商也將大力擴張以滿足中國汽車行業日益成長的需求,從而為市場創造光明的前景。

- 中國政府正在鼓勵推廣電動車。該國已計劃逐步淘汰柴油,而柴油是目前曳引機和施工機械使用的動力。該國計劃在2040年全面禁止柴油和汽油車輛。

印度各邦政府正在將電動公車納入其車隊,以改裝 ICE 公車並降低營運成本,同時減少碳排放並改善空氣品質。例如

- 2021 年 3 月:德里政府核准了提案,採購 300 輛新的低地板電動(AC)公車,以增加該市的公車數量。即將投入營運的公車可能會被引入德里交通運輸公司(DTC)。首批118輛公車預計2021年10月到貨,100輛公車將於2021年11月到貨,60輛公車將於2021年12月到貨,剩餘20輛公車將於2022年1月到貨。

重型卡車行業概況

市場既不分割,也不集中。重型卡車市場是一個公平的機會,主要企業和新參與企業都有參與。重型卡車製造商致力於建立有效的供應商關係,以確保及時交付優質產品,滿足日益成長的消費者需求。

- 2022 年 1 月:福特汽車公司開始生產 e-Transit,這是一款全電動貨車,採用全電動動力傳動系統,廢氣排放為零。

- 2021年9月:塔塔汽車宣布計畫在未來四到五年內投資超過10億美元(750億印度盧比)來重組其商用車業務藍圖。

主導市場的一些主要企業包括沃爾沃卡車、戴姆勒卡車、五十鈴汽車有限公司、帕卡公司、塔塔汽車和第一汽車集團公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 噸位類型

- 10至15噸

- 超過15噸

- 班級

- 5 級

- 6 類

- 7 類

- 第 8 類

- 燃料類型

- 汽油

- 柴油引擎

- 電

- 替代燃料

- 應用

- 建築和採礦

- 貨運與物流

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 其他

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- AB Volvo

- Daimler AG

- Traton Group

- PACCAR Inc.

- Tata Motors Limited

- Ashok Leyland

- FAW Group Corporation

- China National Heavy Duty Truck Group

- Dongfeng Motor Corporation

- Isuzu Motors Ltd

第7章 市場機會與未來趨勢

The Heavy Duty Trucks Market is expected to register a CAGR of 7.4% during the forecast period.

Currently, The heavy-duty trucks market is valued at USD 204.56 billion and it is expected to reach USD 313.95 billion in the next five years.

Amid the COVID-19 pandemic, major OEMs experienced a significant decline in the heavy-duty trucks market. The transportation industry completely shut down due to the pandemic, creating new challenges for the cargo and production houses to shift their goods from one place to another. Severe disturbances in global logistics and supply chain systems during the pandemic caused in decline in the production of heavy-duty trucks. However, the market is expected to grow during the forecast period as OEMs are trying to restart production by bringing heavy investments to the market.

Over the long term, the rising regulations on vehicle emissions, advancement in vehicle safety, and rapidly growing logistics, retail, and e-commerce sectors are expected to drive demand for new and advanced trucks across the world. Growing demand for powerful vehicles with higher carrying capacity to handle weights and strong suspension systems, as well as rising need for fuel-efficient trucks, may further boost the demand in the market. For example, the US National Highway Traffic Safety Administration set new standards for fuel economy for heavy-duty truck engines driven by diesel, natural gas, and substitute fuels.

Asia-Pacific exhibits the fastest economic growth rates in the world. The region is expected to be a major market propelling the global construction industry, with growing construction activities in India and ASEAN countries. North America may register considerable growth in the heavy-duty trucks market due to the presence of major manufacturers, such as Freightliner, Kenworth, International, Peterbilt, Volvo, and Mack, with the surging freight demand in the region.

Heavy Duty Trucks Market Trends

Hybrid and Electric Heavy-duty Trucks to Have Positive Impact on the Market

The high market growth in the hybrid electric segment will be driven by the stringent emission norms established by the governments. The European Commission (EC) is also developing new software solutions to determine fuel consumption and CO2 emissions. In response to these policy changes across North America and Europe, the market players are introducing new models of hybrid electric and fully electric heavy-duty trucks.

North America, India, and Japan are some of the prominent regions saw positive sales for electric trucks in coming years owing to the expanding infrastructure and constantly growing need of freight loading. However, most countries across the globe in 2019 have witnessed decline in truck sales owing to the slowdown in economy, which was further continued during 2020 due to the outbreak of COVID-19.

Companies such as Tesla, BYD, Volvo, and Mercedes-Benz are launching electric truck models to replace diesel and gasoline-powered models in the coming years. For instance,

- January, 2022 : Volvo Truks launched Volvo VNR electric truck with longer range. Volvo VNR Electric had an operating range of up to 240 km (150 miles). The company launched an enhanced version of the class 8* electric truck, with an operational range of up to 440 km (275 miles) and increased energy storage of up to 565kWh. The improved performance is due to improved battery design and a new six battery package option, among other things.

With the shifting consumer preferences, development of charging infrastructure, availability of fast-charging station, and subsidiary benefits on electric vehicles over conventional internal combustion engine trucks, the demand for electric trucks for freight operation is expected to grow, and the market may experience an exponential upward trajectory during the forecast period.

Asia-Pacific Likely to Have Major Influence on Overall Market

The expansion of the heavy-duty trucks industry in Asia-Pacific over the study period was due to the increasing product sales, with a huge presence of reputed players in the region. The easy availability of a workforce at reduced wages and access to abundant raw materials at lower costs may boost the construction and automotive sectors, resulting in huge product penetration in Asia-Pacific. Countries like Thailand, China, India, Malaysia, and Indonesia are projected to contribute sizeably to the regional market's revenue over the forecast period.

The growing government regulations to improve electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate rising demand from the automotive industry in China are expected to create a positive outlook for the market during the forecast period. For instance,

- The government of China is encouraging people to adopt electric vehicles. The country has already made plans to phase out diesel fuel, which runs the current generation of tractors and construction equipment. The country is planning to completely ban diesel and petrol vehicles by 2040.

The state governments of India are including electric buses in their fleets to convert their ICE fleet of buses and reduce the operational cost while also reducing carbon emissions and improving the air quality. For instance,

- March, 2021 : The Delhi government approved a proposal to procure 300 new low-floor electric (AC) buses to increase the number of buses in the city. The upcoming buses will likely be inducted into the Delhi Transport Corporation (DTC). The first lot of 118 buses were expected to arrive in October 2021, an addition of 100 buses in November 2021, 60 buses in December 2021, and the remaining 20 buses by January 2022.

Heavy Duty Trucks Industry Overview

The market is neither fragmented nor consolidated. The heavy-duty truck market accommodates major regional players and new players, providing equal opportunities. Manufacturers of heavy-duty trucks are engaged in developing effective supplier relations to ensure the timely delivery of high-quality products to meet the growing consumer demand.

- January 2022: Ford Motor Company began the production of an all-electric van, an e-Transit, which has an all-electric powertrain and claims zero tailpipe emissions.

- September 2021: Tata Motors announced its plans to invest over USD 1 billion, or an amount exceeding INR 7,500 crore, over the next 4-5 years to recreate its roadmap for the commercial vehicle business, a major part of which comprises electric vehicles, especially buses.

Some of the major players dominating the market include Volvo Trucks, Daimler Trucks, Isuzu Motors Ltd, PACCAR Inc., Tata Motors, and FAW Group Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD billion)

- 5.1 Tonnage Type

- 5.1.1 10 to 15 tons

- 5.1.2 More than 15 tons

- 5.2 Class

- 5.2.1 Class 5

- 5.2.2 Class 6

- 5.2.3 Class 7

- 5.2.4 Class 8

- 5.3 Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Electric

- 5.3.4 Alternative Fuels

- 5.4 Application Type

- 5.4.1 Construction and Mining

- 5.4.2 Freight and Logistics

- 5.4.3 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 AB Volvo

- 6.2.2 Daimler AG

- 6.2.3 Traton Group

- 6.2.4 PACCAR Inc.

- 6.2.5 Tata Motors Limited

- 6.2.6 Ashok Leyland

- 6.2.7 FAW Group Corporation

- 6.2.8 China National Heavy Duty Truck Group

- 6.2.9 Dongfeng Motor Corporation

- 6.2.10 Isuzu Motors Ltd