|

市場調查報告書

商品編碼

1687738

貿易管理軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Trade Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

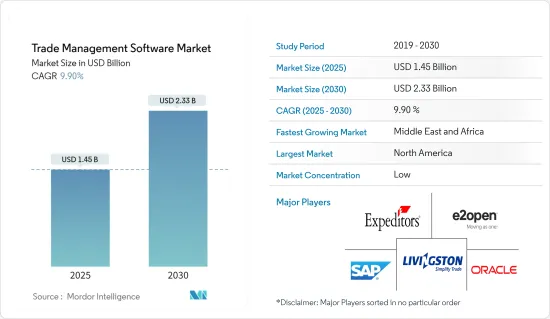

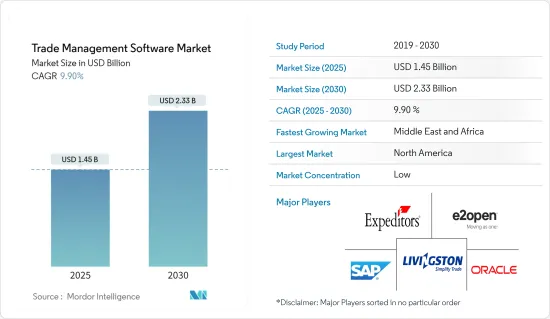

貿易管理軟體市場規模預計在 2025 年為 14.5 億美元,預計到 2030 年將達到 23.3 億美元,預測期內(2025-2030 年)的複合年成長率為 9.9%。

主要亮點

- 對貿易控制自動化技術的需求不斷成長以及減少組織支出的願望日益強烈是推動市場成長的主要因素。市場規模是根據針對各種最終用戶應用程式的貿易管理軟體銷售產生的收入來計算的。

- 此外,貿易管理軟體還提供可協助商家和企業減輕供應鏈和法律風險的功能。該軟體將出口商和進口商與其他國家的供應商、仲介、物流服務提供者和承運商聯繫起來。公司使用該軟體來監控和追蹤其跨境業務。透過自動化跨境流程,該應用程式有助於降低風險並有助於管理進出口和法律/監管要求。

- 全球化和外包使得供應網路變得越來越複雜和分散。這些進步擴大了供應鏈視覺性解決方案的產品範圍,也增加了國際貿易量、改善解決方案的需求以及受合規、海關和關稅約束的商品數量。

- 新冠肺炎疫情擾亂了國際貿易。為了防止冠狀病毒傳播,許多國家的當局實施了全球運輸和貿易限制。這些限制和社會排斥阻礙了分銷網路和國際貿易。美國、歐盟、中國等已開發國家的化學品和汽車銷售量大幅下降。紡織品、辦公室設備、精密儀器、通訊設備等貿易均大幅下降。

- 然而,自疫情爆發以來,該行業已看到各種規模和行業的公司數位化進程加速。快速的數位轉型將促進全球貿易、商業和就業創造。例如,根據亞洲開發銀行的《2022年亞洲經濟整合調查》,數位產業規模預計將成長20%,以便在2022年至2028年期間為全球產出增加4.3兆美元。

貿易管理軟體市場趨勢

消費品推動市場

- 進出口管制、限制方篩選、貿易合規、海關申報、自由貿易區和跨境貿易管理都是消費品公司可以使用貿易管理軟體處理的與貿易相關的流程。國家之間的經濟交流稱為國際貿易。服裝和電視等消費品、機械等資本財、原料、食品等定期交換。

- 許多全球消費品企業依賴單一平台收集來自不同市場和通路的貿易支出資料,以便進行企業範圍的報告和決策。根據逆向工程研究,這通常包含有關交易對手保證金需求的資料,並清楚地說明交易對手想要的安排。

- 貿易促銷管理 (TPM) 和最佳化 (TPO) 是消費品製造商用來規劃、管理和執行需要零售合作夥伴協作促銷參與的活動的程序和技術。

- 消費品企業面臨多重挑戰,包括通貨膨脹導致的成本上升、淨利率縮小以及全球供應鏈問題,這些可能導致銷售額和品牌忠誠度下降。由於經濟的不確定性,消費品產業正在尋求數位解決方案來提高業務的效率和穩健性。

- 例如,根據英國國家統計局的數據,2023 年第三季英國出口額約為 269,581 美元。本季進口額約為 275,278 美元。進口量不斷成長,各組織正在使用貿易管理軟體來降低國際貿易的成本和風險。

- 透過整合的銷售計劃,貿易管理軟體使消費品製造商能夠將其零售合作夥伴的貿易投資需求與其自身的收益和銷售成長目標相結合,從而獲得更高的利潤和投資回報率。

北美預計將佔據主要市場佔有率

- SAP、 Oracle和 Amber Road Inc. 等知名競爭對手的存在預計將使北美在貿易管理軟體市場佔據相當大的市場佔有率。

- 此外,該地區快速而嚴格的貿易法規正在推動對這些解決方案的需求,以實現無縫合規並避免錯過稅收和關稅期限。

- 美國政府正在努力增加本地生產商品的使用。因此,出口成長將與國際進口成長保持一致。因此,使用貿易管理軟體來追蹤和滿足各國的監管標準預計將進一步增加。

- 此外,北美雲端基礎解決方案產業的興起可能會使貿易管理軟體市場受益。

- 根據世界貿易組織(WTO)消息,2022年3月,加拿大捐款200萬美元(150萬澳元),幫助開發中國家和最不開發中國家更積極參與全球農業貿易。標準與貿易發展基金(STDF)提供的資金幫助各國達到國際食品、植物和動物健康標準,促進其進入區域和全球市場。

- 根據美國經濟分析局的數據,2022年第一季美國進口的商品和服務總價值從2021年第一季的7955億美元增加至1.185兆美元。隨著美國進口的商品和服務的增加,對貿易管理軟體的需求可能會增加。

- 其他區域性公司正在進行收購、合併和合作等各種行動,這可能會刺激對貿易管理軟體的需求。

貿易管理軟體產業概況

貿易管理軟體市場競爭激烈,有Oracle Corporation、Expeditors International of Washington、Amber Road, Inc. (E2open)、SAP SE 和 Livingston International 等公司。

2024年2月,Oracle公司宣布Oracle Fusion Cloud Supply Chain and Manufacturing增加了針對物流和運輸管理的新的商業智慧功能。由於運輸和全球貿易能力建立在同一平台上,因此這項新功能旨在管理貨物的流動和分配。

2022 年 7 月,報關、貨運代理商和全球貿易諮詢服務供應商 Livingston International 推出了 Livingston Direct。這種完全數位化、用戶主導的工具使美國進口商對其網路通關有更大的可視性和控制力。推出 Livingston Direct 是該公司的最新舉措,該公司將繼續為希望簡化清關流程的企業提供數位服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 高效處理全球貿易

- 加強政府對國際貿易的監管

- 市場限制

- 組織中的採用率緩慢

第6章 市場細分

- 按組件

- 解決方案

- 供應商管理

- 進出口管制

- 出貨單管理

- 其他解決方案(財務、合規等)

- 服務

- 諮詢

- 執行

- 解決方案

- 擴張

- 在雲端

- 本地

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- 防禦

- 藥品

- 能源

- 運輸和物流

- 消費品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Oracle

- Expeditors International of Washington Inc.

- Amber Road Inc.(e2open, LLC.)

- SAP SE

- Livingston International

- Thomson Reuters Corporation

- Cognizant

- United Parcel Service of America, Inc.

- The Descartes Systems Group Inc.

- MIC

- Bamboo Rose LLC

- OCR Services Inc.

第8章投資分析

第9章:市場的未來

The Trade Management Software Market size is estimated at USD 1.45 billion in 2025, and is expected to reach USD 2.33 billion by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

Key Highlights

- Growing demand for trade management automation technologies and the increasing desire to reduce organizational expenditures are among the primary drivers driving market growth. The income from trade management software sales for various end-user applications calculates the market size.

- Furthermore, trade management software provides features that help merchants and enterprises reduce supply chain and legal risks. It links importers and exporters with suppliers, brokers, logistic service providers, and carriers in other countries. The software is used by businesses to monitor and track cross-border operations. By automating cross-border processes, the application decreases risk and assists in properly managing and administrating imports-exports and legal and regulatory requirements.

- Supply networks have grown increasingly complicated and fragmented due to globalization and outsourcing. These advancements strengthen the product range of supply chain visibility solutions, the amount of international commerce, the demand for solutions to improve it, and the number of items subject to compliance, customs, and tariffs.

- The COVID-19 epidemic impeded international trade. To prevent the spread of the coronavirus, authorities in numerous countries enforced worldwide transportation and commerce restrictions. Such constraints and social alienation hampered the distribution network and international trade. Chemical and automobile sales have fallen dramatically in industrialized economies such as the United States, the European Union, and China. Textiles, office machinery, precision instruments, and communications equipment have all seen significant declines in trade.

- However, following the pandemic, the industry saw a faster digital transition for businesses of all sizes and industries. This rapid digital transformation will increase global trade, business, and job creation. For instance, according to the Asian Development Bank's Asian Economic Integration Study 2022, a 20% growth in digital sector size is predicted to boost global output by USD 4.3 trillion between 2022 and 2028.

Trade Management Software Market Trends

Consumer Goods to Drive the Market

- Import/export management, restricted party screening, trade compliance, custom filings, free trade zones, and cross-border trade management are all trade-related procedures that consumer products firms can use trade management software to handle. Economic exchanges between countries are referred to as international commerce. Consumer items like apparel and television sets and capital goods like machinery, raw materials, food, and other things are regularly exchanged.

- Many global consumer products businesses utilize a single platform to collect trade spending data from diverse markets and channels for reporting and decision-making throughout the company. Based on reverse-engineering research, the venue usually incorporates data regarding trade partners' margin needs to clarify what sort of arrangement trading partners want.

- Trade promotion management (TPM) and optimization (TPO) are procedures and technology consumer goods manufacturers use to plan, manage, and execute activities that need collaborative promotional involvement from their retail partners.

- The consumer products business faces several challenges, including inflation-driven cost increases, narrower margins, and global supply chain issues, which can lead to decreasing sales and brand loyalty. As a result of economic uncertainty, the consumer products industry is looking for digital solutions to improve the efficiency and robustness of its operations.

- For instance, according to the Office for National Statistics (UK), United Kingdom exports in the third quarter of 2023 were about USD 269,581. Its imports were valued at roughly USD 275,278 that quarter. Imports are increasing, and organizations use trade management software to reduce the costs and hazards of international commerce.

- Through integrated sales planning, consumer goods manufacturers may use Trade Management Software to match retail partners' trade investment demands with their own revenue and volume growth goals, as well as more significant margins and ROI.

North America Expected to Hold Major Market Share

- The existence of prominent rivals such as SAP, Oracle, and Amber Road Inc. is expected to provide North America with a significant market share in the trade management software market.

- Furthermore, the region's rapid and severe trade laws raise demand for these solutions to ensure seamless compliance and no missed tax and duty deadlines.

- The United States government seeks to increase its use of locally produced items. As a result, export growth will be equivalent to international import growth. As a result, the use of trade management software to track and conform to each country's regulatory standards is projected to rise further.

- Furthermore, the rising cloud-based solutions industry in North America will benefit the trade management software market.

- According to the World Trade Organization (WTO), in March 2022, Canada donated $2,000,000 (USD 1.5 million) to assist developing and least-developed nations in becoming more active participants in global agricultural trade. The Standards and Trade Development Facility (STDF) funding assists nations in meeting international food, plant, and animal health standards, allowing them to access regional and global markets more easily.

- According to BEA, In the first quarter of 2022, the total value of goods and services imported into the United States increased from USD 795.5 billion in the first quarter of 2021 to USD 1,018.5 billion. The demand for trade management software will increase as more goods and services are imported into the US.

- Other regional firms are engaged in different actions such as acquisition, merger, and partnership, which will likely enhance demand for trade management software.

Trade Management Software Industry Overview

The trade management software market is competitive with the presence of players like Oracle Corporation, Expeditors International of Washington, Inc., Amber Road Inc. (E2open), SAP SE, and Livingston International.

In February 2024, Oracle Corporation announced that Oracle Fusion Cloud Supply Chain and Manufacturing has added new business intelligence capabilities for logistics and transportation management. The new capabilities are aimed at managing the flow and distribution of goods, as the transportation and global trade functionalities are built on the same platform.

In July 2022, Livingston International, a supplier of customs brokerage, freight forwarding, and worldwide trade consultancy services, introduced Livingston Direct. This entirely digital, user-directed tool allows US importers better visibility and control over online customs clearance. The introduction of Livingston Direct is the company's newest move in its continuous drive to deliver expanded digital services to businesses wishing to streamline customs procedures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of The Impact of COVID-19 on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Efficient Handling of Global Trade

- 5.1.2 Increasing Government Regulations in International Trade

- 5.2 Market Restraints

- 5.2.1 Slow Adoption Rates Among Organizations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.1.1 Vendor Management

- 6.1.1.2 Import/Export Management

- 6.1.1.3 Invoice Management

- 6.1.1.4 Other Solutions (Finance, Compliance, Etc.)

- 6.1.2 Service

- 6.1.2.1 Consulting

- 6.1.2.2 Implementation

- 6.1.1 Solution

- 6.2 By Deployment

- 6.2.1 On-Cloud

- 6.2.2 On-Premise

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 Defense

- 6.4.2 Pharmaceuticals

- 6.4.3 Energy

- 6.4.4 Transportation and Logistics

- 6.4.5 Consumer Goods

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle

- 7.1.2 Expeditors International of Washington Inc.

- 7.1.3 Amber Road Inc. (e2open, LLC. )

- 7.1.4 SAP SE

- 7.1.5 Livingston International

- 7.1.6 Thomson Reuters Corporation

- 7.1.7 Cognizant

- 7.1.8 United Parcel Service of America, Inc.

- 7.1.9 The Descartes Systems Group Inc.

- 7.1.10 MIC

- 7.1.11 Bamboo Rose LLC

- 7.1.12 OCR Services Inc.