|

市場調查報告書

商品編碼

1687390

小型風力發電機-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Small Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

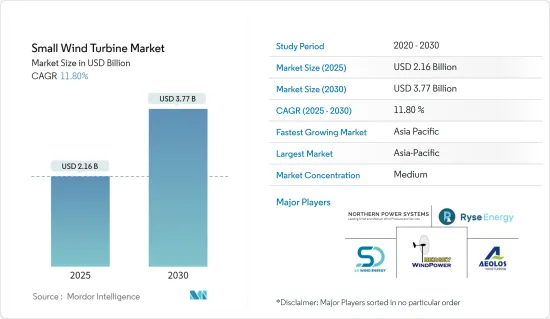

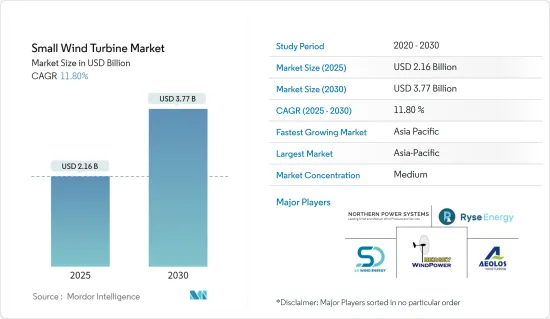

小型風力發電機市場規模預計在 2025 年達到 21.6 億美元,預計到 2030 年將達到 37.7 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 11.8%。

從中期來看,小尺寸、較小的佔地面積、較低的資本支出和營運支出要求以及較小的環境影響預計將推動市場成長。

另一方面,來自屋頂太陽能光伏(PV)等替代分散式發電源的競爭對市場成長產生了負面影響,是主要限制因素之一。

然而,建築一體化風力發電機的商業化和無葉片風力發電機的發展預計將在預測期內提供成長機會。

亞太地區佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。成長的一個關鍵驅動力是支持小規模風力發電發展的現有政策架構。

小型風力發電機市場趨勢

水平軸風力發電機預計將顯著成長

目前製造的大多數小型風力發電機(SWT) 都是具有兩個或三個葉片的水平軸風力渦輪機,通常由玻璃纖維等複合材料製成。

水平軸風力發電機(HAWT) 的主轉子軸和發電機位於塔頂,並使用簡單的風向標將渦輪機指向盛行風或逆風。

小型風力發電機主要由水平軸風力發電機組成,這種渦輪機已經生產了30多年,而大多數小型垂直軸風力發電機(VAWT)都是在過去十年內生產的。小型化HWAT因其技術和經濟優勢而備受關注。除了風力發電成本低之外,小型水平軸風力發電機還易於維護,無需熟練的勞動力。

此外,小型水平風力發電機有兩種類型。一種是經典的三葉片設計,另一種是動態更複雜的帶罩設計。兩種類型的輸出功率大致相同,均為 3kW 左右。

小型水平風力渦輪機的一個優點是,它們的塔基較高,可以在風切(風速垂直於風向的變化,往往會產生旋風力)區域更好地利用風。增強風能利用可能會增加發電量。因此,預計在預測期內這些單位的採用速度將會放緩。

小型風力發電機廣泛用於該地區的開發中國家和已開發國家,主要是農村和偏遠地區。根據美國能源局《分散式風電市場報告:2022 年版》的歷史資料,SWT 市場成長僅限於英國、丹麥、義大利和德國等國家。

此外,根據美國能源局的數據,到2022年,美國小型風力發電機的數量將達到1,745台,投資價值為1,460萬美元。展望未來,由於政府努力透過計畫和補貼提供財政支持,預計小型太陽能光電和小型風力發電的分散式計劃投資將會增加。

此外,各公司正在對小型風力發電設備的開發進行研發。 2024年4月,全球小型風力發電機製造商新興國家公司(Emerging Nations)開始調查開發中國家小型風力發電的光明前景。這些舉措可能為未來的市場前景增添動力。

因此,鑑於上述情況,預計水平軸風力發電機部分將在預測期內佔據市場主導地位。

亞太地區可望主導市場

預計亞太地區將在 2023 年主導風電市場,並在未來幾年保持其主導地位。該地區在小型風力風力發電機市場擴張方面具有巨大潛力,尤其是離網和住宅規模的小型風力發電機。

小型風力發電機可以在低至每秒 2 公尺的風速下運作。它們可以是併網系統、獨立系統、與太陽能混合系統或屋頂安裝系統。

中國是世界上最大的風電生產國,截至2023年,裝置容量為441.89吉瓦。此外,到2022年我們將安裝6,000萬千瓦的小型風力發電機,使累積設置容量達到704.32兆瓦。該國於 2009 年首次推出陸上風電上網電價,目前小型風力發電機的上網電價為 13.4 至 20.1 美分/千瓦時。

中國小型風力發電機的應用正從農村電氣化轉向城市街道照明和電信獨立電源系統。這些新應用領域的發展正在迅速推進。

同時,印度的風電裝置容量位居世界第四。截至2023年,該國風電裝置容量將達到44.7GW。就SWT而言,印度目前安裝的大多數系統都是離網或獨立的。馬哈拉斯特拉邦擁有印度大部分的 SWT 安裝量。在泰米爾納德邦和古吉拉突邦等「多風」的邦,SWT 的安裝較少。

隨著中國和印度風力發電容量的持續成長,預計未來幾年該地區小型風力發電機計劃將會增加。因此,預計未來幾年對小型風電基礎設施建設的投資將會增加。

總體而言,預計亞太地區將在預測期內主導小型風力發電機市場。

小型風力發電機產業概況

小型風力發電機市場相當分散。市場的主要企業(不分先後順序)包括 Northern Power Systems Inc.、Bergey Wind Power Co.、SD Wind Energy、Aeolos Wind Energy Ltd. 和 Ryse Energy。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2029 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 投資機會

- 市場動態

- 驅動程式

- 小型風力發電機在企業、社區和家庭中的應用日益增多

- 降低資本支出 (CAPEX) 和營運支出 (OPEX) 要求

- 限制因素

- 來自分散式發電替代方案的競爭

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 軸類型

- 水平軸風力發電機

- 垂直軸風力發電機

- 應用

- 併網

- 離網

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 馬來西亞

- 印尼

- 越南

- 泰國

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Aeolos Wind Energy Ltd

- Bergey Wind Power Co.

- City Windmills Holdings PLC

- Wind Energy Solutions

- SD Wind Energy Limited

- UNITRON Energy Systems Pvt. Ltd

- Northern Power Systems Inc.

- Shanghai Ghrepower Green Energy Co. Ltd

- TUGE Energia OU

- Ryse Energy

- Market Ranking/Share(%)Analysis

第7章 市場機會與未來趨勢

- 建築一體化風力發電機的商業化和無葉片風力發電機的開發

The Small Wind Turbine Market size is estimated at USD 2.16 billion in 2025, and is expected to reach USD 3.77 billion by 2030, at a CAGR of 11.8% during the forecast period (2025-2030).

Over the medium term, the market's growth is expected to be driven by lower environmental impact due to its smaller size and land footprint and lower CAPEX and OPEX requirements.

On the other hand, competition from alternative distributed generation sources such as rooftop solar photovoltaic (PV) would negatively impact the market's growth and is one of the major restraints.

Nevertheless, the commercialization of building-integrated wind turbines and the development of bladeless wind turbines are expected to provide growth opportunities in the forecast period.

The Asia-Pacific region dominates the market and will likely witness the highest CAGR during the forecast period. The growth is mainly driven by the existing framework of policies supporting the adoption of small-scale wind power developments.

Small Wind Turbine Market Trends

The Horizontal Axis Wind Turbine Segment is Expected to Witness Significant Growth

A majority of small wind turbines (SWT) manufactured today are horizontal-axis, upwind machines that have two or three blades, usually made of composite materials such as fiberglass.

A horizontal axis wind turbine (HAWT) has its main rotor shaft and electrical generator at the top of the tower, and a simple wind vane is used to point the turbine toward or away from the prevailing wind.

Small wind turbines consist primarily of horizontal axis wind turbines that have been in production for over three decades, whereas most small vertical axis wind turbines (VAWTs) have been produced within the last decade. Due to the technological and economic advantages associated with the small HWAT, it receives considerable attention. In addition to low-cost wind energy generation, small horizontal-axis wind turbines can be maintained easily and without a skilled workforce.

Furthermore, there are two types of small HAWTs. The first is a typical three-bladed design, while the second is an aerodynamically complex, shrouded type. Both types have a similar rate power of approximately three kW.

Among the advantages of small HAWTs is their tall tower bases, which allow them to gain greater access to wind at sites with wind shear (where variations in wind velocity occur at right angles to the wind direction and tend to exert a turning force). As a result of stronger wind access, power generation is likely to increase. This is likely to result in moderate deployment of these units during the forecast period.

Small wind turbines are used throughout the developing and developed nations across the region and are used mainly in rural or remote settings. As per the historical data by the US Department of Energy in their Distributed Wind Market Report: 2022 Edition, the growth in the SWT market is restricted to countries like the United Kingdom, Denmark, Italy, and Germany.

Further, according to the United States Department of Energy, the number of small wind turbines in the United States reached 1,745 units in 2022, having an investment of USD 14.6 million. In the future, investment in distributed projects attributing small-scale solar and small-scale wind is expected to increase with the efforts of the government to provide financial support through schemes and subsidies.

Moreover, companies are undergoing research & development to develop small wind installations. In April 2024, FREEN, a global small wind turbine manufacturer, started examining the promising landscape of small wind energy in developing countries. Such an initiative will fuel the scope of the market in the future.

Therefore, owing to the above points, the horizontal axis wind turbine segment is expected to dominate the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

Asia-Pacific dominated the wind power generation market in 2023 and is expected to continue its dominance in the coming years. The region holds vast potential for expanding the small wind turbine market, notably in the form of off-grid and residential-scale small wind turbines.

Small wind turbines can run at wind speeds as low as two meters per second. They can be connected to the grid or stand-alone systems, hybridized with solar, or mounted on rooftops.

China holds the largest wind power generation capacity globally, with 441.89 GW of installed capacity as of 2023. The country also installed 60 MW of small wind turbines in 2022, reaching a cumulative installed capacity of 704.32 MW. The country first introduced FiT from onshore wind in 2009; it currently offers FiT for small wind turbines ranging from USD 13.4-20.1 ct/kWh.

Chinese small wind turbine applications are shifting from rural electrification oriented to city street illumination and telecom stand-alone power systems. It is developing rapidly in these new application fields.

On the other hand, India holds the fourth-largest wind power installed capacity in the world. The country's wind power installed capacity stood at 44.7 GW as of 2023. Regarding SWTs, almost all the systems installed in India today are off-grid or stand-alone. The state of Maharashtra has the majority of the SWT installations in the country. The otherwise 'windy' states like Tamil Nadu and Gujarat fare poorly in the SWT installations.

The region is expected to have more small wind turbine projects in the future, owing to the continuous increase in China and India's wind generation capacity. Thus, investments in developing small wind infrastructure are expected to grow in the upcoming years.

Therefore, owing to the above points, Asia-Pacific is expected to dominate the small wind turbine market during the forecast period.

Small Wind Turbine Industry Overview

The small wind turbine market is moderately fragmented. Some of the major players in the market (not in particular order) include Northern Power Systems Inc., Bergey Wind Power Co., SD Wind Energy, Aeolos Wind Energy Ltd, and Ryse Energy., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Investment Opportunities

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Growing Adoption of Small Wind Turbines for Businesses, Communities and Homes

- 4.6.1.2 Lower CAPEX and OPEX Requirements

- 4.6.2 Restraints

- 4.6.2.1 Competition from Alternative Distributed Generation Source

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Axis Type

- 5.1.1 Horizontal Axis Wind Turbine

- 5.1.2 Vertical Axis Wind Turbine

- 5.2 Application

- 5.2.1 On-grid

- 5.2.2 Off-grid

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 NORDIC

- 5.3.2.8 Rest of the Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Malaysia

- 5.3.3.5 Indonesia

- 5.3.3.6 Vietnam

- 5.3.3.7 Thailand

- 5.3.3.8 Australia

- 5.3.3.9 Rest of the Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Aeolos Wind Energy Ltd

- 6.3.2 Bergey Wind Power Co.

- 6.3.3 City Windmills Holdings PLC

- 6.3.4 Wind Energy Solutions

- 6.3.5 SD Wind Energy Limited

- 6.3.6 UNITRON Energy Systems Pvt. Ltd

- 6.3.7 Northern Power Systems Inc.

- 6.3.8 Shanghai Ghrepower Green Energy Co. Ltd

- 6.3.9 TUGE Energia OU

- 6.3.10 Ryse Energy

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Commercialization of Building-Integrated Wind Turbines and Development of Bladeless Wind Turbines