|

市場調查報告書

商品編碼

1687399

醫療保健領域的 RFID:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Healthcare RFID - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

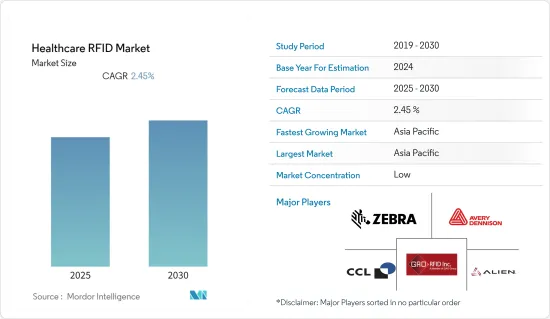

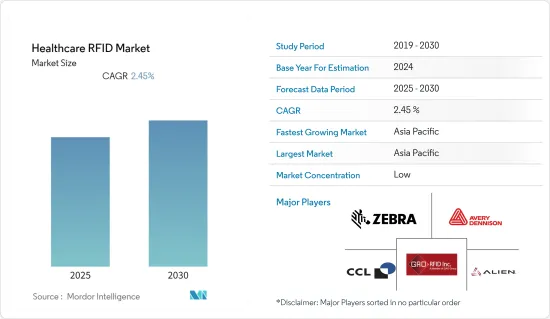

預計預測期內醫療保健 RFID 市場將以 2.45% 的複合年成長率成長。

RFID 技術正在對世界各地的醫院、診所、醫療保健系統、經銷商和製造商產生重大影響,但未來幾年它將產生更大的影響。 RFID 在醫療保健領域的應用推動了越來越多的製藥公司將 RFID 標籤附加到藥品標籤上以管理供應鏈。因此,RFID 的應用可能會繼續在醫療保健領域發揮更突出的作用。

主要亮點

- 幾十年來,跨國製藥公司一直在世界各地生產和銷售藥品。然而,標記是一項嚴格且富有挑戰性的任務,而且只會變得越來越複雜。由於不同國家和地區的新標籤法規差異很大,預計將顯著刺激 RFID 市場的成長,製藥公司需要創建一個能夠滿足全球需求的系統,或交給專家。

- RFID 在藥品中的應用將使整個供應鏈中藥品的管理和認證更加準確,旨在將錯誤減少到接近零,從而提高患者的安全性。此外,它還消除了昂貴且更重要的是勞動密集的住院藥物標籤的需要,減輕了醫院工作人員的負擔。

- RFID還可以應用於醫院和藥局的庫存管理,以確保品質並減少浪費。 RFID 的好處不僅在於投資回報,它還具有拯救生命的潛力。這就是為什麼行業參與者提供包括防篡改 RFID 標籤和發光標籤在內的高級產品組合,以便向藥局、醫院和患者提供關鍵資訊。這些智慧 RFID 解決方案有助於降低成本、提高準確性和加快業務速度,同時保護藥品品牌免於假冒。

- 阻礙市場發展的因素包括在醫療保健領域實施 RFID 系統的成本高昂以及系統互通性。採用 RFID 的行業必須在閱讀器、標籤、軟體、電力和營運交換服務方面進行大量投資。物聯網組件整合、系統可靠性測試和培訓成本等附加功能增加了 RFID 解決方案的成本。

- 在 COVID-19 疫情期間,醫院正在使用 RFID 技術來更好地管理患者和員工。醫療保健行業擴大採用 RFID 設備,這種設備使用無線電波來識別和追蹤資產和設備。當醫療團隊繼續面臨突發公共衛生事件時,RFID 可能會提高他們的效率和課責。

醫療保健領域 RFID 的市場趨勢

製藥業蓬勃發展

- 隨著製造商開始支援具有 RF 標籤識別功能的智慧標籤,並且醫藥產品與其他藥房技術解決方案的互通性越來越強,越來越多的醫院和醫療保健系統開始採用 RFID 標籤來追蹤整個設施內的藥物。

- 然而,RFID 也被製藥業採用,以幫助防止各種處方箋藥的假冒,從而帶來額外的供應鏈和業務效益。由於技術的不斷進步,製造商能夠使用資料分析和 RFID 技術準確分析消費和庫存資料。加州藥局委員會要求在供應鏈中實施電子譜係等監管要求也將在製藥業產生對 RFID 的大量需求。

- 醫療保健RFID市場很大程度上受到製藥業日益嚴格的法規環境的推動。在製藥領域,各國政府和其他監管機構正在採取嚴格措施,以減少仿冒品和其他健康問題造成的問題。

- 一旦處方箋被放入藥櫃,製藥公司就會尋找改進的方法來管理整個供應鏈中的藥物。 RFID 由於其資料擷取和傳輸功能,現在被視為解決此問題的答案。製藥業力求透過提高品質、降低成本以及最重要的提高病患安全來實現這一目標。

亞太地區發展迅速

- RFID在醫療保健領域有著廣泛的應用,包括對病患和醫療設備的持續和直接追蹤。 RFID 透過執行資料收集、一致性、輸入和驗證(包括患者識別、藥物檢查和患者轉診)的繁重工作,幫助醫療保健專業人員改善和提高醫療保健品質、減少醫療錯誤並最佳化和自動化醫療保健流程。

- 對該地區市場成長產生正面影響的主要因素是醫療成本的上升和醫療基礎設施的改善。推動該地區進步的發展因素,例如醫院相關醫護人員的增加、法規結構的改善、患者安全的優先考慮以及醫療設備的追蹤,預計將因疾病負擔的增加而推動對高效醫療服務的需求。

- 此外,澳洲正在廣泛使用 RFID 解決方案進行資產追蹤。醫院和老年護理機構必須處理大量一次性物品,如繃帶、針頭和個人防護裝備。裝有消耗品或一次性物品的盒子可以安裝被動 RFID 標籤。

- 然而,RFID技術廣泛應用於醫療保健產業,包括醫療設備、機械和輔助設備。醫療保健 RFID 市場的成長源於 RFID 在各種醫療保健環境中的日益廣泛使用,用於監控這些設備以提供高效的患者照護。

RFID 在醫療保健產業的應用概述

醫療保健領域的 RFID 市場主要由多個地區和國際參與者組成,因此競爭非常激烈。此外,技術進步為企業提供了永續的競爭優勢。物聯網和雲端運算等技術正在改變市場發展。總體而言,在整個審查期間,供應商競爭一直很激烈,預計這種競爭將持續下去。市場的主要企業包括 Alien Technology Corporation、Zebra Technologies Corporation、CCL Industries Inc.、Avery Dennison Corporation 和 Biolog-id GAO RFID, Inc.

2023 年 6 月,Ascom 宣布與德國 Niels-Stensen-Kliniken 集團達成協議,該協議將引入 Ascom 的創新警報系統解決方案和 IP-DECT 基礎設施,實現醫療保健基礎設施數位化,確保更有效率、更好的患者照護,同時最佳化整體成本。

2023年3月,斑馬技術公司宣布,Alpro Pharmacy部署了斑馬的行動運算和RFID解決方案,將其手動庫存管理系統數位化,以推動業務快速成長。數位化的第一步是為 Alpro Pharmacy 的第一線員工配備 Zebra TC21 觸控電腦,以取代他們的手動紙筆庫存管理系統。部署行動裝置是為了協助完成所有庫存管理業務,從在 Alpro Pharmacy 配送中心接收貨物到為零售店和電子商務訂單挑選商品。該解決方案使 Alpro Pharmacy 的效率提高了約 80%,並透過減少人為錯誤提高了準確性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 製藥業對藥品標籤的要求日益嚴格

- 醫療保健領域 RFID 設備的使用日益增多

- 市場限制

- 替代標記方法的開發

第6章市場區隔

- 按產品

- 標籤和標記

- RFID系統

- 資產追蹤系統

- 病人追蹤系統

- 藥物追蹤系統

- 血液監測系統

- 按最終用戶

- 醫院

- 製藥公司

- 其他最終使用者(研究機構、實驗室)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 南美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Zebra Technologies Corporation

- Avery Dennison Corporation

- CCL Industries Inc.

- Alien Technology Corporation

- GAO RFID, Inc

- Honeywell International Inc.

- S3Edge Inc.

- STANLEY Healthcare

- Biolog-id

- Impinj Inc.

- Mobile Aspects Inc.

- RF Technologies

- STid Groupe

- Terso Solutions Inc.

- Spacecode Technologies

第8章投資分析

第9章:市場的未來

The Healthcare RFID Market is expected to register a CAGR of 2.45% during the forecast period.

RFID technology has significantly impacted hospitals, clinics, healthcare systems, distributors, and manufacturers worldwide but is due to achieve even more in years to come. The adoption of RFID in the medical field has become a catalyst for more and more pharmaceutical companies to put RFID tags on medicine labels to control their supply chain. The adoption of RFID will thus continue to have a more vital role in the healthcare sector.

Key Highlights

- Multinational pharmaceutical companies have been manufacturing medicines for decades to distribute worldwide. Labelling, however, is a rigorous and challenging task that continues to grow more complex. With new labeling regulations that can vary widely across the country and region, which are predicted To stimulate growth in the RFID market by a large margin, pharmaceutical companies must either build their systems to meet global needs or delegate them to experts to be able to do so.

- Integrating RFID in pharmaceutical products will help increase patient safety because it allows for more precise control and authentication of medicinal products throughout the supply chain, aiming to reduce errors to almost zero. In addition, it eliminates the need for costly and, more importantly, labor-intensive in-house medication labeling, thereby relieving a significant burden on hospital staff.

- RFID may be applied for inventory management at hospitals and pharmacies to ensure quality and reduce waste. The benefits go beyond the return on investment since it has the potential to save lives. That is why, to provide pharmacies, hospitals, and patients with critical information, industry players are putting together a premium product portfolio that includes tamper-evident RFID tags and luminous labels; these smart RFID solutions will help to reduce costs, raise accuracy, and speed up operations while protecting pharmaceutical brands from counterfeiting.

- A few factors slowing down the market studied include high installation costs for RFID systems in healthcare and system interoperability. Any industry adopting RFID must invest significantly in readers, tags, software, electricity, and operating replacement services. Additional features such as integration of Internet of Things components, system reliability testing, and training costs add to the cost of an RFID solution.

- Hospitals use RFID technology to manage patients and staff better during pandemics due to the COVID-19 outbreak. The healthcare industry has seen a great uptake of RFID devices, which use radio waves to identify and track assets and equipment. RFID will increase the efficiency and accountability of healthcare teams as we continue to face a Public Health Emergency.

RFID in Healthcare Market Trends

Pharmaceuticals to Witness the Growth

- More hospitals and healthcare systems are beginning to adopt RFID tags for tracking medication inside their facilities as manufacturer-enabled smart labels with RF tag identification increases, in addition to more interoperability between medications and other pharmacy technology solutions.

- However, RFID has also been adopted by the pharmaceutical industry to prevent the counterfeiting of different prescription medicines with added supply chains and operational benefits. As a result of continued technological advancement, manufacturers can accurately analyze consumption and inventory data using data analysis techniques and RFID technology. As mandated by the California Board of Pharmacy, regulatory demands such as implementing e-Pedigree in the supply chain will also generate substantial demand for RFID in the pharmaceutical sector.

- The healthcare RFID market has been significantly driven by an increasingly strict regulatory environment in the pharmaceuticals sector. In the field of pharmaceuticals, stringent measures have been introduced by governments and other regulatory bodies throughout different countries to reduce problems caused by counterfeits and other health issues.

- Once a prescription has been put in the medicine cabinet, pharmaceutical companies look for improved ways of controlling their medicines throughout the supply chain. RFID is currently regarded as the answer to this question due to its capacity for capturing and transmitting data. The pharmaceutical industry tries to achieve that by improving quality, reducing costs, or, most of all, enhancing patient safety.

Asia Pacific to Register Fastest Growth

- RFID is applied to a wide range of applications in the healthcare sector, such as constant and direct patient or medical device tracking. It helps and supports healthcare professionals to improve and promote healthcare quality, decreases medical errors, and optimizes and automates the healthcare process by carrying out large amounts of work in data collection, integrity, entry, and confirmation such as patient identification, pharmaceuticals checks, and patient referrals, among others.

- The main factors positively influencing growth in the region's market are rising medical costs and improved healthcare infrastructure. Growth factors contributing to regional development, including the increasing number of healthcare professionals associated with hospitals, improved regulatory framework, prioritizing patient safety, and tracking medical devices, are expected to drive demand for efficient health services due to the rising disease burden.

- In addition, the use of RFID solutions to track assets is widespread in Australia. Large quantities of disposable goods like bandages, needles, and personal protection equipment must be handled by hospitals and elderly care facilities. Box containing consumables and disposable items may be fitted with passive RFID tags.

- However, RFID technology has been extensively used in the healthcare industry, for instance, in medicine devices, machinery, and support equipment. The growth of the healthcare RFID market is fueled by the increasing use of RFID to monitor these devices in different health environments to provide efficient patient care.

RFID in Healthcare Industry Overview

The RFID market in healthcare primarily comprises multiple regional and international players in a fairly contested market space. Furthermore, firms gain a sustained competitive edge due to technological progress. Technologies like the Internet of Things and cloud computing are altering market developments. Overall, it is anticipated that the intensity of competitive competition between vendors will be high throughout the period under review and continue to do so. Some key players in the market are Alien Technology Corporation, Zebra Technologies Corporation, CCL Industries Inc., Avery Dennison Corporation, and Biolog-id GAO RFID, Inc., among others.

In June 2023, Ascom announced a contract agreement with Niels-Stensen-Kliniken Group in Germany with the installation of the Ascom innovative alarming system solution and IP-DECT infrastructure and Digitization of the healthcare infrastructure, making it possible to ensure more efficient and better patient care while optimizing overall costs.

In March 2023, Zebra Technologies Corporation announced that Alpro Pharmacy had introduced Zebra's mobile computing and RFID solutions to digitalize its manual inventory management system to advance its fast-growing business. The first stage of digitalization was to equip Alpro Pharmacy's front-line workers with Zebra's TC21 touch computers to replace their manual inventory management system using pen and paper. The mobile devices were introduced to assist with all inventory management tasks, from receiving goods at Alpro Pharmacy's distribution center to picking goods for its retail stores and e-commerce orders, to name a few. The solution has since enhanced Alpro Pharmacy's efficiency by approximately 80% and improved its accuracy by reducing human errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Stringency in the Pharmaceutical Sector with Regards to Medicine Labeling

- 5.1.2 Increased Applications and Use of Devices Supporting RFID Across the Healthcare Sector

- 5.2 Market Restraints

- 5.2.1 Development of Alternate Labeling Methods

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Tags and Labels

- 6.1.2 RFID Systems

- 6.1.2.1 Asset Tracking Systems

- 6.1.2.2 Patient Tracking Systems

- 6.1.2.3 Pharmaceutical Tracking Systems

- 6.1.2.4 Blood Monitoring Systems

- 6.2 By End User

- 6.2.1 Hospitals

- 6.2.2 Pharmaceuticals

- 6.2.3 Other End Users (Research Institutes and Laboratories)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 South Korea

- 6.3.3.6 Rest of Asia Pacific

- 6.3.4 South America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zebra Technologies Corporation

- 7.1.2 Avery Dennison Corporation

- 7.1.3 CCL Industries Inc.

- 7.1.4 Alien Technology Corporation

- 7.1.5 GAO RFID, Inc

- 7.1.6 Honeywell International Inc.

- 7.1.7 S3Edge Inc.

- 7.1.8 STANLEY Healthcare

- 7.1.9 Biolog-id

- 7.1.10 Impinj Inc.

- 7.1.11 Mobile Aspects Inc.

- 7.1.12 RF Technologies

- 7.1.13 STid Groupe

- 7.1.14 Terso Solutions Inc.

- 7.1.15 Spacecode Technologies