|

市場調查報告書

商品編碼

1687396

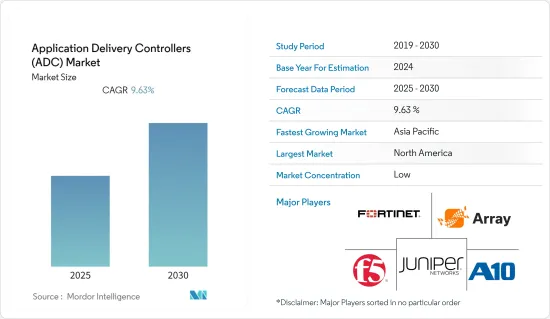

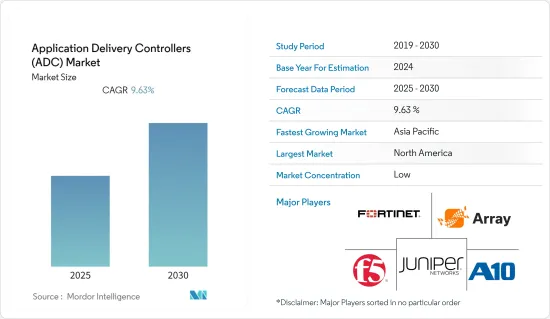

應用傳遞控制器 (ADC) - 市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Application Delivery Controllers (ADC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計應用傳遞控制器市場在預測期內的複合年成長率將達到 9.63%。

主要亮點

- 成長要素包括基於 Web 的應用程式的廣泛採用、雲端運算和虛擬的興起,以及向最終用戶更快、更安全地交付應用程式的業務需求不斷成長。

- 應用傳遞控制器在過去幾年中獲得了顯著的發展,這主要是由於對負載平衡、性能改進以及處理與應用傳輸相關的更高級要求的需求不斷成長。這些解決方案提供可用性、可擴展性、效能、安全性、自動化和控制,以確保您的應用程式和伺服器運作。這些功能還可以幫助想要遷移或已經遷移到雲端環境的組織。

- 近年來,網路攻擊的頻率和複雜程度不斷增加,對應用程式交付控制器 (ADC) 的需求也日益成長。 ADC 在加強應用程式和基礎設施的安全態勢方面發揮關鍵作用,使其成為防禦各種網路威脅的重要組成部分。

- 透過向網路添加新服務來擴展應用程式(通常由來自不同供應商的解決方案組成)的需求不斷增加,這可能會增加網路的複雜性和故障點。這可能會導致向用戶提供服務時出現複雜且嚴重的延遲,從而造成收益損失和糟糕的用戶體驗。

- 此外,由於遠距工作者迅速改變了他們的工作環境以確保員工在任何地方都能有效工作,新冠疫情使得應用程式的可見性和管理變得更加重要。預計這將在預測期內推動應用傳遞控制器市場的發展。

應用程式交付控制器市場趨勢

BFSI 終端用戶部門預計將佔據主要市場佔有率

- 由於各種創新和發展,BFSI 領域對應用傳遞控制器的需求日益成長。再加上網銀行和行動銀行等數位管道,這導致技術採用率不斷提高,並使其成為銀行服務的首選。利用先進的身份驗證和存取控制流程正成為銀行更關鍵的要求。

- 圍繞銀行的數位生態系統正在迅速擴張。隨著消費者需求的不斷變化,銀行被迫客製化其產品以滿足消費者的需求。此外,隨著消費者接受行動生活方式並在數位平台上互動,他們希望銀行能夠在相同的平台上與他們聯繫。這導致 BFSI 領域對應用傳遞控制器的需求增加。

- 此外,隨著網路、線上和行動銀行銀行數位流量的增加,BFSI 部門也因維護活動而面臨停機。這意味著銀行必須實施負載平衡並支援循環分配,將潛在客戶從伺服器 1 移動到伺服器 2 再移動到伺服器 3,依此類推,但透過引入 ADC,這不再是必要的。

- 巨量資料和分析等下一代技術和服務的日益普及要求傳統網路進行轉型。軟體定義網路為各種規模的企業提供更大的靈活性、更低的成本和更輕鬆的管理。

- 據威瑞森電信 (Verizon) 稱,2022 年全球金融服務業共報告了 1,829 起網路事件。金融業發生資料外洩事件,數百萬敏感資料被駭客竊取,導致多家公司損失數百萬美元,此後新興市場對強大的安全性提出了更高的要求。隨著全球業務的成長,DDoS 等威脅使關鍵資料面臨風險。這促使企業採用更好的解決方案來保護其端點和網路中的資料免受攻擊。

亞太地區預計將佔據主要市場佔有率

- 預計亞太地區將在預測期內實現最高的成長率。該地區雲端運算的快速崛起預計將成為雲端基礎的應用程式交付控制器的主要驅動力。

- 此外,預計該地區將隨著中小企業的投資而實現成長。中小型企業正在為其基於雲端基礎的應用程式投資具有成本效益且技術先進的基於雲端基礎的解決方案。中國和印度等國家為該地區提供了巨大的成長機會。

- 技術進步導致受調查市場中聯網設備的數量增加。中國雲端處理產業的成長也受到政府的大力支持和私營部門的大量投資的推動。此外,5G和支援5G的設備將大大提高設備互通性。由此導致的連接設備數量的增加直接增加了對雲端基礎的應用程式的資料流量和安全性的控制需求。

- 此外,「數位印度」計畫旨在將傳統系統和內部系統遷移或整合到雲端基礎雲端基礎的模型中,並且有望為公民提供電子服務。

- 此外,中國、印度和印尼等國家的網路用戶和資料流量正在增加,進一步推動了該地區 ADC 解決方案的成長。隨著數位時代的進步,市場供應商正在為最終用戶提供更多創新的網路解決方案和產品,確保最佳的技術體驗並引領細分市場。

應用程式交付控制器行業概覽

應用傳遞控制器 (ADC) 市場高度分散,主要參與者包括 F5 Networks Inc.、Fortinet Inc.、Juniper Networks Inc.、A10 Networks Inc. 和 Array Networks Inc.。市場上的公司正在採用聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2022年9月,自動化機器身分管理(MIM)和應用程式基礎設施安全領域的領導者AppViewX宣布,該公司已加入F5的技術聯盟計畫(TAP)。透過此次合作,F5 和 AppViewX 將共同推動企業應用安全和交付解決方案,專注於跨本地、雲端和邊緣位置的應用程式管理和網路安全。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 對可靠應用程式效能的需求不斷增加

- 網路攻擊增加

- 市場限制

- 網路複雜度不斷增加

- ADC 管理挑戰與成本上升

第6章市場區隔

- 按部署

- 雲

- 本地

- 按公司規模

- 中小型企業

- 大型企業

- 按行業

- BFSI

- 零售

- 資訊科技/通訊

- 衛生保健

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭格局

- 公司簡介

- F5 Networks Inc.

- Fortinet Inc.

- Juniper Networks Inc.

- A10 Networks Inc.

- Array Networks Inc.

- Citrix Systems Inc.

- Radware Corporation

- Akamai Technologies Inc.

- Barracuda Networks Inc.

- Piolink Inc.

- Sangfor Technologies Inc.

- HAProxy Technologies LLC

- Loadbalancer.org Inc.

- Kemp Technologies Inc.

8.供應商市場佔有率分析

第9章投資分析

第10章:投資分析市場的未來

The Application Delivery Controllers Market is expected to register a CAGR of 9.63% during the forecast period.

Key Highlights

- Factors contributing to the ADC market's growth include the proliferation of web-based applications, the rise of cloud computing and virtualization, and the increasing need for businesses to deliver applications faster and securely to end-users.

- Application delivery controllers have gained significant traction in the past few years, primarily owing to the rising need for load balancing, improving performance, and handling much more advanced requirements associated with application delivery. These solutions provide availability, scalability, performance, security, automation, and control to keep the applications and servers running in their power band. These capabilities also aid organizations that want to or have already migrated to the cloud environments.

- The increasing frequency and sophistication of cyber attacks have driven the demand for application delivery controllers (ADCs) in recent years. ADCs play a crucial role in enhancing the security posture of applications and infrastructure, making them a vital component in defending against various cyber threats.

- The increasing need to scale out applications, which in various cases consists of solutions from different vendors along with the addition of new services to the network, can result in increased complexities and increased points of failure in the network. As a result, delivering these services to the consumers becomes more complex and can result in significant delays, leading to loss of revenue streams and lowered subscriber quality of experience.

- Additionally, with the COVID-19 pandemic, application visibility and management took on even more importance as remote workers quickly changed their working environments to maintain staff productivity from any place. This is expected to boost the market for application delivery controllers over the forecast period.

Application Delivery Controllers Market Trends

BFSI By End-user Vertical Segment is Expected to Hold Significant Market Share

- The demand for application delivery controllers in the BFSI sector gained traction owing to various reforms and developments. The growing technological penetration, combined with digital channels, such as Internet banking, mobile banking, etc., is becoming a preferred choice for banking services. There is a more significant requirement for banks to leverage advanced authentication and access control processes.

- The digital ecosystem surrounding a bank is increasing at a rapid pace. With the constant change in consumer demand, banks have been pressured to customize their product offerings according to their demands. Moreover, consumers embracing a mobile lifestyle and socializing on digital platforms expect banks to connect with them on the same platforms. This is increasing the demand for application delivery controllers in the BFSI sector.

- Further, with increased digital traffic toward net banking, online banking, and mobile banking, the BFSI sector also faces downtime due to maintenance work. This requires the banks to implement load balancing where the banks would have to support round-robin distribution that is shifting lead from server 1 to server 2, followed by server 3, and so on, which is now eliminated with ADC.

- The rising popularity of next-generation technologies and services, such as Big Data and analytics, requires the transformation of legacy networks. Software-defined networks offer greater flexibility, lower cost, and easier management for businesses of all sizes.

- According to Verizon, in 2022, there were 1,829 reported cyber incidents in the financial industry worldwide. The instances of data breaches across financial industries that have leaked millions of crucial data to hackers and the loss of millions of dollars for multiple companies have increased the focus on robust security across emerging economies. As businesses worldwide grow, threats like DDoS have exposed critical data to risk. This has encouraged organizations to deploy better solutions to safeguard their data within endpoints and networks against attacks.

Asia Pacific is Expected to Hold Significant Market Share

- Asia Pacific is expected to witness the highest growth rate over the forecast period. The rapid increase in cloud computing in this region is expected to be a significant driver for cloud-based application delivery controllers.

- Additionally, the region is expected to witness growth, owing to the investments of small and medium organizations. SMEs are investing in cost-effective cloud-based and technologically advanced solutions for cloud-based applications. Countries such as China and India provide significant growth opportunities in the region.

- Owing to technological advancements, there is an increase in the number of connected devices in the studied market. Moreover, Strong government backing and substantial private sector investment are behind the growth of China's cloud computing industry. Furthermore, 5G and 5 G-enabled devices will exponentially increase the devices' interconnectivity. As a result, it increases connected devices, thereby directly augmenting the need for controlling the data traffic and security of cloud-based applications.

- Additionally, the Digital India initiative aims to move legacy and on-premise systems to a cloud-based model or integrate with it, and the cloud platform is expected to host the delivery of e-services to citizens.

- In addition, the increasing internet users and data traffic in countries like China, India, and Indonesia further augment the growth of ADC solutions in the region. With the evolving digital era, market vendors offer more innovative network solutions and products for end users, ensuring they have the best technology experience and driving the market segment.

Application Delivery Controllers Industry Overview

The Application Delivery Controllers (ADC) Market is highly fragmented, with the presence of major players like F5 Networks Inc., Fortinet Inc., Juniper Networks Inc., A10 Networks Inc., and Array Networks Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In September 2022, AppViewX, the leader in automated machine identity management (MIM) and application infrastructure security, announced that the company joined F5's Technology Alliance Program (TAP). Through the partnership, F5 and AppViewX will jointly promote enterprise application security and delivery solutions focused on managing applications and ensuring cybersecurity across on-premises, cloud, and edge locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Reliable Application Performance

- 5.1.2 Increasing Cyberattacks

- 5.2 Market Restraints

- 5.2.1 Increasing Network Complexity

- 5.2.2 Management Challenges and Higher Costs of ADCs

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 F5 Networks Inc.

- 7.1.2 Fortinet Inc.

- 7.1.3 Juniper Networks Inc.

- 7.1.4 A10 Networks Inc.

- 7.1.5 Array Networks Inc.

- 7.1.6 Citrix Systems Inc.

- 7.1.7 Radware Corporation

- 7.1.8 Akamai Technologies Inc.

- 7.1.9 Barracuda Networks Inc.

- 7.1.10 Piolink Inc.

- 7.1.11 Sangfor Technologies Inc.

- 7.1.12 HAProxy Technologies LLC

- 7.1.13 Loadbalancer.org Inc.

- 7.1.14 Kemp Technologies Inc.