|

市場調查報告書

商品編碼

1687456

計程車 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Taxi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

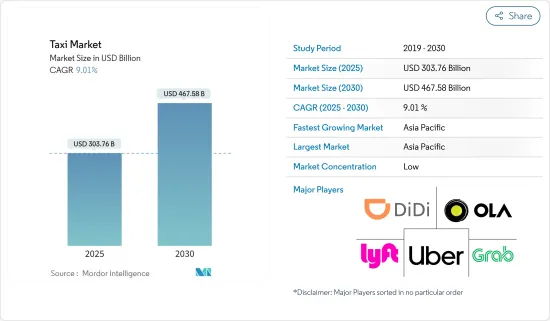

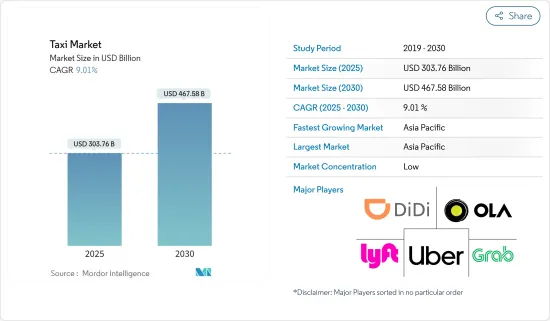

預計 2025 年計程車市場規模為 3,037.6 億美元,到 2030 年將達到 4,675.8 億美元,預測期內(2025-2030 年)的複合年成長率為 9.01%。

近年來,受技術進步、消費者偏好變化和監管環境演變的影響,計程車市場發生了重大轉變。計程車曾經主要在街上行駛,現在正在轉向基於應用程式的叫車服務。 Uber、Lyft 和滴滴出行等公司已經顛覆了傳統的計程車模式,為乘客提供了使用行動應用程式預訂車輛的便捷高效的方式。

叫車服務的出現大大改變了計程車業。這些服務透過智慧型手機應用程式連接乘客和司機,並提供即時追蹤、無現金付款和用戶評級等好處。這些平台提供的便利性和透明度對傳統的計程車調度系統提出了挑戰,並促進了其廣泛應用。但這一轉變也引發了有關公平競爭、司機權利和當地監管問題的爭論。

隨著對永續性的日益重視,計程車市場正在轉向電動車(EV)。許多計程車營運商和叫車公司正在將電動和混合動力汽車納入其車隊,以減少碳排放並促進環保交通。政府旨在控制空氣污染的激勵措施和法規進一步支持了電動計程車的推廣,標誌著計程車行業向更永續邁出了重要一步。

從長遠來看,由於叫車和共乘服務需求的增加、線上計程車預訂管道的需求的增加以及車輛擁有成本的增加,預計計程車行業將會成長。交通堵塞加劇和與其他交通途徑相比計程車票價較低也是推動計程車市場發展的主要因素。

然而,公共交通的改善和世界各地政府對計程車服務的不同法律阻礙了該行業的發展。預計環保電動計程車服務的興起將為 2024 年至 2029 年期間的市場擴張提供誘人的潛力。

在目標市場中,亞太地區預計將呈現顯著的成長率。這是因為該地區擁有全球 60% 的人口,其中印度和中國是世界上最大的勞動人口。

計程車市場趨勢

線上預訂推動市場

推動市場成長的主要因素之一是網路計程車預訂平台的使用率不斷提高。我們還提供簡單的線上付款選項和靈活的取貨和送貨地點。

隨著網路和智慧型手機在全球的普及率不斷提高,透過應用程式預訂的便利性極大地吸引了那些喜歡線上預訂而不是線下預訂的客戶。此外,該應用程式還提供司機位置追蹤、提前行程費用報價、司機聯絡資訊和車輛詳細資訊等資訊,進一步增加了客戶對線上預訂的偏好。

許多主要營運商(例如 Grab、Uber 和 Ola)現在在某些地區提供共乘服務,以滿足客戶對低成本計程車服務日益成長的需求。為了跟上共乘服務日益成長的趨勢,營運商也採用了相同的策略,並在其應用程式開發中加入了共乘選項。

- 例如,越南領先的計程車業者之一 Mai Linh 專注於提供共乘服務,以克服越南的交通堵塞和人口等旅行挑戰。該公司計劃未來與 Kyyti Group 合作在越南推出共乘服務。

然而,隨著網路計程車需求的飆升,政府推出了嚴格的指導方針,要求計程車聚合商規範價格。例如

- 2024 年 1 月,卡納塔克邦政府對 Ola 和 Uber 等線上計程車服務以及在該邦營運的其他計程車服務實施了標準化收費。該舉措旨在解決城市計程車服務普遍存在的收費過高問題,並建立全面一致的票價制度。

亞太地區計程車市場預計將顯著成長

亞太地區佔據計程車業的主導地位,約佔一半的市場佔有率。推動亞太地區摩托車/自行車叫車服務興起的主要因素是交通堵塞加劇以及與其他交通途徑相比計程車費用較低。由於該地區居住著全球 60% 的人口,因此叫車產業已經成熟且發展迅速。

亞太地區的計程車業正在迅速擴張。滴滴出行、Ola 和 Onda 等公司正在利用亞太地區智慧型手機的高普及率獲利。透過利用尖端技術和創新,我們正在擴大市場佔有率。南亞領先的計程車服務供應商在國際上不斷發展,同時也加劇了當地市場的競爭。中國計程車公司滴滴出行已在墨西哥、澳洲、哥斯大黎加、日本和其他幾個國家開展業務。 Ola 是印度市場的領導者,其業務範圍也涵蓋澳洲、紐西蘭和英國。

中國是世界上人口最多的國家,因此擁有世界上最大的計程車市場。計程車因其靈活性、舒適性、高可用性和終點連接性而逐漸成為一項必要的服務。

印度也擁有僅次於中國的第二大計程車市場。由於國家發生的各種社會經濟和政治情況,計程車行業不斷變化(甚至每季變化)。計程車共乘/共享在印度產生了巨大的需求。摩托車計程車在印度市場也越來越受歡迎。

- 2023年,Rapido推出“Rapido Cabs”,正式宣布進軍計程車聚合領域。該公司已經向客戶提供摩托車計程車和汽車(三輪車)載客服務。計程車服務的加入使得 Rapido 更接近與市場領導者 Ola 和 Uber 的競爭。基於電動車的 BluSmart 和 InDrive 也希望進入這個市場,但市場佔有率相對較小。

由於計程車需求旺盛,尤其是在層級城市和大城市,隨著摩的的出現,線上計程車市場正在改變,摩的比計程車便宜得多,即使在交通堵塞時也易於操縱。因此,預計未來幾年摩托車計程車市場將快速成長。

計程車業概況

計程車市場的主要企業包括 Uber、Grab、Lyft 和 Ola。 Uber 的主要擴張策略是專注於自動駕駛汽車等新興技術。

- 土耳其的城市交通狀況受到 Marti Technologies Inc. 的關注。 2024 年 2 月,這家以綜合交通服務而聞名的公司在伊斯坦堡推出了計程車叫車功能,標誌著其簡化城市交通的努力進入了新階段。

- 第七大道計程車協會於 3 月 1 日星期五宣布推出一項創新的無現金付款系統。

- 計程車行業的主要企業正在大力投資技術。優步和滴滴出行正在致力於開發自動駕駛汽車,以改善客戶體驗。在印度,選擇現場服務的客戶數量激增。因此,Ola、Meru 和 Prydo 以極具競爭力的價格為客戶提供增值服務。 Ola 與 Apple Music 以及其他音樂和影片串流服務合作推出 Prime Play 服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 預訂類型

- 線上預訂

- 線下預訂

- 服務類型

- 叫車

- 共乘

- 車輛類型

- 摩托車

- 車

- 其他車型(廂型車)

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 越南

- 韓國

- 其他亞太地區

- 世界其他地區

- 墨西哥

- 巴西

- 南非

- 阿根廷

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- ANI Technologies Pvt. Ltd(Ola)

- BlaBlaCar

- Bolt Technologies OU

- Curb Mobility LLC

- (Didi Chuxing)Beijing Xiaoju Technology Co. Ltd

- Flywheel Software Inc.

- Gojek Tech

- Grab Holdings Inc.

- FREE NOW

- Kabbee Exchange Limited

- Lyft Inc.

- Uber Technologies Inc.

第7章 市場機會與未來趨勢

The Taxi Market size is estimated at USD 303.76 billion in 2025, and is expected to reach USD 467.58 billion by 2030, at a CAGR of 9.01% during the forecast period (2025-2030).

The taxi market has undergone substantial transformations in recent years, influenced by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Taxis, once primarily hailed on the streets, have witnessed a significant shift toward app-based ride-hailing services. Companies like Uber, Lyft, and Didi Chuxing have disrupted traditional taxi models, introducing convenient and efficient ways for passengers to book rides using mobile applications.

The emergence of ride-hailing services has been a game-changer in the taxi industry. These services connect passengers with drivers through smartphone apps, offering benefits such as real-time tracking, cashless payments, and user ratings. The convenience and transparency provided by these platforms have contributed to their widespread adoption, challenging the traditional taxi dispatch system. However, this shift has also sparked debates regarding fair competition, driver rights, and regulatory concerns in various regions.

With a growing emphasis on sustainability, the taxi market is experiencing a shift toward electric vehicles (EVs). Many taxi operators and ride-hailing companies are incorporating electric or hybrid vehicles into their fleets to reduce carbon emissions and promote environmentally friendly transportation. Government incentives and regulations aimed at curbing air pollution further encourage the adoption of electric taxis, marking a significant step towards a more sustainable taxi industry.

Over the long term, the taxi industry is expected to grow due to increasing demand for ride-hailing and ride-sharing services, increasing demand from online taxi booking channels, and an increase in the cost of vehicle ownership. Compared to other modes of transportation, increasing traffic congestion and low taxi fares are the other major factors driving the taxi market.

However, the development of the industry is hampered by improvements in public transit and differing government laws on taxi services in different nations worldwide. The rise of eco-friendly electric cab services is likely to provide an attractive potential for market expansion between 2024 and 2029.

Asia-Pacific is expected to witness a considerable growth rate in the target market. This is due to the fact that the region is home to 60% of the world's population, with India and China contributing significantly to the region having the highest working population in the world.

Taxi Market Trends

Online Bookings are Driving the Market

One of the primary factors fueling the market's growth is the increased usage of online cab booking platforms, mostly because of the convenience they provide to clients. They also offer simple online payment options and the flexibility of choosing the pick-up and drop-off locations.

The ease of booking through the app has significantly attracted customers to prefer online booking over offline booking, owing to the increasing penetration of the internet and smartphones worldwide. Additionally, the availability of information on an app, like tracking the driver position, pre-estimated ride fare, driver contact, and vehicle details, has further increased the customer preference for online booking.

Many major operators, such as Grab, Uber, and Ola, provide ride-sharing options (which offer a fare-splitting option among co-passengers) in certain regions, capturing the increasing demand for low taxi fare services among customers. Operators are adopting the same strategy and incorporating the ride-sharing option in their app development to sustain the growing trend of ride-sharing services.

- For instance, in Vietnam, Mai Linh, one of the country's major taxi operators, focuses on providing ride-sharing services to overcome the country's mobility challenges, like traffic congestion and population. The company partnered with Kyyti Group to launch a ride-sharing service in Vietnam in the future.

However, with the surge in demand for online taxis, governments are implementing strict guidelines for taxi aggregators to regulate their prices. For instance,

- In January 2024, the Karnataka government implemented standardized fares for online taxi services such as Ola and Uber, as well as other taxi services operating within the state. This initiative is designed to tackle prevalent issues of overcharging in city taxi services and establish a consistent fare system across the board.

Asia-Pacific is Expected to Grow at a Significant Pace in the Taxi Market

Asia-Pacific has been dominating the taxi industry, accounting for about half of the taxi market. Key elements fueling the rise of motorcycle/bike ride-hailing services in Asia-Pacific are increasing traffic congestion and inexpensive taxi fares compared to other means of transportation. As the region is home to 60% of the world's population, its ride-hailing industry is substantial and developing rapidly.

In Asia-Pacific, the taxi industry is expanding rapidly. Players like DiDi Chuxing, Ola, and Onda are capitalizing on Asia-Pacific's high smartphone penetration rate. They are gaining market share by utilizing cutting-edge technology and innovation. Major South Asian cab service providers are increasing the competition in regional marketplaces while growing internationally. Didi Chuxing, a Chinese taxi company, launched operations in Mexico, Australia, Costa Rica, Japan, and several other countries. Ola, the Indian market leader, operates in Australia, New Zealand, and the United Kingdom.

China has the world's largest taxi market as it is the most populous country. Taxis gradually became a necessary service due to their flexibility, comfort, high availability, and end-mile connection.

India also has a huge taxi market after China. The taxi industry is changing continuously (even every quarter) due to the different socio-economic and political situations arising in the country. Pooling/sharing of taxis in the country saw huge demand. Bike taxis are also gaining popularity in the Indian market.

- In 2023, Rapido officially announced its entry into the cab aggregation space with the launch of 'Rapido Cabs.' The company already provides bike taxis and auto (three-wheeler) passengers to its customers. The addition of a cab service brings Rapido closer to competition with market leaders Ola and Uber. EV-based BluSmart and InDrive are also trying to tap into the market but have a relatively smaller presence in the market.

With a high demand for cabs, especially in tier one and metro cities, the online cab market is changing with the entry of bike taxis into the market, which are much more affordable than cabs and provide easy maneuvering in traffic congestion. Thus, the bike taxi market is expected to grow rapidly in the coming years.

Taxi Industry Overview

Some of the major players in the taxi market are Uber, Grab, Lyft, and Ola. Uber's main strategy for expanding its business is to focus on upcoming technologies like automated driving vehicles.

- Turkey's urban mobility landscape is undergoing a significant transformation, as evidenced by the latest strategic move by Marti Technologies Inc. In February 2024, the company, renowned for its comprehensive range of transportation services, introduced a taxi-hailing feature in Istanbul, signaling a new phase in its efforts to streamline urban transit.

- The 7th Avenue Taxi Rank Association unveiled an innovative cashless payment system on Friday, 1 March, a notable advancement in local public transportation.

- Key players in the industry are investing hugely in technology. Uber and DiDi Chuxing are working on self-driving cars to enhance the customer experience. In India, there has been a surge in the number of customers opting for outstation services. Thus, Ola, Meru, and Prydo are offering value-added services to their customers at very competitive prices. Ola partnered with Apple Music and other music and video streaming services for its Prime Play service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Booking Type

- 5.1.1 Online Booking

- 5.1.2 Offline Booking

- 5.2 Service Type

- 5.2.1 Ride-hailing

- 5.2.2 Ride-sharing

- 5.3 Vehicle Type

- 5.3.1 Motorcycle

- 5.3.2 Cars

- 5.3.3 Other Vehicle Types (Vans)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Vietnam

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 South Africa

- 5.4.4.4 Argentina

- 5.4.4.5 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ANI Technologies Pvt. Ltd (Ola)

- 6.2.2 BlaBlaCar

- 6.2.3 Bolt Technologies OU

- 6.2.4 Curb Mobility LLC

- 6.2.5 (Didi Chuxing) Beijing Xiaoju Technology Co. Ltd

- 6.2.6 Flywheel Software Inc.

- 6.2.7 Gojek Tech

- 6.2.8 Grab Holdings Inc.

- 6.2.9 FREE NOW

- 6.2.10 Kabbee Exchange Limited

- 6.2.11 Lyft Inc.

- 6.2.12 Uber Technologies Inc.