|

市場調查報告書

商品編碼

1687836

美國包裝:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)US Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

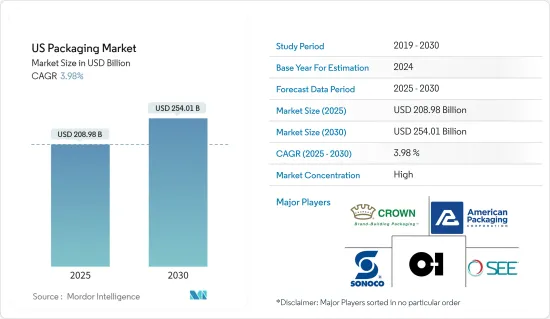

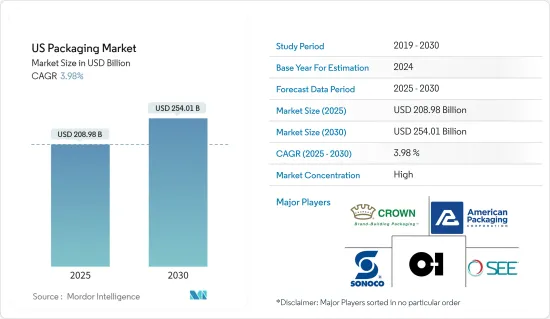

預計2025年美國包裝市場規模為2,089.8億美元,至2030年預計將達到2,540.1億美元,預測期間(2025-2030年)的複合年成長率為3.98%。

主要亮點

- 美國包裝產業正在不斷發展,並針對各種包裝挑戰開發創新解決方案。軟包裝協會(FPA)正在尋找機會來宣傳軟包裝在減少食物廢棄物的好處。 FPA提案,透過採用同時考慮產品和包裝方面的“系統方法”,軟包裝可以有效減少食物廢棄物。

- 紙板包裝廣泛應用於包裝食品市場,尤其是湯、調味品、乳製品等。它們通常塗有聚合物或塑膠,以幫助保持清潔並保持食品品質。與玻璃和金屬替代品相比,紙板有助於保持食物新鮮度,同時減輕最終產品的總重量。它的中性氣味和味道使其成為理想的包裝材料。

- 市場主要受到電子商務銷售成長和折疊式紙盒包裝需求增加的推動。然而,高性能替代品的出現可能會阻礙市場的成長。紙板包裝被認為是一種環保選擇,可以生產多種尺寸且佔地面積小,適用於多個最終用戶領域。

- 美國零售市場為各種規模的企業提供了眾多成長機會。電子商務銷售比例的增加預計將對市場產生正面影響。許多公司尚未調整其包裝以適應電子商務,從配送中心運送到消費者手中時過度包裝的情況很常見。這種複雜的零售鏈導致了更多的廢棄物、能源消耗和污染。軟包裝具有防水和輕質的特性,為電子商務提供者提供了極具吸引力的尺寸和重量優勢。

- 聯邦政府對塑膠包裝的嚴格環境法規可能會影響市場成長。例如,2023年4月,美國環保署(EPA)發布《國家防止塑膠污染策略》草案,並徵求公眾意見。該計劃是拜登-哈里斯政府實現永續經濟的努力的一部分,目標是到2040年終止塑膠和其他廢棄物從陸地流入環境。

美國包裝市場趨勢

紙和紙板佔據主要市場佔有率

- 受下游產業強勁需求的推動,美國仍然是世界上最大的瓦楞紙箱生產國和消費國之一。該國瓦楞紙箱出口也持續成長。美國是北美的一個主要地區,其紙張市場正在發生重大變化,部分原因是政府主導的環境舉措。隨著消費者偏好轉向生物分解性和永續的包裝材料,對紙張的需求正在增加。

- 包括美國在內的已開發國家對塑膠材料的全面禁令正在對市場產生積極影響。美國宣布計劃到2032年在公共土地上禁止使用一次性塑膠。這一分階段的做法將在未來10年內逐步從國家公園和其他公共區域消除一次性塑膠。該禁令將涵蓋寶特瓶、塑膠袋以及食品和飲料包裝紙的銷售和分銷。政府機構有一年的時間制定向替代材料(如可堆肥或生物分解性材料)過渡的策略,過渡將於 2032 年完成。

- 最終用戶,尤其是食品飲料和家居用品製造業的最終用戶,越來越意識到使用環保包裝材料的重要性。折疊紙盒由紙板等可回收和生物分解性的材料製成,是一種永續的替代品,對環境的影響極小。為了順應這一趨勢,許多供應商現在提供回收利用率更高的瓦楞紙瓦楞紙箱,進一步增加了環境效益。

- 美國瓦楞紙箱出口量也穩定成長。據美國最大的瓦楞包裝和容器供應商國際紙業稱,美國瓦楞紙出口量為 4,160 億平方英尺 (BSF)。預計 2022 年至 2026 年美國瓦楞紙出貨量將大幅成長,達到 560 BSF。

食品和飲料佔很大市場佔有率

- 由於外出用餐需求的增加和食品零售業務的成長,食品業佔據了很大的市場佔有率。消費者的健康意識日益增強,推動了對新鮮健康食品宅配的需求,進而影響了食品包裝需求。

- Hello Fresh 等餐套件業務和 Uber Eats 等食品宅配服務的擴張導致包裝需求增加。這一趨勢在一定程度上是由千禧世代和年輕消費者推動的,他們在擴大使用這些服務的同時,仍然保持著環保意識。

- 由於消費者習慣的改變,美國飲料產業正在經歷顯著成長。根據PMMI的飲料報告,預計2018年至2028年北美飲料產業將成長4.5%,其中美國將佔北美飲料銷售額的大部分。

- 紙張和紙板正成為各種食品塑膠包裝的可行替代品。可回收或可堆肥的紙質包裝可以利用回收材料更有效率地生產。永續的強化方法,例如水性塗料,可以使紙質替代品達到與塑膠相當的強度、防潮性和耐用性。

- 金屬包裝廣泛應用於食品和飲料行業,為食品內容物提供出色的保護,並保證比大多數其他包裝解決方案更長的保存期限。

- 根據聯合國統計,全球都市化正在加快,預計到 2050 年,都市區比例將達到 66%。都市化趨勢加上日益富裕的生活水準,正在推動飲食習慣的改變,其特徵是對包裝食品的需求量很大。

- 近年來,人們明顯傾向於使用有機包裝食品和更生態的包裝,尤其是在食品和飲料領域。有機貿易協會報告稱,對有機包裝食品的需求正在大幅增加。預計到 2025 年,這筆金額將從 2018 年的 174.59 億美元增至 250.6 億美元。

美國包裝產業概況

美國包裝產業比較分散,只有幾家大公司。主要公司包括美國包裝公司、Sonoco Products Company、Sealed Air Corp. 和 Owen Illinois Inc.。隨著全國經濟對包裝應用的需求不斷成長以及技術進步,許多公司正在將其基地擴展到各個最終用戶行業來增加其市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 對便利包裝的需求不斷增加

- 轉向永續替代品將推動對紙質和生質塑膠塑膠產品的需求

- 人口和生活方式的變化

- 市場限制

- 關於一次性塑膠包裝的政府環境法規

- 高度依賴原料的供應和價格

第6章市場區隔

- 依材料類型

- 紙和紙板(瓦楞紙箱、折疊式紙盒等)

- 塑膠(硬質和軟質)

- 金屬(罐、蓋、塞、容器、其他金屬)

- 玻璃(瓶子、容器)

- 按最終用戶產業

- 食物

- 飲料

- 製藥

- 家庭和個人護理

- 其他最終用戶產業

第7章競爭格局

- 公司簡介

- American Packaging Corporation

- Sonoco Products Company

- Sealed Air Corporation

- Amcor Group GmbH

- Owen Illinois Inc.

- Crown Holdings Inc.

- CCL Container

- Ball Corporation

- Berry Global Inc.

- International Paper Company

- Proampac LLC

第8章投資分析

第9章:市場的未來

The US Packaging Market size is estimated at USD 208.98 billion in 2025, and is expected to reach USD 254.01 billion by 2030, at a CAGR of 3.98% during the forecast period (2025-2030).

Key Highlights

- The US packaging industry is experiencing growth and developing innovative solutions for various packaging challenges. The Flexible Packaging Association (FPA) has identified opportunities to promote the benefits of flexible packaging in reducing food waste. The FPA suggests that flexible packaging can effectively reduce food waste when a "systems approach" is applied, considering both product and packaging aspects.

- Paperboard packaging is widely used in the packaged food market, particularly for products such as soups, seasonings, and dairy items. It is often coated with polymers or plastics to maintain cleanliness and preserve food quality. Compared to glass and metal alternatives, paperboard reduces the overall weight of the final product while preserving food freshness. Its odor and taste neutrality make it an ideal packaging material.

- The market is primarily driven by the growth of e-commerce sales and increasing demand for folded carton packaging. However, the availability of high-performance alternatives may hinder market growth. Paperboard packaging is recognized as an environmentally friendly option and can be produced in various sizes with a small footprint, making it suitable for multiple end-user sectors.

- The US retail market offers numerous growth opportunities for providers of all sizes. The increasing share of e-commerce sales is expected to impact the market positively. Many companies are still adapting their packaging for e-commerce, and overpacking is common in shipments from distribution centers to consumers. This complex retail chain leads to additional waste, energy consumption, and pollution. With its waterproof and lightweight properties, flexible packaging offers dimensional weight benefits that are attractive to e-commerce providers.

- Stringent environmental regulations from the federal government on plastic packaging are likely to affect market growth. For instance, in April 2023, the US Environmental Protection Agency (EPA) introduced a draft of the "National Strategy to Prevent Plastic Pollution" for public feedback. This initiative, part of the Biden-Harris Administration's efforts to create a sustainable economy, aims to halt the distribution of plastic and other waste from land-based sources into the environment by 2040.

US Packaging Market Trends

Paper and Paperboard Vertical to Hold Significant Market Share

- The United States remains one of the world's largest cardboard box producers and consumers, driven by high demand from downstream sectors. The country's cardboard box exports are also experiencing consistent growth. The United States is a key region in North America that is showing significant shifts in the paper market, largely due to government-led environmental safety initiatives. The demand for paper is increasing as consumer preferences shift toward biodegradable and sustainable packaging materials.

- The comprehensive ban on plastic materials in developed countries, including the United States, has positively impacted the market. The United States has announced plans to ban single-use plastics on public lands by 2032. This phased approach will gradually eliminate single-use plastics from national parks and other public areas over the next decade. The ban will encompass the marketing and distribution of plastic bottles, bags, and wrappers for food, drinks, and other items. Government agencies have been given one year to develop strategies for transitioning to alternatives such as compostable and biodegradable materials, with a deadline of 2032 to complete the shift.

- End users, particularly in the food and beverage industry and household care goods manufacturing, increasingly recognize the importance of using environmentally friendly packaging materials. Folding cartons, made from recyclable and biodegradable materials like paperboard, offer a sustainable alternative with minimal environmental impact. Responding to this trend, many suppliers now offer folding cartons with a high percentage of recycled paper content, further enhancing their environmental benefits.

- Cardboard box exports from the United States are also steadily increasing. According to International Paper, one of the country's top suppliers of containerboard and corrugated cardboard, the United States exported corrugated packaging totaling 416 billion square feet (BSF). Corrugated box shipments from the United States are anticipated to grow significantly between 2022 and 2026 to reach 560 BSF.

Food and Beverage to Hold Significant Market Share

- The food segment holds a significant market share due to increasing demand for food services and growth in the retail food business. Consumers are becoming more health-conscious, driving demand for fresh, healthy food delivery and consequently impacting food packaging requirements.

- The expansion of meal kit businesses like Hello Fresh and food delivery services such as Uber Eats is contributing to increased packaging demand. This trend is partly driven by millennials and younger consumers who frequently use these services while maintaining environmental awareness.

- The US beverage industry has experienced significant growth due to changing consumer habits. According to PMMI's Beverage Report, the North American beverage industry is projected to grow by 4.5% from 2018 to 2028, with the United States accounting for the majority of beverage sales in North America.

- Paper and cardboard are emerging as viable alternatives to plastic packaging for various food products. Recycled or compostable paper packaging can be produced more efficiently from recycled materials. Sustainable strengthening methods, such as water-based coatings, enable paper substitutes to achieve comparable strength, moisture resistance, and durability to plastic.

- Metal packaging is finding extensive application in the food and beverage industry, offering superior protection for food content and ensuring a longer shelf life than most other packaging solutions.

- According to the United Nations, global urbanization is rapidly increasing, with the proportion of people living in urban areas expected to reach 66% by 2050. This urbanization trend, coupled with rising affluence, is driving changes in dietary habits characterized by high demand for packaged food.

- In recent years, there has been a significant push for organic packaged food and more ecological packaging, particularly food and drink items. The Organic Trade Association reports that demand for organic packaged food is growing substantially. Its value is expected to increase from USD 17,459 million in 2018 to USD 25,060 million in 2025.

US Packaging Industry Overview

The US packaging industry is fragmented and has several major players. Some major players are American Packaging Corporation, Sonoco Products Company, Sealed Air Corp., and Owen Illinois Inc. With the rising demand for packaging applications and technological advancements across the country's economy, many companies are increasing their market presence by expanding their business footprint across various end-user industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Convenient Packaging

- 5.1.2 Move Toward Sustainable Alternatives to Spur Demand for Paper-Based and Bio -Plastic Based Products

- 5.1.3 Changing Demographic and Lifestyle Factors

- 5.2 Market Restraints

- 5.2.1 Environmental Regulations from Government Bodies over Single-use Plastic Packaging

- 5.2.2 High Dependence on Raw Material Availability and Pricing

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Paper and Paperboard (Corrugated Boxes, Folding Cartons, etc.)

- 6.1.2 Plastic (Rigid and Flexible)

- 6.1.3 Metal (Cans, Caps and Closures, Containers, and Other Metals)

- 6.1.4 Glass (Bottle and Containers)

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Household and Personal Care

- 6.2.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 American Packaging Corporation

- 7.1.2 Sonoco Products Company

- 7.1.3 Sealed Air Corporation

- 7.1.4 Amcor Group GmbH

- 7.1.5 Owen Illinois Inc.

- 7.1.6 Crown Holdings Inc.

- 7.1.7 CCL Container

- 7.1.8 Ball Corporation

- 7.1.9 Berry Global Inc.

- 7.1.10 International Paper Company

- 7.1.11 Proampac LLC