|

市場調查報告書

商品編碼

1687814

碳化鈣-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Calcium Carbide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

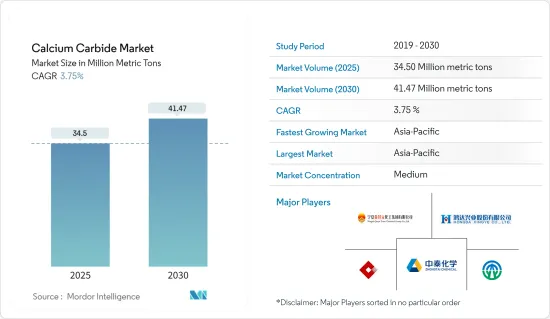

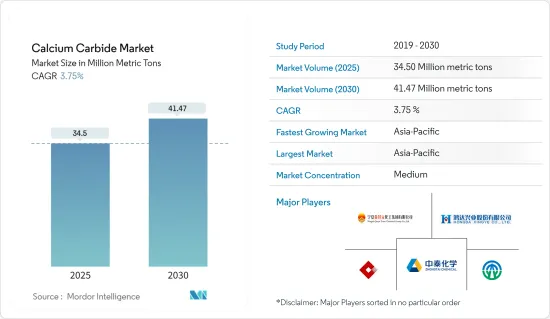

預計 2025 年碳化鈣市場規模將達到 3,450 萬噸,預計到 2030 年將達到 4,147 萬噸,預測期內(2025-2030 年)的複合年成長率為 3.75%。

COVID-19 對受訪市場產生了負面影響。疫情期間,汽車製造活動因封鎖而暫時停止,導致碳化鈣消費量下降。然而,限制解除後市場恢復良好。由於化工、冶金、食品等終端用戶產業對碳化鈣的消費量增加,市場出現明顯復甦。

化學製造需求的不斷成長和全球鋼鐵產量的上升正在推動所研究市場的成長。然而,碳化鈣對健康的不利影響和嚴格的環境法規可能會阻礙市場成長。

擴大乙炔及其衍生物的下游應用可以為所研究的市場帶來機會。

亞太地區佔據市場主導地位,中國是世界上最大的碳化鈣生產國和消費國。預計亞太地區在預測期內的複合年成長率最高。

碳化鈣市場趨勢

化工產業佔市場主導地位

- 碳化鈣是合成有機化學和工業化學中的關鍵組成部分。碳化鈣是乙炔的主要來源之一,廣泛應用於化學工業。乙炔是一種非常有用的碳氫化合物,因為其三鍵中蘊含著能量。

- 乙炔最常見的用途之一是作為生產氯乙烯、乙酸和丙烯腈的原料。 PVC 用於各種纖維、薄膜、電纜和片材配方,在建築和汽車領域有著廣泛的應用。

- 乙炔生產的另一種產品是氫氧化鈣,它有多種用途。其最廣泛的用途是石化燃料發電廠產生的排放,以去除硫化合物,防止其排放到大氣中。化學製造商使用氫氧化鈣來中和廢棄物,地方政府則用它來處理污水。

- 根據BASF2023發布的報告,預計全球化學品產量年增將從2023年的2.2%上升至與前一年同期比較的2.7%。

- 在美國,2022 年化學品產量增加了 2.3%。然而,2021 年與天氣相關的生產損失起了主要作用。同時,預計2022年南美產量將成長2.6%,略低於上年(成長3.6%)。

- 同樣,在歐洲,法國化學工業的化學品和化學產品總銷售額僅次於德國。法國在化學工業研發投入方面排名世界第六,每年投入約21億美元。

- 在南美,巴西化學工業協會(Abiquim)為化學工業提出了短期、中期和長期提案,以幫助降低成本、提高競爭力、改善監管和促進投資。該提案的目標是到2030年將化學工業在該國GDP的佔有率提高到2,312億美元。

- 碳化鈣也主要用於生產氰胺基化鈣,用作肥料。根據國際肥料工業協會預測,到2022年,東亞將成為全球化肥產能最高的地區,佔全球產量的31%以上。其次是東歐和中亞,佔17%。

- 根據中東通訊引述埃及化肥出口委員會的聲明稱,埃及化肥出口額預計將從 2021 年的 73.3 億美元成長 23%,至 2022 年的 86.2 億美元。化學工業佔埃及非石油出口總額的24%。

- 因此,這些因素和趨勢可能會影響未來幾年全球碳化鈣市場的成長。

亞太地區可望主導市場

- 亞太地區約佔全球碳化鈣需求的94%。中國是世界上最大的碳化鈣生產國和消費國,化學、冶金、食品等終端用戶產業的需求日益成長。

- 此外,由於蘊藏量龐大以及對VCM(氯乙烯單體)、VAM(醋酸乙烯單體)和乙炔法生產BDO(丁二醇)的需求不斷成長,碳化鈣的消費量也在增加。

- 中國是最大的煤炭消費量。除了用於發電之外,中國長期以來也利用煤炭生產化學品。自 19 世紀下半葉以來,煤焦油主要用於染料工業的芳香族化合物和特殊化合物的合成。

- 最近,碳化鈣已被用來將煤轉化為乙炔。這導致丙烯腈 (ACN)、氯乙烯單體 (VCM)、1,4-丁二醇 (BDO) 和丙烯酸 (AA) 的產量增加。中國計劃擴建約 10 個丙烯腈產能,到 2026 年總產能將達到約 223 萬噸/年。

- 此外,中國也是世界上最大的鋼鐵生產國。 2023年粗鋼產量為10.191億噸。 2023 年 9 月,中國鋼鐵製造商烏蘭浩特鋼鐵在其位於內蒙古(中國北方的一個自治區)的工廠運作了一座新的高爐。該高爐容量為1,200立方米,預計年產鐵113萬噸。預計鋼鐵產量的上升將推動用於燃燒和清洗用途的乙炔氣的需求。此外,碳化鈣也用於生產低碳鋼。碳化鈣在鋼鐵工業中扮演重要角色。主要用於鋼鐵生產過程中的脫硫工藝。

- 此外,日本是該地區第二大碳化鈣消費國。日本化學工業由少數知名公司主導,這些公司通常高度多元化,並經常與其他公司建立合作關係。根據德國化學工業委員會(VCI)預測,2022年日本化學工業銷售額預計將達到約2,272.6億歐元(2,466.3億美元)。日本化學工業銷售額位居亞洲第二,僅次於中國。

- 乙炔是由碳化鈣(CaC2)與水(H2O)反應生成的。預計到2022年,日本化學工業溶解乙炔產量將下降至8,110噸,低於2014年的10920噸,是觀察期間該產業的最低產量。值得注意的是,近年來該行業的產量一直在下降。

- 東南亞國協的硬質合金消費量也在增加。越南和印尼分別是全球第12大和第15大粗鋼生產國,產能分別為1,900萬噸和1,600萬噸。

- 根據世界鋼鐵協會的報告,預計2023年印尼粗鋼產量將增加2.8%,達到約1600萬噸,而2022年為1560萬噸。印尼鋼鐵業的積極成長得益於政府在智慧供需理念下,從上游到下游優先發展鋼鐵業的管理努力。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

碳化鈣產業概況

碳化鈣市場部分分散,頂級公司之間為擴大市場佔有率展開激烈競爭。市場主要企業(排名不分先後)包括新疆天業(集團)、新疆中泰化工、宏達興業、中鹽內蒙古化工、寧夏金裕源化工集團等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 全球鋼鐵業需求旺盛

- 化學製造需求增加

- 限制因素

- 碳化鈣對健康的不良影響

- 嚴格的環境法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 乙炔氣

- 氰胺基化鈣

- 還原劑和脫水劑

- 脫硫脫氧劑

- 其他用途

- 最終用戶產業

- 化學品

- 冶金

- 食物

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 世界其他地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Alzchem Group AG

- American Elements

- Carbide Industries LLC

- China Salt Inner Mongolia Chemical Co. Ltd

- DCM Shriram

- Denka Company Limited

- Hongda Xingye Co. Ltd

- Inner Mongolia Baiyanhu Chemical Co. Ltd

- Merck KGaA(Sigma-Aldrich)

- NGO Chemical Group Ltd

- Ningxia Jinyuyuan Chemical Group Co. Ltd

- Ningxia Yinglite Chemical Co. Ltd

- Xiahuayuan Xuguang Chemical Co. Ltd

- Xinjiang Tianye(Group)Co. Ltd

- Xinjiang Zhongtai Chemical Co. Ltd

第7章 市場機會與未來趨勢

- 乙炔及其衍生物下游用途的成長

The Calcium Carbide Market size is estimated at 34.50 million metric tons in 2025, and is expected to reach 41.47 million metric tons by 2030, at a CAGR of 3.75% during the forecast period (2025-2030).

COVID-19 negatively impacted the market studied. During the pandemic, automotive manufacturing activities were stopped temporarily due to the lockdown, thereby decreasing the consumption of calcium carbide. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of calcium carbide in chemicals, metallurgy, food, and other end-user industries.

The increasing demand for chemical production and rising steel production worldwide are driving the growth of the market studied. However, the detrimental health effects of calcium carbide and stringent environmental regulations may hinder market growth.

Growing downstream applications of acetylene and its derivatives can act as an opportunity for the market studied.

Asia-Pacific dominated the market, with China being the largest producer and consumer of calcium carbide globally. During the forecast period, Asia-Pacific is expected to record the highest CAGR.

Calcium Carbide Market Trends

Chemical Industry to Dominate the Market

- Calcium carbide is one of the primary building blocks in synthetic organic and industrial chemistry. It is one of the major sources of acetylene, which is extensively used in the chemical industry. Acetylene is an extremely useful hydrocarbon due to the energy that is locked up in its triple bond.

- One of the most common applications of acetylene is its use as a raw material for manufacturing vinyl chloride, acetic acid, and acrylonitrile. Vinyl chloride is used in the formulation of various fibers, films, cables, sheets, etc., and it has numerous applications in the construction and automotive sectors.

- The co-product of acetylene production is calcium hydroxide, which has several uses. It is most widely used in the process of scrubbing stack gases from fossil fuel-based power plants to remove sulfur compounds before they are released into the air. Chemical manufacturers use calcium hydroxide to neutralize their waste streams, while municipalities use it to treat sewage water.

- According to a report published by BASF 2023, global chemical production is expected to increase to 2.7% in 2024 from 2.2% in 2023, thus increasing year-on-year.

- In the United States, chemical production increased by 2.3% in 2022. However, the underlying impact of weather-related production losses in 2021 played a major role. Meanwhile, production in South America grew at 2.6% in 2022, slightly slower than the previous year (+3.6%).

- Similarly, in Europe, the French chemical industry is the second-largest in total sales of chemicals and chemical products after Germany. France ranks sixth among all countries in terms of R&D investments in the chemical industry, spending around USD 2.1 billion annually.

- In South America, the Brazilian Chemical Industry Association, Abiquim, introduced a set of short-, medium-, and long-term proposals for the chemical industry, which may help reduce cost, increase competitiveness, improve regulatory aspects, and increase investment. This proposal aims to increase the share of the chemical sector in the country's GDP to USD 231.2 billion by 2030.

- Calcium carbide is also majorly used in the production of calcium cyanamide, which is used as a fertilizer. As per the International Fertilizer Industry Association, in 2022, East Asia recorded the highest fertilizer production capacity worldwide, accounting for more than 31% of production. Eastern Europe and Central Asia followed, with a share of 17%.

- Moreover, according to the Middle East News Agency (MENA), citing a statement by the Egyptian Fertilizer Export Council, Egypt's chemical fertilizer exports were expected to increase by 23% from USD 7.33 billion in 2021 to USD 8.62 billion in 2022. The chemical sector accounted for 24% of Egypt's total non-oil exports.

- So, these factors and trends can affect the growth of the global calcium carbide market over the next few years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific accounts for around 94% of the global demand for calcium carbide. China is the world's largest producer and consumer of calcium carbide, with increased demand from end-user industries such as chemicals, metallurgy, and food.

- Moreover, because of its large reserves and growing demand for VCM (vinyl chloride monomer), VAM (vinyl acetate monomer), and BDO (butanediol) from acetylene, the consumption of calcium carbide is increasing.

- China records the largest consumption of coal. Not only has it been used for power generation, but the Chinese have been using coal for chemical production for a long time. Since the late 19th century, coal tar has been used to synthesize aromatics and special chemical compounds, primarily for the dye industry.

- Lately, the country has been using calcium carbide to convert coal to acetylene. This has led to the increased production of acrylonitrile (ACN), vinyl chloride monomer (VCM), 1,4-butanediol (BDO), and acrylic acid (AA). China has around ten planned additions to acrylonitrile capacity, with a total capacity of about 2.23 million tonnes per annum (Mtpa) by 2026.

- Additionally, China is by far the largest steel producer globally. In 2023, the county produced 1,019.1 million tons of crude steel. The second largest, India, had a production of a mere 140.2 Mt. Moreover, in September 2023, Chinese steel company Ulanhot Steel launched a new blast furnace at a plant in Inner Mongolia (an autonomous region in Northern China). The blast furnace capacity of 1.2 thousand cubic meters is estimated at 1.13 million tons of iron per year. The increasing steel production is expected to increase the demand for acetylene gas for flame-cutting and cleansing purposes. Additionally, calcium carbide is used in the production of low-carbon steel. Calcium carbide plays a vital role in the steel industry. It is primarily utilized in the desulfurization process during steel production.

- Moreover, Japan is the second largest consumer of calcium carbide in the region. The Japanese chemical industry is dominated by a few prominent companies, which are usually highly diversified and often form alliances with other companies. According to the German Chemical Industry Association, VCI, in 2022, the sales value of the chemical industry in Japan amounted to approximately EUR 227.26 billion (USD 246.63 billion). Following China, the Japanese chemical industry had the second-largest sales value in Asia.

- The reaction of calcium carbide (CaC2) with water (H2O) is used to produce acetylene. The production volume of dissolved acetylene in the chemical industry in Japan decreased to 8.11 thousand tons in 2022. The production volume has declined since 2014, when it amounted to 10.92 thousand tons. This marked the lowest production quantity in this industry during the observed period. Notably, this industry's production quantity decreased over the last few years.

- ASEAN countries are also witnessing an increased consumption of calcium carbide. Vietnam and Indonesia were the 12th and 15th largest crude steel producers globally, with a production capacity of 19 million tonnes and 16 million tonnes.

- As per the World Steel Association report, Indonesia produced around 16 million tons of crude steel in 2023, compared to 15.6 million tons in 2022, registering a growth of 2.8%. The positive growth of the steel industry in Indonesia was due to control efforts carried out by the government in the country, with the concept of smart supply demand, which was executed by prioritizing the national steel industry from the upstream sector to the downstream sector.

- Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

Calcium Carbide Industry Overview

The market studied is partially fragmented, with intense competition among the top players to increase their shares in the market. Some of the key players in the market (not in a particular order) include Xinjiang Tianye (Group) Co. Ltd, Xinjiang Zhongtai Chemical Co. Ltd, Hongda Xingye Co. Ltd, China Salt Inner Mongolia Chemical Co. Ltd, and Ningxia Jinyuyuan Chemical Group Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Demand from Steel Industry Across the World

- 4.1.2 Increase in Demand for Chemical Production

- 4.2 Restraints

- 4.2.1 Detrimental Effect of Calcium Carbide on Health

- 4.2.2 Stringent Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Acetylene Gas

- 5.1.2 Calcium Cyanamide

- 5.1.3 Reducing and Dehydrating Agent

- 5.1.4 Desulfurizing and Deoxidizing Agent

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Chemicals

- 5.2.2 Metallurgy

- 5.2.3 Food

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alzchem Group AG

- 6.4.2 American Elements

- 6.4.3 Carbide Industries LLC

- 6.4.4 China Salt Inner Mongolia Chemical Co. Ltd

- 6.4.5 DCM Shriram

- 6.4.6 Denka Company Limited

- 6.4.7 Hongda Xingye Co. Ltd

- 6.4.8 Inner Mongolia Baiyanhu Chemical Co. Ltd

- 6.4.9 Merck KGaA (Sigma-Aldrich)

- 6.4.10 NGO Chemical Group Ltd

- 6.4.11 Ningxia Jinyuyuan Chemical Group Co. Ltd

- 6.4.12 Ningxia Yinglite Chemical Co. Ltd

- 6.4.13 Xiahuayuan Xuguang Chemical Co. Ltd

- 6.4.14 Xinjiang Tianye (Group) Co. Ltd

- 6.4.15 Xinjiang Zhongtai Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Downstream Applications of Acetylene and Its Derivatives