|

市場調查報告書

商品編碼

1687483

乙烯醋酸乙烯酯 (EVA) - 市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Ethylene Vinyl Acetate (EVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

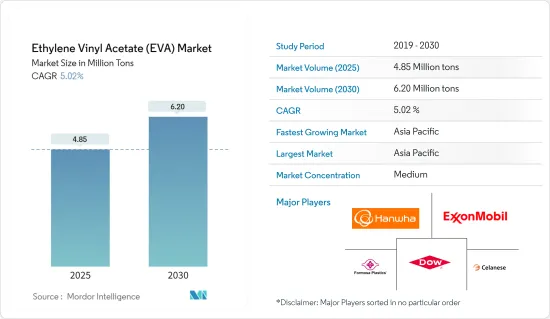

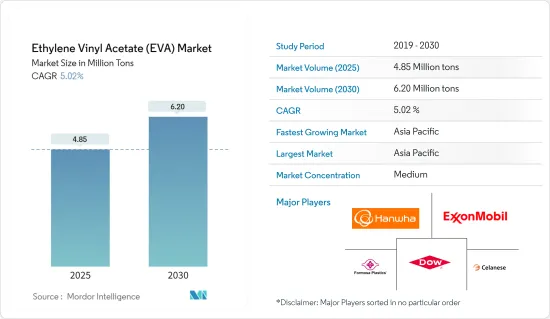

預計 2025 年乙烯醋酸乙烯酯市場規模為 485 萬噸,預計 2030 年將達到 620 萬噸,預測期內(2025-2030 年)的複合年成長率為 5.02%。

主要亮點

- COVID-19 疫情嚴重影響了各行業的市場成長。為控制疫情而導致的計劃停工和放緩、旅行限制、生產停頓和勞動力短缺導致乙烯醋酸乙烯酯市場成長放緩。然而,由於薄膜、黏合劑和發泡體等一系列應用的消費增加,2021 年該數字已大幅回升。

- 短期內,包裝產業和農業應用對乙烯醋酸乙烯酯 (EVA) 的需求不斷增加預計將推動市場發展。

- 替代品威脅的增加預計會阻礙市場的成長。

- 預計光伏 (PV) 太陽能電池封裝需求的不斷成長將為 2024 年至 2029 年的市場提供成長機會。

- 預計亞太地區將主導市場,在 2024 年至 2029 年期間實現最高複合年成長率。該地區的經濟正在成長,推動薄膜、黏合劑和發泡體的消費。

乙烯醋酸乙烯酯 (EVA) 市場趨勢

預計電影市場將佔據主導地位。

- 乙烯醋酸乙烯酯 (EVA) 是一種共聚物樹脂,加熱並充分混合後,透過扁平晶粒擠出形成 EVA 薄膜。該薄膜有白色、透明或其他顏色可供選擇,並提供不黏、光滑的表面處理。 EVA 薄膜通常夾在兩塊塑膠或玻璃板之間作為夾層。

- 在 EVA 薄膜的生產中,熱塑性樹脂通常與 LLDPE、LDPE 或其他樹脂共聚,或作為多層薄膜的一部分生產。一般來說,對於共聚物和共混物,乙烯醋酸乙烯酯的比例範圍為2至25。

- 添加EVA可以增加烯烴的密封性和透明度,改善其低溫性能,降低其熔點。此外,增加醋酸乙烯酯的含量會對機械性質產生顯著的影響,並會降低對水分和氣體的阻隔性,同時提高透明度。

- EVA薄膜的優點包括抗張強度相對較高、隔音、透明度好、黏合性好、天然防水、防紫外線。它還在高溫、強風和潮濕環境下具有出色的抵抗力和耐用性。

- EVA薄膜使用率較低,用於冷凍食品包裝(EVA 6%)、麵包袋(EVA 2%)、冰袋(EVA 4%)等,密封性能良好。此外,EVA 含量高達 20% 的薄膜還可用於低熔點/全批量封閉袋等應用。同樣,在太陽能電池板中,高達 33% 的 EVA 薄膜被用作電池板中的黏合層。

- 然而,最近茂金屬聚乙烯已被用作食品包裝應用中 EVA 薄膜的替代品。使用茂金屬聚乙烯可以實現更薄的薄膜,從而使整體包裝更薄,同時仍能提供相對較好的防潮和防氣體阻隔性。

- 如今,EVA 仍廣泛應用於各種薄膜領域。 EVA 樹脂通常與其他薄膜樹脂結合以實現所需的性能。其他主要應用包括乳製品和肉類包裝中的密封劑、光伏封裝、電線電纜絕緣以及用於提高抗衝擊性的玻璃層壓。

- 由於關鍵應用對 EVA 薄膜的需求不斷成長,一些領先的 EVA 薄膜製造商正在增加對生產擴張計劃的投資。例如,中國最大的光電模組EVA薄膜供應商斯威克在2023年2月宣布,決定投資約13.6億元人民幣(約2.03億美元)用於生產擴建計劃。新廠將分兩期在中國江蘇省鹽市建設,預計年產能將達4.2億平方公尺。第一期專案預計2023年第三季投入商業營運,16條生產線年產能達1.2億平方公尺。

- 非食品應用、光伏封裝和太陽能板對 EVA 薄膜的需求不斷成長,預計將在 2024 年至 2029 年期間推動 EVA 薄膜市場的發展。

亞太地區可望主導市場

- 亞太市場是最大的乙烯醋酸乙烯酯(EVA)市場。預計從 2024 年到 2029 年,它仍將是最大的市場。這是由於中國和印度的需求量很大,主要是對黏合劑和包裝產業的應用。

- 乙烯醋酸乙烯酯共聚物 (EVA) 通常用於包裝應用,並且是最常用來取代聚氯乙烯的樹脂。 EVA 共聚物不需要硬化劑或塑化劑且無味。由於其比傳統包裝塑膠具有的優勢,EVA在包裝領域的使用量大幅增加。

- 中國的包裝產業預計將會成長。根據政府預測,該產業預計將實現近6.8%的成長率。中國政府發布的一份報告預測,到2025年,該產業的價值將達到2兆元(約2,900億美元)。中國食品工業的成長位居世界前列,預計將對EVA市場產生影響。

- 此外,印度擁有龐大的包裝產業。由於出口成長以及微波爐、零食和冷凍食品等食品領域的客製化包裝增加,預計該國將在 2024 年至 2029 年期間持續成長。

- 根據印度包裝產業協會(PIAI)的數據,預計2024年至2029年間印度包裝產業將成長22%。預計2025年印度包裝市場規模將達2,048.1億美元,複合年成長率為26.7%。因此,預計該地區的 EVA 市場將會成長。

- 由於其減震性能,EVA 也擴大被應用於鞋類、曲棍球墊片、武術手套和其他運動器材。

- 中國製鞋業共有企業14400多家。中國是世界上最大的鞋類生產國。中國佔鞋類出口的50%以上。 2022年,鞋類出口量超過90億雙。

- 此外,據印度貿易和工業、消費者事務、食品、公共分配和紡織部部長稱,在政府和工業界的努力下,印度有潛力成為鞋類和皮革行業的全球領導者。例如,由於與阿拉伯聯合大公國簽署的自由貿易協定(FTA),皮革產業預計將實現成長,2022 年 11 月出口將成長 64%。

- 印度是世界第二大鞋類和皮革服飾生產國,擁有約 30 億平方英尺的製革廠。此外,2021 年,印度鞋類和皮革發展計畫(IFLDP)中央撥款 170 億印度盧比(2.058 億美元),該計畫將從 2021 年持續到 2026 年。

- 預計所有上述因素將在 2024 年至 2029 年期間刺激所研究市場的需求。

乙烯醋酸乙烯酯 (EVA) 產業概況

全球乙烯醋酸乙烯酯市場部分整合,主要企業佔了相當大的全球市場佔有率。乙烯醋酸乙烯酯 (EVA) 的主要製造商有埃克森美孚、韓華解決方案、陶氏、台塑公司和塞拉尼斯公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 包裝產業需求不斷成長

- 農業應用需求增加

- 限制因素

- 替代品的威脅日益增加

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 年級

- 低密度

- 中等密度

- 高密度

- 應用

- 電影

- 膠水

- 發泡體

- 太陽能電池封裝

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers

- Braskem

- Celanese Corporation

- China Petrochemical Corporation

- Clariant

- Dow

- Exxonmobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- HD Hyundai

- Innospec

- Jiangsu Sailboat Petrochemical Co. Ltd

- Levima Advanced Materials Corporation

- Lotte Chemical Corporation

- LG Chem

- Lyondellbasell Industries Holdings BV

- Repsol

- Saudi Arabian Oil Co.(Arlanxeo)

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical Co. Ltd

第7章 市場機會與未來趨勢

- 太陽能電池封裝需求不斷成長

簡介目錄

Product Code: 64084

The Ethylene Vinyl Acetate Market size is estimated at 4.85 million tons in 2025, and is expected to reach 6.20 million tons by 2030, at a CAGR of 5.02% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic severely impacted market growth in various sectors. Stoppage or slowdown of projects, movement restrictions, production halts, and labor shortages to contain the pandemic have led to a decline in the ethylene vinyl acetate market growth. However, it recovered significantly in 2021, owing to rising consumption from various applications, including films, adhesives, and foams.

- In the short term, the increasing demand for ethylene-vinyl acetate (EVA) from the packaging industry and agricultural applications is expected to drive the market.

- The increasing threat of substitutes is expected to hinder the market's growth.

- The increasing demand for photovoltaic (PV) solar cell encapsulants is expected to offer growth opportunities for the market between 2024 and 2029.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR from 2024 to 2029, as the economies in the region are growing, driving the consumption of films, adhesives, and foams.

Ethylene Vinyl Acetate (EVA) Market Trends

The Films Segment is Expected to Dominate the Market

- Ethylene vinyl acetate (EVA) is a copolymer resin that, when heated and mixed thoroughly before being extruded through a flat die, forms EVA films. These films are available in white, clear, and other colors, providing a non-sticky and smooth surface finish. EVA films are generally sandwiched between two plastic or glass sheet pieces as an interlayer.

- During the manufacturing of EVA films, the thermoplastic resin is typically copolymerized with LLDPE, LDPE, or other resins, or it is manufactured as a part of a multi-layer film. Generally, the percentage of ethylene vinyl acetate ranges between 2 and 25 in the case of copolymers and blends.

- Adding EVA helps to enhance the sealability and clarity of olefins, improve the low-temperature performance, and reduce the melting point. Further, a higher percentage of vinyl acetate content can significantly impact the mechanical properties and lower the barrier to moisture and gas while improving the clarity.

- Some of the advantages of EVA films are relatively higher tensile strength, sound barrier properties, excellent transparency, superior adhesion, waterproofing in nature, and UV protection. It also exhibits good resistance and durability at high temperatures, strong winds, and humid environments.

- In lower percentages, EVA films have been used for frozen food packaging (at 6% EVA), bread bags (at 2% EVA), and ice bags (at 4% EVA), as they help provide enhanced sealability for such applications. Further, in higher percentages, with up to 20% EVA, these films are used in applications involving low melt/total batch inclusion bags. Similarly, in solar panels, films with up to 33% EVA are used as a bonding layer for these panels.

- However, recently, food packaging applications have seen increased consumption of metallocene PE as an alternative to EVA films, as it offers superior down-gauging properties and faster hot tack. The use of mPE allows for thinner films and overall packaging while providing a relatively better barrier to moisture and gases.

- EVA is still extensively used across several film applications. Usually, EVA resin is combined with other film resins to obtain the desired properties. Some of the other key applications include using EVA films as sealants in dairy and meat packaging applications, photovoltaic encapsulation, wire and cable insulation, and glass lamination to help improve its impact resistance.

- Some of the key manufacturers of EVA films have been increasingly investing in production expansion projects, given the growing demand for EVA films in critical applications. For instance, in February 2023, SVECK, one of the largest suppliers of EVA films for PV modules in China, announced its decision to invest around CNY 1.36 billion (~USD 203 million) into its production expansion project. The new factory will be built in two phases, in Yancheng, China's Jiangsu, at a planned annual capacity of 420 million sq. m. The first phase is expected to begin commercial operations by Q3 2023, with an annual capacity of 120 million sq. m spread across 16 production lines.

- The increasing demand for EVA films in non-food applications, photovoltaic encapsulations, and solar panels is anticipated to strengthen the EVA films market between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific market is the largest ethylene vinyl acetate (EVA) market. It is also expected to remain the largest market between 2024 and 2029, owing to the major demand from China and India, mainly for the adhesive and packaging industry applications.

- Ethylene vinyl acetate copolymers (EVA) are commonly used in packaging applications, replacing polyvinyl chloride as the most used resin. EVA copolymers require no curing or plasticizer and have no odor. The use of EVA in the packaging sector is increasing significantly, owing to its advantages over the conventional packaging plastics used.

- The Chinese packaging industry is expected to grow. As projected by the government, the industry is expected to achieve a growth rate of nearly 6.8%. The report published by the Chinese government foresees the industry achieving a valuation of CNY 2 trillion (approximately USD 290 billion) by 2025. The growing Chinese food industry, which ranks among the largest globally, is expected to affect the EVA market.

- Moreover, India has a huge packaging industry. The country is expected to witness consistent growth between 2024 and 2029, owing to the rise of customized packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow by 22% between 2024 and 2029. The Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% till 2025. Therefore, the EVA market is expected to grow in the region.

- EVA is also increasingly used in footwear, hockey pads, martial arts gloves, and other sports goods due to its shock absorber properties.

- The Chinese footwear industry consists of over 14,400 businesses. China is the largest footwear producer in the world. China accounts for over 50% of footwear exports. The country exported more than 9,000 million pairs of shoes in 2022.

- Furthermore, according to the Union Minister for Trade Industries, Consumer Affairs, Food, and Public Distribution and Textiles, India has the potential to become a world leader in the footwear and leather sector due to government and industry efforts. For instance, the leather industry is expected to grow, owing to a free trade agreement (FTA) with the United Arab Emirates, which saw exports increase by 64% in November 2022.

- India is the second largest producer of footwear and leather garments, boasting nearly 3 billion sq. ft of tanneries worldwide. In addition, in 2021, the Center passed an expenditure of INR 1,700 crore (USD 205.8 million) to the Indian Footwear and Leather Development Program (IFLDP) for implementation from 2021 to 2026.

- All the aforementioned factors are expected to boost the demand for the market studied between 2024 and 2029.

Ethylene Vinyl Acetate (EVA) Industry Overview

The global ethylene vinyl acetate market is partially consolidated, with top-level players accounting for a sizeable global market share. The major manufacturers of ethylene vinyl acetate (EVA) are Exxon Mobil Corporation, Hanwha Solutions, Dow, Formosa Plastics Corporation, and Celanese Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Increasing Demand from Agricultural Applications

- 4.2 Restraints

- 4.2.1 Increasing Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Low Density

- 5.1.2 Medium Density

- 5.1.3 High Density

- 5.2 Application

- 5.2.1 Films

- 5.2.2 Adhesives

- 5.2.3 Foams

- 5.2.4 Solar Cell Encapsulation

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of the Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asia Polymer Corporation

- 6.4.2 BASF-YPC Company Limited

- 6.4.3 Benson Polymers

- 6.4.4 Braskem

- 6.4.5 Celanese Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 Clariant

- 6.4.8 Dow

- 6.4.9 Exxonmobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Hanwha Solutions

- 6.4.12 HD Hyundai

- 6.4.13 Innospec

- 6.4.14 Jiangsu Sailboat Petrochemical Co. Ltd

- 6.4.15 Levima Advanced Materials Corporation

- 6.4.16 Lotte Chemical Corporation

- 6.4.17 LG Chem

- 6.4.18 Lyondellbasell Industries Holdings BV

- 6.4.19 Repsol

- 6.4.20 Saudi Arabian Oil Co. (Arlanxeo)

- 6.4.21 Sinochem Holdings Corporation Ltd

- 6.4.22 Sipchem Company

- 6.4.23 Sumitomo Chemical Co. Ltd

- 6.4.24 Zhejiang Petroleum & Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Photovoltaic (PV) Solar Cell Encapsulants

02-2729-4219

+886-2-2729-4219