|

市場調查報告書

商品編碼

1687391

人造板市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Wood-based Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

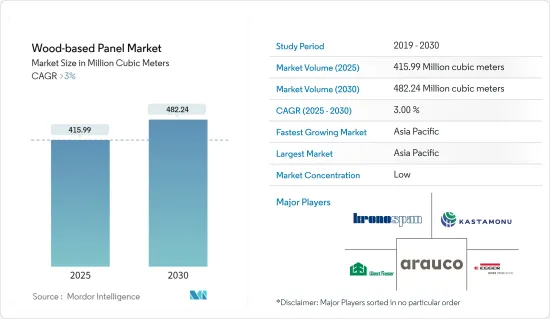

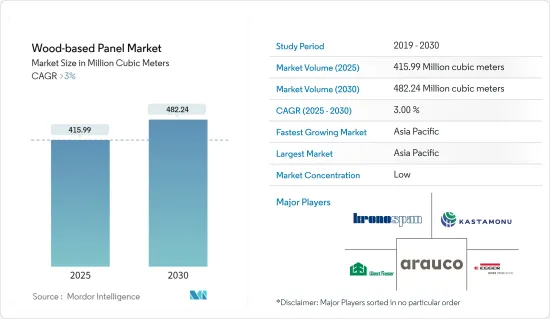

預計2025年人造板市場規模為4.1599億立方米,到2030年將達到4.8224億立方米,預測期內(2025-2030年)的複合年成長率將超過3%。

受調查的市場在2020年受到了新冠疫情的負面影響。一些國家對用於家具的某些種類的纖維板的進口徵收反傾銷稅,以支持國內生產商。為了遏制病毒傳播,所有建築工程和其他活動都停止了,對市場造成了不利影響。然而,由於建築建設活動的增加,預計市場將從 2021 年起穩步成長。

主要亮點

- 短期內,住宅和商業建築的看漲成長趨勢以及家具產業需求的增加是推動市場成長的主要因素。

- 然而,預計預測期內木質板材的甲醛排放量將成為限制市場成長的主要因素。

- 然而,OSB 在結構絕緣板 (SIPS) 中的使用日益增多,預計很快將為全球市場創造豐厚的成長機會。

- 預計在評估期內,亞太地區的人造板市場將出現成長,這是因為人造板因其優良的性能而被廣泛應用於家具、建築和包裝等終端使用領域。

人造板市場趨勢

家具業需求增加

- 由於其多種優點,人造板被廣泛應用於住宅家具。儘管木製家具有多種替代品,但其需求仍處於高峰。人造板耐用、經濟、易於清潔且用途廣泛。

- 民用家具佔全球家具市場的65%,其次是商業(包括辦公室、飯店等)。亞太地區是全球最大的家俱生產地區,其中中國、印度和日本佔據領先地位。

- 宜家是世界上最大的家具製造商之一。根據該公司發布的資料,預計2023年的年收益將成長約6.73%,達到476億歐元(約502.9億美元)。

- 中國是世界領先的家居裝飾生產國。都市化趨勢促使中國家具產業新興品牌不斷湧現。最熱情的顧客是年輕一代,他們更了解新趨勢,購買力更強。此外,該國日益成長的技術進步正在培育家具行業的新一代。

- 印度家具業最大的細分市場是家居家具。臥室家具佔印度家居家具市場的最大佔有率,其次是客廳家具。然而,衣櫃和廚房是最昂貴的購買品,顧客在廚房家具上的花費約為 7,000-10,000 美元。

- 歐洲家居裝飾產業嚴重依賴亞洲國家的進口,最近的供應鏈中斷使籌資策略變得複雜。因此,零售商擴大從鄰國而不是亞洲國家進口,以降低運輸成本和交貨時間。

- 2022 年 10 月,MoKo Home+Living 在由美國投資基金 Talanton 和瑞士投資者 AlphaMundi Group 共同領主導的B 輪債務和股權資金籌措中籌集了 65 億美元。目的是增加家具產量並保持良好的品質。這項舉措正在推動家居裝飾領域的成長。

- 在家工作等工作模式的改變,推動了對緊湊、耐用且易於操作的家具的需求。從辦公室工作空間到住宅環境的轉變推動了對更實用、更靈活的家具的需求。一些製造商已經開始提供採用木質鑲板的高效家具。無論是符合人體工學的椅子、辦公桌或學習桌,在家工作將焦點重新轉移到家居裝飾上,從而促進了家具行業的成長。

- 預計上述因素將在未來幾年推動人造板市場的發展。

亞太地區佔市場主導地位

- 亞太地區在全球市場佔有重要佔有率。中國、印度和日本等國家建設活動的增加,加上家具需求的增加,推動了該地區對人造板的需求。

- 根據國際熱帶木材組織(ITTO)預測,2022年中國無甲醛人造板產品產量預計將年增與前一年同期比較%,達到約810萬立方米,其中無甲醛膠合板160萬立方米,纖維板20萬立方米,塑合板630萬立方米。

- 我國木質板材生產主要集中在山東、江蘇、廣西等省區,約佔全國總產量的60%。根據中國木材與木製品流通協會統計,去年中國約44%的人造板用於家具製造、裝飾和翻新。

- 中國正經歷建築業的繁榮。根據中國國家統計局的預測,2023年中國建築業總產值將成長1.99%,達到人民幣712,847.2億元(約108,678.0億美元)。此外,預計到2030年中國將在建築方面投資近13兆美元,這對人造板來說是一個利好。

- 據印度投資局稱,印度是世界第五大家俱生產國和第四大家具消費國。 2022 年,印度家具市場價值為 231.2 億美元。此外,預計 2023-28 年印度家具市場的複合年成長率為 10.9%,到 2026 年將達到 327 億美元。

- 印度政府的「印度製造」舉措吸引了多家跨國公司在該國投資,預計這將在預計的時間內增加對新辦公大樓的需求,並支持對用於家俱生產的塑合板等各種人造板的需求。

- 預計到2022年,印度建築業將成為世界第三大建築市場。印度政府正在實施的政策包括智慧城市計劃和2022年實現全民住宅計畫。這些政策預計將為陷入困境的建設產業提供急需的提振。

- 上述因素將導致預測期內該地區人造板消費需求增加。

人造板產業概況

人造板市場本質上是高度分散的。主要企業(不分先後順序)包括 Kronoplus Limited、West Fraser、ARAUCO、EGGER 和 Kastamonu Entegre。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 住宅和商業建築強勁成長

- 家具業需求增加

- 其他促進因素

- 限制因素

- 人造板的甲醛釋出量

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 中密度纖維板(MDF)/高密度纖維板(HDF)

- 定向纖維板(OSB)

- 塑合板

- 硬質纖維板

- 合板

- 其他產品類型(木板、軟板、塑合板、輪胎邊緣)

- 應用

- 家具

- 住宅

- 商業的

- 建築學

- 地板和屋頂

- 牆

- 門

- 其他結構(裝飾用途、木製框架、配件)

- 包裝

- 其他用途(藝術品、工業原型、玩具等)

- 家具

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- ARAUCO

- CenturyPly

- VRG Dongwha MDF

- DEXCO

- EGGER

- Georgia-Pacific Wood Products LLC

- GREENPANEL INDUSTRIES LIMITED

- Kastamonu Entegre

- Kronoplus Limited

- Langboard Inc.

- Louisiana-Pacific Corporation

- Pfleiderer

- Roseburg Forest Products

- SWISS KRONO Group

- West Fraser

- Weyerhaeuser Company

第7章 市場機會與未來趨勢

- 擴大OSB在結構絕緣板(SIPS)的應用

- 其他機會

The Wood-based Panel Market size is estimated at 415.99 million cubic meters in 2025, and is expected to reach 482.24 million cubic meters by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The market studied was negatively impacted by COVID-19 in 2020. Several countries imposed anti-dumping duty on the import of a certain variety of fiberboard used in furniture in order to aid domestic producers. All the construction work and other activities were put on hold to curb the spreading of the virus, thereby negatively affecting the market. However, the market studied is projected to grow steadily, owing to increased building and construction activities since 2021.

Key Highlights

- Over the short term, bullish growth trends in residential and commercial construction, coupled with increasing demand from the furniture industry, are major factors driving the growth of the market studied.

- However, formaldehyde emission from wood-based panels is a key factor anticipated to restrain the growth of the market studied over the forecast period.

- Nevertheless, the increasing application of OSB in structural insulated panels (SIPS) is expected to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is estimated to experience growth over the assessment period in the wood-based panel market due to the wide usage of wood-based panels in end-use application segments, such as furniture, construction, and packaging, due to their desirable properties.

Wood-based Panel Market Trends

Increasing Demand from the Furniture Industry

- Due to their several benefits, wood-based panels are extensively used in residential furniture. There are various alternatives to wooden furniture, but the demand for it is still at its peak. Wooden panels are long-lasting, economically friendly, easy to clean, and highly versatile.

- The global furniture market comprises 65% of domestic home furniture, followed by commercials (including offices, hotels, and others). Asia-Pacific is the world's largest home furniture producer, among which China, India, Japan, and others are the leading producers.

- IKEA is one of the largest furniture manufacturers globally. According to public data published by the company, its annual revenue in 2023 increased by about 6.73% and was valued at EUR 47.6 billion (~USD 50.29 billion).

- China is the leading producer of home furniture globally. Due to the growing trend of urbanization, new brands have emerged in the Chinese furniture industry. Their most dedicated customers are younger people who adopt new trends and have tremendous purchasing power. Moreover, the growing technological advancement in the country has brought up a new generation in the furniture industry.

- The Indian furniture industry's largest segment is home furniture. Bedroom furniture has the highest share of the Indian home furniture market, followed by living room furniture. However, wardrobes and kitchens are the most expensive purchases, with customers spending around USD 7,000-10,000 on kitchen furniture.

- The European home furniture industry is heavily dependent on products imported from Asian countries, and recent supply chain interruptions complicate their sourcing strategies. As a result, retailers have increased their share of imports from neighboring countries compared to Asian countries to reduce transportation costs and delivery times.

- In October 2022, MoKo Home + Living raised USD 6.5 billion in a Series B debt-equity funding round, co-led by US-based investment fund Talanton and Swiss investor AlphaMundi Group. The aim is to increase home furniture production and maintain good quality. This initiative has driven the growth of the home furniture segment.

- The ongoing working pattern, such as work-from-home, has increased the demand for compact, durable, and easy-to-handle home furniture. The shift from office workspaces to house settings has increased the demand for more functional and flexible home furniture. Several manufacturers have started offering efficient furniture using wood panels. Whether it is an ergonomic chair, office desk, or study table, working from home puts the focus back on home decor, increasing the growth of the furniture segment.

- All the above factors are expected to drive the market for wood-based panels in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region held a major share of the global market. With growing construction activities and the increasing demand for furniture in countries such as China, India, and Japan, the demand for wood-based panels is increasing in the region.

- According to the International Tropical Timber Organisation (ITTO), the production of formaldehyde-free wood-based panel products in China increased by about 36% in 2022 as compared to the previous year and stood at about 8.1 million cubic meters, including formaldehyde-free plywood (1.6 million cubic meters), fibreboard (0.2 million cubic meters) and particleboard (6.3 million cubic meters).

- China's wood-based paneling production is concentrated in the Shandong, Jiangsu, and Guangxi provinces, which account for about 60% of the total production. According to the China Timber and Wood Products Distribution Association, around 44% of China's wood-based panels were used for furniture manufacturing, decoration, or renovation last year.

- China is amid a construction mega-boom. According to the National Bureau of Statistics of China, the gross output value of the construction industry in China in 2023 increased by 1.99% and was valued at CNY 71,284.72 billion (~USD 10,086.78 billion). Furthermore, China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for wood-based panels.

- According to Invest India, India is the 5th largest producer and 4th largest consumer of furniture globally. The furniture market in the country was valued at USD 23.12 billion in 2022. Furthermore, the Indian furniture market is expected to grow at a CAGR of 10.9% during 2023-28 and reach USD 32.7 billion by 2026.

- The Make in India initiative by the government attracted several multinational companies to invest in the country, which is expected to increase the demand for new office buildings in the estimated time, supporting the demand for various wood-based panels, such as particle boards for furniture production.

- The Indian construction sector is expected to become the world's third-largest construction market by 2022. The Smart Cities project and Housing For All by 2022 are policies implemented by the Indian government. These policies are expected to bring the needed impetus to the slowing construction industry.

- The factors above are contributing to the increasing demand for wood-based panel consumption in the region during the forecast period.

Wood-based Panel Industry Overview

The wood based panel market is highly fragmented in nature. The major players (not in any particular order) include Kronoplus Limited, West Fraser, ARAUCO, EGGER, and Kastamonu Entegre.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Bullish Growth Trends in Residential and Commercial Construction

- 4.1.2 Increasing Demand from the Furniture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Formaldehyde Emission from Wood-based Panels

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Medium-density Fiberboard (MDF)/High-density Fiberboard (HDF)

- 5.1.2 Oriented Strand Board (OSB)

- 5.1.3 Particleboard

- 5.1.4 Hardboard

- 5.1.5 Plywood

- 5.1.6 Other Product Types (Lumber Panels, Softboard, Chipboard, and Beadboard)

- 5.2 Application

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Other Constructions (Decorative Applications, Wooden Frames, and Accessories)

- 5.2.3 Packaging

- 5.2.4 Other Applications (Artistry, Industrial Prototyping, Toys, etc.)

- 5.2.1 Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARAUCO

- 6.4.2 CenturyPly

- 6.4.3 VRG Dongwha MDF

- 6.4.4 DEXCO

- 6.4.5 EGGER

- 6.4.6 Georgia-Pacific Wood Products LLC

- 6.4.7 GREENPANEL INDUSTRIES LIMITED

- 6.4.8 Kastamonu Entegre

- 6.4.9 Kronoplus Limited

- 6.4.10 Langboard Inc.

- 6.4.11 Louisiana-Pacific Corporation

- 6.4.12 Pfleiderer

- 6.4.13 Roseburg Forest Products

- 6.4.14 SWISS KRONO Group

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application of OSB in Structural Insulated Panels (SIPS)

- 7.2 Other Opportunities