|

市場調查報告書

商品編碼

1687772

基油:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Base Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

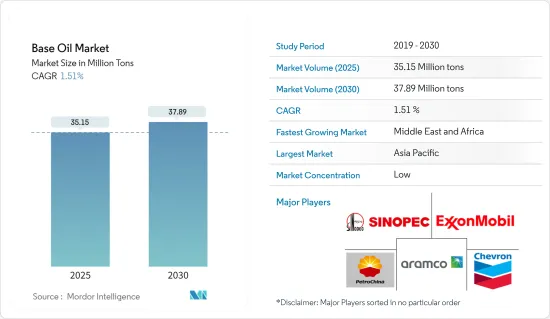

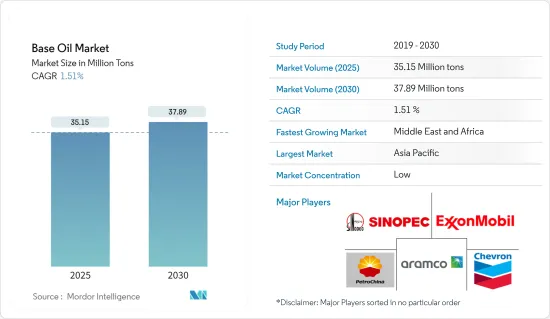

預計 2025 年基油市場規模為 3,515 萬噸,2030 年將達到 3,789 萬噸,預測期內(2025-2030 年)的複合年成長率為 1.51%。

受新冠疫情影響,2020年基油需求大幅下降。該病毒導致汽車業和其他各行業(航空、工業等)的產量下降。機油、齒輪油、潤滑脂和金屬加工油消費量的減少影響了基油市場。然而,由於汽車製造和其他行業生產活動的活性化,基油市場在 2021 年和 2022 年有所復甦。

主要亮點

- 在預計預測期內,亞太地區的快速工業化、液壓油和工業齒輪油等基油油的工業用途的探索以及汽車產量和銷量的增加將推動市場成長。

- 另一方面,由於對低黏度基礎基油的偏好導致對 I 類基礎基油的需求下降,預計將在預測期內阻礙市場成長。

- 然而,可再生基油和基油回收利用領域的技術創新有望提供市場機會。

- 由於中國、印度和日本等國家的需求龐大,預計亞太地區將佔據市場主導地位。

基油市場趨勢

機油領域佔據市場主導地位

- 由於汽車、電力、重型機械、金屬加工、化學品等各行業對引擎油的需求不斷成長,機油領域佔據了基油市場的主導地位。

- 機油廣泛用於潤滑內燃機。機油一般含有約7-10%的添加化學物質,其餘為基油。

- 在使用各種基油和添加劑配製引擎油時,氧化穩定性、沉積物預防、磨損和腐蝕保護等性能都是考慮的重要因素。高燃油經濟性機油由於其防止漏油和減少消費量的特性,近年來越來越受歡迎。

- 此外,各種投資和商業實踐的發展正在增加對機油的需求,這可能會促進基油市場的發展。例如,2023 年 4 月,Brakes India 宣布透過其 Revia 品牌進軍潤滑油領域。憑藉這一新品牌,該公司將進軍機油領域,滿足乘用車和商用車市場的需求。

- 此外,2023 年 3 月,埃克森美孚宣布將投資約 90 億印度盧比(1.1 億美元),在馬哈拉施特拉邦工業發展公司位於賴加德的伊桑貝工業區建立潤滑油製造廠。新廠的成品潤滑油年產能為159,000千公升,預計2025年開始商業營運。

- 此外,2023 年 2 月,殼牌公司宣布推出乘用車機油產品組合 Shell Helix SP HX8 0W-20。根據該公司介紹,該產品是一種全合成、符合 BS VI 標準的引擎油,專為渦輪增壓缸內噴油(TGDI) 引擎設計,可防止有害的低速預點火器(LSPI)。該公司還聲稱將提高車輛的燃油效率,同時減少排放氣體並改變引擎設計。

- 預計汽車產業對機油的需求將推動基油市場的發展。根據OICA預測,2023年全球汽車銷售量將達到9,272萬輛,而2022年為8,287萬輛。

- 因此,預計上述因素將在預測期內影響引擎油領域基油的成長。

亞太地區佔市場主導地位

- 預計亞太地區將主導全球市場。中國、印度、日本和韓國等國家各領域的潤滑油消費量不斷增加,推動了該地區基油使用量的上升。

- 根據國際貿易局發布的資料,中國對汽車潤滑油的需求預計將在 2026 年達到 51.9 億公升,2021 年至 2026 年的複合年成長率為 5.41%。預計這將推動該國的基油需求。

- 同樣,國家統計局發布的資料顯示,2024年3月中國工業增加與前一年同期比較增4.5%。 2023年9月至12月,製造業、公共產業和採礦業的營運放緩限制了整體工業生產的與前一年同期比較成長。

- 在印度,汽車保有量的強勁成長(2023 年汽車銷量年增 12%)和工業活動的活性化(2024 年 2 月年增率為 5.7%)預計將在預測期內推動與前一年同期比較基油需求。

- 此外,在日本,各大潤滑油廠商都依賴長期供應合約來滿足該國對基油的需求。例如,出光興產於2023年10月簽署了一份合作備忘錄,以確保長期穩定採購第三類基油。

- 因此,預計上述因素將在預測期內對亞太地區的基油市場產生重大影響。

基油產業概覽

基油市場本質上是分散的。主要參與者(不分先後順序)包括埃克森美孚公司、沙烏地阿拉伯石油公司(Aramco)、中國石油天然氣股份有限公司、雪佛龍公司和中國石油化學集團公司(SINOPEC)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區快速工業化

- 汽車產銷量不斷成長

- 限制因素

- 一級基油需求下降

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 第一組

- 第二組

- 第三組

- 第四組

- 其他(第五類和生物基基油)

- 按應用

- 機油

- 變速箱/齒輪油

- 金屬加工油

- 油壓

- 潤滑脂

- 其他(加工油、透平油、壓縮機油、循環油等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 印尼

- 越南

- 泰國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 埃及

- 卡達

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- ADNOC(Abu Dhabi National Oil Company)

- Chevron Corporation

- China Petrochemical Corporation(SINOPEC)

- CNOOC Limited

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Gazprom Neft PJSC

- GS Caltex Corporation

- Indian Oil Corporation Ltd

- LUKOIL

- Nynas AB

- Petrobras

- PetroChina

- PETRONAS Lubricants International

- Philips 66 Company

- Repsol

- Saudi Arabian Oil Co.(ARAMCO)

- Sepahan Oil Company

- Shandong Qingyuan Group Co. Ltd

- Shell PLC

- SK Innovation Co. Ltd

- Total Energies

第7章 市場機會與未來趨勢

- 可再生基油油的創新

- 基油油回收

The Base Oil Market size is estimated at 35.15 million tons in 2025, and is expected to reach 37.89 million tons by 2030, at a CAGR of 1.51% during the forecast period (2025-2030).

The demand for base oil decreased significantly in 2020 due to the outbreak of COVID-19. The virus caused production to decline in the automotive industry and various other industrial units (aviation, industrial, etc.). The reduction in the consumption of engine oil, gear oil, greases, and metalworking fluid affected the base oil market. However, in 2021 and 2022, the base oil market recovered as car manufacturing and production activities across other industries ramped up.

Key Highlights

- Rapid industrialization in Asia-Pacific, considering the industrial application of base oil such as hydraulic fluid and industrial gear oil, and growing automotive production and sales are expected to drive the market's growth during the forecast period.

- On the flip side, the declining demand for group I base oils due to the preference for lighter viscosity base oils is likely to hamper the market's growth over the forecast period.

- Nevertheless, innovations in the field of renewable base oils and recycling of base oils are anticipated to provide opportunities for the market studied.

- Asia-Pacific is expected to dominate the market owing to significant demand from countries such as China, India, and Japan.

Base Oil Market Trends

The Engine Oil Segment to Dominate the Market

- The engine oil segment dominates the base oil market due to the growing demand for engine oil from various industries such as automotive, power, heavy equipment, metalworking, and chemicals.

- Engine oils are widely used to lubricate internal combustion engines. They generally contain about 7% to 10% additive chemicals, with the rest as base oil.

- Properties like oxidation stability, deposit control, and wear and corrosion protection are the key factors taken into consideration when forming engine oils using different base oils and additives. High-mileage engine oils are in demand lately, owing to the properties that help prevent oil leaks and reduce oil consumption.

- Additionally, various investments and developments in business practices are enhancing the demand for engine oil, which may boost the market for base oil. For instance, in April 2023, Brakes India announced it would enter the lubricants segment through the Revia brand. With its new brand, the company is diversifying into the engine oil space, catering to both passenger car and commercial vehicle segments.

- Furthermore, in March 2023, Exxon Mobil Corporation announced the investment of nearly INR 900 crore (USD 110 million) to build a lubricant manufacturing plant at the Maharashtra Industrial Development Corporation's Isambe Industrial Area in Raigad. The new plant is expected to produce 159,000 kiloliters of finished lubricants per year, with commercial startup expected by 2025.

- In addition, in February 2023, Shell PLC announced the launch of its passenger car motor oil portfolio, Shell Helix SP HX8 0W-20. According to the company, the product is a fully synthetic, BS VI-compliant engine oil designed for turbocharged petrol direct injection (TGDI) engines to protect against damaging low-speed pre-ignition (LSPI). The company also claims to aid a vehicle's fuel economy while reducing emissions and changes in engine design.

- The demand for engine oil from the automotive sector is expected to enhance the base oil market. According to OICA, global motor vehicle sales amounted to 92.72 million in 2023 compared to 82.87 million in 2022.

- Hence, the aforementioned factors are expected to influence the growth of base oil in the engine oil segment over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global market. With the growing consumption of lubricants from various sectors in countries like China, India, Japan, and South Korea, the usage of base oil is increasing in the region.

- According to the data published by the International Trade Administration, China's demand for automotive lubricants is expected to reach 5.19 billion liters in 2026, registering a CAGR of 5.41% during the 2021-26 period. It is expected to drive the demand for base oils in the country.

- Similarly, according to the data published by the National Bureau of Statistics, China's industrial output grew by 4.5% year-on-year in March 2024. The slowdown of operations in the manufacturing, utilities, and mining sectors from September 2023 to December 2023 restricted the overall Y-o-Y growth of industrial output.

- In India, strong growth in vehicle population (12% Y-o-Y growth in vehicle sales in 2023) and increasing industrial activity (5.7% on an annual basis in February 2024) are expected to drive the demand for base oils during the forecast period.

- Additionally, in Japan, various large-scale lubricant manufacturers are relying on long-term supply contracts to meet the domestic base oil demand. For instance, in October 2023, Idemitsu Kosan Co. Ltd signed an MoU to secure a long-term stable procurement of group III base oil.

- As a result, the above-mentioned factors are projected to substantially influence the base oil market in Asia-Pacific during the forecast period.

Base Oil Industry Overview

The base oil market is fragmented in nature. The major players (not in any particular order) include Exxon Mobil Corporation, Saudi Arabian Oil Co. (Aramco), PetroChina, Chevron Corporation, and China Petrochemical Corporation (SINOPEC).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Industrialization in Asia-Pacific

- 4.1.2 Growing Automotive Production and Sales

- 4.2 Restraints

- 4.2.1 Declining Demand for Group I Base Oils

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Other Types (Group V and Bio-based Base Oils)

- 5.2 Application

- 5.2.1 Engine Oils

- 5.2.2 Transmission and Gear Oils

- 5.2.3 Metalworking Fluids

- 5.2.4 Hydraulic Fluids

- 5.2.5 Greases

- 5.2.6 Other Applications (Process Oils, Turbine Oil, Compressor Oil, Circulating Oils, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malayisa

- 5.3.1.6 Indonesia

- 5.3.1.7 Vietnam

- 5.3.1.8 Thailand

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADNOC (Abu Dhabi National Oil Company)

- 6.4.2 Chevron Corporation

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 CNOOC Limited

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Formosa Petrochemical Corporation

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 GS Caltex Corporation

- 6.4.9 Indian Oil Corporation Ltd

- 6.4.10 LUKOIL

- 6.4.11 Nynas AB

- 6.4.12 Petrobras

- 6.4.13 PetroChina

- 6.4.14 PETRONAS Lubricants International

- 6.4.15 Philips 66 Company

- 6.4.16 Repsol

- 6.4.17 Saudi Arabian Oil Co. (ARAMCO)

- 6.4.18 Sepahan Oil Company

- 6.4.19 Shandong Qingyuan Group Co. Ltd

- 6.4.20 Shell PLC

- 6.4.21 SK Innovation Co. Ltd

- 6.4.22 Total Energies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in the Field of Renewable Base Oils

- 7.2 Recycling of Base Oils