|

市場調查報告書

商品編碼

1687484

汽車線束:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

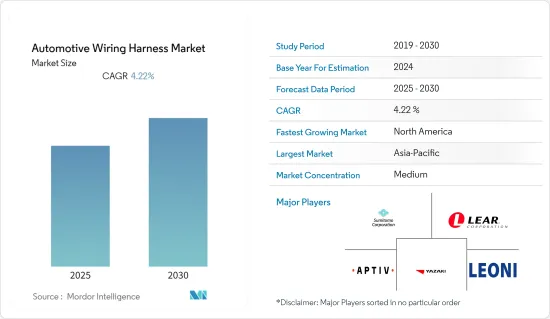

預計預測期內汽車線束市場複合年成長率將達到 4.22%。

新冠疫情對全球一體化汽車產業產生了迅速且嚴重的影響。許多OEM生產線的關閉間接影響了汽車線束市場。然而,一些國家解除封鎖措施導致汽車需求略有增加,預計將推動未來幾年的市場成長。例如,預計2022年乘用車銷量將達到5,749萬輛,高於2021年的5,644萬輛。因此,線束公司也增加了2022年的製造投資,以滿足因新冠疫情后經濟復甦導致的汽車銷售成長對線束產品的需求成長。例如

主要亮點

- 2022年7月:住友電裝在柬埔寨皇家集團金邊經濟特區開設了新的汽車線束產品製造廠。

推動市場成長的關鍵因素包括對安全解決方案的日益重視、混合動力汽車和電動車的需求和使用的成長以及汽車電氣化的不斷提高。然而,可靠性和耐用性等挑戰可能會限制市場成長。

電動車銷量的不斷成長也是汽車線束行業成長的主要驅動力,因為線束是控制電動車幾乎所有重要功能的線束系統的主要組成部分。

由於自動化故障而發生的一系列事故引起了客戶和政府對先進安全功能的興趣。他們正在致力於增強汽車的安全系統,預計這將推動線束市場的發展。導航和資訊娛樂系統已成為全球大多數汽車的標準配備。

從長遠來看,行業巨頭加大對研發的投資、電動和混合動力汽車銷量的成長以及對車輛連接功能的需求的不斷成長,可能會推動汽車線束行業的需求,導致汽車線束系統銷量激增。

預計亞太地區將在預測期內佔據市場主導地位。預計收緊和監管力度的加強將導致汽車需求增加,從而進一步推動該地區汽車線束市場的成長。此外,世界各國政府正在採取各種措施來鼓勵人們使用電動車。

汽車線束市場趨勢

電動車可望推動市場成長

電動車正迅速成為汽車產業的主流。電動車幫助車主降低車輛營業成本,幫助政府實現清潔環境和能源獨立,減少污染物和其他溫室氣體的排放,並減少石油進口。日益增強的環保意識和積極主動的政府舉措是推動全球範圍內採用電動車的主要因素。

電動車市場經歷了顯著成長,預計2022年銷量將超過1,000萬輛。今年,所有售出的汽車中將有14%是電動車,比2020年增加5倍(當時新車中不到5%是電動車),比2021年增加55%(當時新車購買中約有9%是電動車)。

中國再次佔全球電動車銷量的60%左右。全球道路上行駛的電動車有一半以上來自中國,中國已超額完成了2025年新能源車銷售目標。在第二大市場歐洲,電動車銷量到2022年將成長15%以上,屆時售出的汽車中將有五分之一以上是電動車。 2022年美國電動車銷量預計將翻倍55%,達到已揭露銷量的8%。

隨著電動車在全球範圍內越來越受歡迎,一些電線電纜製造商正在大力投資擴大生產能力,以滿足日益成長的需求。例如

2022年9月,矢崎株式會社在摩洛哥拉巴特附近的蓋尼特拉開設了第四家製造工廠,投資額為3,000萬美元。

由於上述趨勢和發展,預計電動車需求的不斷成長將暫時推動線束市場的需求。

預計亞太地區將主導目標市場

預計亞太地區將佔據汽車線束市場的大部分佔有率。亞太地區可支配收入的增加和 GDP 的成長正在推動市場的發展。汽車零件製造的便利性、汽車銷售的便利性、政府法規的不斷增加改善了電動車的普及,以及亞太地區OEM和供應商為滿足汽車行業日益成長的需求而採取的強勁擴張措施,預計將為預測期內的市場成長創造光明的前景。

為了滿足中國汽車行業日益成長的需求,政府法規的不斷增加提高了該地區OEM和供應商對電動車的採用率,並且強勁擴張預計將為市場成長帶來積極的前景。例如,

- 中國市場在 2022 年上半年迎頭趕上,在新註冊的乘用車中,電動車 (BEV) 佔 19%,插電式混合動力車佔 5%。這比去年的市場佔有率提高了8個百分點,是2020年的4倍,中國已經超額完成了「十四五」排放減排工作規劃中確定的20%電動車佔比目標,比2025年的目標提前了兩年。

該地區其他重要國家為印度和韓國。印度對於汽車線束製造商來說是一個利潤豐厚的市場,因為政府允許 100% 的外國投資進入汽車產業。此外,印度新車註冊數量每年都在增加,為汽車線束製造商創造了良好的成長環境。印度也是領先的汽車線束系統製造商 Motjrson Sumi Ltd. 的所在地。

由於傳統的佈線方法不適合汽車製造商提供的功能升級,汽車線束正在穩步成長。這種線束系統的引入還提高了車輛的燃油效率,使其符合印度政府的燃油消耗和排放氣體法規。由於這些因素,汽車線束市場預計將以合理的速度成長,從而導致預測期內需求擴大。

汽車線束產業概況

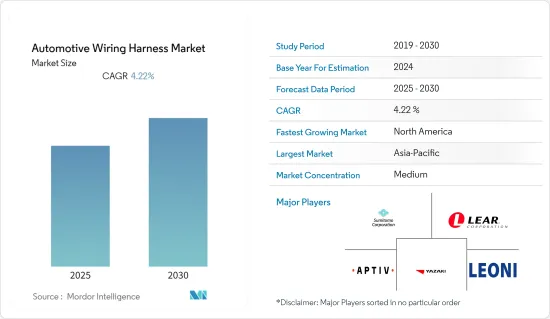

汽車線束市場高度整合,由全球企業和極少數本地企業主導。主要公司包括住友商事株式會社、Aptiv Plc、矢崎株式會社、Motherson Group、Leoni AG 和 Lear Corporation。市場競爭適中。

不同的線束製造商在汽車的其他控制系統中也佔有突出地位。 Leoni AG 集團專門為汽車市場提供電線、電纜系統和光纖。 Leoni 僅在 EMEA 地區就創造了約 45% 的銷售額。為了在市場上獲得顯著優勢,許多公司正在建立夥伴關係,為其產品提供最新功能並擴大生產能力。

例如,矢崎株式會社於2022年6月宣布,將在瓜地馬拉聖馬可斯省阿尤特拉建立中試生產設施。該工廠投資額為 1,000 萬美元,僱用 1,000 名員工,預計將於 2023 年 1 月運作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 汽車產量成長

- 對先進安全功能的需求不斷增加

- 市場限制

- 原物料價格波動

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按應用程式類型

- 點火系統

- 充電系統

- 傳動系統和動力傳動系統傳動系統

- 資訊娛樂系統和儀錶板

- 車輛控制和安全系統

- 車身和座艙線束

- 按線材類型

- 銅

- 鋁

- 按車輛類型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- LEONI AG

- Yazaki Corporation

- Aptiv PLC

- Sumitomo Electric Industries Ltd.

- Lear Corporation

- Motherson Sumi Systems Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Coroplast Fritz Muller GmbH & Co.

- Jiangsu Kyungshin Electronic Co. Ltd.

- Nexans

- THB Group

第7章 市場機會與未來趨勢

- 聯網汽車日益普及

The Automotive Wiring Harness Market is expected to register a CAGR of 4.22% during the forecast period.

The COVID-19 outbreak swiftly and severely impacted the globally integrated automotive industry. The shutdown of many OEM production lines indirectly affected the automotive wiring harness market. However, with the removal of lockdown guidelines in several countries, the demand for vehicles slightly increased, which is expected to propel the market growth forward in the coming years. For instance, passenger vehicle sales in 2022 reached 57.49 million units, up from 56.44 million in 2021. Thus, wiring harness companies also increased their manufacturing investments in 2022 to address the increased demand for wiring harness products due to growing automotive sales resulting from the post-COVID-19 pandemic recovery. For instance

Key Highlights

- July 2022: Sumitomo Wiring Systems Ltd inaugurated a new manufacturing facility for automobile wiring harness products at Royal Group Phnom Penh Special Economic Zone in Cambodia.

The growing emphasis on safety solutions, expanding demand and usage of hybrid and electric vehicles, and increasing electrification of vehicles are some of the primary driving factors for the market's growth. However, challenges such as reliability and durability may limit the market's growth.

The rising sales of electric vehicles also provide a major impetus to the growth of the automotive wiring industry since wiring harnesses are a major component of wiring systems used to control almost all the critical functions of an electric vehicle.

The continual rise in accidents caused by automation faults has led customers and governments to exhibit increased interest in advanced safety features. They are working on enhancing their vehicle's safety systems, which is expected to drive the wire harness market. The adoption of navigation and infotainment systems has become standard features in most cars worldwide.

Over the long term, increasing investments in R&D by major industry players and a rise in sales of electric and hybrid vehicles, as well as rising demand for connectivity features in automobiles, will create demand in the automotive wiring harness industry with a surge in sales of automotive wiring harness systems.

The Asia-Pacific region is expected to dominate the market during the forecast period. With the upliftment of lockdown and restrictions, the increased demand for vehicles is expected to be observed, which is anticipated to further aid in the growth of the automotive wiring harness market across the region. Moreover, various initiatives have been undertaken by different governments worldwide to promote the adoption of electric vehicles.

Automotive Wiring Harness Market Trends

Electric Vehicles are Expected to Drive the Market Growth

Electric vehicles are fast becoming a mainstream part of the automotive industry. They help vehicle owners cut down the operating costs of their vehicles and governments to achieve a clean environment and energy independence along with reduced emission of pollutants and other greenhouse gases as lower oil imports. The increasing environmental concerns and favorable government initiatives are the major factors driving the adoption of electromobility worldwide.

Electric car markets experienced significant growth in 2022, as sales surpassed the 10 million mark. By that year, 14% of all cars sold were electric, representing a five-fold increase from 2020, when less than 5% of new vehicles were electric, and a 55% rise from 2021, when around 9% of new cars purchased were electric.

China once again dominated global electric car sales, accounting for around 60%. With more than half of all-electric cars internationally on the roads located in China, the country has already surpassed its 2025 target for new energy vehicle sales. In Europe, the 2nd greatest market, electric car sales enhanced by over 15 % in 2022, meaning that over one in any five vehicles sold was electric. Electric car sales in the United States doubled by 55 % in 2022, arriving at a sales disclose of 8 %.

With this increasing adoption of electric vehicles worldwide, some wire and cable manufacturers are investing heavily in increasing their production capacity to cater to the rising demands. For instance

In September 2022, Yazaki Corporation opened its fourth manufacturing facility in Morocco at Kenitra near Rabat with an investment of USD 30 million.

With the aforementioned trends and developments, the rising demand for electric vehicles will propel demand in the wiring harness market during the foreseeable future.

Asia-Pacific Region is Expected to Dominate the Target Market

The Asia-Pacific region is expected to have a majority share in the automotive wiring harness market. Rising disposable income and an increase in GDP in the Asia Pacific are driving the market. Ease of manufacturing auto parts, vehicle sales, and growing government regulations improving electric vehicles adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate rising demand from the automotive industry across the Asia-Pacific region is expected to create a positive outlook for market growth during the forecast period.

Growing government regulations improving electric vehicle adoption and robust expansion adopted by OEMs and suppliers in the region to accommodate rising demand from the automotive industry in China are expected to create a positive outlook for market growth. For instance,

- The Chinese market caught up during the first half of 2022. BEVs and PHEVs made up 19% and 5% of the total number of new passenger car registrations that were electric vehicles. This represents an 8% point increase over the market share from the previous year and is four times higher than it will be in 2020. As a result, two years before the target year of 2025, China has already surpassed the 20% EV share target set forth in the 14th Five-Year Plan Energy Saving and Emission Reduction Work Plan.

Other important countries in the region are India and South Korea. India is a lucrative market for automotive wiring harness market manufacturing companies as the government has allowed 100% foreign equity investment in the automobile sector. Additionally, the number of new vehicle registrations per year is increasing in India, serving as a positive growth environment for automotive wiring harness manufacturing companies. India is also home to Motjrson Sumi Ltd, a major manufacturer of automotive wiring harness systems.

As traditional wiring methods are not suitable for upgrading features offered by automakers, the automobile wire harness is growing steadily. Also, installing such wire harness systems enhances the vehicle's fuel efficiency and complies with Indian government fuel usage and emissions laws. Owing to these factors, the sector is expected to grow at a reasonable rate, enhancing the demand in the automotive wiring harness market during the forecast period.

Automotive Wiring Harness Industry Overview

The Automotive Wiring Harness Market is highly consolidated, with global and very few local players dominating the market. Some of the major players in the market are Sumitomo Corporation, Aptiv Plc, Yazaki Corporation, Motherson Group, Leoni AG, and Lear Corporation. The market concentration can be considered to be medium-level competitive.

Different wiring harness manufacturers are prominent in other control systems of vehicles. Leoni AG group specializes in wires, wiring systems, and optical fibers for the automotive market. Leoni generates about 45% of its sales only in the EMEA region. To gain a considerable edge over other players in the market, many companies are forming partnerships to bring the latest features to their products and expand their production capacities.

For instance, in June 2022, Yazaki Corporation announced to set up a pilot production facility in Guatemala at Ayutla in the San Marcos Department. The plant will likely be set up at an investment of USD 10 million, will employ 1,000 people, and is expected to be operational by January 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Production

- 4.1.2 Growing Demand For Advanced Safety Features

- 4.2 Market Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value in USD)

- 5.1 By Application Type

- 5.1.1 Ignition System

- 5.1.2 Charging System

- 5.1.3 Drivetrain and Powertrain System

- 5.1.4 Infotainment System and Dashboard

- 5.1.5 Vehicle Control and Safety Systems

- 5.1.6 Body and Cabin Wiring Harness

- 5.2 By Wire Type

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 LEONI AG

- 6.2.2 Yazaki Corporation

- 6.2.3 Aptiv PLC

- 6.2.4 Sumitomo Electric Industries Ltd.

- 6.2.5 Lear Corporation

- 6.2.6 Motherson Sumi Systems Ltd.

- 6.2.7 Furukawa Electric Co. Ltd.

- 6.2.8 Fujikura Ltd.

- 6.2.9 Coroplast Fritz Muller GmbH & Co.

- 6.2.10 Jiangsu Kyungshin Electronic Co. Ltd.

- 6.2.11 Nexans

- 6.2.12 THB Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption Of Connected Vehicles