|

市場調查報告書

商品編碼

1687473

鋰離子電池回收-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Lithium-ion Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

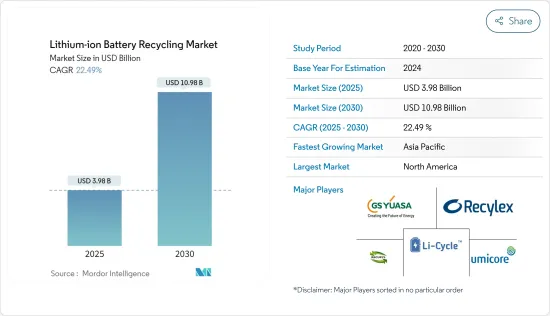

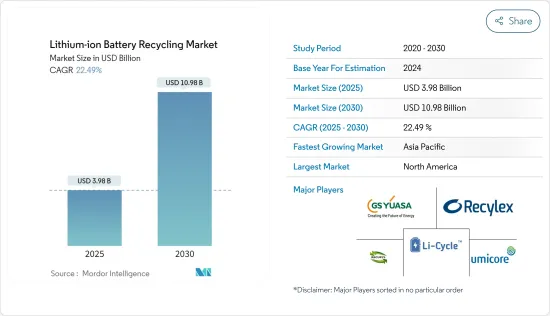

預計 2025 年鋰離子電池回收市場規模為 39.8 億美元,到 2030 年將達到 109.8 億美元,預測期內(2025-2030 年)的複合年成長率為 22.49%。

在各種類型的電池回收技術中,鋰離子電池(LIB)回收市場預計將在預測期後半段佔據全球電池回收市場的主導地位。此外,在預測期內,人們對電池廢棄物處理的擔憂日益加劇,政府政策也愈發嚴格,加上鋰離子電池價格下跌以及電動車普及導致鋰離子電池使用量增加,這些都可能推動鋰離子電池回收市場的發展。然而,雖然製造鋰離子電池的原料成本低廉,但回收成本卻很高。預測期內,電池回收的高成本、缺乏強大的供應鏈以及低產量比率可能會抑制電池回收市場的成長。

主要亮點

- 促進可再生能源發電和電動車大規模應用的政策措施正在推動電力產業的顯著成長,而電力產業需要能源儲存解決方案。

- 主要企業在電池技術方面的發展促使製造商開發出技術更先進的電池,這可能為願意投資和引導資源以創造突破性電池回收技術的電池回收公司創造重大機會。

- 由於製造業、可再生能源和電動車需求的成長,預計亞太地區將在預測期內引領鋰離子電池回收市場。

鋰離子電池回收市場趨勢

電力產業需求不斷成長

- 過去十年來,鋰離子電池價格大幅下跌。 2018年,鋰離子電池價格為每度電176美元。鋰離子電池價格持續下跌,2018年價格較2017年下降17.75%。鋰離子電池用於與電力產業相關的各種應用,例如儲能系統 (ESS),並可能推動電力產業的市場發展。

- 成本大幅降低的主要原因有二:

- 透過持續的研究和開發,穩步提高電池性能,旨在改善電池材料、減少非活性材料的數量和材料產量比率、改進電池設計和生產產量以及提高生產速度。

- 電力產業(尤其是中國)終端用戶的產量增加,有助於實現鋰離子電池製造的規模經濟,大規模的產能擴張加劇了製造商之間的競爭(進一步降低價格,但卻以犧牲製造商的盈利為代價)。

- 這些趨勢預計將導致成本快速且持續降低,並有助於使鋰離子成為所有能源儲存和電力行業市場(包括電網規模、電錶後端儲存、住宅儲存和微電網)的首選電池化學材料。

- 此外,鋰離子電池的平均價格預計將繼續下降,到 2025 年將達到約 100 美元/kWh。預計這一趨勢將導致鋰離子電池在預測期內在住宅和商業應用中,在能源儲存系統(ESS) 等新興市場以及與太陽能、風能和水力發電等可再生能源相結合的領域中的使用增加。

- 因此,隨著價格下降,鋰離子電池在電力行業的使用預計會增加。為了使此類電池的採用更加永續和環保,預計在預測期內回收這些電池的需求也將加速。

亞太地區佔市場主導地位

- 傳統上,鋰離子電池主要用於行動電話、筆記型電腦和個人電腦等家用電子電器,但目前人們正在重新考慮將其設計為混合動力汽車和全電動汽車(EV)的電源,因為電動車不會排放二氧化碳或氮氧化物等溫室氣體,對環境的影響較小。

- 電動車和能源儲存系統(ESS) 等新興市場的出現正在推動商業和住宅應用對 LIB 的需求。此外,儲能系統與風能、太陽能和水能等再生能源相結合,在技術和商業性都是增強電網穩定性的必要條件,從而推動鋰離子電池產業的發展。

- 中國目前是最大的電動車市場,佔全球銷售量的40%左右。隨著中國努力降低國內空氣污染水平,電動車銷量預計將創下高成長率,從而導致對鋰離子電池的需求增加。

- 中國目前是最大的電動車鋰離子電池生產國。中國的鋰產量從2017年的6,800噸增加到2018年的8,000噸。由於電池一直與環境問題聯繫在一起,中國政府制定了電池回收設施政策,電池產業必須按要求建立回收設施。

- 此外,2018 年 8 月,印度政府撥款 550 億印度盧比用於快速採用和製造混合動力汽車和電動車 (FAME) 印度計畫的第二階段,以鼓勵採用電動車和在當地製造鋰離子電池。因此,包括亞馬遜和 Amara Raja Batteries 在內的多家印度汽車零件製造商和電力及能源解決方案提供商已提出在當地生產計畫,以進軍該國蓬勃發展的綠色汽車市場。

- 此外,該地區政府對技術研發的投入將有助於降低迴收過程中的成本,從而激勵回收商使用回收材料製造新產品,從而促進市場成長。因此,預計近期趨勢將在預測期內推動鋰離子電池回收市場的發展。

鋰離子電池回收產業概況

由於技術複雜,鋰離子電池回收市場相當分散,企業發展該行業的公司很少。市場的主要企業包括嘉能可、GS Yuasa Corporation、Li-Cycle Technology、Recupyl Sas、Umicore、Metal Conversion Technologies 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2025 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章市場區隔

- 按行業

- 車

- 海洋

- 力量

- 其他

- 科技

- 濕式冶金工藝

- 火法冶金工藝

- 物理/機械過程

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東和非洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Glencore PLC

- Green Technology Solutions, Inc.

- Li-Cycle Technology

- Recupyl Sas

- Umicore SA

- Metal Conversion Technologies LLC

- Retriev Technologies Inc.

- Raw Materials Company

- TES-AMM Pte Ltd.

- American Manganese

第7章 市場機會與未來趨勢

The Lithium-ion Battery Recycling Market size is estimated at USD 3.98 billion in 2025, and is expected to reach USD 10.98 billion by 2030, at a CAGR of 22.49% during the forecast period (2025-2030).

Among different types of battery recycling technology, the lithium-ion battery (LIB) recycling market is expected to dominate the global battery recycling market in the latter part of the forecast period, majorly due to the demand for lithium-ion batteries and its ability such as favorable capacity-to-weight ratio. Moreover, Rising concerns over battery waste disposal and stringent government policies clubbed with the increase in usage of lithium-ion battery due to the declining lithium-ion battery prices and growing adoption of electric vehicles, are likely to drive the lithium-ion battery recycling market during the forecast period. However, the raw materials for the manufacturing of lithium-ion batteries are available at a low cost, whereas a high cost is incurred in recycling. The high cost, along with the lack of a strong supply chain and low yield related to battery recycling, is likely to restrain the growth of the battery recycling market during the forecast period.

Key Highlights

- The power sector witnessing significant growth owing to requirement for energy storage solutions in the wake of policy-level initiatives to promote renewable power generation and massive deployment of electric vehicles.

- Advancements in battery technologies leading to the creation of technologically advanced batteries being developed by manufacturers are likely to create a massive opportunity for the battery recycling companies to invest and redirect their resources to make a breakthrough battery recycling technology.

- Asia-Pacific is expected to lead the lithium-ion battery recycling market, during the forecast period, due to the growth of the manufacturing sector, renewables power and the EV demand.

Lithium-Ion Battery Recycling Market Trends

Increasing Demand In Power Industry

- The price of lithium-ion batteries has fallen steeply over the past 10 years. In 2018, the lithium-ion battery price was USD 176 per kWh. Lithium-ion battery prices are falling continuously, and the price decreased by 17.75% in 2018 compared to the price in 2017. The lithium-ion battery used in various application related to power sector such as ESS and other, which in turn likely to drive the market in power sector.

- The two principal reasons for the drastic cost decline are:

- The steady improvement of battery performance achieved through sustained R&D, aimed at improving battery materials, reducing the amount of non-active materials and the cost of materials, improving cell design and production yield, and increasing production speed.

- Increase in production volume for end user in power industry, particularly in China, which helped in achieving the economies of scale in lithium-ion battery manufacturing, and the large capacity additions, which increased the competition among manufacturers (further declining the prices, but at the expense of the profitability of the manufacturers).

- These trends result in sharp and sustained cost reduction which is expected to help cement lithium-ion as the battery chemistry of choice in all energy storage, power industry markets, including grid-scale, behind-the-meter storage, residential storage, and micro-grids.

- Furthermore, the decline in average lithium-ion battery prices is expected to continue and reach approximately USD 100/kWh by 2025, in turn, making it much more cost-competitive than other battery types. The trend is expected to result in an increased application of lithium-ion batteries in new and exciting markets, such as energy storage systems (ESS), paired with renewables, like solar, wind, or hydro, for both residential and commercial applications, during the forecast period.

- Hence, with declining prices, the use of lithium-ion batteries is expected to rise in power industry. The need for recycling these batteries is also expected to gain pace during the forecast period, in order to make the adoption of such batteries more sustainable and eco-friendlier.

Asia-Pacific to Dominate the Market

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices, such as mobile phones, notebook, and PCs, but are now increasingly being redesigned for use as the power source of choice in hybrid and the complete electric vehicle (EV) range, owing to factors, such as low environmental impact, as EV does not emit any CO2, nitrogen oxides, or any other greenhouse gases.

- The emergence of the new and exciting markets, such as electric vehicle and energy storage systems (ESS), for both the commercial and residential applications, is driving the demand for LIB. Moreover, ESS, coupled with renewables, such as wind, solar, or hydro, is technically and commercially necessary for increasing grid stability, consequently, driving the LIB segment.

- Currently, China is the largest market for electric vehicles, as the country accounts for around 40% of the global sale. China is making efforts to reduce the air pollution level in the country, and it is expected to register a high growth rate in the electric vehicle sales, consequently, leading to the high demand for LIB.

- Currently, China is the largest manufacturer of lithium-ion battery majorly for electric vehicles. In China, lithium production in the country, increasing from 6,800 metric tons in 2017 to 8,000 metric tons in 2018. As batteries are always related to environmental concerns, the government of china presents a policy for recycling facilities that the industry must set up as required.

- Furthermore, in August 2018, the Government of India directed an outlay of INR 5,500 crore for the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme, for encouraging the adoption of EVs and local manufacturing of lithium-ion batteries. Thus, several automobile component manufacturers and power and energy solution providers in India, such as Amazon and Amara Raja Batteries, have put forth plans for manufacturing lithium-ion batteries locally, to leverage the booming green vehicles market in the country.

- Additionally, the R&D investment by the government in the region on developing technologies can help decrease the cost incurred for the recycling process, which can motivate the recycling companies to take up recycled material for manufacturing a new product, and thereby, helping the growth of the market. Hence the recent trends are expected to propel the lithium-ion battery recycling marketduring the forecast period.

Lithium-Ion Battery Recycling Industry Overview

The lithium-ion battery recycling market is moderately fragmented due to few companies operating in the industry because of the complex technology. The key players in this market include Glencore, GS Yuasa Corporation, Li-Cycle Technology, Recupyl Sas,Umicore, Metal Conversion Technologies, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, until 2025

- 4.3 Recent Trends and Developments

- 4.4 Government Policies & Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Industry

- 5.1.1 Automotive

- 5.1.2 Marine

- 5.1.3 Power

- 5.1.4 Others

- 5.2 Technology

- 5.2.1 Hydrometallurgical Process

- 5.2.2 Pyrometallurgy Process

- 5.2.3 Physical/Mechanical Process

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Glencore PLC

- 6.3.2 Green Technology Solutions, Inc.

- 6.3.3 Li-Cycle Technology

- 6.3.4 Recupyl Sas

- 6.3.5 Umicore SA

- 6.3.6 Metal Conversion Technologies LLC

- 6.3.7 Retriev Technologies Inc.

- 6.3.8 Raw Materials Company

- 6.3.9 TES-AMM Pte Ltd.

- 6.3.10 American Manganese