|

市場調查報告書

商品編碼

1687877

亞太地區紡織品:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Asia-Pacific Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

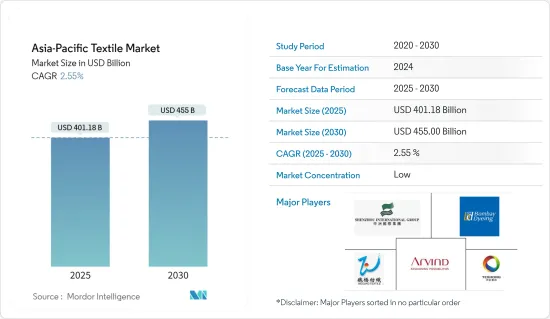

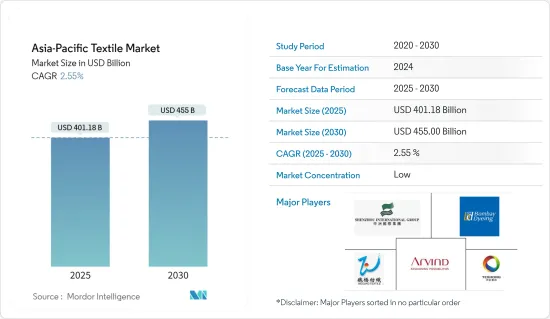

預計 2025 年亞太地區紡織品市場規模為 4,011.8 億美元,到 2030 年將達到 4,550 億美元,預測期內(2025-2030 年)的複合年成長率為 2.55%。

關鍵亮點

- 亞太地區對服飾和家居裝飾的需求不斷成長是主要的成長要素。

- 新冠疫情危機對全球服飾造成了重大破壞和困難,以各種方式影響品牌、製造商和工人。這次疫情暴露了服飾供應鏈的嚴重脆弱性,以及採購決策對供應商工廠及其工人的影響。亞洲佔全球服飾產量的大部分,仍處於供應鏈負面影響的前沿。

- 亞太地區是全球最大、成長最快的絲綢市場。由於生絲供應充足,中國在亞太絲綢市場佔據主導地位,佔該地區絲綢需求的 80% 左右。中國也是世界上最大的生絲絲線生產國,僅次於印度、泰國和烏茲別克。它是世界主要紡織品出口國之一,約佔全球紡織品和服飾出口的40%。有超過2萬家公司。隨著亞太地區經濟成長、養蠶技術的快速進步以及絲綢在紡織業中的使用不斷增加,亞太絲綢市場預計將進一步擴大。

- 泰國是世界聞名的世界上最大的布料、運動服、嬰兒服裝、女性服飾和休閒服生產國之一。此外,精湛的整理、染色和印花服務使泰國成為世界上最受歡迎的紡織品外包目的地之一。泰國目前擁有 4,500 家紡織和服裝製造商,僱用員工近百萬人。這些製造商大多位於曼谷和泰國東部地區,是人造纖維廠,生產從紡紗、織佈到染色和印花等各種產品。

- 據孟加拉出口促進局(EPB)稱,孟加拉的家用紡織品出口產品包括床單、床單和其他臥室紡織品、浴室用亞麻巾、地毯和地毯、毛毯、廚房用布、窗簾、靠墊和靠墊套以及羽絨被套。剛結束的2021-22會計年度,家紡出口額達16.2億美元,與前一年同期比較成長43.28%。值得注意的是,上會計年度家紡產品出口額為11.3億美元。

- 亞洲佔世界服飾產量的大部分,正處於供應鏈受到負面影響的前沿。挑戰也帶來了建立新夥伴關係的機會、思考產業未來的新方式,以及更重要的是,我們如何重建一個更具彈性、更永續和人性化的未來。國內消費者正在推動企業重新思考其供應鏈,電子商務數位化正在獲得回報。

亞洲紡織品市場趨勢

亞洲消費者在時尚配件上的支出增加

預計亞洲服飾和鞋類消費者支出將持續成長,2024年至2028年間總合278億美元(成長35.8%)。經過連續八年的成長,時尚支出預計將達到1,054億美元,並在2028年達到新的高峰。

勞動市場的持續復甦也可能增強消費者信心,進而促進消費。隨著亞洲(主要是中國)服飾需求的成長,歐洲和北美在這一領域的重要性正在下降。預計到 2021 年,北美和歐洲以外地區的服飾銷售額將與這些地區持平,到 2025 年將達到全球服飾總銷售額的 55%。

亞太地區(越南、菲律賓、印尼、馬來西亞、泰國和新加坡)對服裝業具有極大的吸引力,尤其是擁有大量青年人口,數位解決方案在其中發揮關鍵作用和成長。

出口成長推動亞洲收益

2022年,中國是全球最大的服飾出口國,佔有率約31.7%,其次是歐盟、孟加拉和越南。當年,中國和歐盟也是全球最大的紡織品出口國。

許多亞洲國家已經建立了服飾、紡織和鞋類(GTF)製造業,為其GDP和全球服裝市場做出了重大貢獻。中國出口占亞洲紡織品出口總量的近52.2%。

消費者對價格實惠且舒適的服飾的觀念轉變推動了對黏膠、絲綢和亞麻等高價值纖維的需求。由於人造紗線和天然紗線的突出特點,混紡纖維的品種也呈指數級成長,這將在未來幾年開闢新的市場和成長機會。

聚酯纖維和棉是該地區廣泛使用的紡織紗線產品。亞太地區的消費模式變化、人口成長、可支配收入增加以及對服飾和家居用品的需求增加是主要的成長要素。

此外,亞太地區對家用紡織品的需求正在上升。家用紡織品包括毛毯、床單、桌布、清潔和廚房抹布、窗簾、床罩、紗布、壁掛、睡袋、毛巾、床墊、被子、枕頭、掛毯等產品,用於家庭、酒店、辦公室等室內裝飾。

亞太紡織業概況

亞太地區紡織品市場競爭激烈且分散。亞太地區紡織業的公司包括申洲國際集團、魏橋紡織、天虹紡織集團、Arvind Ltd 和孟買染化製造有限公司。許多本地企業受到位置的限制,但隨著技術的進步,即使在網際網路和電子商務滲透困難時期,它們也能夠引領市場。此外,合併、聯盟和收購後的市場整合可能有助於企業在市場上建立更強大的支柱。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態與洞察

- 當前市場狀況

- 市場動態

- 驅動程式

- 越來越願意為高品質服飾付款溢價

- 天然纖維服飾的流行趨勢正在改變

- 限制因素

- 供應鏈中斷限制亞太貿易

- 機會

- 社群媒體和電子商務的影響力日益增強

- 驅動程式

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 供應鏈/價值鏈分析

- 技術趨勢和自動化

- 政府法規和舉措

- 電子商務市場洞察

- COVID-19對市場的影響

第5章市場區隔

- 應用

- 服飾

- 工業技術

- 家用

- 其他

- 材料

- 棉布

- 黃麻

- 絲綢

- 合成的

- 羊毛

- 地區

- 中國

- 印度

- 巴基斯坦

- 孟加拉

- 澳洲

- 其他亞太地區

第6章競爭格局

- 市場集中度概覽

- 公司簡介

- Shenzhou International Group

- Weiqiao Textile

- Texhong Textile Group

- Arvind Ltd

- Bombay Dyeing and Manufacturing Company Ltd

- Bombay Rayon Fashions Ltd

- Fabindia Overseas Pvt Ltd

- Raymond Ltd

- Vardhman Textiles Ltd

- Cotton Corporation Of India*

- 其他公司

第7章:市場的未來

第 8 章 附錄

The Asia-Pacific Textile Market size is estimated at USD 401.18 billion in 2025, and is expected to reach USD 455.00 billion by 2030, at a CAGR of 2.55% during the forecast period (2025-2030).

Key Highlights

- Increasing demand for clothing and home furnishing products in the Asia-Pacific region are the major growth factors.

- The COVID-19 crisis caused considerable damage and hardship across the global garment industry, affecting brands, manufacturers, and workers in various multitudes. The pandemic has exposed acute vulnerabilities in garment supply chains and the impact that sourcing decisions have on supplier factories and their workers. With the bulk of global garment production in Asia, the region remains the frontline of the adverse effects rippling through the supply chain.

- Asia-Pacific is both the largest and fastest-growing silk market. Due to the easy availability of raw silk, China leads the Asia-Pacific silk market, accounting for approximately 80% of the region's demand for silk. China is also the world's largest producer of raw silk and silk yarns, trailing India, Thailand, and Uzbekistan. The country is the world's leading textile exporter, accounting for roughly 40% of global textile and clothing exports. With over 20,000 enterprises. The Asia-Pacific silk market is expected to expand further as a result of the region's growing economy, rapid advances in sericulture technology, and increased use of silk in the textile industry.

- Thailand is well-known throughout the world as one of the world's largest producers of fabric, sportswear, children's wear, women's wear, and casualwear. Furthermore, the country's exquisite finishing, dyeing, and printing services make it one of the world's most popular textile outsourcing destinations. Thailand currently employs nearly one million people through its 4,500 textile and apparel manufacturers. Most of these manufacturers, based in and around Bangkok and eastern Thailand, produce everything from man-made fiber plants, spinning and weaving to dyeing and printing.

- According to Bangladesh's Export Promotion Bureau (EPB), the country's home textile export basket includes bed linen, bed sheet and other bedroom textiles, bath linen, carpets and rugs, blankets, kitchen linen, curtains, cushions and cushion covers, and quilt covers. Home textiles earned USD 1.62 billion from exports in the recently concluded fiscal year 2021-22, representing year-on-year growth of 43.28%. It is worth noting that home textiles earned USD 1.13 billion in exports in the previous fiscal year.

- With Asia accounting for the majority of global garment production, the region remains at the forefront of the negative effects reverberating through the supply chain. With the challenges comes a window of opportunity for new alliances and new thinking about the industry's future and, more importantly, how it can be reshaped for a more resilient, sustainable, and human-centered future. Domestic consumers have prompted businesses to reconsider their supply chains, and e-commerce and digitalization have benefited.

Asia Textile Market Trends

Increase in Consumer Spending in Fashion Accessories in Asia

The total consumer spending on clothing and footwear in Asia was forecast to continuously increase between 2024 and 2028 by a total of 27.8 billion U.S. dollars (+35.8 percent). After the eighth consecutive increasing year, fashion-related spending is estimated to reach 105.4 billion U.S. dollars and, therefore, a new peak in 2028.

The ongoing labor market recovery will also aid consumer confidence and, hence, spending. As demand for clothing from Asia (mainly China) grows, the importance of Europe and North America in this sector is declining. Sales of clothing products outside North America and Europe equaled sales in these regions in 2021, and they are expected to reach 55% of the total world sales of clothing products in 2025.

The Asia-Pacific region (Vietnam, the Philippines, Indonesia, Malaysia, Thailand, and Singapore) is highly attractive to the apparel sector, especially because it has a large proportion of young people for whom digital solutions play an important and growing role.

Increase in Exports Boosting Revenue in Asia

In 2022, China was the top-ranked global clothing exporter, with a share of approximately 31.7 percent, followed by the European Union, Bangladesh, and Vietnam. In that year, China and the European Union were also the leading textile exporters in the world.

Many Asian economies have established garment, textiles, and footwear (GTF) manufacturing industries that contribute considerably to their GDPs and the global apparel market. China's export figures translate to almost 52.2% of the total textile export market in Asia.

The shift in consumer perception of affordable and comfortable clothing increases the demand for high-value fabrics, such as viscose, silk, and hemp. Blended varieties of fibers are also growing exponentially due to significant features of artificial and natural yarn, thus opening up new markets and growth opportunities in the coming years.

Polyester and cotton are widely used textile yarn products in the region. Changing consumption patterns, increasing population, disposable incomes, and the increasing demand for clothing and home furnishing products in the Asia-Pacific region are the major growth factors.

Also, the demand for home textiles is rising in the APAC region. Home textile includes products such as blankets, bedsheets, table cloths, cleaning and kitchen cloths, drapes, bed covers, sheers, wall carpets, sleeping bags, terry towels, mattresses, quilts, pillows, tapestry, etc., which are utilized in the interiors of homes, hotels, offices, etc.

Asia Textile Industry Overview

The Asia-Pacific textile market is highly competitive and fragmented. Some of the companies in the Asia-Pacific Textile industry are Shenzhou International Group, Weiqiao Textile, Texhong Textile Group, Arvind Ltd, and Bombay Dyeing and Manufacturing Company Ltd. Numerous local companies are restricted to their locations, but with technological advancement, Internet and e-commerce penetration has driven the market even in the hard times. Further, integration of the market, followed by mergers, partnerships, and acquisitions, will help the companies to create a strong foothold in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rising willingness to pay premium for high quality apparel

- 4.2.1.2 Shifting inclination toward natural fiber-based textile garments

- 4.2.2 Restraints

- 4.2.2.1 Asia pacific trade limitations because of supply chain disruption

- 4.2.3 Opportunities

- 4.2.3.1 Growing influence of social media and e-commerce platform

- 4.2.1 Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Supply Chain/Value Chain Analysis

- 4.6 Technological Trends and Automation

- 4.7 Government Regulations and Initiatives

- 4.8 Insights into the E-commerce Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Clothing

- 5.1.2 Industrial and Technical

- 5.1.3 Household

- 5.1.4 Other Applications

- 5.2 Material

- 5.2.1 Cotton

- 5.2.2 Jute

- 5.2.3 Silk

- 5.2.4 Synthetics

- 5.2.5 Wool

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Pakistan

- 5.3.4 Bangladesh

- 5.3.5 Australia

- 5.3.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Shenzhou International Group

- 6.2.2 Weiqiao Textile

- 6.2.3 Texhong Textile Group

- 6.2.4 Arvind Ltd

- 6.2.5 Bombay Dyeing and Manufacturing Company Ltd

- 6.2.6 Bombay Rayon Fashions Ltd

- 6.2.7 Fabindia Overseas Pvt Ltd

- 6.2.8 Raymond Ltd

- 6.2.9 Vardhman Textiles Ltd

- 6.2.10 Cotton Corporation Of India*

- 6.3 Other Companies