|

市場調查報告書

商品編碼

1687425

石膏板-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Gypsum Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

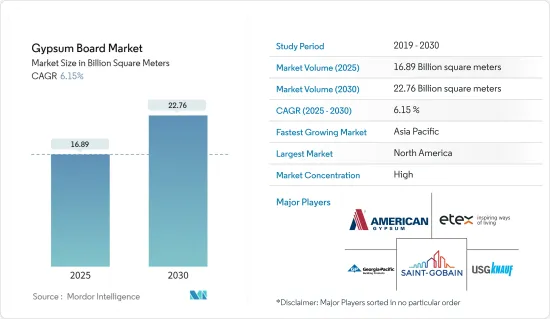

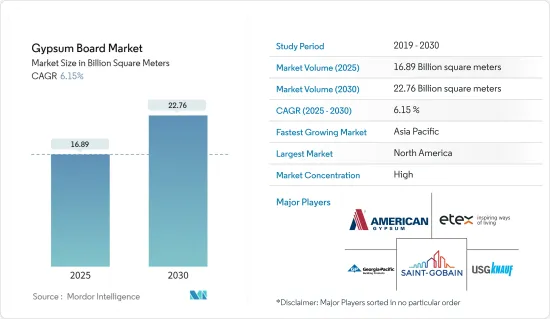

預計2025年石膏板市場規模為168.9億平方公尺,到2030年將達到227.6億平方公尺,預測期間(2025-2030年)的複合年成長率為6.15%。

COVID-19對石膏板市場產生了負面影響。在疫情初期,政府的封鎖措施延後了許多建設計劃。建設活動的減少導致住宅、商業和基礎設施計劃對石膏板的需求下降,影響了製造商和經銷商的銷售和收益。然而,隨著限制的解除,建築和維修計劃激增,對石膏板和相關產品的需求也隨之增加。

主要亮點

- 推動市場成長的關鍵因素是全球住宅建築對石膏板的需求不斷增加以及改造和翻新活動的活性化。

- 然而,原料價格的波動預計會阻礙市場成長。

- 然而,預計快速的都市化、人口成長和未來的建築投資將在預測期內為石膏板市場帶來有利的成長機會。

- 預計亞太地區將在預測期內佔據最大的市場佔有率。

石膏板市場趨勢

住宅領域佔據市場主導地位

- 一般來說,住宅領域佔石膏板消費的大部分,受到住宅建設和現有住宅重建和整修的推動。石膏板因其易於施工、耐用、防火、隔音等特性,被廣泛用於住宅的內牆、天花板、隔間等部分。

- 此外,住宅領域透過住宅裝修和改造計劃推動了對石膏板的需求。住宅經常使用乾牆來重建住宅,例如添加新牆壁、隔間或天花板,或裝修地下室。乾式牆是這些應用的熱門選擇,因為它用途廣泛且易於自訂。

- 預計到 2025 年,印度建築業規模將成長至 1.4 兆美元。到 2030 年,預計將有 6 億人居住在城市中心,從而需要額外建造 2,500 萬套中高階住宅。根據國家投資計畫(NIP),印度的基礎設施投資預算為1.4兆美元,其中24%分配給可再生能源、道路、高速公路和城市基礎設施,12%分配給鐵路。

- 在印度,由於都市化加快和家庭收入增加,住宅需求旺盛。根據印度品牌股權基金會(IBEF)預測,2023會計年度印度住宅銷售額預計將達到3.47兆印度盧比(420億美元),與前一年同期比較大幅成長約48%。

- 在中國,財政部於2023年11月宣布,將在2024年為都市區保障性住宅計劃撥款425億元人民幣(58.7億美元)。央行也在2023年1月宣布,將額外增加5,000億元人民幣(690億美元)可用於承諾的資金,用於保障性住宅、城市振興和基礎建設相關計劃。

- 根據美國人口普查局發布的報告,2024年4月完工的私人住宅數量經季節性已調整的年率增加至162.3萬套。這比2024年3月修訂後的149.5萬輛增加了8.6%,比2023年4月增加了14.6%。

- 預計這些趨勢將在預測期內推動石膏板市場的成長,從而補充住宅建築業。

亞太地區在受訪市場中佔據主導地位

- 亞太地區正在經歷快速的都市化和人口成長,尤其是中國、印度和東南亞等國家。這種成長將推動住宅、商業和基礎設施建設的需求,從而導致隔間牆、天花板和其他應用的石膏板消費量增加。

- 亞太地區各國政府紛紛推出舉措,推動基礎建設、經濟適用住宅和城市復興計劃。這些舉措正在刺激建設活動,為石膏板市場繁榮創造有利環境。

- 根據國家統計局的數據,中國建設產業商務活動指數(BASI)從2023年11月的55.9上升至12月份的56.9。 BASI 得分高於 50 表示行業成長,2023 年 10 月的 BASI 得分為 53.5。

- 此外,根據《環球時報》2023年4月發布的資料,中國在2023年第一季加大了基礎設施投資,全國啟動了10,000多個計劃,以促進國家發展。

- 根據印度品牌股權基金會(IBEF)發布的資料,2023-24 年預算中基礎設施資本支出成長 33%,達到 10,0000 億印度盧比(1,220 億美元)。

- 此外,據IBEF稱,印度政府計劃在未來五年內透過國家基礎設施管道(NIP)在基礎設施建設上投入1.4兆美元。

- 根據《日本時報》發布的資料,多家建設公司已開始在東京建造高層建築。從2022年起,首都將建造103,100套住宅。

- 此外,日本國土交通省諮詢委員會的數據顯示,面向國內公司的建築訂單增加了 5.1 兆日圓(454.8 億美元)。這將導致全國範圍內對石膏板的需求增加。

- 由於政府重新關注基礎設施建設以及所有正在進行和即將開展的建設和維修活動,預計預測期內亞太地區對石膏板的需求將大幅成長。

石膏板產業概況

全球石膏板市場正在整合。主要企業(排名不分先後)包括聖戈班 (Saint-Gobain)、USGKnauf、 喬治亞-Pacific Gypsum LLC、American Gypsum Company LLC 和 Etex Group。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 住宅建設需求不斷成長

- 改造和翻新增加

- 限制因素

- 原物料價格波動

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 牆板

- 天花板

- 裝飾板

- 應用

- 住宅領域

- 設施類別

- 工業部門

- 商業領域

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 奈及利亞

- 埃及

- 卡達

- 南非

- UAE

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- American Gypsum Company LLC

- Beijing New Building Material Public Limited Company(BNBM)

- Etex Group

- Everest Industries Limited

- Georgia-Pacific Gypsum LLC

- Global Gypsum Board Co. LLC(Gypcore)

- Gypsotonne(VOLMA0)

- HOLCIM Ltd

- Jason Plasterboard(Jiaxing)Co. Ltd

- National Gypsum Services Company

- Osman Group

- PABCO

- Saint-Gobain

- USGKnauf

- VANS Gypsum

第7章 市場機會與未來趨勢

- 建築業的未來投資

The Gypsum Board Market size is estimated at 16.89 billion square meters in 2025, and is expected to reach 22.76 billion square meters by 2030, at a CAGR of 6.15% during the forecast period (2025-2030).

COVID-19 negatively impacted the gypsum board market. During the initial stages of the pandemic, many construction projects were delayed due to government-imposed lockdowns. Reduced construction activities led to lower demand for gypsum boards in residential, commercial, and infrastructure projects, impacting sales and revenues for manufacturers and distributors. However, as restrictions were lifted, there was a surge in construction and renovation projects, driving up demand for gypsum boards and related products.

Key Highlights

- The significant factors that are driving the market's growth are the increasing demand for gypsum boards for residential construction and rising renovation and remodeling activities globally.

- However, fluctuations in the raw material prices are expected to hinder the growth of the market studied.

- Nevertheless, rapid urbanization, population growth, and future construction investments are expected to create lucrative growth opportunities for the gypsum board market during the forecast period.

- Asia-Pacific is expected to hold the most considerable market share over the forecast period.

Gypsum Board Market Trends

The Residential Sector to Dominate the Market

- The residential sector typically accounts for a significant portion of gypsum board consumption due to the construction of new houses and the renovation or remodeling of existing residential buildings. Gypsum boards are widely used in residential construction for interior walls, ceilings, and partitions due to their ease of installation, durability, fire resistance, and soundproofing properties.

- The residential sector also drives demand for gypsum boards through home improvement and renovation projects. Homeowners often use gypsum boards to renovate their homes, such as adding new walls, partitions, or ceilings or finishing basements. Gypsum boards are preferred for these applications due to their versatility and ease of customization.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people are expected to live in urban centers, resulting in a need for 25 million additional mid and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- In India, the demand for residential properties has rapidly increased due to growing urbanization and rising household income. According to the Indian Brand Equity Foundation (IBEF), in FY 2023, India's residential property market witnessed the value of home sales at INR 3.47 lakh crore (USD 42 billion), marking a robust increase of around 48% Y-o-Y.

- In China, in November 2023, the finance department announced it would allocate CNY 42.5 billion (USD 5.87 billion) in subsidies toward affordable housing projects in cities for 2024. The central bank also announced in January 2023 that it was raising the funds to be made available for pledges, increasing it by CNY 500 billion (USD 69 billion) for projects related to affordable housing, revitalization of cities, and infrastructure development.

- According to the report released by the US Census Bureau, in April 2024, the number of privately owned homes that were finished increased to a seasonally adjusted yearly pace of 1,623,000. This marked an increase of 8.6% from the previously revised March 2024 figure of 1,495,000, which was 14.6% higher than the rate in April 2023.

- These trends are expected to facilitate the growth of the gypsum board market over the forecast period, thereby supplementing the residential construction sector.

Asia-Pacific to Dominate the Market Studied

- Asia-Pacific is experiencing rapid urbanization and population growth, particularly in countries like China, India, and Southeast Asia. This growth drives the demand for residential, commercial, and infrastructure construction, leading to increased consumption of gypsum boards for interior partition walls, ceilings, and other applications.

- The governments in Asia-Pacific have launched initiatives to promote infrastructure development, affordable housing, and urban renewal projects. These initiatives stimulate construction activity and create a favorable environment for the gypsum board market to thrive.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose from 55.9 in November 2023 to 56.9 in December 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- Moreover, according to the data released by the Global Times on April 2023, in order to boost the country's development, China increased investment in infrastructure during the 1st quarter of 2023 and launched over 10,000 projects throughout the country.

- According to the data released by the Indian Brand Equity Foundation (IBEF), the capital expenditure on infrastructure increased by 33% to INR 10 lakh crore (USD 122 billion) in the budget for 2023-24.

- Furthermore, according to the IBEF, the Indian government intends to spend USD 1.4 trillion over the next five years on infrastructure via the National Infrastructure Pipeline (NIP).

- According to data published by The Japan Times, several construction companies have started the construction of skyscrapers in Tokyo. The capital has had 103,100 housing units since 2022.

- Furthermore, according to an advisory panel from Japan's Infrastructure Ministry, the Japanese Ministry of Land, Infrastructure and Transport increased construction orders to domestic companies by up to JPY 5.1 trillion (USD 45.48 billion). This will, in turn, raise demand for gypsum boards across the country.

- The demand for gypsum boards in Asia-Pacific is expected to increase significantly over the forecast period due to all such ongoing and upcoming construction and renovation activities, along with the government's renewed focus on infrastructure.

Gypsum Board Industry Overview

The global gypsum board market is consolidated. The major players (not in any particular order) include Saint-Gobain, USGKnauf, Georgia-Pacific Gypsum LLC, American Gypsum Company LLC, and EtexGroup.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From Residential Construction

- 4.1.2 Rising Renovation and Remodeling Activities

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Wall Board

- 5.1.2 Ceiling Board

- 5.1.3 Pre-decorated Board

- 5.2 Application

- 5.2.1 Residential Sector

- 5.2.2 Institutional Sector

- 5.2.3 Industrial Sector

- 5.2.4 Commercial Sector

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Nigeria

- 5.3.5.3 Egypt

- 5.3.5.4 Qatar

- 5.3.5.5 South Africa

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Gypsum Company LLC

- 6.4.2 Beijing New Building Material Public Limited Company (BNBM)

- 6.4.3 Etex Group

- 6.4.4 Everest Industries Limited

- 6.4.5 Georgia-Pacific Gypsum LLC

- 6.4.6 Global Gypsum Board Co. LLC (Gypcore)

- 6.4.7 Gypsotonne (VOLMA0)

- 6.4.8 HOLCIM Ltd

- 6.4.9 Jason Plasterboard (Jiaxing) Co. Ltd

- 6.4.10 National Gypsum Services Company

- 6.4.11 Osman Group

- 6.4.12 PABCO

- 6.4.13 Saint-Gobain

- 6.4.14 USGKnauf

- 6.4.15 VANS Gypsum

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Investments in the Construction Sector